Mark my words: Rehyping will be the fastest growing category in 2024.

Re-staking is the tenth largest DeFi category, with $1.78 billion for EigenLayer alone (and rising as I write this).

Let’s not forget the “liquidity rehypothecation” category, which ranks 13th with $641 million.

Now, with the launch of the first AVS token (ALT) and Eigenlayer opening deposits on February 5th, it’s time to take a look at everything happening in the space.

This is the first article about “Re-Staking Navigation”. I'll briefly introduce Eingelayer's reset feature and describe emerging use cases for leveraging the reset feature to enable Active Authentication Services (AVS). These are cool!

Re-staking: ELI5

Back in September 2023, I elaborated on the idea of restaking in relation to liquidity staked tokens. But things have come a long way since then. Now that there are multiple LRT protocols on mainnet and AltLayer has launched the token, the market is heating up.

You can read my previous article in full, but since this article is already a paid article, I will briefly highlight the key points.

Many people are still confused about what “restaking” is and tend to overcomplicate it.

Simply put, it allows you to guarantee (mortgage) your ETH for various Active Validation Services (AVS), increasing the security of selected protocols. This includes services such as bridges, oracles, and sidechains, with more innovative concepts coming soon.

For example, Optimism and Arbitrum can bypass the 7-day fraud proof window and enable instant withdrawals, as long as there is sufficient financial security (in this case, ETH) to support the withdrawal.

These “insurance bridges” ensure adequate redistribution in the event of validator misbehavior. However, if you re-withdraw money to "Insurance Bridge AVS", you risk losing some ETH if the validator goes wrong. (Judging from the current situation, if there is a loophole in the smart contract, the "insurance bridge" cannot protect your interests).

You can directly re-stake ETH, or you can re-stake through liquid staking tokens such as stETH, rETH, cbETH, etc. Eigenlayer will add LST sfrxETH, mETH and LsETH this round.

Benefits of re-staking:

Multi-Protocol Bonus: Profit from multiple protocols using the same ETH. For example, bridge insurance premiums.

Enhanced security: Leverage Ethereum’s security to implement new protocols.

Developer freedom: No need to build new security layers, saving developers time and resources.

risk:

Cutting Risk: Increased risk of losing staked ETH due to malicious activity.

Centralization risk: Ethereum may face systemic risks if too many stakers move to EigenLayer.

Smart Contract Risk: Just like the risk that is everywhere in DeFi.

I believe the risk is limited at this time, as EigenLayer is still in its second phase testnet and does not have permissionless AVS deployment enabled. However, I agree with ChainLinkGod that the risks will mostly be ignored, but at least until 2025 we will have fun.

In the current second phase, stakers like you can delegate to operators. These operators verify AVS. Therefore, you do not need to re-stake directly to AVS.

EigenDA (Data Availability) is the first AVS of Phase 2. Rollup can be integrated to improve throughput. Phase 2 mainnet will launch in the first half of 2024, and phase 3 will launch later in 2024 with more AVS (where the real fun begins).

In fact, you can see how to authorize an operator on the Goerli testnet. Follow the guide here to get some goerliETH and swap to stETH. Then go to the Eigenlayer testnet page to deposit stETH. Then select the operator that EigenDA AVS is running on.

Interestingly, among the many operators, one stands out: Deutsche Telekom. It appears that Telekom will use Eigenlayer to provide its staking services.

Anyway, are you ready to manually select AVS and carriers yourself? On mainnet where gas costs are high? And then claim your reward from AVS? Then sell the rewards for more ETH to compound interest? If you are not a millionaire, the gas charges here will be high.

I’m sure you can guess what I’m going to say: Liquid staking tokens. But more about LRT in the next article. Now, let’s focus on the use case of active validation services that will airdrop shiny new tokens for us.

The first AVS is EigenDA, but I won't go into details as I doubt it will have a separate token (it's a data availability layer for rollup to save on data storage fees).

Active verification service

Don't let its name fool you. AVS is a fully fledged protocol that uses re-staking ETH to enhance its functionality. I mentioned the “insurance bridge” above, but the scope and impact of AVS will soon become more apparent.

I will cover the 7 aspects of AVS in very simple terms in this blog, because if we are serious about investing our ETH in the restaking ecosystem, we need to understand the scope of AVS. I’ll share more resources if you want to dive deeper.

Ethos - Bringing Ethereum security to the Cosmos

Ethos brings the economic security and liquidity of Ethereum to Cosmos.

So-called Cosmos consumer chains typically issue their native tokens to ensure network security. However, this brings more complexity and inflation to the token economy. While Cosmos ATOM stakers provide inter-chain security (ICS) solutions, the Ethereum ecosystem with Ethos+ staking is now expanding into Cosmos itself.

Coupled with the launch of Dymension, ATOM fork and now Ethos, ATOM seems to be under a lot of pressure. Not everyone agrees, so check out this thread for insightful comments.

Ethos is inspired by mesh security (allowing one chain's staked tokens to be used on another chain), thus increasing economic security without the need for additional nodes. For more details, check out the Ethos blog post here.

Which security solution wins depends on adoption rates. And Ethos is launching strongly.

Sommelier, a revenue aggregator with a total locked value of $60 million, is the first partner. As far as I know, more "consumer chains" are coming soon.

The benefit of this structure is that ETHOS will likely receive token airdrops (and revenue) from partner chains. At the same time, the ETHOS token itself will be airdropped to users who stake ETH on Eigenlayer and mine EIGEN tokens.

All you need to do is re-stake ETH and receive the airdrop. A breeze, right?

AltLayer - Redeposit Rollup

I introduced AltLayer in a previous article before they made their airdrop announcement, so I won’t go into too much depth about their features in this article.

But what you need to know is that AltLayer introduces three AVS to bring 1) fast confirmation, 2) decentralized sorting and 3) decentralized verification to Rollup.

The ALT token economics are interesting because ALT must be staked alongside re-staking ETH to secure these three AVS. Many people seem to overlook this.

If you have participated in Pool2 liquidity mining in DeFi summer 2020

trade and you will understand the Ponzi effect it can have.

Currently, only 3% of the total supply is airdropped to the community, but more airdrops are planned in the future. The initial circulating supply is 11%. Does an FDV of $4.3 billion (at the time of writing) justify a deal that no one had heard of just a few weeks ago?

Not sure, but it makes me more bullish on the entire restaking ecosystem.

Additionally, I also suspect that AltLayer is reserving liquidity mining rewards for restakers. As more AVS becomes available, various services will compete to attract valuable ETH deposits.

After all, AVS without an ETH deposit is worthless.

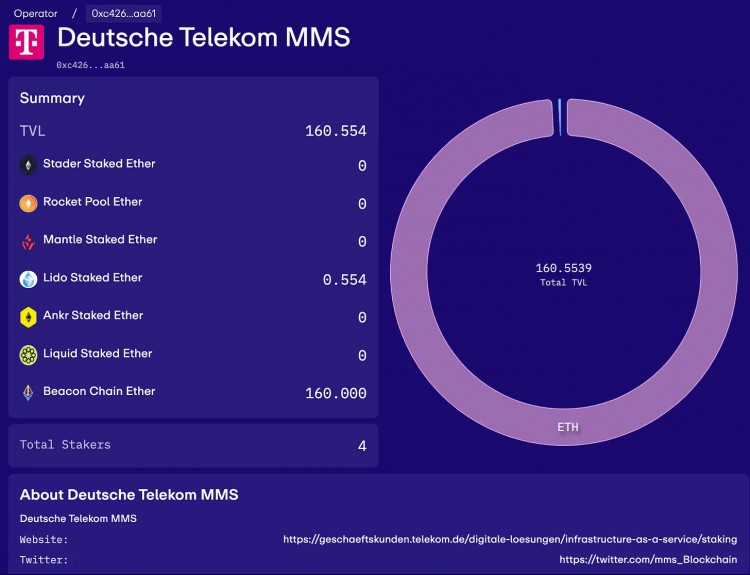

Espresso - Decentralized sorter

I'll make a long story short.

Espresso is a Layer 2 focused decentralized sorter. As we all know, L2 gets a lot of flak due to the centralization of the sequencer. There’s a great visual representation of how Espresso achieves this with their HotShot consensus, check out their website here.

AltLayer actually integrates with Espresso, so developers can choose to use AltLayer's decentralized validation solution or the Espresso sequencer when deploying on the AltLayer stack.

Omni - The blockchain built to connect all Rollups

Problem: L2 reduces transaction costs but leads to a fragmented ecosystem. This makes it difficult for builders to reach a wide audience, the user experience becomes complex, and mobility becomes fragmented.

Bridging has also become a necessity, but bridges usually issue risky wrapped tokens. If the bridge is hacked, there won’t be enough underlying assets to support the bridge’s wrapped tokens. As a result, the wrapped token loses its peg.

Solution Omni

Omni is a “remortgaged Layer 1 blockchain” designed to unify all Ethereum rollups.

Omni introduces a “unified global state layer” that is secured through EigenLayer re-staking. This layer centralizes the cross-domain management of the application.

Use cases include:

Cross-rollup margin accounts and leverage trading: deposit margin on one chain and use that margin to trade on another chain;

Cross-rollup NFT minting;

Cross-rollup lending: Deposit collateral on one chain and borrow that collateral as collateral on another chain.

There’s more, sound familiar? LayerZero does just that.

LayerZero’s cross-chain messaging implements chain-wide fungible tokens (OFTs) instead of encapsulated tokens. Manta’s STONE token is an ETH OFT, and LayerZero issued Lido’s wstETH OFT.

But what if there’s a vulnerability in LayerZero’s messaging system? Well, Omni ensures its security by re-staking ETH, and if a validator misbehaves, the ETH will be slashed.

Consider a typical Degen who wants to use his ETH on Arbitrum to obtain a USDC loan on Optimism. Degen’s transactions on Arbitrum are monitored by Omni validators, who ensure the integrity of data transferred to Optimism. Validators verify and report these transactions, and their motivation is to receive rewards and risk losing their staked ETH if reports are false.

LayerZero may use their token staking to secure cross-chain messages, but if something goes wrong with the LayerZero contract and the tokens get dumped, that security is... useless. ETH is an asset outside the system that is more difficult to secure on the network.

Injective partners with Omni to make $INJ the first asset on the Omni open liquidity network. Omni issues xERC20 INJ tokens, bringing INJ into the Ethereum rollup ecosystem.

In addition, Omni has received $18 million in support from high-profile investors including Pantera Capital, Two Sigma Ventures, and Jump Crypto. So, I think it will do well.

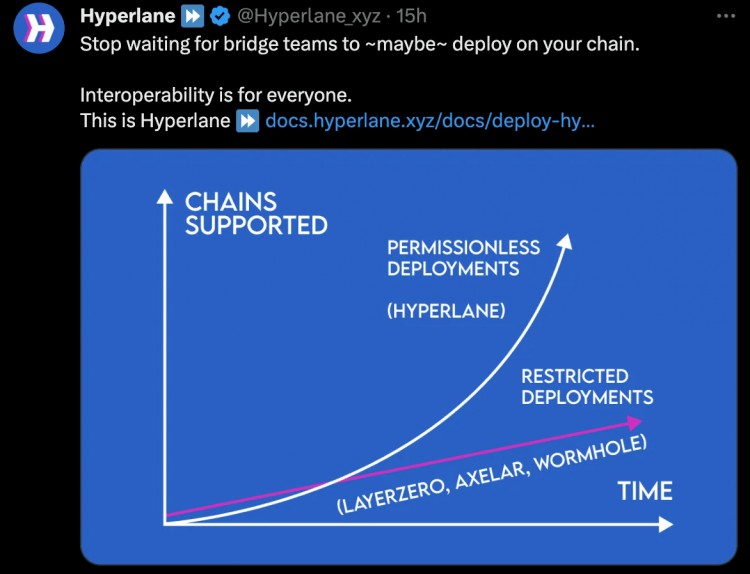

Hyperlane - Like Omni, but better?

Think Omni is cool for connecting to Ethereum Rollups? Omni, get out of the way, Hyperlane's goal is to connect all L1 and L2.

Using Hyperlane, developers can build interchain applications - applications that span multiple blockchains using cross-chain messaging, with a modular security stack featuring cross-chain security modules (whatever that means) and Re-staking ETH.

Judging from the documentation, Hyperlane will support Ethereum L2, Cosmos ecosystem chains, Solana, Move-based chains, and more. That's cool.

Hyperlane's permissionless interoperability sets it apart, as Rollup can connect to Hyperlane itself without the need for troublesome governance approvals, etc. As you can see from the tweet below, they are very proud of this. However, LayerZero v2 also appears to allow permissionless deployment.

Unfortunately, I couldn’t find token information for Omni or Hyperlane, so we’ll have to wait a little longer.

The Blockless - Powering apps as they are used

“TLDR for users: You open an app and just use it, which automatically powers the app and the app rewards you”. - Twitter

This fascinates me.

In ordinary dApps, we cannot directly contribute computing power, and applications are limited to specific L1 or L2 capabilities, such as latency, transmission speed, Gas fees, etc.

Therefore, Blockless adopts Net Neutrality Application (nnApp), allowing users to power the application simply by using it. It uses "nested nodes", where each user's device is a node providing resources to the network. This means that an application's computing power increases as its user base grows, a significant shift from the traditional model.