Written by: Mary Liu, BitpushNews

As the halving approaches, Bitcoin has had a strong start to the week, surging above $72,000 in early trading on Monday, less than 3% away from its all-time high of $73,750. After trading near $69,400 over the weekend, Bitcoin bulls began to move higher in the early hours of Monday morning, breaking through the $71,000 resistance level and hitting a high of $72,780 shortly after 8 a.m. ET, according to market data. At press time, Bitcoin is trading at $71,845, up 3.5% in the 24 hours.

Other tokens that gained on Monday included Ethereum (up 8%), meme coin Dogwifhat (up 18%) and Pepe (up 10%).

Data released by Coinshares on Monday showed that digital asset investment products recorded $646 million in inflows last week. Bitcoin-related investment products remained in the spotlight, with inflows totaling $663 million, while investment products that short Bitcoin saw outflows totaling $9.5 million for the third consecutive week, indicating a slight capitulation among bearish investors.

“Year-to-date inflows are at an all-time high of $13.8 billion, currently well ahead of 2021’s $10.6 billion,” said James Butterfill, head of research at Coinshares.

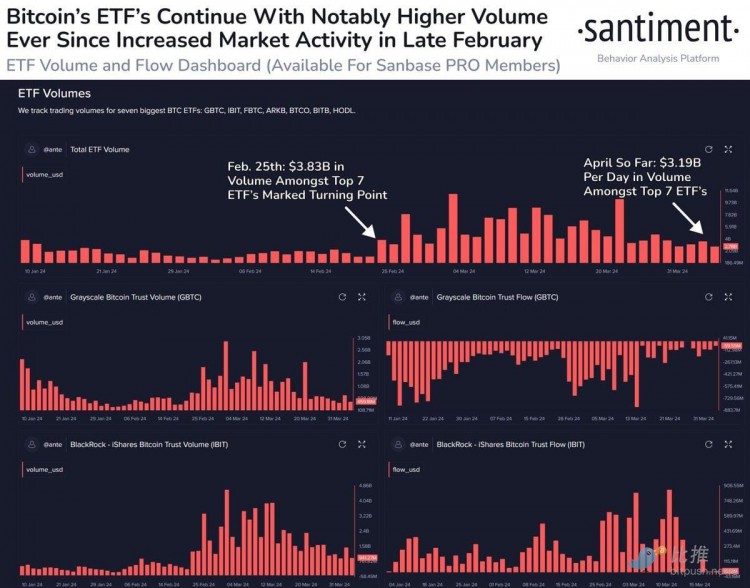

On-chain analysis company Santiment believes that ETF trading activity remains at a relatively active level. Analysts at the company said: "Bitcoin ETF trading volume has not slowed down four weeks after BTC broke through new highs. In GBTC, IBIT, FBTC, ARKB, BTCO, BITB and HODL, trader activity is still significantly higher than the turning point that began after retail trading began to pour in at the end of February."

They added: “High activity should continue until the halving on April 19, but it will be interesting to see whether ETF volume and on-chain volume decline directly after the halving.”

Stablecoin activity suggests bulls are preparing for a rally

While the bitcoin price has been moving sideways and consolidating since early March, it could soon resume its climb, according to Markus Thielen, head of research at 10x Research.

“After being significantly bullish since January 25, we turned cautious a month ago (March 8) as forward returns seemed unpredictable based on the technical setup of the market,” the analyst said in a market update on Monday. “Trading (cryptocurrency) is about risk reward and knowing when to bet big/small, and the past thirty days have indeed been a period of small bets. But this will soon change.”

Thielen noted: “Bitcoin was trading in a symmetrical triangle pattern last month, and according to some historical analysis, 75% of triangle patterns will see a continuation pattern (of a bull run) and higher prices.”

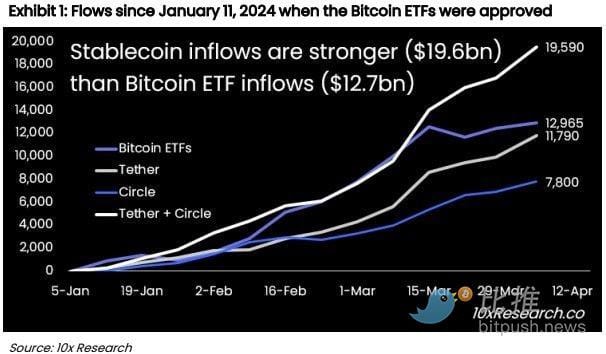

Thielen said stablecoin trading volumes could be a better predictor of future conditions than just looking at ETF flows or futures data.

He said: “In the past 30 days, we have seen ETFs record net inflows of about $5 billion, while more notably, Tether has a net inflow of $6.9 billion and Circle has minted about $3 billion, with a total of $10 billion of new funds entering through stablecoins. While Bitcoin ETF flows have attracted media attention, in contrast to ETFs, stablecoins have minted twice as much and may only be long. We recommend reducing the focus on Bitcoin ETF flows and stablecoin issuers are the ones to watch and will drive this market higher.”

Thielen concluded: “While we expressed concerns about weak ETF flows, the baton has been passed to stablecoins. Tether recorded a 7-day minting signal of $2.4 billion, one of the highest since the start of this bull run, fiat currencies are accelerating into the crypto space, and we want to be bullish as a symmetrical triangle breakout is imminent.”

Thielen’s analysis shows that based on the current formation, the triangle pattern “met” on April 18, and if it is a bullish breakout, Bitcoin could climb above $80,000 in the coming weeks, and buying at 69,280 and setting a stop loss at 65,000 seems “appropriate.”

Many cryptocurrency traders expect the Bitcoin halving event to be a pivotal moment in 2024, with a significant impact on the cryptocurrency market. However, analysts at Steno Research expect it to be a "buy the rumor, sell the news" event. Steno Research expects the value of BTC to surge ahead of the halving event. However, within the first 90 days after the halving, its value could "fall below the price at the time of the halving."

According to data provided by Alternative, with only 11 days left until the Bitcoin halving, sentiment in the crypto ecosystem remains in the realm of “extreme greed.” The overall cryptocurrency market cap is currently $2.69 trillion, and Bitcoin’s dominance rate is 52.4%.