Wall Street analysts say the risk of disruption in U.S. financing markets is growing as the April tax deadline approaches.

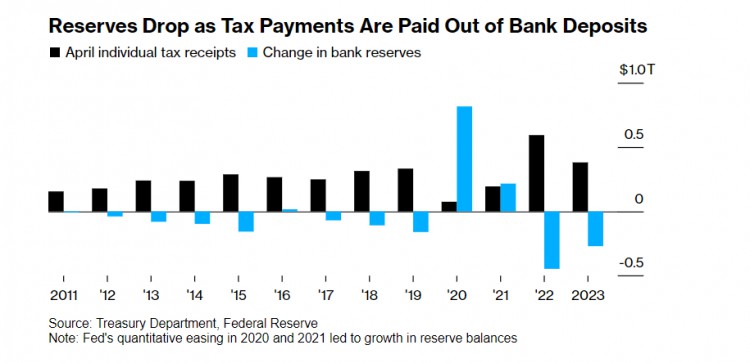

Broadly speaking, the annual rush to pay taxes this time of year tends to suck hundreds of billions of dollars out of the banking system. Americans are expected to pay more in taxes this year than in previous years due to rising incomes and a booming stock market, causing bank reserves to fall below a critical level that many suspect is critical to the stability of funding markets.

This may remind some of 2019, when a sudden increase in corporate tax payments and a sharp drop in bond issuance prompted a sudden surge in liquidity needs, causing chaos in overnight funding markets and ultimately forcing the Federal Reserve to intervene. Market observers said that while no one predicted a turmoil of this scale this time, the possibility of turmoil should not be ignored.

“The most interesting thing to watch is how close we are to the minimum ‘comfortable’ reserve level,” said Teresa Ho, head of short-rate strategy at JPMorgan Chase & Co. “We will see liquidity being pulled out of the system during tax season. This is only slightly different than month-end and quarter-end, but still potentially disruptive.”

Bank reserves, or the cash that institutions park with the Fed to meet unexpected needs, currently stand at $3.62 trillion, and with Wall Street predicting potential tax-related outflows of at least $400 billion, reserves could slip to a so-called “comfortable” level below $3 trillion.

Meanwhile, money market funds saw their assets cut as the tax deadline approached. The amount of money individuals keep in government funds, which invest primarily in securities such as Treasury bills, repurchase agreements and agency debt, fell by about $10.3 billion, nearly double the outflows seen in the week before the 2022 tax day.

In short-term funding markets, any tax-related stress would most likely show up first in a rise in the secured overnight financing rate (SOFR), a key benchmark tied to the financial system’s daily liquidity needs, as investors scramble for cash, causing liquidity to dry up, Ho said. She said trading volumes in the federal funds futures market should also be watched to see if lending activity picks up.

SOFR peaked in late November and December last year, driven by a series of events including banks cutting lending for regulatory purposes.

Is liquidity risk a cause for concern?

Societe Generale strategists said the Treasury's cumulative personal tax revenue through March was $44 billion higher than a year earlier, and they predict personal tax revenue through April will be higher than the $381 billion in 2023 but lower than in 2022.

Two years ago, as the Treasury took in nearly $600 billion in tax revenues thanks to a stock market boom and a strong economic recovery, banks took out $446 billion, according to government and Fed data. The money was deposited into the Treasury General Account, or TGA, which operates like a government checking account at the Fed and is closely watched by the Fed because as cash balances in the TGA grow, bank reserves fall.

Bank reserves fall on tax-related spending

Bank reserves fall on tax-related spending

In 2022, the tax season will have minimal impact on funding markets because the Fed has not yet begun to reduce its balance sheet (quantitative tightening). Even after tax-related expenses, banks still have about $3.32 trillion parked at the Fed and about $1.8 trillion in overnight reverse repurchase facilities (RRPs), which are a barometer of excess liquidity in the financial system.

The New York Fed's survey of primary dealers showed that while bank reserves remain at elevated levels, there are concerns that tax-related spending this month will reduce total reserves to a minimum comfortable level of $3 trillion to $3.1 trillion.

Given that RRP balances have fallen by three-quarters over the past two years, market watchers are wary of a potential liquidity crunch, with even the Federal Reserve discussing when to slow the pace of quantitative tightening to avoid a repeat of 2019, when overnight funding costs surged.

Fed Chairman Jerome Powell said last month that policymakers plan to taper quantitative tightening soon. Meanwhile, minutes of the March 19-20 meeting released on Wednesday showed policymakers favored easing quantitative tightening "sooner rather than later" to avoid market stress. With RRP balances approaching zero, any future quantitative tightening could lead to further losses of bank reserves, "potentially at a rapid pace."

“The Fed is really frightened by the specter of 2019,” said John Velis, currency and macro strategist at BNY Mellon, who estimates that if tax-related spending approaches 2022 levels, bank reserves would fall by about $500 billion. “They’re generally concerned that if 2019 conditions repeat in some form, they’ll end up moving to quantitative easing, which is expanding their balance sheet.”

In September 2019, increased government borrowing and corporate tax-related spending added to already tight bank reserves, when a key lending rate surged fivefold.

Some market observers also believe that as time goes by, concerns about renewed turmoil appear to be unfounded.

Stronger tax revenues mean the Treasury can issue fewer short-term bonds. With supply reduced, excess cash on the front end of the bond market could flow into the Fed's RRP facility as a liquidity backstop, Bank of America strategists Mark Cabana and Katie Craig said. They expect funding markets to likely remain healthy.

For BNY Mellon's Velis, he is on the sidelines for now and believes the risk remains. Velis said individuals will dip into their bank accounts more than usual to pay their taxes as they avoid withdrawing cash from other investment vehicles with yields far above 5%. There is also a large group of California taxpayers who applied for an extension last year for natural disasters and now face an April deadline.

“If we see repo rates spike in the middle of the month, then you know there’s a problem,” Velis said. “It’s a significant risk and it’s enough to warrant attention.”

The article is forwarded from: Jinshi Data