Original title: State of Solana Q1 2024

Original article by Peter Horton, Messari

Original translation: Felix, PANews (This article has been edited)

Key insights:

Solana network daily spot DEX volume increased 319% month-over-month to $1.5 billion. Solana became a hub for retail and Memecoin traders.

Projects built primarily on Solana raised $89.2 million in Q1, $2.5 million more than they raised in all of 2023.

The launch of token extensions, which provide a set of configurable features for token issuers. So far, stablecoin issuers including Paxos and GMO Trust and crypto-native projects such as Photo Finish LIVE and Wen have adopted token extensions.

· With the launch of developer store Anza and growth organization Colosseum, the Solana ecosystem has made significant progress towards further decentralization.

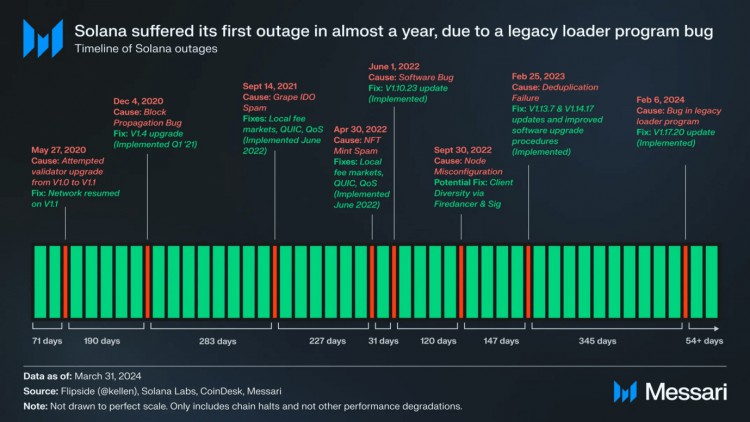

The Solana network experienced its first outage in nearly a year due to a bug in the legacy loader, but the network remains stable. Upcoming scheduler and network upgrades will reduce spam and improve user experience.

financial analysis

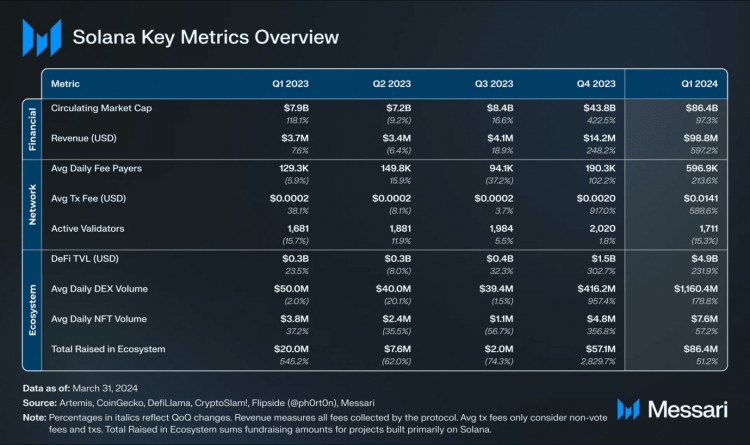

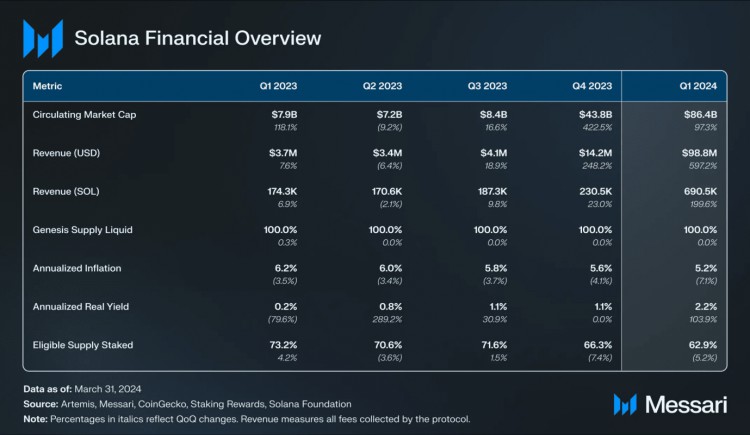

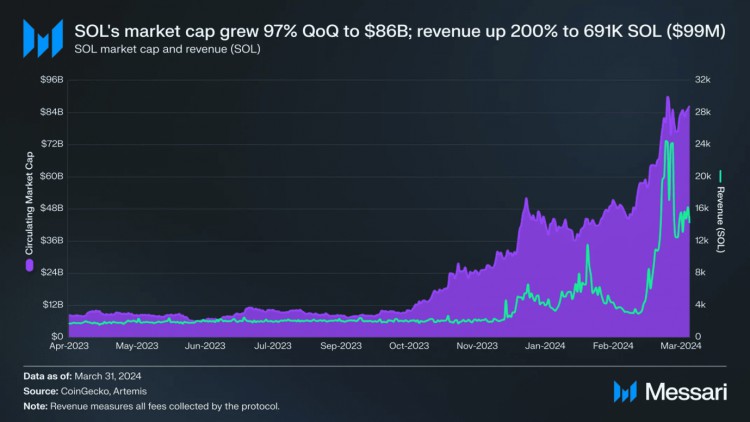

SOL continues to lead the market in terms of market capitalization. Its market capitalization ranks fifth among all tokens, second only to BTC, ETH, USDT, and BNB. After reaching a peak of $77 billion in the previous cycle, SOL's market capitalization continues to reach its historical high. As of the first quarter of 24, the market capitalization was $86.4 billion, a month-on-month increase of 97%. However, SOL is still about 25% away from its historical high of nearly $260.

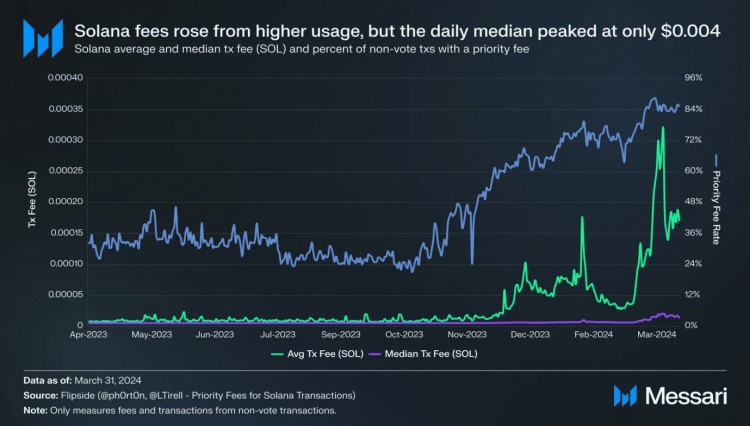

Revenue in Sol grew 200% quarter-over-quarter. Total quarterly revenue in USD grew 597% quarter-over-quarter to $98.8 million as Solana’s price rose. Solana’s single-day revenue hit an all-time high of approximately $4.9 million on March 18.

Half of these fees are burned, while the other half is distributed to block producers. Burning tokens reduces Solana’s annualized quarterly inflation rate from 5.5% to 5.2% in Q1. The SOL issuance rate will decrease by 15% per year until it reaches 1.5%.

Network analysis

use

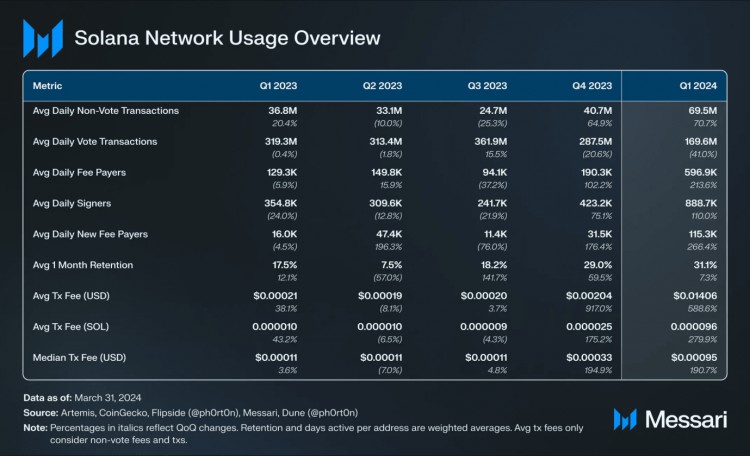

Network activity, as measured by non-voting and paid transactions, continued to rise in Q1. Average daily paying users grew 214% month-over-month to 597,000, peaking at over 2 million on March 17. The growth in addresses was primarily driven by Memecoin transactions. Average daily non-voting transactions grew 71% month-over-month to 70 million. However, 62% of non-voting transactions failed, up 10% month-over-month. Most of the failed transactions came from arbitrage bots or user transactions on DEXs.

New paying users also showed a similar growth trend, reaching a high of about 1.2 million on March 17. Average daily new paying users increased 266% month-on-month to 115,000. The retention rate of new paying users is also high. The one-month retention rate of new paying user groups in December 2023, January 2024, and February 2024 is above 30%, while the average retention rate from January 2023 to November 2023 is 18%.

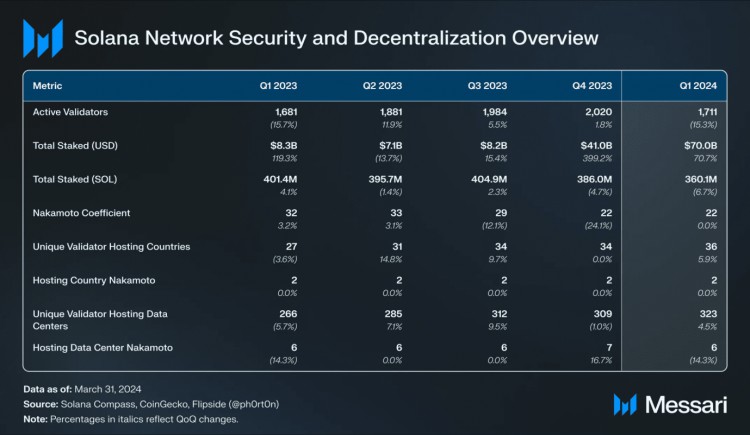

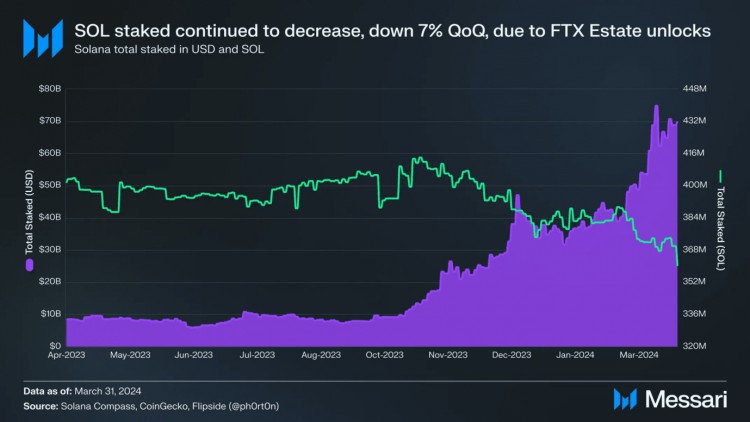

Security and decentralization

SOL staking rate fell for the second consecutive quarter, down 7% month-on-month. The main reason for the decline is that FTX Estate canceled staking when the token was unlocked. However, as the SOL price rose, the total staking amount in US dollars increased by 71% month-on-month to $70 billion, ranking second among all networks, second only to Ethereum.

Performance, Upgrades, and Roadmap

On February 6, the Solana network suffered its first outage in nearly a year, with the outage lasting about five hours due to a bug in an older version of the loader. The bug was previously discovered on Solana’s devnet, but its fix has not yet been implemented.

The Solana network remains stable, although increased network usage has led to congestion issues that have deteriorated the user experience. Identified issues and potential solutions include: launching a transaction scheduler, upgrading the network, etc.

The most notable development this quarter is token extensions. Token extensions are part of the new SPL token standard and provide a set of configurable features for token issuers. These extensions support features that are largely available on other networks, but currently require developers to build their own infrastructure or permissioned environments.

Ecosystem Analysis

DeFi

Solana DeFi TVL grew 232% quarter-over-quarter to $4.9 billion, ranking fourth among all networks. Lending and yield protocol Kamino jumped from the fourth-largest Solana protocol to the top of the TVL list. Its lending protocol ended the quarter with nearly $1.3 billion in TVL, up 811% quarter-over-quarter.

DeFi trading volume also continued to grow, with average daily spot DEX trading volume increasing 319% month-over-month to $1.5 billion. The growth in DEX trading volume was primarily driven by Memecoin trading. SLERF and BOME ranked seventh in terms of trading volume. Other Memecoins in the top 15 by trading volume include BONK and WEN.

Telegram bots have become a popular trading venue for retail investors, with the average daily active addresses of Solana Telegram bots increasing by 573% month-over-month to 45,000. About 5% of the total quarterly volume came from Telegram bots, up more than 2x month-over-month. BONKbot is the largest trading volume among Solana Telegram bots, with an average daily trading volume of $37 million. The bot charges a 1% fee to purchase BONK and distribute it to various parties, including destruction (10% of the fee).

In mid-March, BONKbot launched its Valhalla upgrade. Trojan on Solana went live in late January, with an average daily trading volume of nearly $14 million, and released the Bolt Pro feature in March. Other Telegram trading bots include FluxBot, SolTradingBot, and Banana Gun.

Over 59% of spot DEX volume is traded through the Jupiter trading aggregator. Jupiter released its native token, JUP, in late January. Since launch, Jupiter Perps has averaged $328 million in daily volume. Another major player in Solana, Drift, has been on a strong growth trajectory. In Q4, Drift’s average daily revenue grew by about 10x, and in Q1 it grew by 6x to $142 million. In late January, Drift launched its points program, which will end in March, followed by the token launch. In mid-March, Drift launched its pre-launch market offering, offering rewards for yet-to-be-launched tokens, starting with Wormhole’s W.

Following a 21% increase last quarter, Solana’s stablecoin market cap grew 55% quarter-over-quarter to $2.8 billion, ranking fifth among all networks. This growth was driven entirely by USDC, whose Solana market cap grew 111% quarter-over-quarter to $2 billion. Solana now has the second-largest amount of USDC held, behind only Ethereum.

Liquidity Staking

Solana’s liquidity staking rate grew 27% quarter-over-quarter to 5.5%. Jito, a liquidity staking protocol, has been leading the way in terms of growth. Jito’s TVL grew 47% quarter-over-quarter to 9.4 million SOL, replacing Marinade for the top spot in TVL. At the end of the quarter, Jito’s liquidity staking market share was close to 50%. Marinade Liquid’s TVL fell 9% quarter-over-quarter to 6.4 million SOL. Blaze’s TVL grew 38% quarter-over-quarter.

Average daily NFT trading volume increased 57% month-over-month to $7.6 million. After topping out at over $331 million in total trading volume in December 2023, growth reversed in January and February but picked up again in March 2024.

In the NFT market, Tensor's market share increased by 9% month-on-month to 71%, while Magic Eden's market share continued to decline, down 18% month-on-month to 25%.

DePIN

Solana is becoming the hub for DePIN applications, including hosting Helium, Hivemapper, Render, Teleport, and GenesysGo. Notable events in the first quarter include: Helium Wi-Fi and Telefonica partnership, Io.net financing and launch plans, etc.

Financing

After a prolonged bear market, Solana ecosystem financing is recovering. 16 projects built primarily on Solana announced several rounds of financing in the first quarter, with a total of $89.2 million in financing. Including the fourth quarter of 2023, 25 projects raised $146.3 million, while in the previous two quarters, 7 projects raised $9.6 million.

Summarize

Solana continued to grow in 2024 after a strong performance in 2023. Solana became a major gathering place for retail and Memecoin traders. Its daily spot DEX trading volume increased by 319% month-on-month to $1.5 billion. Solana also made great progress in its ability to support institutions, launching token extensions, which provide a set of configurable functions for token issuers.

However, the increase in network activity has led to congestion issues, which are being addressed in upcoming network, scheduler, and fee market upgrades.

After a protracted bear market, investment in the Solana project is heating up. Projects built primarily on Solana raised $89.2 million in the first quarter, $2.5 million more than the total raised in all of 2023. The Solana ecosystem is also becoming more decentralized. Former Solana Labs engineers and executives announced the launch of developer shop Anza, and the former head of growth at the Solana Foundation launched the growth organization Colosseum.

Original link