Recently, more and more friends from outside the industry are asking me about things in the crypto industry. Sometimes they ask about this project, sometimes they ask which project, and they often ask cautiously, "Is this Ponzi?"

I usually answer: This is Ponzi, what happened to Ponzi? Who is not Ponzi?

Although the term Ponzi was only coined a hundred years ago, it has been in operation for thousands of years.

Such tenacious vitality has its own reason for existence~

When Chinese people mention "Ponzi", they always think it is a scam. The original English text is actually "Ponzi scheme."

Don't participate in "scams". Generally, you will lose all your money.

The characteristic of the scam is "forged earnings". All the money you handed over is given to others, and you have nothing in your hands.

In most cases, there will be a relatively fixed or promised interest, and the collapse depends on when the boss chooses to run away.

The Ding Yifeng mentioned before is a perfect Ponzi method: people in the financial circle get excited, and those who engage in encryption are disgusted.

The asset prices of profitable projects are usually related to hematopoietic capacity. Basically, the real rich people in the world (those with more than one billion US dollars) hold most of their assets in a rent-collecting model: real estate with stable cash flow (office buildings/hotels or Reits), bonds (treasury bonds and high-rated bonds) ), and stocks (such as Apple/Tencent).

However, most of the world's listed company stocks/bonds and other assets are essentially Ponzi structures: stocks rely on investors to continue to pay, and the company's business is recognized; bonds rely on borrowing new ones to repay old ones, otherwise they will go bankrupt instantly.

Whether it is the U.S. national debt (the current scale makes it difficult to pay off the debt through taxes) or the pension funds of most countries, these things that seem indestructible to ordinary people are also Ponzi structures.

The pensions in a certain country mainly rely on young people to pay for their work and pay them to the elderly. A large part of the elderly have not paid much pension due to historical reasons.

Once there are not enough young people working (for example due to low fertility or high unemployment), the pension plate will collapse at any time.

Of course, some people will say that the government can also print money to provide pensions. The U.S. government is like this now. The Treasury Department borrows large amounts of money and distributes it to the people, and then borrows new money to repay the old money. The current borrowing scale of the U.S. Treasury Department has reached 30 trillion U.S. dollars, which may be similar to the scale of China's local debt (including various hidden liabilities such as guarantees by state-owned enterprises, etc.).

This approach is not impossible. Chiang Kai-shek played 666 very well, and finally inflation retreated to Taiwan. What the common people have complained about most about U.S. imperialism in recent years is the soaring prices. The Federal Reserve has raised interest rates to 5% in one go.

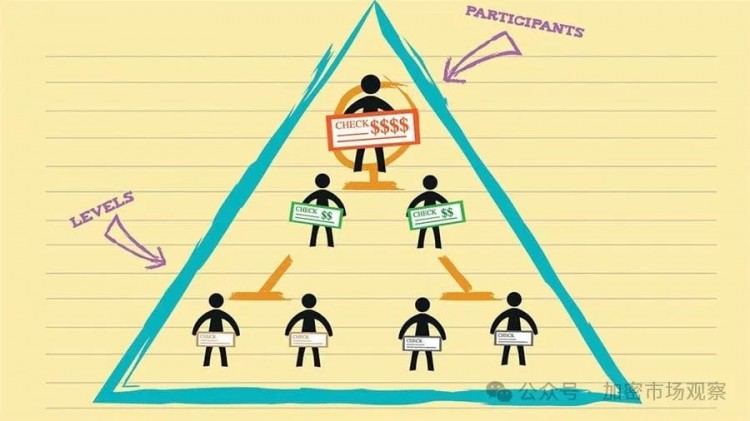

Since many friends do not know much about Ponzi, I would like to share with you the basic principles of Ponzi structure based on my personal experience:

At the top, we become the first layer, and this layer is the earliest beneficiary of the entire structure. For a company or crypto project, it is the original shareholder; for a pension, it can be thought of as the pensioner.

The middle layer is generally the main force of diffusion. For a company, it can be subsequent investors, funds or research institutions after listing. For crypto projects, this can be a KOL or a community activist. This layer mainly serves as a link between the previous and the following, because the users that the project side can reach are still limited.

The lower layer can be considered as the taker. The arbitrage exit of the upper layer and the middle layer is essentially the bottom layer footing the bill.

But the stratification here is not absolute. For example, the Dogecoin project was very copycat from the beginning, with a complete copycat model of Bitcoin.

Dogecoin was launched in December 2013, and the founder of the project can definitely be said to have a top-level role in the early stages of the project. Jackson Palmer and program developer Billy Marcus both sold all of their Dogecoins in 2015, exiting the “Dogecoin arena” and believing that the crazy rise was irrational.

They didn't realize that the meme track was such that they sold all the Dogecoin in 2015, and the profit should only be tens of thousands of dollars.

However, as Musk backed Dogecoin later, Dogecoin experienced a surge. Now the market value of this project is more than 10 billion U.S. dollars, and its liquidity is higher than 90% of U.S. stocks.

In this process, those who held Dogecoin before the surge were considered to be at the top level (they can exit at any time if they make profits). Musk was actually only considered to be at the middle level (affecting the bottom level). The users who rushed in at the high point were the takers.

Therefore, when playing Ponzi, the timing of entry is very important.

For example, in a certain country's pension system, the people who benefit the most are those who have not paid pensions but receive the most pensions (veterans/civil servants before Roosevelt's New Deal, etc.). As for the young people who will pay pensions later, until the U.S. government solves the problem of fertility/unemployment rates, who will receive the pensions will be a big problem.

Either the pension received is too small and not enough to live on, or the person will continue to work as long as he is old.

Nowadays, in the United States and Japan, you can see elderly people working in restaurants or driving taxis everywhere.

The same goes for investing in stocks and cryptos. You should buy a business model before it is widely recognized and exit after it is fully recognized. (If the business achieves hematopoietic capabilities, you do not need to exit).

This is why companies hope to find endorsements from star institutions when financing, while crypto projects value community activity. Because star institutions and active communities have strong CX capabilities.

Once the business model is falsified, it is almost a death sentence for the project. There are many reasons for the falsification of the business model of traditional companies, such as backward technology/market occupation by rival companies/interruption of capital flow and other reasons.

Crypto projects are much better, because most crypto businesses do not make money, and they do not need to be maintained after the currency is issued. Even the tokens of scammer projects such as FTX have a decent trading volume.

For encryption projects, as long as the project side does not run away, Ponzi's game can always be played. Filecoin/ICP, these old projects that plummeted hundreds of times in the last cycle, haven't they come back to life in the past few months?

And if a project can be upgraded to the meme level (similar to FTT), even if the project team is caught, it will not affect the currency price to continue to rise.

FTT now has a market value of more than 500 million U.S. dollars, with a daily turnover rate of 5%, and it has also killed 80% of Hong Kong stocks.

Before the emergence of the encryption industry, it can be said that Ponzi's game was only allowed to be played by the rich and powerful, not ordinary people.

The U.S. stock market is known as the most NB stock market in the world, and 70% of stocks will return to zero within 10 years after listing.

It seems to everyone that the U.S. stock market is rising every day. In fact, it is the dozens of leading U.S. stocks that are rising, driving the market index to new highs.

Looking at this ratio, is it similar to the encryption industry?

Although there are many coins in the crypto industry, the market value of the top coins is still very strong.

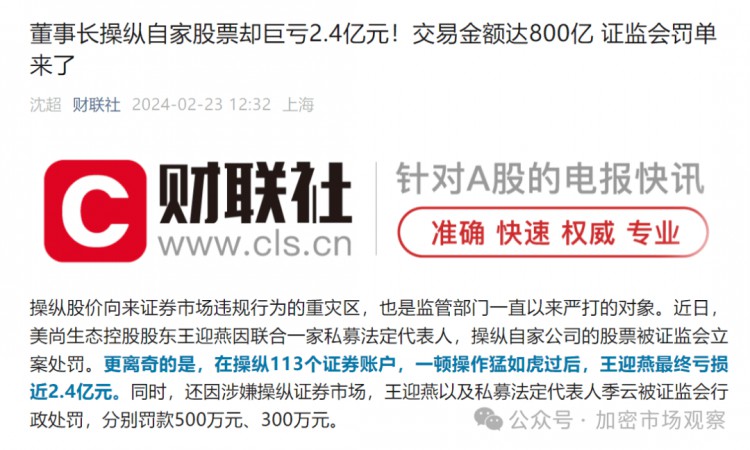

In fact, except for China, most countries in the world (including the United States) do not have the crime of pyramid schemes. Because they themselves know very well that many things are Ponzi structures. But what the United States is cracking down on is "fraud"/"insider trading"/"market manipulation." Even if investors at the bottom are protected, they cannot be easily harvested by the middle and upper classes.

The encryption industry is actually technically more conducive to combating "insider trading" and "market manipulation" because the transaction data of each wallet address is on the chain.

In the past, whether it was securities trading or pension operations, a large amount of expenditure was required to support the people who served in the middle.

Listed companies need to maintain financial/auditing/board secretarial costs, and pension funds also need to pay management fees to fund managers.

Cryptocurrency tokens, on the other hand, have no cost. Nowadays, many encryption projects are also distributed offices. Business data is all on the chain, and intermediate services can be executed with just a few lines of code.

Tokens like meme, on the other hand, do not even have a business, so there is no need to worry about business risks at all. As long as this meme can be spread and deeply rooted in people's hearts, there is no limit to the room for growth.

Trolls and Trump have appeared in North America this year, and Pepe appeared last year.

Troll and Trump, two North American memes, would have gained hundreds of times if they had been held two months ago.

I wonder if the Chinese can come up with a meme of our own.#内容挖矿