In response to the astonishing rise of Bitcoin in February, ten well-known KOLs have provided wonderful insights.

Author of the article: Followin

Article source: Followin

Crypto markets generally fell after the passage of a BTC spot ETF. BTC retraced $8,000.

After January 22, BTC rose from $40,000 for 14 consecutive days, rising to $68,686 on March 5. Crypto market sentiment has thus entered a stage of madness.

Why are BTC and ETH rising? How is the market outlook? Followin has compiled the top ten must-know data, which are refreshing the historical records of the encryption industry, and we have sorted out the judgments of 10 KOLs on the market outlook. as follows:

1. BTC exceeded US$686.86 million, rising by more than US$5,000 within the day, only 314 US dollars away from the all-time high.

2. Bitcoin’s market value exceeds that of silver.

3. The market value of BTC has reached US$1.337 trillion, surpassing Meta Platforms (previously Facebook, with a market value of US$1.27 trillion), and jumping to the ninth place in the world's mainstream asset market value.

4. The market value of ETH has reached US$438.98 billion, surpassing Mastercard (market value of US$437.05 billion) and jumping to the 24th place in the market value of global mainstream assets.

5. The issuance of ETH in the past 30 days was -0.568%, indicating continued deflation.

6. CoinGecko data shows that the total market value of cryptocurrency is US$2.641 trillion, with a 24H increase of 6.4%. In addition, BTC has a market share of 50.8% and ETH has a market share of 16.6%.

7. Today’s panic and greed index is 90, the highest value since February 2021, and the level is greed. (Note: The panic index threshold is 0-100).

8. Global Bitcoin ETP product holdings briefly exceeded 1 million BTC. Among them, in the past 90 days, only ETF products have seen an inflow of approximately 133,000 BTC.

9. As of the close of U.S. stocks on Monday, the daily trading volume of the U.S. spot Bitcoin ETF hit the second-highest level in history, reaching $5.5 billion.

10. The total amount of USDT officially exceeded 100 billion and is now approximately US$100.5 billion, a record high.

One criterion for judging when the pie will grow may be: 1% of asset management companies’ allocation to Bitcoin, that is, 330 billion U.S. dollars (counting only the United States). The current net value of Bitcoin ETFs is about 50 billion U.S. dollars, which means that it will reach 1% There is still some distance to go before the level, so the Bitcoin price of US$80,000-100,000 should be expected. The alt season may need to wait for Bitcoin to start going sideways. There have been recent concerns that the ETH ETF will not pass. If it does not pass, it may follow the same trend as altcoins.

——Colin Wu@WutalkWu

This bull market feels more like 2016 than 2020. If so, it means that the popularity of Bitcoin has not yet been transmitted to the primary market, which means that the violent bull market has not yet begun. In fact, breaking the previous high is the official establishment of the bull market. So everything has just begun.

——孟彥@Solv Protocol | ERC-3525(孟岩)

According to Deribit Insight, the current BTC is only about 1,000 points away from the all-time high. After studying the instances where BTC was close to the 10% ATH range of the previous cycle, it was found that BTC eventually crossed and created new highs, including four in the past ten years. Of the examples, three had reached the previous all-time high within a week of exposure to the 10% ATH range, and all had significant gains after making new highs.

——Wu Shuo Blockchain @wublockchain12

In a bull market, chasing highs means buying lows; buy small when prices fall, and buy big when prices fall big. It will definitely still be a bull market by mid-March, so play whatever you want. At the end of the month (for large positions) quarterly delivery + FOMC meeting + Easter, there should be a wave of adjustments.

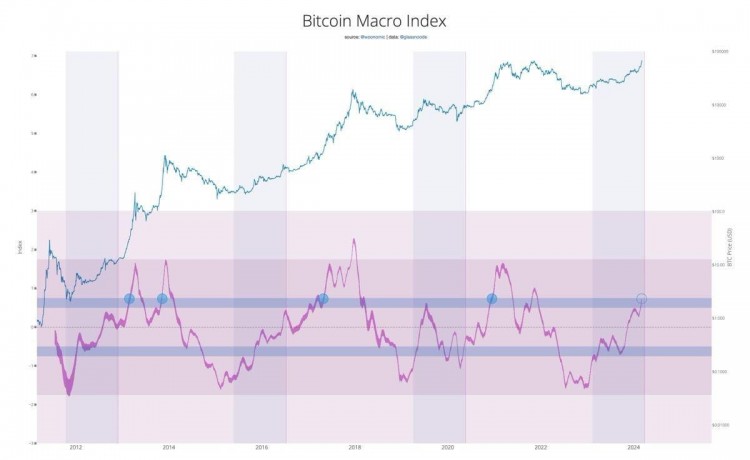

Comparing the fear and greed index of the last bull market, this wave broke out of the blue line, and#BTCalso began to pull wildly; referring to the previous script, the blue line will continue, and the price will continue to pull... The fear and greed index last time was at the top and continued for almost as long 2 months later, the spot price began to correct significantly.

——Sister Lin @LinChen91162689 (DeribitExchange Asia Pacific Business Leader)

So do you think we are in a bull market? We didn't, it was just a warm-up. A comprehensive fundamentals-driven bull market is marked by a breakout of the blue cap. When it crashes, TradFi will be shocked.

——Willy Woo@woonomic

My personal views on the Bitcoin market are open to discussion.

Bitcoin soon broke through the previous high of the previous bull market;

After Bitcoin is between 90,000 and 100,000, it may be the first real correction point (there will be no major correction at present), and then after the correction to 60,000 to 80,000, it will accumulate strength and take off again, entering more than 120,000;

The halving of Bitcoin is positive, and there is definitely a short-selling sentiment. The offset of the current strong ETF Bitcoin rise may be negligible.

This time next year, it may be difficult to see Bitcoins worth less than 100,000. Similarly, it may be difficult to see Ethereum under 10,000 at that time.

In particular, the current rise stimulated by Bitcoin spot ETFs has just awakened the traditional overall crypto market from the market winter, and is far from allowing the crypto market to enter the greed stage.

——Xiaoyin New Ten Years (Feng Wang) @wangfeng_0128

Coinbase currently ranks 23rd in the Finance category on the Play Store. Not even in the top 100 of all apps. It's still some way off from full-blown mania.

——Haseeb>|<@hosseeb

ETF capital inflows have been considerable in the past two months, but for ETF issuers such as BlackRock, Franklin, Fidelity, and Ark, the promotion of big-pie ETFs has just begun. A large number of traditional asset management institutions have not yet turned a corner. It seems that the FOMO period of institutions may not have come yet.

——qinbafrank@qinbafrank

Sometimes you need to be wise, and sometimes you need to stay awake. MEME’s super cycle will not die out due to the contempt of “value coins”, nor will it generate “value” due to the large-scale FOMO in the community. He is there, recognize and To enjoy the bubble, there is no need to invest a lot of energy, just find the strongest ecological fastest elevator, sit in it, sell when it goes up, buy when it goes down, sell high and buy low between 1-10W , have you learned it? It is worth investing a lot of time to dive into the rabbit hole, but it is a field that everyone can talk about but no one understands very much, such as AI/DEPIN (of course I don’t understand it myself, so I am learning slowly). Cycle, give it some time to ferment slowly.

——Pima@LeePima

In fact, a large degree of winning potential in secondary operations is based on psychology. If you open a position at a low enough price for an underlying target, you will have a great psychological advantage in holding it, and it will not be easy to chase the rise and fall in a hurry, or be washed out by the dealer's back and forth fluctuations. Instead of hesitating to chase the highs without stepping on the rhythm of big pie and meme, it is better for big funds to first make up for the two and three pie that have not been moved much, and to ambush other potential sectors that have been sucked by blood. Sooner or later, ETFs will have their turn, and prices are relatively sluggish now. Buying them will give you a price advantage in the future. Then use a small part of your jungle funds to chase popular memes. You made a profit, but you didn't miss it. It’s a scam, it’s a small amount of money anyway. The main reason for this is that being in the air is far more psychologically uncomfortable than being covered by a quilt. No matter how much, let yourself be in the car and adjust your mentality.

——Brother BroLeon of Tu’ao | 2024 Reload@BroLeonAus

I have never seen any good results come from showing off to friends outside the circle that one has coins, except that it can easily lead to jealousy, and in extreme cases, one can even be kidnapped and blackmailed by people around him (a true story).

So, whenever someone around you asks you about Bitcoin, zip up your mouth and just reply: "I've heard that it's too expensive, so I don't dare to buy it. Why, do you have it?"

——一石@ohyishi