比特幣的價格繼續保持在三天的供應區內,即 59,717 美元至 67,525 美元之間。 鑑於技術法則規定要超越 63,755 美元的水平,下一個方向偏差將取決於比特幣如何處理該金額。 Bitwise 的資訊長和 Galaxy 的執行長都將「BTC 價格發現階段」視為資本流入現貨 ETF 的驅動主題。 鑑於有關交易所交易基金 (ETF) 的樂觀頭條新聞繼續推動加密貨幣市場,比特幣 (BTC) 的價格正在密切關注 69,000 美元的歷史高點,該價格可能會在不久的將來重新上漲。

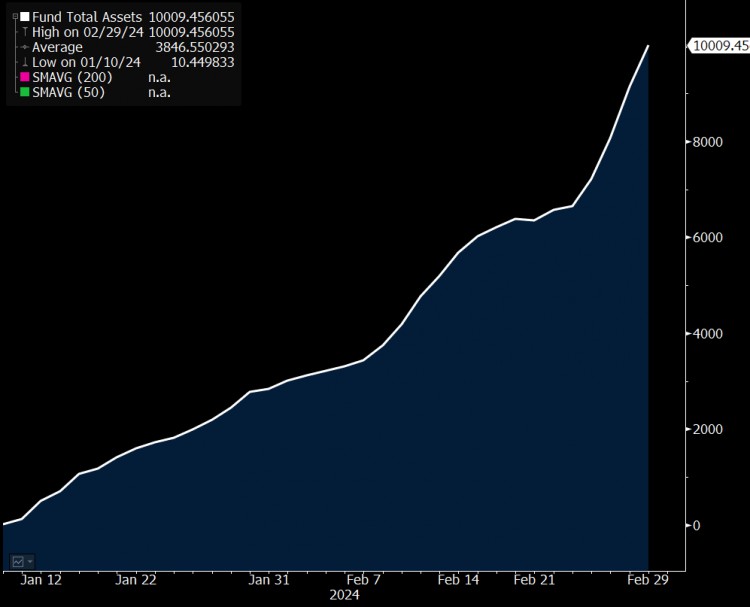

The nine new Bitcoin exchange-traded funds (ETFs) that are all functional have a total of up to $21.17 billion in assets under management. According to the statistics, BlackRock's IBIT has become the Bitcoin ETF that has reached $10 billion in assets the quickest in the history of the industry. The fact that this is the quickest an exchange-traded fund (ETF) has reached $10 billion in assets under management (AUM) is noteworthy. Since the investment product became online on January 11, 37 trading days have passed. Of all exchange-traded funds (ETFs), only roughly 4% have hit the $10 billion level.With an astonishing surge of assets into Bitcoin exchange-traded funds (ETFs), the data make for an exciting period in the adoption of cryptocurrencies. As Galaxy CEO Mike Novogratz said that Bitcoin is now in a price discovery period, Bitwise Chief Information Officer Matt Hougan, who forecasts an even stronger surge of inflows for Bitcoin exchange-traded funds (ETFs) from institutional players, came to the same conclusion during an interview with CNBC.Nevertheless, Nick Tomaino, the founder of the cryptocurrency investing business 1confirmation, said that in addition to Bitcoin exchange-traded funds (ETFs), there are other triggers that are pushing up the values of cryptocurrencies. According to what he stated, projects like as Farcaster, Worpcast, Polymarket, Worldcoin, and Bridge are contributing to the inclusion of new people in the sector.Bitcoin price forecast as cash flows into the Bitcoin exchange-traded fund (ETF) drive marketsThe price of bitcoin continues to be contained inside the supply barrier of $59,717 and $67,525 during the course of the three-day period, with the prevailing trend continuing to move in a northerly direction, as indicated by a number of technical indicators. Despite the fact that the Relative Strength Index (RSI) indicates that Bitcoin is very overbought at 81, this momentum indicator continues to be inclined north, which indicates that there is increasing purchasing pressure.In the event that buyer momentum propels the price of Bitcoin to close higher than the mean level of $63,755 during the three-day period, this have the potential to pave the way for sustained gains. The first possibility is that Bitcoin might break over the top border of the supply zone at $67,525, so transforming it into a bullish breaker. After that, it could rocket above it to recapture the high price of $69,000.A significant number of green histogram bars that are in the positive region for both the Moving Average Convergence Divergence (MACD) and the Awesome Oscillator (AO) indicate that bulls are present in the market. This is evidence that bulls are present in the market.Despite this, experts urge caution since there has been a large increase in profit-taking by Bitcoin whales. This is occurring in the midst of continued fear of missing out (FOMO) in the market.Indicators of the blockchain that suggest an optimistic prognosis for the price of bitcoin

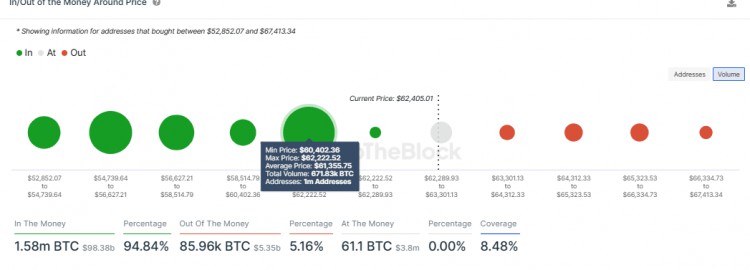

According to the information provided by the on-chain aggregator IntoTheBlock's In/Out of The Money Around Price (IOMAP), the price of Bitcoin continues to remain much higher than a significant support wall. This is due to the fact that one million addresses purchased approximately 671,000 Bitcoins at prices ranging from $60,402 to $62,222, with the average price being $61,355.

This is attributed by analysts to the high amount of trust that investors have in the market, which makes the zone an essential level of support for the price of Bitcoin, which might possibly cushion against additional declines.On the other hand, if profit takers are successful and the supply zone continues to act as a barrier, the price of bitcoin can be subject to a rejection, which would result in the loss of the psychological support of sixty thousand dollars. In a worst-case scenario, the decline might continue until it reaches the barrier of $50,000, providing investors who have been sidelined or belated with a further entry opportunity to purchase the dip.

The fact that the Relative Strength Index (RSI) is over 70 indicates that Bitcoin is very overbought, which raises the possibility of a drop. Additionally, the Spent Output Profit Ratio (SOPR) is greater than one (at 3.30), which indicates that the owners of the spent outputs are in a position to make a profit at the time of the transaction. As a result, they are able to capitalize on the profits in the midst of an increased demand for profit booking.

$BTC