This article briefly:

•Two prominent stablecoins, BUSD and USDC, have had different fates due to regulatory scrutiny.

•Circle’s USDC experienced its first supply increase in over 10 months, marking a significant shift.

• On the other hand, Binance’s BUSD is facing a sharp decline and the supply is close to being exhausted.

USD Coin (USDC) and Binance USD (BUSD) have had very different fates. USDC has experienced a significant upward trend, rebounding from the U.S. banking crisis, while BUSD is facing a severe supply shortage.

The disparity highlights shifts within the stablecoin market, particularly affected by the regulatory challenges encountered over the past year.

USDC market value soars

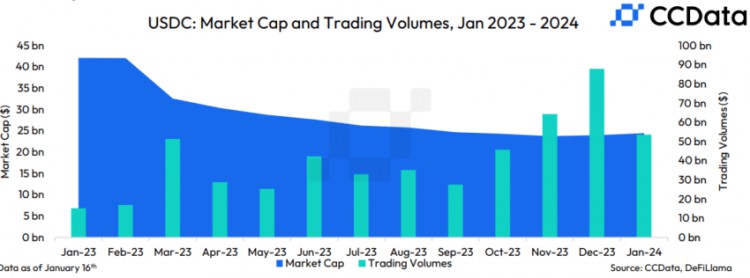

USDC’s market capitalization surged at the start of the new year, driven by favorable market conditions. The latest data shows that its market capitalization has grown to an impressive $1.6 billion. This marked a 6.6% increase, bringing the total market capitalization to $26.15 billion.

Cryptocurrency analytics platform CCData reported that USDC’s market capitalization surged for the second consecutive month, confirming this positive trend. This follows an 11-month losing streak for the stablecoin, which briefly topped the $25 billion market capitalization milestone in January.

Several factors have contributed to this upward trajectory. Notably, Circle announced its intention to go public in a recent filing with the U.S. Securities and Exchange Commission (SEC). This disclosure played a role in solidifying USDC’s market position.

Additionally, there has been a significant surge in USDC transfer volume, especially on the Solana blockchain. Data from Artemis shows that Solana-based USDC played a major role in driving the stablecoin to its highest transfer volume levels in more than a year.

Despite these positive developments, USDC’s current supply remains well below its all-time high of $45 billion.

BUSD falls below $100 million

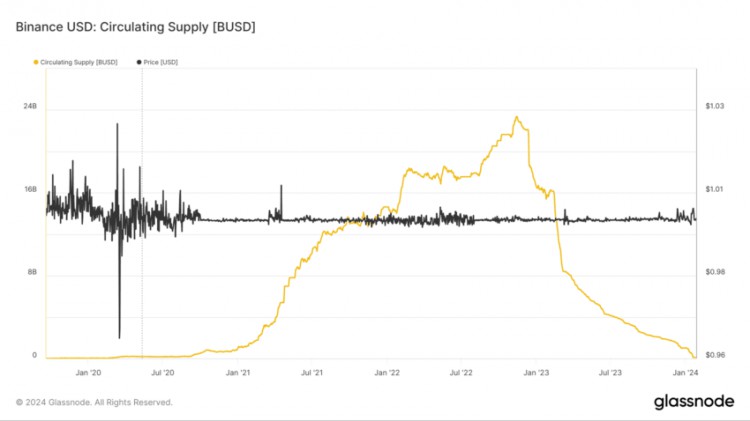

In contrast, the supply of Binance-backed stablecoin Binance USD (BUSD) has plummeted, reaching an unprecedented low of less than $100 million.

Challenges for the stablecoin emerged last year when the SEC issued a Wells Notice to BUSD issuer Paxos, halting the creation of additional units of the digital asset. The situation further escalated when the federal agency classified the stablecoin as a security in taking legal action against Binance.

In response to these regulatory dynamics, Binance initiated a strategic shift to encourage users to transition from BUSD to alternative stablecoins such as FDUSD. Additionally, it discontinued multiple services related to BUSD, causing the total supply to decrease from a peak of over $20 billion to less than $100 million in just one year. #稳定币 #BUSD