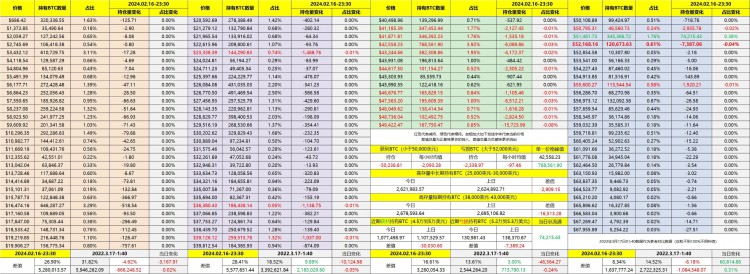

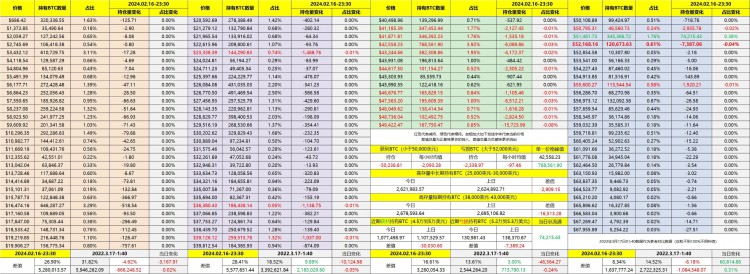

Judging from the movement of BTC on the chain today, it is found that the liquidity has decreased. Normally, there are more than ten or two hundred thousand BTC moved every day. Today, it has reduced to less than 80,000. This can only mean that the short-term in the last 24 hours Selling pressure from profit makers is decreasing.In fact, there is no need to talk nonsense. The data makes it very clear. Yesterday, investors who made recent profits, that is, investors whose holding prices were between US$45,000 and US$50,000, reduced their holdings by more than 116,000 #BTC, and today This data is not even 30% of yesterday's, which shows that investors' holding reductions have been significantly reduced recently.In addition to investors who have made profits recently, we can still see that investors who have suffered recent losses have not shown much signs of leaving the market. Even if they have lost money, most of their positions have not changed, let alone those with lower holding prices. These investors, even short-term investors with positions ranging from $38,000 to $43,000, have reduced their holdings by nearly 80% compared to yesterday.This situation is actually not normal, and it does not look like the handiwork of investors. Maybe the market maker has taken a break for the past 24 hours. Is it an accident? We will find out when we look at the data tomorrow. After all, there is no weight today. The release of high-level information, even Coinbase's financial report, will not cause the circulation to drop so much. If the flow continues to recover to more than 150,000#BTCtomorrow, it means that today should be an "accident."Why I am so concerned about the flow of BTC on the chain is because we have said it many times before that more investors, including institutions, are moving in the direction of long-term holdings. This is from the long-term perspective. It can be seen from the medium and long-term profit and loss chips that only in the four weeks or so after the spot ETF has just passed, due to the large number of GBTC leaving the market, there have been many moves to hold BTC for a long time, and when the selling pressure of GBTC After the reduction, the reduction of long-term holders has reached a very low level. As for BTC held in the medium and long term, that is, those who started holding positions in June last year because BlackRock applied for spot ETFs with prices ranging from US$25,000 to US$30,000, began to return to low liquidity after Sell The News s level.