由資本主義實驗室撰寫

Magpie 的 LRT subDAO 今天推出了積分活動。這是迄今為止輕軌項目中 TVL 提供者最大的蛋糕。專案獨特,Magpie的subDAO先前已經賺了不少錢,配置價值龐大。

本貼文將分析Eigenpie的空投玩法、機制、前景以及收益預期,幫助您明確收益最大化。

A. 空投玩法

目前,儲值stETH並等待LST可以獲得三重好處:

Eigenpie積分對應空投總量的10%;

Eigenlayer積分(Eigenlayer於2月5日開放儲值後);

Eigenpie對應IDO總份額為24%,3M FDV估值較低;

存入LST的基本回報(例如mETH APR為7%,則可繼續享有7%);

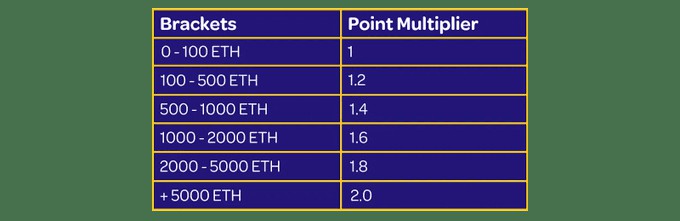

積分將根據團隊的總規模提供收益。隊伍越大,增幅越大,最多可達兩倍,所以最好待在一起取暖。

B、機制

Eigenpie 所做的就是隔離 LRT (ILRT)。每個LST都會傳送對應的Token來隔離風險。見下表:

目前Eigenlayer上有很多LST。如果一個輕軌專案普遍接受它們,那麼該專案將承擔所有基礎LST的風險。一旦某個LST出現安全問題,可能會對其造成毀滅性打擊。

因此,Eigenpie 的 ILRT 可以隔離風險。

隔離風險、隔離流動性,這會是個問題嗎?事實上,這並不重要。與支援Native Stake的LRT相比,支援LST的LRT的優勢之一是可以充分利用底層LST的流動性。 mrETH/rETH、mmETH/mETH等個別貨幣對實際上更有利於與LST計畫方合作刺激流動性。

C、前景

這個專案有什麼優勢?畢竟發布確實晚了一些,但確實存在尚未填補的需求缺口:加入 Eigenlayer 的 LST 渴望參與 LRT 敘事,而 Eigenpie 是目前最好的解決方案,而每個LST有獨立的LRT,不用擔心給別人做婚紗。和mETH一樣利率較高的LST也能繼續發揮優勢。

Mint的mstETH什麼時候可以在DEX上交易?會在彭德爾上嗎?

顯然,專案方有極大的意願和能力去推動這些,不計其數,這些就能為 Magpie 旗下的 Cakepie、Penpie 等 subDAO 帶來巨大的賄賂利益。

如果你不了解Magpie的架構,可以參考我們先前的推文。

D、獲利預期

收入方面,我們先來看看通證經濟:

眼睛:40%;

空投:10%;

激勵35%;

喜鵲金庫:15%(不照常出售,將分紅押給vlMGP);

It is basically a FairLaunch operation. The difference is that most of the current Fairlaunch whitelists are predetermined, while most of the IDO whitelists are explicitly given to TVL providers.

The benefits given to TVL providers are:

10% airdrop of total amount;

60% IDO share, IDO accounts for 40% of the total, $3M FDV valuation;

That is to say, 10%+60%*40% = 34% of the total amount will be given to TVL providers, which accounts for 34%/50% = ~70% of the initial circulation. There will be no VC selling pressure in the future.

The LRT narrative is currently very hot. $RSTK with only $7M TVL has $35M mcap and $180M FDV. Several other projects have been released with very high valuations.

The final TVL of Eigenpie will most likely be much higher than RSTK. If benchmarked against the FDV of $RSTK, the total profit of the TVL provider can reach: 10%*180+60%*40%*(180-3)= $60M .

Assuming that the currency is issued two months later and the average TVL is $200M, it can also reach (60/2)/200*12= 180% APR. This does not include the income of the underlying Eigenlayer points, which will be provided as an early stage in the first 15 days. Players who participate will also get 2 times the points increase.

Let’s take a look at the previous gains of magpie’s subDAO IDO so far:

Penpie, IDO 3M FDV, 14x

Radpie, two rounds of IDO average 7.5M FDV, 1.4x

Cakepie,IDO 20M FDV,2.4倍

This time to enter the LRT track with a larger market, not only did 3M FDV come out, but the airdrops and IDO shares given to TVL providers were several times that of PNP in the past. I wonder whether the income will be replicated or even surpassed.

Summarize

Airdrops need to be grouped together to gain greater growth;

The featured mechanism is ILRT to isolate the risk of each LST;

The advantage is that it can make full use of Magpie’s accumulated Pendle/Pancake resources to accelerate development;

Most of the rights and interests are clearly given to the TVL provider, Fairlaunch, whose IDO quota is transparent.