過去一周,比特幣 (BTC) 從 51,728 美元上漲至 64,000 美元的第二個歷史新高,這一驚人的漲幅出乎許多分析師的預期。 隨著加密貨幣市場持續升溫,華爾街巨頭也嗅到了多頭市場的氣息,開始行動。 然而,在比特幣暴漲之前,美國政府卻做出了「奇怪」的舉動。

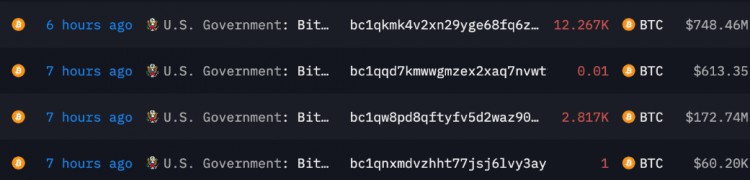

鏈上數據顯示,昨天美國東部時間下午1點39分左右(北京時間凌晨0點39分左右),也就是比特幣價格飆升至6.4萬美元以上之前,美國政府扣押的一個錢包裡轉移了1個比特幣。 。 不到半小時後,錢包中剩餘的2817個BTC也被轉移,本次轉移的總價值約為1.73億美元。

隨後,另一個裝有約12,300 BTC的錢包先將0.01 BTC轉入未知地址,隨後將剩餘的比特幣全部轉出,價值約7.5億美元。 最後,從這兩個錢包轉出的比特幣總價值約為9.23億美元,這些錢包中的資金是從2016年攻擊Bitfinex的駭客手中繳獲的。

由於美國政府目前是全球最大的比特幣鯨魚之一,因此當局如何處理這些比特幣也牽動著許多投資者的心。 美國政府突然轉移BTC也被許多人視為準備拋售的訊號。 比特幣在觸及6.4萬美元後的大幅下跌是否真的與此有關,目前還不得而知。 不過,美國司法部回應稱,從 Bitfinex 駭客手中扣押的近 10 億美元比特幣的轉移是出於合法執法目的。

由於比特幣的上漲過於突然,市場對推動這項上漲的主要因素感到好奇。 CoinShares研究總監James Butterfill表示:過去,比特幣價格走勢與降息預期有密切關係。 然而,隨著美國比特幣現貨ETF的上市,比特幣的價格走勢出現了明顯的分化,這些ETF極大地影響了比特幣近期的價格走勢。

目前,每天只生產約 900 個比特幣,但美國新推出的 ETF 每天需要約 2800 個比特幣(意味著比特幣的需求超過供應量的三倍)。 這導致自 2020 年以來交易所的比特幣儲備減少了 28%,凸顯比特幣市場正在經歷重大的需求面衝擊。

Despite the ambiguous attitude of the U.S. government towards Bitcoin, the market activity of Bitcoin spot ETFs promoted by BlackRock, Fidelity and other major banks continues to rise, quickly becoming the second largest single commodity ETF in the U.S. market.

Bloomberg analyst James Seyffart tweeted that there are currently four U.S. Bitcoin spot ETFs with asset management scale exceeding US$2 billion, namely Grayscale’s GBTC, BlackRock’s IBIT, Fidelity’s FBTC and Ark ARKB by 21Shares.

It is worth mentioning that BlackRock also recently held a private event for their top clients and industry participants, and there was a lot of exciting news at this private event. A senior BlackRock employee said: We received a lot of calls from people we never expected to receive calls from, and there may be many unexpected participants in this bull market.

Edward Snowden, the leaker of the "Prism" incident and a former defense contractor who fled the United States, also released a heavy signal yesterday. He wrote on X: "It is predicted that this year a sovereign country will be exposed to be purchasing Bitcoin. , replacing gold reserves with cryptocurrencies without publicly disclosing this fact.”

However, in this round of Bitcoin’s rise to over $60,000, retail investors’ participation was low. Analysts said: “Despite the incredible price action in Bitcoin, current data points to calm retail investors. This suggests that institutional investors may dominate this stage, with ETFs being viewed as potential accumulation vehicles.”

The top cryptocurrency's rally continues amid an influx of funds, fueling a "fear of missing out" mentality among investors who are looking forward to Bitcoin's all-time high of $69,000. Investors are awaiting the mining reward “halving” expected to occur in April, a situation that has historically been positive for Bitcoin prices. In addition, the prospect that the Federal Reserve may cut interest rates this year has stimulated investor interest in higher-yielding or more volatile assets.

Summarize

The cryptocurrency market is experiencing a bull run unlike any before as the price of Bitcoin surges. This bull market may attract many unexpected sovereign countries and institutions to participate. At the same time, the rise of Bitcoin spot ETFs will become an important milestone in the history of cryptocurrency evolution, providing more investors with opportunities to participate in the cryptocurrency market.

比特幣美元 $ETH