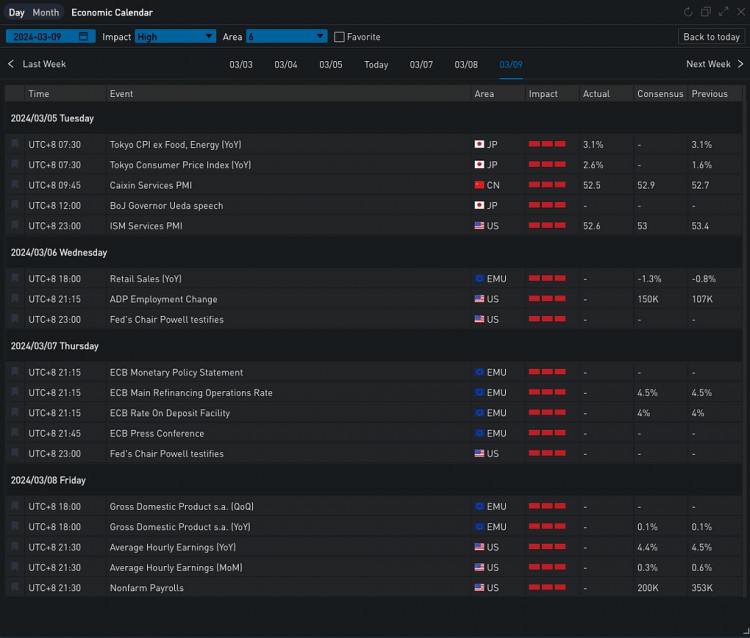

Yesterday (5 MAR), the S&P Global Services PMI in the United States for February finally recorded 52.3, higher than the expected 51.4 and the previous value of 51.3, showing signs of a slight increase in price pressure. The ISM Services PMI Index for February was subsequently released. Lower than expected, U.S. bond yields opened higher and moved lower. The current two-year/ten-year bonds are 4.566%/4.166% respectively. All three major U.S. stock indexes closed down more than 1%.

Source: SignalPlus, EconomicCalendar

Source: Binance & TradingView

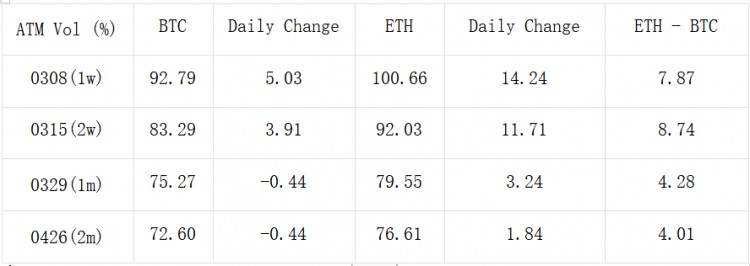

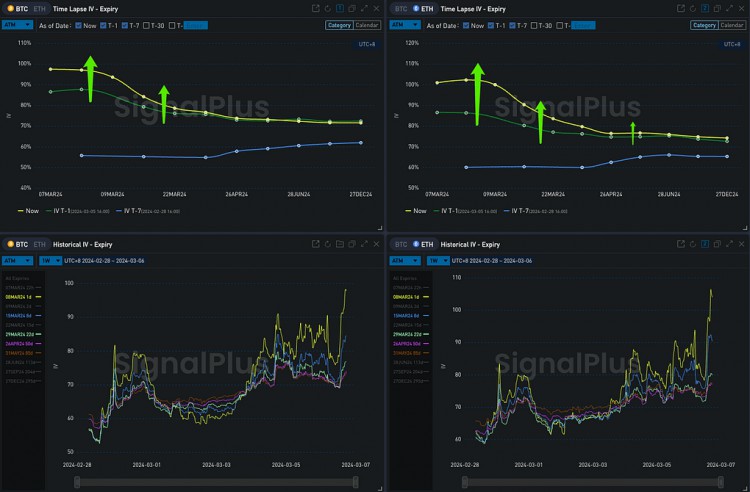

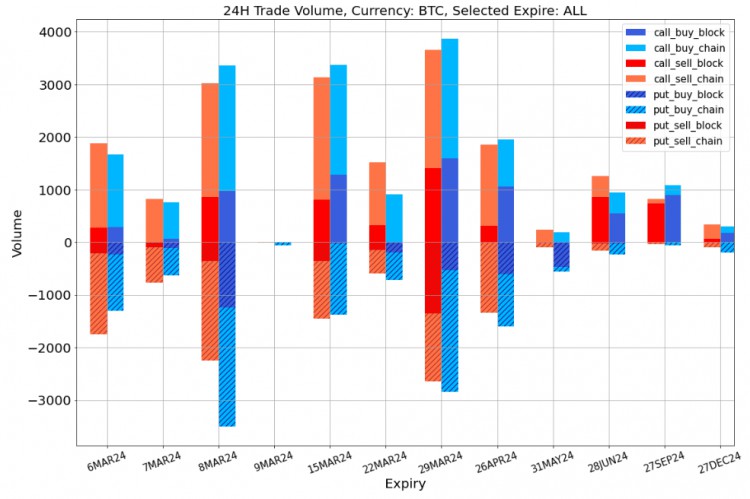

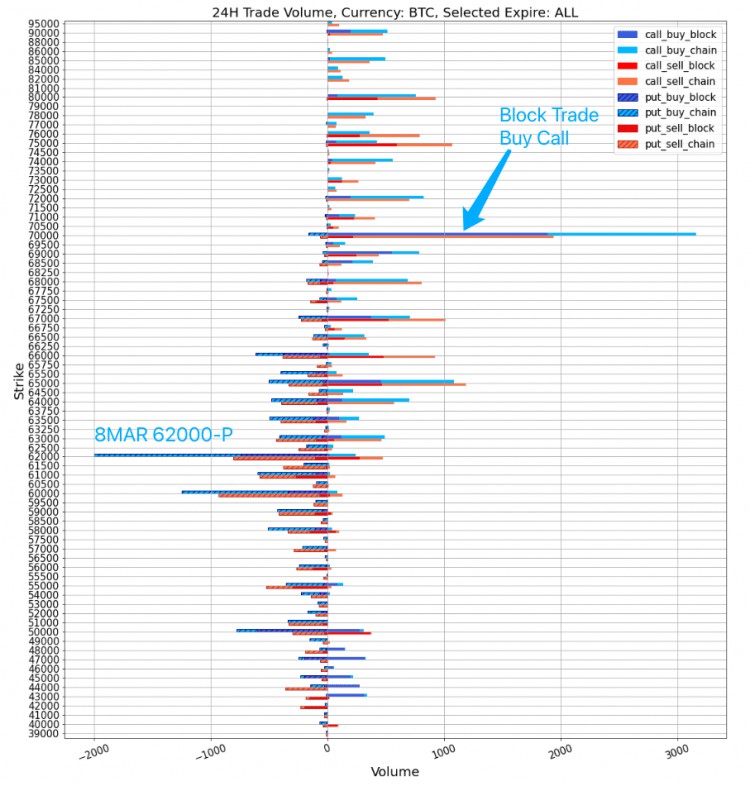

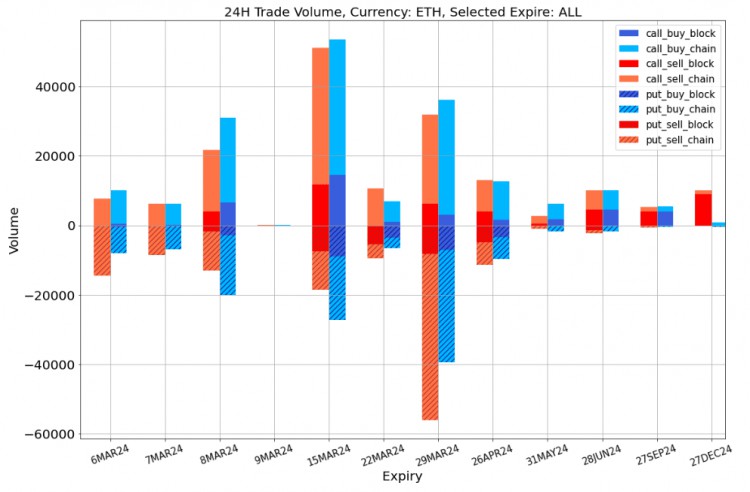

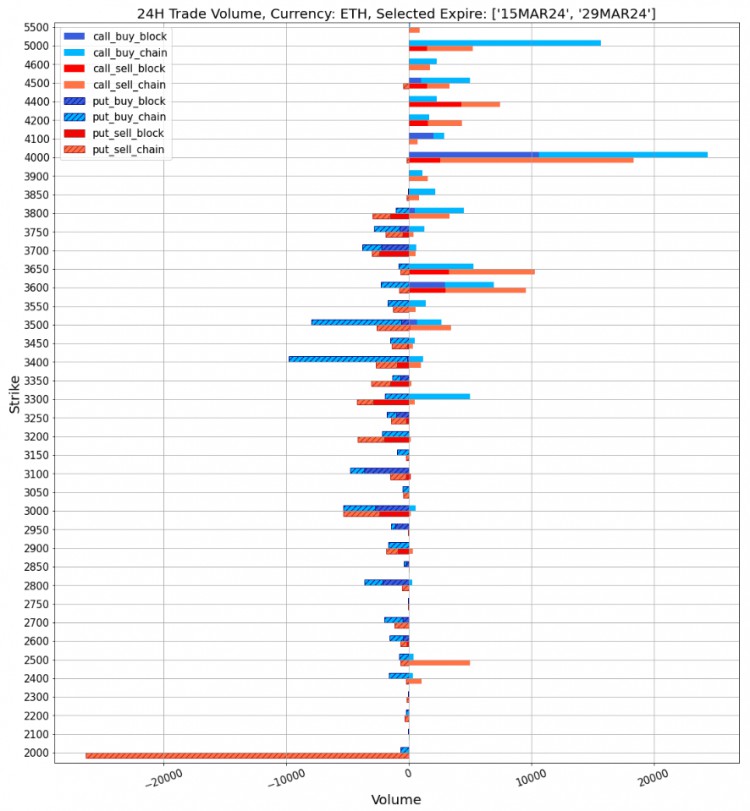

In terms of digital currencies, Bitcoin plunged by more than 10% after breaking through its historical high. It once dropped below $60,000. It has now recovered most of its losses and returned to around 66,000. As of now, the amount of long/short positions in BTC during the day has been liquidated. Reached 218 million/96.78 million. Regarding this callback, analysts pointed out that Bitcoin had basically risen in a straight line in the past few days, and a little profit-taking was expected. In addition, some traders held "one-time profits" The mentality of "closing it" caused the currency price to quickly encounter profit-taking selling pressure at the historical high point. It also gave people reason to believe that this was not the so-called "panic selling", but the market still increased the short-term price fluctuations. It is expected that the front-end implied volatility of options will rise sharply by 3 to 5%, and ETH will increase by 10% Vol, once again widening the gap with BTC. In terms of trading, this pullback attracted the opening of put options, represented by BTC 8 MAR-62000-P, and ETH 29 MAR 3500/3400-P buy order inflows. On the other hand, during the price rebound, the trading of bullish buying strategies on the bulk platform remained active, expressing the outlook for the upside in the market outlook.

Source: Deribit (as of 6 MAR 16:00 UTC+ 8)

Source: SignalPlus, Short-term implied volatility levels rise again

Data Source: Deribit, BTC transaction distribution

Data Source: Deribit, ETH transaction distribution

Source: Deribit BlockTrade

Source: Deribit BlockTrade