Native is positioned as the liquidity layer of the blockchain and includes three products: Native, a liquidity interface that can be integrated by projects, NativeX, a transaction and cross-chain aggregator, and Aqua, a new lending tool. NativeX integrates multiple decentralized exchanges and cross-chain bridges as liquidity sources, and cooperates with some private market makers on this basis to provide users with zero slippage and a convenient trading experience. Its core product, Aqua, allows market makers to borrow funds from deposit users to make markets, solving the problem of market makers' lack of liquidity. Because market makers use Aqua liquidity for settlement during settlement, funds are always stored in Aqua contracts, and the risk is significantly lower than traditional institutional lending. Aqua controls risks while also increasing the efficiency of fund utilization and profitability.

Project Overview

Native is positioned as a programmable liquidity layer. It currently has three products: Native, a protocol-oriented liquidity interface, NativeX, a cross-chain transaction aggregation, and Aqua, a new lending tool for market makers. Native can help project parties directly access Native liquidity on their own web pages. NativeX is already at the forefront of the cross-chain aggregation trading track. Although the overall demand for the track is low, it reflects the team's operational capabilities to a certain extent. The design of its new lending product Aqua greatly improves the capital efficiency of market makers while controlling risks, and is highly innovative. Native has received two rounds of funding from Nomad Capital and is launching its core product, Aqua.

Native can help project parties launch trading functions on their own websites, giving protocol users a more convenient interactive experience. By using Native's tools, protocols can easily access Native's liquidity on their own websites and change transaction fees by themselves.

Although cross-chain transaction aggregation products are currently less adopted, they have certain growth potential. Users have great demand for cross-chain bridges and transaction aggregation, but they often operate them separately, and there are fewer users who directly use cross-chain transaction aggregation. Although cross-chain transaction aggregation can provide a convenient transaction experience, it has not been widely adopted due to issues such as liquidity and user habits. NativeX is already at the forefront in the field of cross-chain aggregation. It has integrated more liquidity and accumulated more market maker resources. It can receive more than 70% of DeFi's order flow, which will help the subsequent launch of Aqua. And with the outbreak of major L1 and L2, the demand for cross-chain transactions increases, and cross-chain transaction aggregation may gain more user adoption.

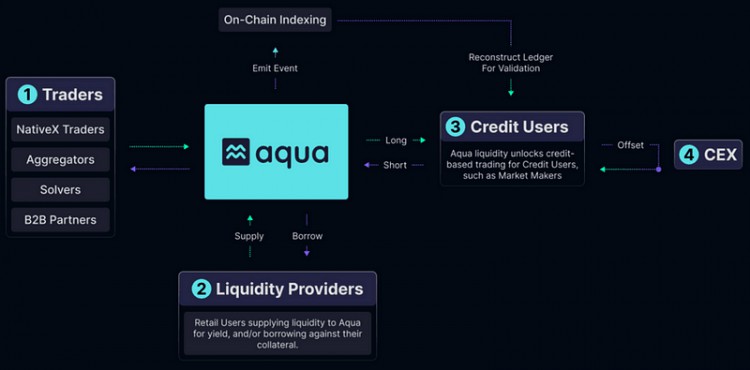

As a new lending tool, Aqua improves the capital efficiency of market makers while reducing user capital risks as much as possible. Credit lending agreements for institutions often do not require collateral. Institutions can directly lend user funds after being reviewed. Information disclosure such as the use and whereabouts of funds after lending is basically zero, and users need to bear greater risks of institutional default. The market makers that borrow from Aqua are all over-collateralized and do not actually lend out the funds. The market makers only use the funds in the Aqua pool for transaction settlement, and there are two-way transactions between users and the Aqua pool before and after settlement. Then the market maker generates corresponding long positions and short positions in the Aqua pool, and the market maker can simultaneously perform reverse operations on the centralized exchange to earn the transaction price difference. For deposit users, the funds used for mortgage by market makers are always stored in the Aqua pool, the risk of default is minimized, and users can obtain sustainable low-risk returns. For institutions, they gain liquidity on the asset-free blockchain and can open more positions, maximizing capital efficiency.

As joint products, Native, NativeX and Aqua can provide each other with pricing, order flow and liquidity, forming a linked competitive advantage.

Overall, Native has accumulated a lot of resources in cross-chain transaction aggregation, which will help the further development of its new product Aqua. And form the effect of the linkage between Native, NativeX and Aqua. As a new product of Native, Aqua creates a new paradigm for cooperation between liquidity providers and market makers. While ensuring the safety of deposit users' funds, it also provides market makers with higher capital efficiency and convenience, forming a win-win situation. As a rare innovation in the DeFi field, there is currently no similar product, and Native deserves attention.

1. Basic overview

1.1. Project Introduction

Native is positioned as a programmable liquidity layer. It currently has a protocol-oriented liquidity interface Native and a cross-chain transaction aggregation product NativeX to provide trading users with a more convenient trading experience. Native has launched Aqua, a new lending protocol for users and market makers, on the test network. Aqua enables market makers to obtain borrowing capacity through mortgages and settle users' transactions through funds from the Aqua pool, which increases capital efficiency while minimizing the market maker's default risk.

1.2. Basic information

2. Project details

2.1. Team

According to Linkedin data, team members are 3–10 people. The core members are introduced as follows:

Meina Zhou, CEO of Native. He has a master's degree in data science from New York University, has more than 8 years of experience in leading data science teams, and has extensive experience in machine learning, data mining and project management. Meina Zhou is also the founder and host of the CryptoMeina Podcast.

Wee Howe Ang, a consultant at Native, holds a bachelor's degree in electrical engineering from the National University of Singapore. Served as Software Development Manager (Assistant Vice President) at Deutsche Bank. CTO of cryptocurrency trading company Altonomy, CTO of cryptocurrency trading company Tokka Labs.

Hung, Native’s technical lead. Entered the encryption industry in March 2019, is a full-stack engineer, and is familiar with EVM smart contracts.

The number of Native members is small, but the team has a clear division of labor and has rich industry experience in the fields of technology, trading and publicity operations.

2.2. Funding

In April 2023, Nomad led a $2 million seed round. Nomad Capital received investment from Binance in March 2023 and invested in its first project, Native, the following month. In December 2023, Native received strategic investment from Nomad Capital.

2.3. Products

2.3.1. Aqua

In the early days, decentralized exchanges mostly used order books and RFQ (requesting quotes directly from market makers instead of placing orders, which is slightly different from order books) trading types. However, the cost of order book transactions on the Ethereum network is too high, the transaction depth is poor, and matching is difficult. Therefore, the automatic market maker mechanism has become the mainstream model of decentralized exchanges. Take Uniswap as an example. Uniswap adopts a constant product market making model. Although it achieves self-discovery of prices, its capital efficiency is low and a large amount of liquidity is required to reduce the price impact of transactions, and liquidity providers still face free losses. The risks and benefits of providing liquidity are often not as high as simply holding tokens.

Native is launching Aqua, a new paradigm of trading model. Aqua is a new lending product for ordinary users and market makers, which combines the attributes of decentralized exchanges and lending products. It is committed to increasing the capital efficiency of market makers and users' deposit income while ensuring the safety of user funds. Usually, market makers' funds are stored in centralized exchanges and individual blockchains. If there is a certain demand for market making on a new blockchain, they need to allocate part of the funds and bear the security risks of this blockchain. Market makers may give up part of their market-making profits as a result.

Through Aqua, market makers use asset mortgages to borrow money to make markets in the new blockchain network (the collateral can exist on other chains). Generally, the RFQ mechanism is used, which has high capital efficiency but does not suffer from slippage, MEV and other disadvantages. Its funds come from deposit users/liquidity providers (deposit users can also obtain certain borrowing capabilities). Assume that the user sells ETH for USDT, and the market maker gives a quotation and settles it through Aqua's funds (deposited by the user). After settlement, the market maker generates a short position in USDT and a long position in ETH (equivalent to the market maker's The pool has lent USDT and deposited ETH, but the funds are in the Aqua contract). Within the scope of its borrowing, a market maker can maintain multiple positions simultaneously, maximizing the market maker's liquidity and capital efficiency.

Aqua not only improves the capital efficiency of market makers, but also solves the problem of market makers' lack of liquidity on some blockchains. The bigger highlight is that the money borrowed by the market maker has always been in Aqua's contract, and the actual manifestations are long positions and short positions. The asset sheet of the market maker is more transparent and the borrowed assets cannot be misappropriated. The risk is significantly lower than that of traditional institutions. Lending Agreement.

For lending users, the income is superimposed on the traditional lending agreement with the interest on funds used by the market maker (the interest fee for opening a position). The deposited funds have more lending scenarios, and the yield is higher than the traditional lending agreement. High, but does not face the credit risk of the market maker (the funds are always stored in the Aqua contract). And market makers have a continuous need for transaction settlement, that is, the income of deposit users is relatively stable and sustainable.

Aqua market makers are all over-collateralized, and the collateral and settlement funds do not need to exist in the same blockchain. Aqua uses a fixed-rate lending model that adjusts based on market conditions and capital utilization. Interest will be calculated through off-chain calculations (the specific interest amount is determined based on the number of blocks passed and position changes), and the calculated interest amount will be sent to the chain periodically. Aqua uses off-chain quotes. When a market maker's borrowing exceeds its borrowing limit, whitelisted liquidators can propose a liquidation proposal. Aqua will verify the proposal and return a signature, and the liquidator will then perform liquidation on the chain.

2.3.2. Native & NativeX

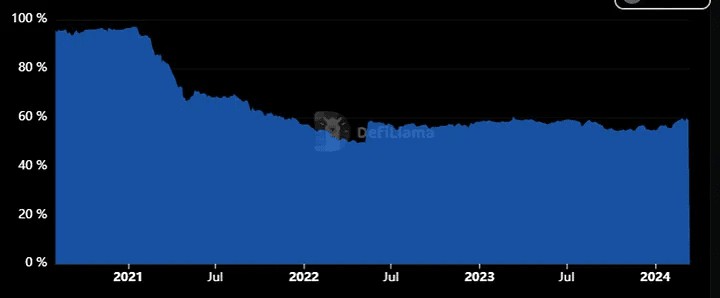

Since the GAS issue of Ethereum was criticized, the encryption market is gradually moving towards multi-chain. From the perspective of TVL, the TVL ratio of the Ethereum network has remained around 58% in the past two years, which shows that other blockchains have certain market competitiveness and maintain a certain degree of liquidity. From the perspective of public chain narrative, Ethereum will serve the second-layer network as its core, and more of its funds will migrate to the second-layer network in the future. It can be expected that the future encryption market will be a multi-chain parallel rather than a simple Ethereum one-size-fits-all situation.

As more and more blockchains are launched, liquidity becomes fragmented. Whether it is the first-layer blockchain of Solana and Aptos or the second-layer network of Ethereum, there is a huge demand for liquidity.

For traders, the current price order book trading model and deep liquidity of centralized exchanges can reduce transaction costs, but it also means that users need to give up ownership of assets and cannot trade unlisted tokens. Although asset ownership can be retained on decentralized exchanges, it is limited to on-chain liquidity, and traders have to bear slippage, price impact, and MEV losses.

Native is a liquidity solution that integrates multi-chain liquidity sources. Its product Native can help project parties access Native’s liquidity and launch trading functions on their own websites. Another product, NativeX, has both cross-chain bridge and transaction aggregation functions, allowing users to conduct cross-chain