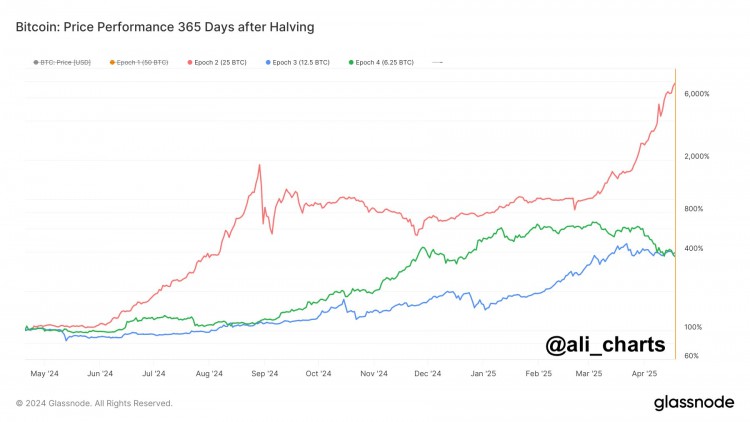

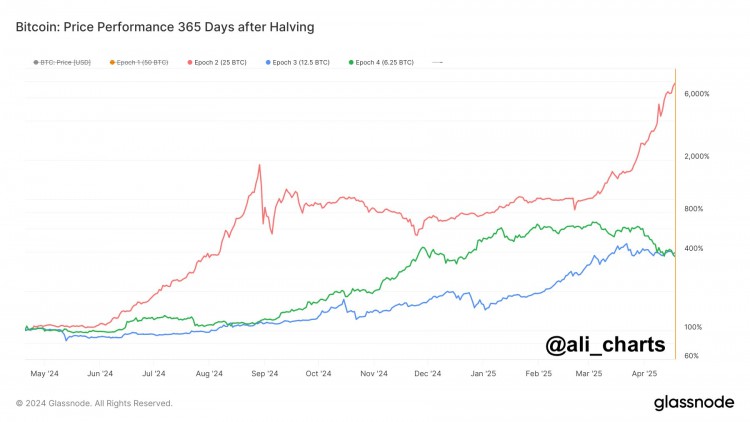

The cryptocurrency market will not only focus on the adoption of Bitcoin spot ETFs in the first half of 2024, but we also need to pay attention to the fact that there are only 106 days left before Bitcoin’s fourth halving. Although the halving usually does not trigger an immediate rise in Bitcoin and generally takes several months to a year and a half to ferment, no one knows whether the market will respond in advance and rise first.Every 210,000 Bitcoin blocks, about once every 4 years, the block reward received by miners will be reduced by half. This event called "halving" will lead to a 50% reduction in the income of miners who verify Bitcoin transactions. It is currently expected that It is estimated that the fourth halving will take place on April 22, 2024, when the Bitcoin block reward will drop from 6.25 BTC to 3.125 BTC.Historical data shows that Bitcoin’s halving narrative always brings about a sharp increase in its price, which has become the market consensus.Let’s review the percentage increase in Bitcoin price after the past few halvings, and you can understand why this has become the market consensus:Looking at the one-year period after the first halving, the price of Bitcoin experienced a 6,000% increase. After the second and third halving, the price increase of Bitcoin within one year fell to about 400%.So can the price of Bitcoin similarly experience an increase of more than 400% this year? Let's keep it imaginative.