Original author: rhythm worker

Original source: BlockBeats

At 23:00 last night, the price of Bitcoin briefly crossed the US$69,000 mark, with a market value of US$1.35 trillion. It surpassed Meta Platforms and jumped to the ninth place in the world's mainstream asset market value. Everyone in the currency circle "stand up and pay tribute."

However, the horn did not sound long. Bitcoin, which had just broken its all-time high, turned sharply lower in less than 5 minutes, once falling below $60,000 during the session. The sharp rise and fall caused nearly $1.2 billion in positions to be liquidated across the entire network. According to data from CoinGlass, 318,392 traders were liquidated in the past 24 hours, totaling $1.19 billion, mainly on the long side.

A mysterious address that has been dormant for 14 years

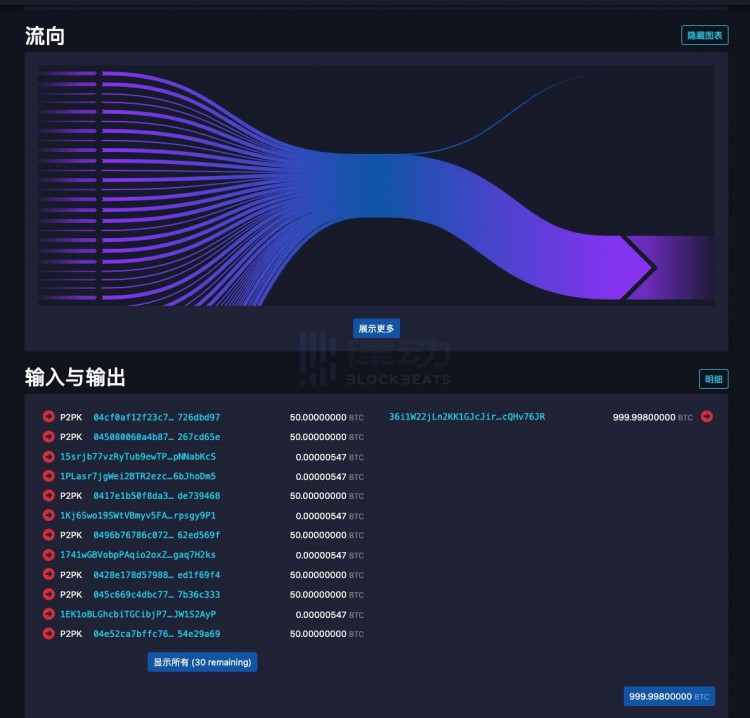

While the market speculated on the cause of the plunge, the community discovered that 1,000 Bitcoins worth approximately $69 million were transferred to Coinbase from addresses dating back more than a decade, according to CryptoQuant data, which the research firm said was linked to miners.

Generally speaking, the transfer of long-dormant tokens to large cryptocurrency exchanges is a precursor to a sale. CryptoQuant analyst Bradley Park also said in a report: "Given that the trading order book shows that there is 5-10 Bitcoins of liquidity for every $100 price change, selling 1,000 Bitcoins is likely to trigger a significant price drop. .”

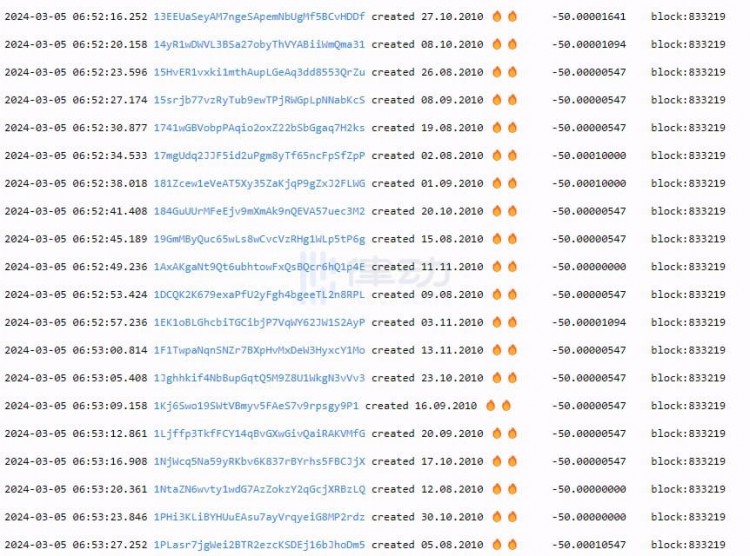

Transaction Record

According to the transaction records of its address, the address has been active since 2010. It has gone through several cycles over the past 14 years without any transfer behavior, until Bitcoin once again reached the $69,000 mark, setting a new record high. Record, there will be new activities at this address.

While there is no evidence that the Bitcoins transferred to Coinbase were sold, it is clear that the mysterious address has sparked a lot of speculation.

Speculation caused by OG address

Some people speculate that the owner of this address lost the mnemonic phrase and key before, so he was forced to "sleep". After all, for most people, it is possible to hold Bitcoin from 0 to 70,000 after multiple cycles. Sex is too small.

Some people also speculate that before the sell-off, the address may have used leverage to short-sell, and then made a profit by selling a large amount of Bitcoin at once. However, the possibility of such speculation is still relatively small. After all, the market value of Bitcoin is so huge now, and the interested parties involved and factors are also extremely wide.

Transaction transfer records for this address

Interestingly, the community also speculated that this address is one of the addresses of the US National Security Agency. They had previously held a huge amount of Bitcoin through confiscation. There has been a rumor on the Internet that "the US government holds the largest number of Bitcoins today." institutions", so choosing to "unload their baggage" at a high point is also a reasonable guess.

In addition, there is also a compelling speculation that the sale may also involve Satoshi Nakamoto himself. Although the true identity of Satoshi Nakamoto remains a mystery, the Bitcoin OG’s transaction has triggered some speculation about whether Satoshi Nakamoto may sell Bitcoin. After all, Satoshi Nakamoto’s identity has always been very mysterious, and his address changes are One of the most dangerous "black swan events" in the bull market.

Tribute to OG

In addition to these speculations, the most common views and attitudes expressed by the community about this address are tributes to OG.

"In a few years, this may be talked about like a Bitcoin pizza shop." Obviously influenced by OG, the encryption industry still has great confidence in the price of Bitcoin. This firm belief and extraordinary patience are very touch.

“Although I personally do not support the sale of Bitcoin, this patriarch deserves our respect because he has experienced the entire journey of Bitcoin, including every market cycle, every bear market decline, and all panic-mongering, huge fluctuations in wealth, etc. Wait," said a member of the Bitcoin community.

More importantly, compared with today’s strategies to make quick money in the encryption industry, the fact that “someone can really hold Bitcoin from 0 to 70,000 in 14 years” is more like a belief. With a solid belief in Bitcoin, we can finally get Bitcoin out of the trouble of centralization and spread it more widely among the population. It's hard not to pay tribute to those who have weathered the storms of FUD and market cycles.

And if we go through four market cycles, maybe we will also be tomorrow’s Bitcoin OG, we are still early.