The market was relatively quiet yesterday, giving it a break before a very busy week of data releases. This week’s data releases include China’s new RMB loans, social financing, M2money supply, CPI, PPI, trade balance, etc. Europe includes German industrial output data, loan surveys, Swedish and Norwegian CPI, and the ECB meeting. The UK includes employment data, monthly GDP and industrial production data, while US data will focus on prices, including the New York Fed’s 1-year inflation expectations, CPI, PPI, the University of Michigan Consumer Confidence Index and inflation expectations. Central bank activities will include interest rate decisions from Singapore, Sweden, New Zealand, Canada, Thailand, the ECB and South Korea. In addition, JPM, Citi, Wells Fargo, State Street and BlackRock will all announce first quarter earnings this week. It is indeed a very busy week!

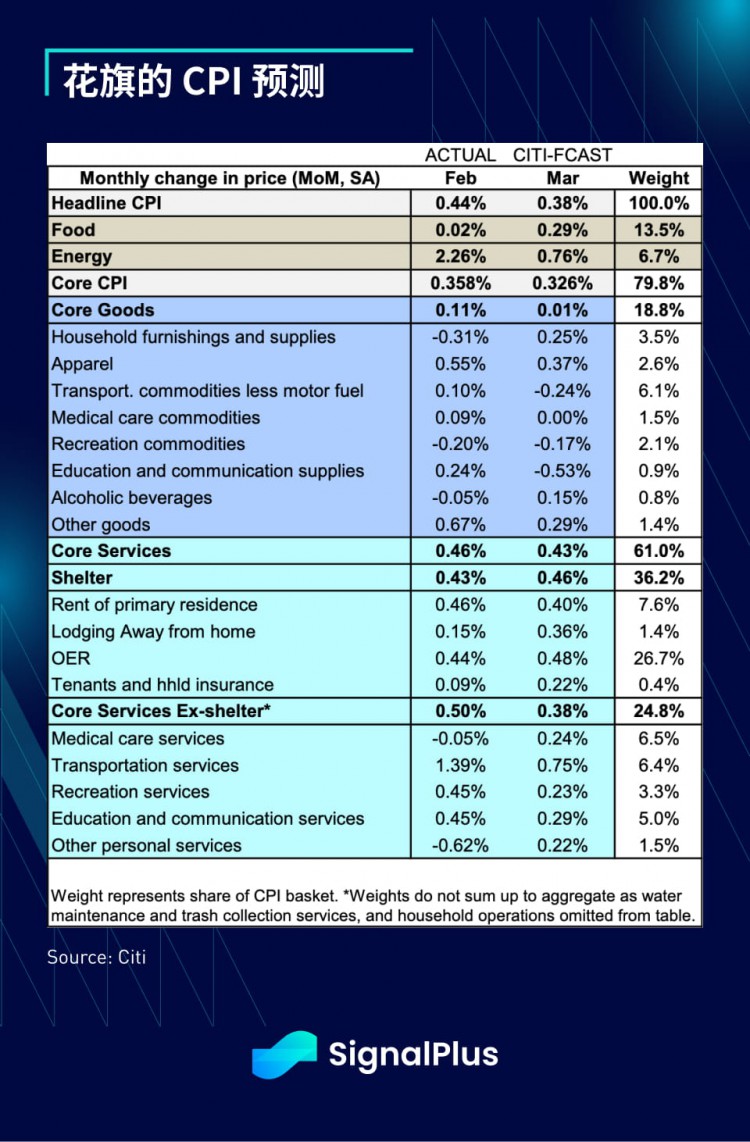

In the US, Wednesday’s CPI will be the focus, with the market expecting a slight pullback in core CPI from 3.8% to 3.7% year-on-year. Judging by the rise in bond yields over the past few days, the market seems to be leaning towards hedging against hawkish surprises. The implied volatility of the SPX on Wednesday by the option straddle is around +/- 1%, while the average volatility of the index on CPI release days over the past 12 months has been +/- 0.7%. It is important to note that option prices have generally overestimated actual volatility over the past two years, as investors have been paying a premium for tail risk protection given the high focus on inflation this cycle.

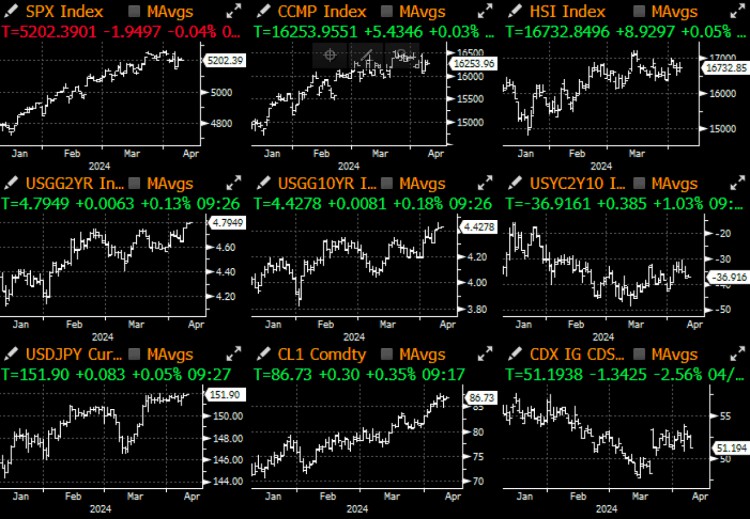

Fixed income markets have fully returned to the belief that “rates are higher for longer”, with market pricing excluding more than 50 basis points of rate cuts compared to early January, and both 2-year yields and long-term rates currently pricing significantly above the Fed’s official guidance.

Speaking of volatility, Citi reports that the SPX is up 23% over the past 6 months with a maximum/minimum trading range of 24.4%, while actual volatility is at a low of 11.7% and the volatility to trading range ratio is at 1 The lowest level since January and the 1st percentile since 1983. With macro event risks all but dissipated, implied correlations have also fallen to 10-year lows, indicating a very high (extreme?) level of market risk complacency amid strong economic performance and corporate earnings .

In other words, the SPX hasn’t had a -2% day since February 2023 (while BTC seems to be moving 2% every 8 hours lately), and according to Citi, this is the 12th longest streak since 1928, with the longest streak in history occurring between 2005 and 2008 at over 900 days, though the current complacency in the U.S. stock market is undoubtedly in stark contrast to the world situation.

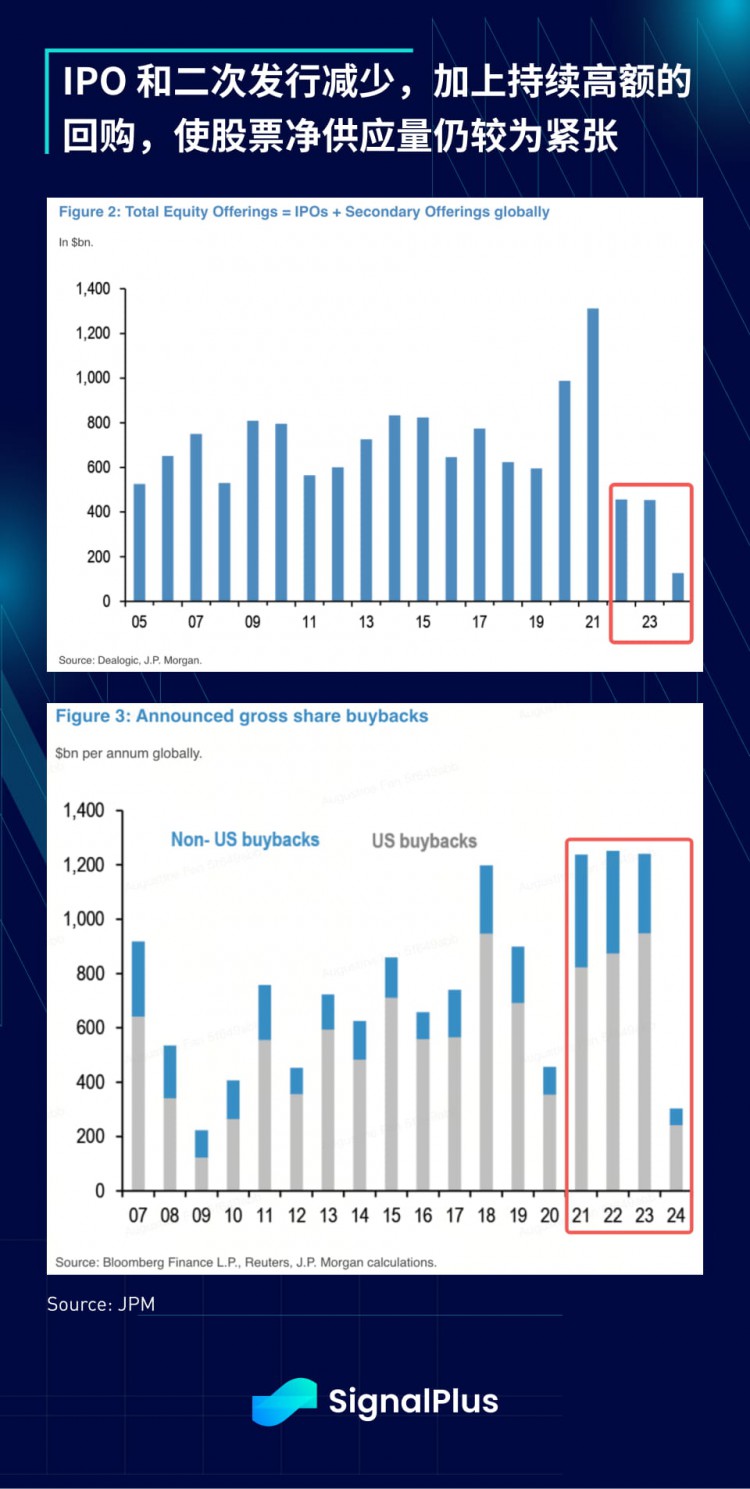

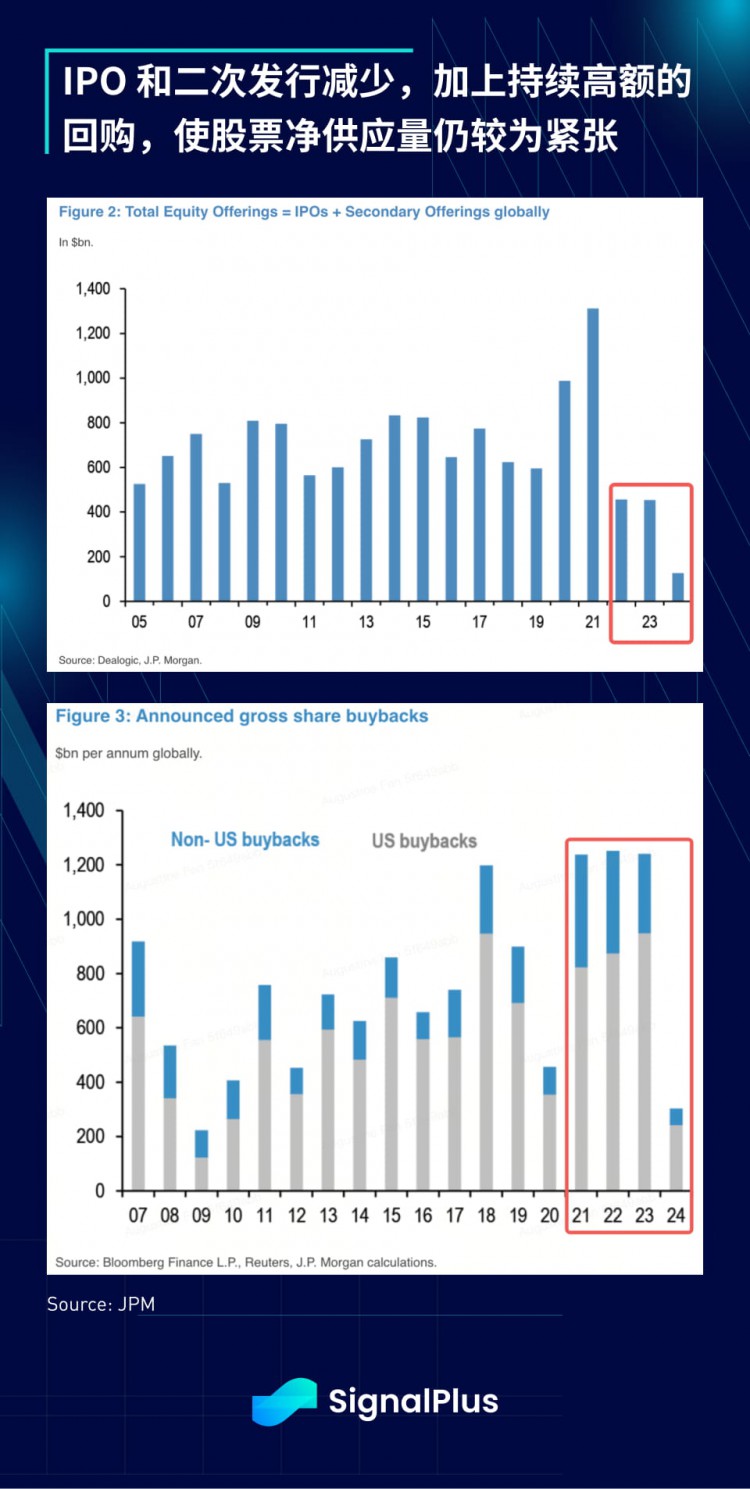

Looking at corporate fundamentals, strong earnings growth and historically high profit margins continue to support the stock market, and the net supply of stocks (secondary offerings + IPOs) continues to shrink compared with the past few years, while corporate Buybacks remain strong, with 2024 expected to be the 4th consecutive year of annual buybacks of around $1.2 trillion. It appears that scarcity does not only apply to BTC, but quality stocks also appear to be in short supply relative to the expanding fiat base. .

Cryptocurrency prices continue to rebound after the liquidation of leveraged longs over the past week, with prices within striking distance of all-time highs, and various altcoins taking turns to show good performance. ETF inflows were more modest at $64 million yesterday, with BlackRock's inflows roughly offset by GBTC's outflows. Finally, Bloomberg reported that crypto venture capital deployed in the first quarter of 2024 rebounded, which is a good sign but still a far cry from 2022, although the BTC price has recovered all of its losses during this period.