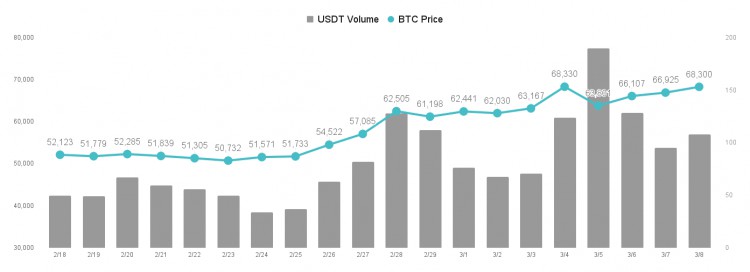

The trend of Bitcoin in the past week was quite exciting. The price once broke through from 61,000 US dollars to 69,000 US dollars, and the highest exceeded 70,000 US dollars. However, it then crashed to 66,000 US dollars. This shows that market investors are very active in adding and price operations, and the market trading volume There is also a significant amplification, and the speculative atmosphere can be said to be quite strong, but the overall market capital still shows a positive net inflow, and buying is still very healthy.

On the other hand, the gains and fluctuations of small and medium-sized crypto tokens and non-Bitcoin mainstream currencies are also expanding, indicating that traders are beginning to conduct capital spillover operations. That is to say, they believe that the future growth of Bitcoin is relatively limited, and it is better to pursue smaller market capitalizations. Small and medium-sized tokens are being speculated. We can expect that the recent small- and medium-sized tokens will perform well under the strong speculative atmosphere, but the price fluctuations will be greater than before. Investors with higher risk tolerance We are actively pursuing this reward.

From the perspective of interest rates, Fed Chairman Powell mentioned in his latest official testimony this week that interest rates are expected to be cut this year, but the actual timing has not yet been determined. He still does not change his previous remarks and insists on seeing more declines in inflation. Evidence, and targeting an annual price index growth rate of 2%, may seem hawkish at first glance, but they are equivalent to telling the market a clear point in time when interest rates will be cut this year. U.S. stocks and cryptocurrencies both experienced significant gains that day.

At the same time, other economic data also showed that inflation is declining moderately. The latest employment report was released on Friday. Although the United States added 275,000 jobs, exceeding market expectations, the unemployment rate also climbed from 3.7% to 3.9%. There is news from both sides, but the market currently tends to believe in the side where inflation is slowing down. After all, the chairman of the Federal Reserve has said that interest rates will be cut this year, which will help the crypto market prices continue to rise.

The recent Bitcoin ETF is still showing a trend of capital inflows compared to before. In fact, analysts are quite surprised that the Bitcoin ETF has maintained a strong growth trend since its launch this year and has pushed up the price of Bitcoin from US$40,000 to 69,000. US dollar, we can't help but wonder where such strong financial momentum comes from.

Not only cryptocurrencies, but also U.S. stocks are showing a strong trend of capital buying, especially the rising stock prices of AI concept stocks, which have even caused many Wall Street analysts to question whether there is a so-called mild bubble in the market. In just one month, 30% The above growth, from the perspective of the traditional stock market, seems to be reproducing the trend of the Internet bubble in 2000. The market has lost its rationality and continues to pursue prices, and continues to push up the prices of risky assets. The overall market The greed index continues to rise.

Sources: MICA RESEARCH

Sources: MICA RESEARCH

A. March 05 Bitcoin approaches $69,000 and is expected to break through to a new all-time high

The Bitcoin ETF has once again seen an astonishing net inflow of funds, driving the price of Bitcoin to continue to rise. Bitcoin has now reached US$68,000, and is expected to break through the new high of US$69,000 set in 2021 this week. The increase is very amazing. , and continues to attract more investors into Bitcoin ETFs, especially US dollar funds from China. Bitcoin has been quite attractive to these funds recently.

Funds are flowing out of electric vehicles, Fintech, gold and other traditional financial products, and are instead flowing into AI and cryptocurrencies. In the past, funds may have only been enough to speculate on one subject, but now electric vehicles have become the target of public criticism, and after a large amount of funds have flowed out, they have switched to buying Bitcoin. Bitcoin continues to drive the upward trend of Bitcoin, so this rise is still healthy, but speculative sentiment has entered the greed stage.

The role of stablecoins as a fund supply is also continuing to expand its scale. Currently, the market value of USDT has exceeded US$1 trillion, constantly breaking the highest record. In addition, the market value of USDC is US$710 billion. It is also flowing into Bitcoin and Ethereum. However, small and medium-sized cryptocurrencies The currency also experienced significant gains, indicating that retail investors and traders are pursuing higher gains beyond mainstream cryptocurrencies.

B. March 07 Cryptoquant: Bitcoin price correction favors long-term rise

Cryptoquant's latest analysis report points out that Bitcoin's recent correction from $69,000 to $61,000 actually gives the encryption market a more positive outlook, because the encryption market is not yet too crazy, and Bitcoin's pullback will contribute to long-term healthy growth, although there are many voices It is believed that the market is currently too greedy, but Bitcoin has also experienced a short-term pullback to a certain extent recently, indicating that investors are still cautious about currency prices and have not excessively pursued prices.

The company's analysis shows that this season's crazy rise has come to an end, and according to past patterns, Bitcoin will continue to fluctuate up and down, which will then push Bitcoin to the next high. The current trading price of Bitcoin is approximately US$65,000 to US$65,000. At US$69,000, traders are still conservative about Bitcoin exceeding the historical high of US$69,000, and do not dare to easily spend large costs to push the price upward.

Analyst company 10x Research has a similar conclusion. Bitcoin is expected to consolidate in the next two weeks, and then fall to another new high. At that time, it will be possible to maximize capital profits. However, Bitcoin is now competing with Bitcoin ETF funds. The trend of net inflows is highly correlated, which will also be an effective indicator to observe.

C. On March 8, the Bitcoin pickle premium rose to a two-year high, and retail investors were greedy.

According to CryptoQuant data, the Bitcoin Kimchi Premium Index has reached a new high. The current average price of Bitcoin transactions among Korean retail investors is 10.32% higher, indicating that Korean retail investors are more interested in Bitcoin and are willing to buy it on local exchanges at a premium of more than 10%. Bitcoin, and is optimistic that its price will continue to rise in the future, but it also means that retail investors are frantically chasing the price of Bitcoin and are quite greedy emotionally.

CryptoQuant also pointed out that based on past statistics, when the Kimchi Premium Index reaches a new high, there will be a wave of market corrections soon after. However, this possibility is not 100%. This time, Bitcoin ETF buying is indeed strong, and it is consistent with past rising factors. Differently, although the sentiment of Korean retail investors is crazy, the performance of Bitcoin ETF may exceed our imagination.

At present, Bitcoin ETFs continue to grow, but we have also seen that long-term investors are beginning to sell Bitcoins for cash. The income of mining farms has also benefited from the outstanding performance of Bitcoin prices and has increased. As the tax season begins and working capital needs increase, , they have a chance to sell Bitcoin to meet cash flow. The market selling atmosphere still exists, but it is not taken seriously.

Bitcoin ETF still has net capital inflows, and buying is expected to continue

If you observe the trend of global stock markets, you will find that the only areas with real stock growth are the United States, Japan, which has experienced a sharp currency devaluation, and the crypto market. If other emerging markets or advanced countries are priced in U.S. dollars, there is not an astonishing increase. , among which the downward trend in China is the most severe. The country’s real estate and stock market funds continue to withdraw from the market. As far as we know, these funds are converted into so-called US dollar funds and invested overseas, and Chinese investors prefer It has always been Japan, the United States, and the crypto market, which happens to be in line with the recent global capital distribution.

Therefore, we are almost certain that this crazy rise is largely caused by funds fleeing from China. That is, these funds flow out of China’s domestic market and into foreign risky assets, thus pushing up overseas assets. In fact, there is no choice for this money, because if you continue to stay in the Chinese market, you will only run the risk of devaluation. Even if you make a profit, the return will be far lower than that of other countries' assets. In the end, you have to turn to investing in the above-mentioned markets, among which Bitcoin has become the first choice for Chinese funds. First choice.

In the past, when Chinese institutional funds wanted to invest in Bitcoin, they mostly used crypto exchanges in Singapore. However, now Bitcoin ETFs have become the best entry option for these funds. US dollar funds that were originally parked overseas are constantly buying Bitcoin. ETF, until now, we have not seen an easing trend. It can even be said that as long as China’s economy continues to slump, cryptocurrencies will be the best hedging tool for huge Chinese funds. We can expect that cryptocurrencies will have very strong support. We We have yet to see an improvement in China's economy.

Even though the cryptocurrency market has been volatile recently, speculative funds are constantly causing the price of the currency to rise and fall, and even the price has begun to be affected by the settlement of options. It can be found that the market is in an extremely greedy state, and traders are very easy to chase prices, but large investors are also Selling has begun, and the strength of short selling is much weaker than before. Those loyal air forces have been forced to liquidate as early as the last wave of surge. The price will be quite unstable in the short term, and the fluctuations are expected to be further magnified.

At the same time, the inflow of ETF buying orders is also real. Judging from the current currency price, which will still fall back from time to time, although retail investors are extremely greedy, the overall situation is not too fanatical and shows a mild bubble trend. In the medium and long term, Bitcoin is expected to After the retracement, the price rose again to exceed US$70,000. In summary, thanks to the continued inflow of Chinese funds through Bitcoin ETF, the price support of the crypto market is quite firm. We expect that there is indeed a risk of retracement in the short term, but the magnitude is not high. It will be too big, and the price will hit a new high again after consolidation.

Review of last week [MICA RESEARCH] Bitcoin once exceeded $64,000, what are the risks in the market outlook?

Statement: The article only represents the author's personal views and opinions, and does not represent the objective views and positions of the blockchain. All contents and opinions are for reference only and do not constitute investment advice. Investors should make their own decisions and transactions, and the author and Blockchain Client will not be held responsible for any direct or indirect losses caused by investors' transactions.

The content of MICA Research has been published simultaneously on Substack. If you don’t want to miss the first-hand news, please click here to subscribe. The weekly report and daily market findings will be sent to you via email.

〈[MICA RESEARCH] Bitcoin price fluctuates violently, and the probability of short-term consolidation is high〉 This article was first published on "Block Guest".