If the price of the first cryptocurrency falls below the level of support for short-term holders at $58,900, the market risks entering a bearish phase, analyst and co-founder Willy Wu said.

According to him, the sell-off in accumulated volume delta (CVD), which measures market orders (instantaneous buys/sells), has reached its peak, so the "up" phase is coming.

The expert noted that the market has not changed structurally since March, but April is "changeable in both directions." Halving will be another catalyst for volatility.

The analyst also suggested that $71,000-75,000 would be the next level at which large liquidations of short positions would occur.

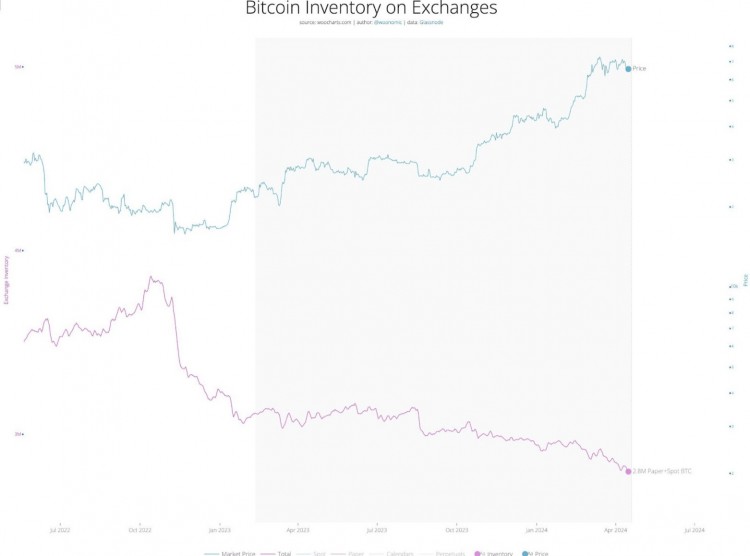

Given Bitcoin's supply and demand charts, it's only a matter of time before "the build-up that's happening in this consolidation pushes us beyond the all-time high," he believes.

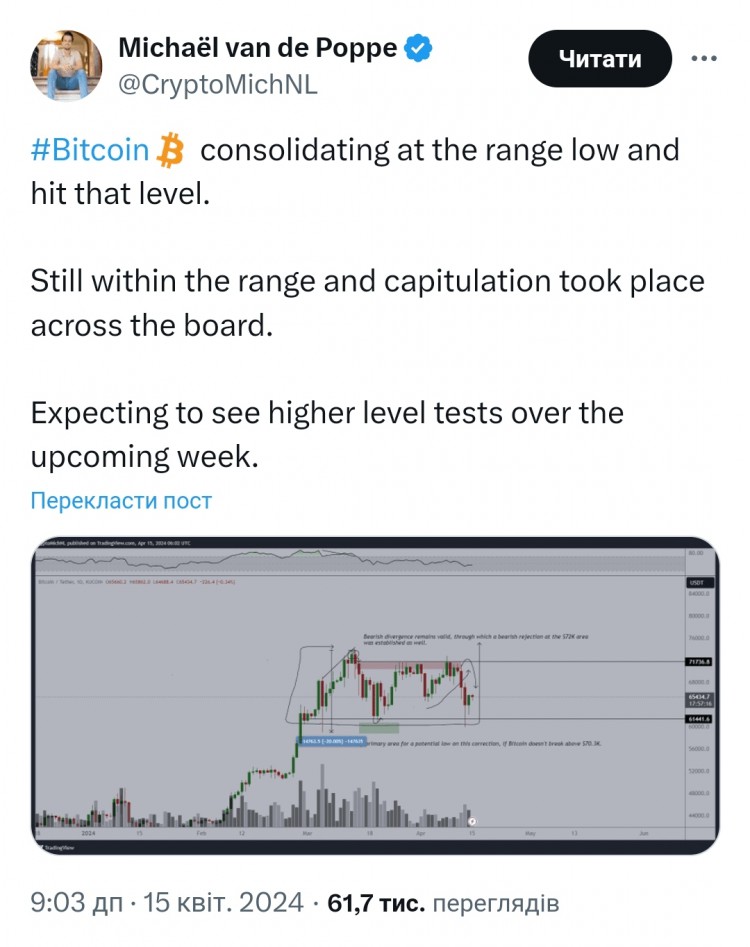

In the evening of Saturday, April 13, the quotations of the first cryptocurrency fell below the level of $61,000 against the background of the aggravation of the situation in the Middle East. The next day, digital gold recovered to levels above $64,000. During the day, the volume of liquidations reached $955 million.

Wu clarified that in almost every cycle, there was a bearish phase before the halving due to the "over-hoarding" of the first cryptocurrency.

MN Trading founder Michael van de Poppe noted a similar dynamic for Bitcoin. According to his observations, the asset consolidated at the lows of the current range of $61,000-71,000.

Earlier, van de Poppe suggested that the quotations of the first cryptocurrency began to move to a maximum at the mark of more than $73,000.

We will remind that Arthur Hayes predicted a possible fall of BTC on the eve of the halving. The reduction of the block reward is a catalyst for the price in the medium term, and the coin will face an outflow of liquidity during this period, according to the expert.

Friends, if you liked the post, subscribe, like, and you can leave a tip. Thank you )