投資者和專家都注意到了比特幣價格突破 47,000 美元大關的驚人成就。這一顯著的轉變引起了兩個群體的注意。這種大幅的價格變動可能與三個主要原因有關:大量投資現貨比特幣交易所交易基金(ETF)、期貨市場的大量行動以及壓縮時期的技術突破。所有這三個因素都導致了顯著的價格變動。在本節中,我們將更詳細地研究這些貢獻方面中的每一個。 1 比特幣交易所交易基金經歷創紀錄的資金流入

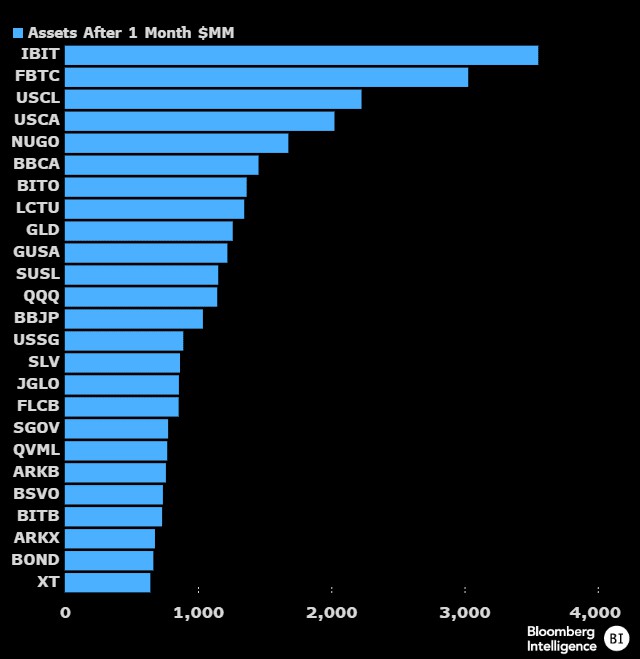

儘管灰階比特幣信託基金(GBTC) 已撤資超過1.016 億美元,但2 月8 日,市場上仍有4.03 億美元的資金湧入現貨比特幣交易所交易基金(ETF)。這是第三大單筆資金。日內淨流入。自1月11日推出這些交易所交易基金(ETF)以來,總流入量已超過21億美元,相當於超過20萬個比特幣。這一行動表明投資者對比特幣表現出日益增長的渴望。 透過使用 X,彭博社著名的交易所交易基金 (ETF) 專家 Eric Balchunas 提供了對這些金融工具前所未有的表現的見解。上市僅一個月後,他發表了以下聲明:“憑藉超過 30 億美元的資產,[貝萊德] IBIT 和 [富達] FBTC 在資產排名前 25 名交易所交易基金 (ETF) 中脫穎而出。” 巴爾丘納斯進一步評論了目前正在發生的競爭動態,他說“真正看不見的力量是競爭。”同一天同時推出十檔交易所交易基金(ETF),其中包括一些最著名的發行人,確實引發了資金流入熱潮,顯示出對市場主導地位的積極追求。

2 期貨市場動態與空頭清算

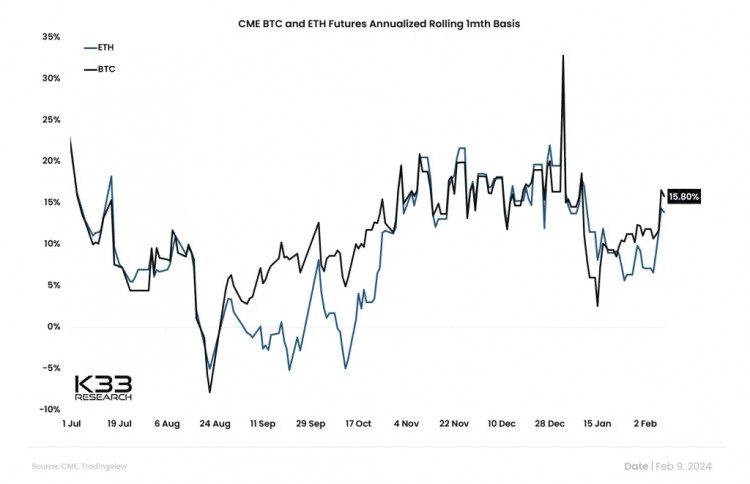

According to statistics provided by Glassnode, the Bitcoin futures market has seen a significant short liquidation event, with the total amount of liquidations hitting $52.09 million in the previous twenty-four hours. The greatest single liquidation order on Bitmex (XBTUSD), which was valued at $5.11 million, had a significant role in highlighting this event.Skew, a cryptocurrency expert, discussed the issue and made the following observation: "I would say that the majority or a decent portion of the revenge shorts that were fading the grind higher were squeezed out above $45K into the current price area." It is much more noteworthy that spot flows are occurring here, particularly when longs have begun to pursue price. Take note of the fact that declining perp discounts are more likely to be applied to possible premiums in the future; if another squeeze higher comes with high perp premiums and spot selling, it would most likely be the local high of this rally.According to Vetle Lunde, a Senior Analyst at K33 Research, the CME basis has recovered to levels that were witnessed before the entry of ETFs, and there has been a significant rise in open interest. The base of CME has restored to the levels it was at before the ETF. Over the course of the previous three days, open interest has increased by 15.6 thousand BTC, which is equivalent to a sixteen percent increase. Active market players, who are not exchange-traded funds, are the source of almost all growth. It was observed by Lunde that the OI within this group has returned to the levels it was at before the ETF.

3 A Breakout in Technical Analysis, as Indicated by the BBW

A breakout from a period of compression was discovered by the Bollinger Band Width (BBW) indicator, which gave a vital signal for the current price action. This indicator indicated a breakout from the compression phase. A time of low volatility and an imminent'squeeze' is indicated by the fact that the BBW plummeted to a position as low as 0.11.As reported by NewsBTC, Bitcoin saw significant price swings immediately after the Bollinger Band Width (BBW) dropped to levels that were comparable to those that occurred in the past. Events from the past provide a glimpse of possible tendencies that may emerge in the future.On October 13 of the previous year, when the BBW hit a similar low, Bitcoin promptly began on a major rebound, attaining a more than thirty percent rise in only ten days. This remarkable surge continued until the present day. On the other hand, the value of Bitcoin dropped by fifteen percent during the course of a just eight days and occurred in the middle of August 2023. In addition, Bitcoin had a remarkable increase in the beginning of January 2023, with its value rapidly increasing by forty percent in only seventeen days.When these past trends are taken into consideration, the Bitcoin Boltzmann Wave (BBW) has once again shown its significance as an indicator for forecasting the next significant price movement of Bitcoin.