Family members, I heard through the grapevine that this coin is going to explode soon, so I directly added 5 million to my position!

Solana is experiencing a huge outage, but don’t panic, things are about to turn around!

Ethereum ERC314 upgrade has come out, and what surprising news are there about Pendle, BNB and EtherFi? Let’s follow Shuqin to take a look.

The first is the short-term surge opportunity of BNB.

You should know that every time Binance announces the mining of new coins, it will increase by 10%, such as ENA on March 29 and Saga on April 4. Because if you want to mine new coins, you must hold BNB.

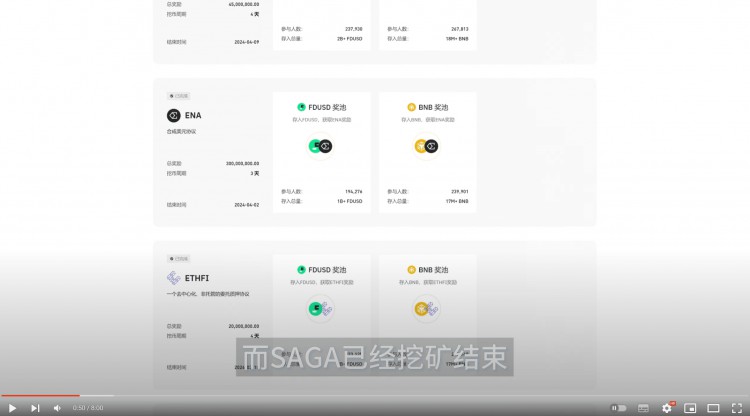

As everyone has seen in the past six months, Binance has launched a mining project every one or two weeks, which is very stable.

SAGA mining has already ended, so Shuqin speculates that there is a high probability that a new coin will be listed tomorrow or next Friday. Each time a new coin is mined, it will cause an increase of about 10%, which is really not small, so everyone can ambush in advance.

In fact, now is also a good time to enter the market, because in addition to the surge in BNB price when the mining is announced, it also has another feature, which is that it will slightly pull back after the mining is completed.

This is easy to understand, because some people will sell their BNB after mining, or you can treat it as a good thing to sell. So now there is a 5% discount from 600, plus the 10% increase in mining announced later. The two are combined and you can play it once a week, selling high and buying low, it’s so cool!

Therefore, instead of playing with Bitcoin contracts whose ups and downs are unclear, it may be easier to make a profit by playing with BNB leverage whose benefits are clear.

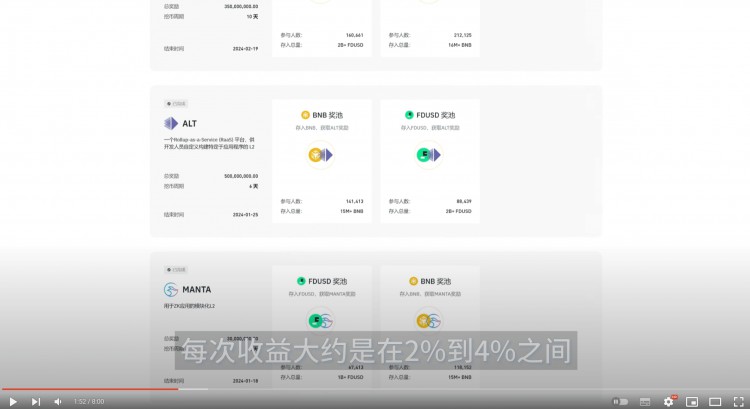

In the long run, holding BNB spot is also a very good choice. I believe you have seen in the previous chart that Binance mines once every one or two weeks, and the profit each time is about 2% to 4%, with an average of 2.5%. Mining 30 times in 50 weeks in a year, the annualized rate is definitely more than 70%.

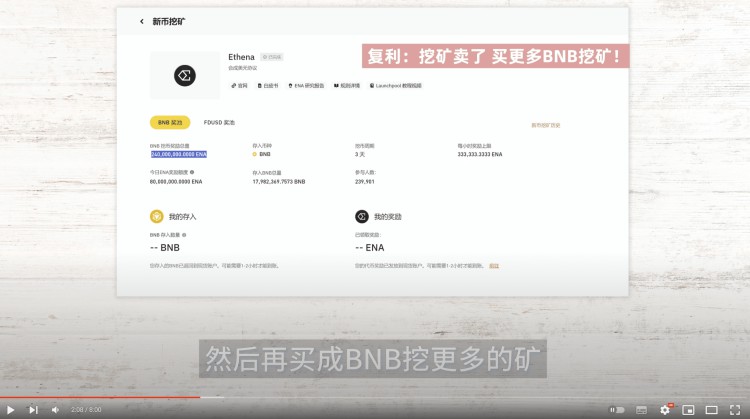

If you take compound interest into account, that is, you sell the coins you earn from mining, and then buy BNB to mine more, then the compound annual rate will definitely exceed 100%. In addition, the price of its own coin will also soar with the bull market, and the dual-core drive is really terrifying.

For example, Shuqin used 500 BNB to mine the new coin Saga. She mined about 1,000 Sagas and earned 6,000u in just three days.

After the mining was completed a few days ago, BNB fell back a lot from 600. Yesterday at 570, I called on everyone to enter the market again. I added 5 million and the average price was 550U.

Therefore, this coin is quite clear whether you are playing short-term contracts or doing long-term spot. Although it cannot make you rich overnight, it performs stably and steadily. Binance pays everyone money every week. Where can you find such a good coin?

In addition, the Solana incident is about to see a turning point.

I believe everyone has noticed recently that due to the popularity of Dogecoin, a large number of robots have appeared in Solana for arbitrage and screen swiping, causing network congestion.

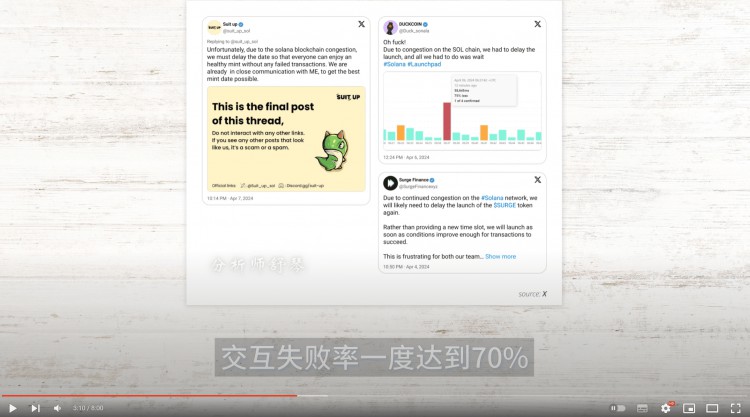

Although this time there was no complete outage like in February, it was still quite troublesome. The interaction failure rate once reached 70%. Coupled with the recent correction of Bitcoin, its price has been stagnant, and WIF has also been greatly implicated.

But now things have finally taken a turn for the better.

Shuqin found a lot of useful information after browsing the Twitter accounts of major developers. Solana will upgrade to fix this problem as early as April 15, so by the time it is officially announced, it is likely that all the bad news will be out and a rebound will begin.

In fact, Shuqin is not worried about Sol's problem at all, because it is not a design failure, but an application problem, which is relatively easy to solve.

When Ethereum was first released in 2016 and 2017, it also experienced many bugs and was even stolen, which eventually led to the hard fork of ETH and ETC. But later it was continuously upgraded and is now very perfect, and its price has also been bullish for a long time, so these problems of Solana are temporary, don't worry.

Speaking of Ethereum, it has also recently ushered in new opportunities.

Previously, the Ethereum mainnet gas fee was too high, often tens or hundreds of U, so price-sensitive local retail investors all ran to Solana to play, and recently the Ethereum ERC314 token protocol was born, which can effectively reduce the mainnet gas fee by more than 90%, but this protocol is only suitable for small players, because large transactions will generate very large slippage. But it is undeniable that this is an innovation that will not go wrong. And coupled with the potential hype of future ETFs, Ethereum's recent performance is indeed outstanding.

If you think that the volatility of Ethereum is too small, you can actually invest in the new coin EtherFi, which has greater potential, because the TVL of the locked funds of this project has been soaring all the way without any signs of decline, and is now heading towards 4 billion US dollars.

Now it has risen and then fallen, following the market correction, but I think it will still have the momentum to rise when the market picks up later.

As for Pendle, we let everyone escape at the highest point at 7.2, and I also called it out several times at that time. Now it has adjusted a lot, and we are bottoming out again at 6u. Because I am actually optimistic about this project in the long term, after all, its data has soared very exaggeratedly, and the usage has increased sharply, while Lido's data is indeed declining.

For example, when I called out Pendle before, it was because I saw its applications increase and data soaring. At that time, it was only 4u, and in just one week it increased to 7u, almost doubling!

Therefore, the rise and fall of each project can be traced, which can be seen on the chain, but retail investors don’t know this. I think there are still many coins that are in the value trough and in the early stage of rising. Those who want to operate with me can take a look.

Okay, let’s continue.

The cryptocurrency market, Bitcoin, is also about to usher in a huge upward momentum.

Who has the final say on the price of the cryptocurrency? First, Wall Street. Second, the miners. And now the production cost of Bitcoin is about to reach $90,000 per coin after the halving. See the picture.

The picture shows the mining costs of mainstream Bitcoin mining machines. The mining cost of the mainstream S19 pro and Pro XP is 40,000 to 50,000 US dollars per piece, while the mining cost of the S21 mining machine which was only released in February this year is 28,000, but it has only been out for a month, so the mainstream is still S19, and the average mining cost is around 43,000.

However, the production of Bitcoin will automatically be halved after April 19th.

In the past, 43,000 Bitcoins could be mined, but now only half can be mined, which is equivalent to a cost of 86,000 Bitcoins. So if they sell now, they will lose money. Therefore, they will only consider selling Bitcoin when it rises to more than 80,000 Bitcoins. The market also knows this, so the price will gradually move closer to the target. Moreover, not only has the cost doubled, but the output has also been halved, so this will further reduce the output on the supply side.

And the demand side is even more amazing.

This ETF has only been launched for two months, and BlackRock has already bought nearly 20 billion bitcoins. Including other ETFs, Wall Street's total holdings have reached 60 billion, and it is still buying heavily.

Therefore, the current situation is not only that the supply side will face production cuts and doubling of costs, but the demand side has also become extremely strong due to Wall Street, so any pullback before the halving is your opportunity to get on board!

After that, the big bulls will come, and you and I will be the trendsetters of the new round of the myth of getting rich quickly.

are you ready?

Well, today's program ends here. Please follow us, and let's achieve financial freedom together in this bull market!

Bye~