With the halving event, spot ETF capital inflows and potential interest rate cut expectations, market sentiment has been relatively high recently. On the backend of the official account, I found that many friends left messages asking questions: When will the big bull market come?

First of all, it is unknown when the bull market will come, because the market trend cannot be predicted. According to our previous view (guess), this round of bull market is likely to occur in 24-25 years (before the end of 25 at the latest). Of course, some analysts think it will happen in 2026.

Secondly, the question of when the big bull market will come actually does not mean much to many people. For example, if you are still waiting on the short side now, then even if the big bull market comes tomorrow, what does it have to do with you? And if they are old leeks who have been hoarding cakes for more than a year in this cycle, they will not care about this kind of problem. Anyway, they can just continue to get it. As long as they don’t get washed out, when will they reach their goal? You can set the expected goal, and then distribute some of them in batches to those who are destined to take over. It is a very simple thing, and all it requires is patience.

But one thing we are sure of is that we are now in the bull market stage (initial stage). Li Huawai has mentioned this point of view many times in his previous articles. It doesn’t matter if you don’t believe what Li said. For example, you can also believe PlanB, a well-known analyst in this field. He also posted on social platforms two days ago saying: The current bull market has begun, and the fund-raising phase has ended. It is in an orderly and slow manner. There are no longer easy buying opportunities in a growing market. If we use historical data as a reference, we will see a crazy FOMO period in the next 10 months or so, with extreme price surges, which may also be accompanied by multiple declines of around -30% (bull markets tend to be rising in shock). As shown below.

As for how to understand the early stage mentioned above, if we look at the progress in percentage terms, we think the current bull market may have reached the 30%-40% range. Therefore, there is no need to feel regret for missing the accumulation opportunity in the bear market. Instead of being immersed in regrets about the past, it is better to learn to grasp the future from now on. Moreover, now is still the best time for you to start accumulating.

In addition to the question "When will the big bull market come?", another type of question I have received more frequently in recent days is: Can we still buy big cakes now? What coin should I buy now?

I have actually seen too many similar questions like this before. There are two types of people asking this kind of questions:

The first type is old users. How should I put it? Whenever someone asks me this question before, my answer has always been: you just need to directly invest and hoard the pie. But the reality is that no matter how many times I reply, as long as the market fluctuates slightly, these people will come back and ask again, which makes my "eyes" almost blurry. I simply choose not to see this kind of problem now. To put it bluntly, although these friends have been following Hua Li Huawai for a long time, I estimate that they rarely read Hua Li Huawai’s articles (especially the methodology column articles), otherwise they would not ask such questions, or even Asked again and again. Let’s take a step back. If your goal (investment plan) is relatively clear from the beginning, what if the pie has reached more than 60,000 now? If your goal is 2 times, then even if you start building a position now, you will have a high probability of getting 2 times the income in the bull market.

The other type is new users. Recently, the number of followers of public accounts has increased significantly more frequently than before. Maybe many people have heard that the bull market in this field is coming, so they rushed to enter the market. But when you first get into this field, you may be a bit confused. When you see a pie priced at 50,000 to 60,000 US dollars each, you feel "too expensive", so you leave a message asking what you should buy. Can you directly recommend a few coins to him? I basically ignore this kind of comments now. First, I have shared/summarized a lot of this topic in past articles, and I also talked about a lot of the truth in it. Second, this kind of question actually sounds rather naive. You have just entered a new field, found a strange blogger, and hope that he will recommend a few coins to you, and then you can sit back and wait to get rich? Do you dare to think of such a script? Or let’s take a step back and say, even if there is such a blogger, and he directly recommends a few copycats/country dogs to you and says they can make you rich, would you really believe it? If you really believe it, then you are not just naive! Remember, all the people who claim to be able to make you rich are most likely after the loose money in your pocket. Otherwise, they could just cover their heads and make money by themselves, and lead you to do wool work?

In short, it is only the early stage of the bull market, and there are many opportunities ahead. The changes in the market in the next 1-2 years will be enough to shock your jaw many times. So now, it is recommended that you put aside your dream of getting rich for the time being. What you should do most now is not to dream, nor to find random strangers to help you realize this dream. Instead, you should calm down and spend some time to make a dream for yourself. Goal planning. As for how to plan, I suggest you first read all the articles in the Hua Hua Wai Methodology series column before talking about it. In fact, there are only dozens of articles in it. I wrote them for more than a year, so you can spend 1- Give it 2 days and see if you won't suffer any loss.

But if you tell me that you don’t even have 1-2 days of study time, but you still have the dream of making a fortune in this field, then I will only give you three suggestions:

First: Just take your funds and leave this circle and return to the real life you should have. Otherwise, you are just gambling. You should have heard the principle that nine times out of ten you will lose.

Second: If you don’t want to leave, then my suggestion remains the same as before, that is, at least 50% of your position should be reserved for the big pie Ether (this round we see 120,000 for the big pie and 10,000 for Ether). You can simply (as a reference), and then you can divide the remaining positions into several shares to buy leading projects in potential fields, such as AI, RWA, GameFi, Depin, BRC20 and other fields. Just go to CoinMarketCap or CoinGecko to take a look.

Third: If you also want to imitate others in playing local dogs, then I only recommend that you spend a few hundred dollars per local dog to simply play, and at the same time, have the mentality that it will return to zero at any time. If you are lucky, remember to take some profits in time and don't be too greedy. At the same time, you should try to stay away from leveraged contracts.

Of course, if you think you are the "chosen person" in this field, or you feel that you already have very rich investment experience in other financial fields (such as the stock market) to deal with this field, then you can simply ignore what I said above. of all words.

Since we are currently in the early stages of a bull market, how should we grasp the rhythm of the general trend?

There are actually many ways to grasp the rhythm. For example, some people like to watch various news and decide their next operation through news information. Some people like to follow some KOLs and decide their next operations through the sharing of these big Vs. Some people like to check various on-chain data and decide their next operations from the perspective of data. etc.

As for myself, if I have to make a choice, I would prefer to use on-chain data to decide my next operation. I remember that in December 2022, Hua Li Huawai wrote an article in which he shared 10 important reference indicators for judging the bull and bear cycle of Bitcoin. Judging from the indicators on each chain at that time, we believe that It was already at the bottom of this current bear market. Looking back now, it also confirms the judgment made at that time.

Today, let’s combine the original indicators and some other data to see what stage the current encryption market is at, or how the market may go next.

1. View from K line

If we compare it through the monthly K-line chart, we can find that whenever Bitcoin breaks through the 0.618 Fibonacci ratio, it will show a parabolic trend. As shown below.

(Image by Ashcrypto)

Of course, as we mentioned above, bull markets tend to rise amid shocks, but we think it is highly likely that this bull market will break through $100,000. Because our predictions (guesses) are relatively conservative and have always been in the range of 100,000-120,000. If you are more radical, I would not be surprised to see 200,000.

2.Rainbow Chart

The Rainbow Chart is a long-term valuation tool for Bitcoin, a model that uses a logarithmic growth curve to predict Bitcoin’s potential future price direction. The warmer colors above the rainbow chart show when the market may be overheating, and historical data has proven that these periods are good times for investors to start taking profits. Judging from the rainbow chart, Bitcoin is currently in the "holding" stage, and the next stages are "bubbles are beginning to appear" and "FOMO is intensifying." As shown below.

3. Two-Year MA Multiplier indicator (2-Year MA Multiplier)

The two-year MA multiple indicator uses a moving average (MA), which is the 2-year MA, and the multiplication of that moving average, which is the 2-year MA x5. Historically, buying Bitcoin when the price falls below the 2-year EMA (green line) has produced huge returns. And selling Bitcoin when the price is above the 2-year EMA x 5 (red line) is effective for profit. As shown below.

4.200 Week Moving Average Heatmap indicator (200 Week Moving Average Heatmap)

In each cycle, Bitcoin’s price has historically bottomed near the 200-week moving average, a line that many refer to as the dividing line between bulls and bears. The 200 Week Moving Average Heatmap indicator uses a color heat map based on the growth rate of the 200 Week Moving Average and assigns a color to the price chart based on the percentage growth of the 200 Week Moving Average month over month. Historically, when we see orange and red dots on the price chart, it’s a good time to sell Bitcoin when the market is overheated, while periods when the price point is purple and close to the 200-week moving average are good times to buy. opportunity. As shown below.

5. The Golden Ratio Multiplier

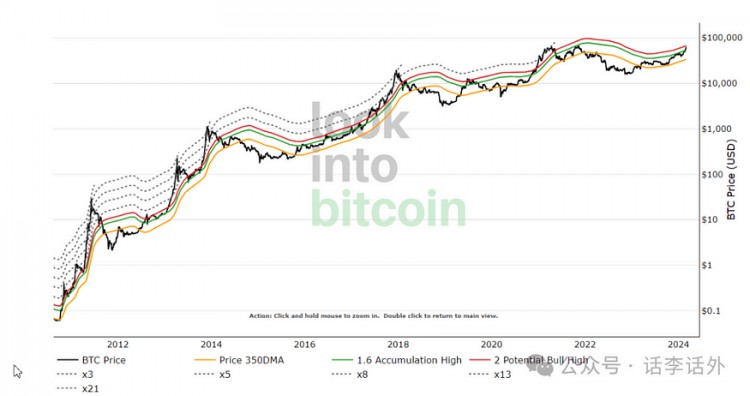

The Golden Ratio Multiplier explores Bitcoin's adoption curve and market cycles to understand how the price will perform over the medium to long-term timeframe. This indicator uses a multiple of the Bitcoin price's 350-day moving average (350DMA) to identify potential resistance to price fluctuations. area. The next potential resistance level is currently forecast to be the x2 multiple (red line). As shown below.

6.MVRV Z-Score

MVRV is an indicator that analyzes whether a currency is overvalued or undervalued. The black line is the market value (i.e. market capitalization) and the blue line is the realized value (the realized value is not the current price of Bitcoin, but takes the price of the last time each Bitcoin moved, i.e. the last time it was sent from one wallet to another price per wallet), the orange line is the Z-score (a standard deviation test that removes extreme values from the data between market value and realized value). When market value > realized value, the orange line entering the pink area is the top of the market cycle. As shown below.

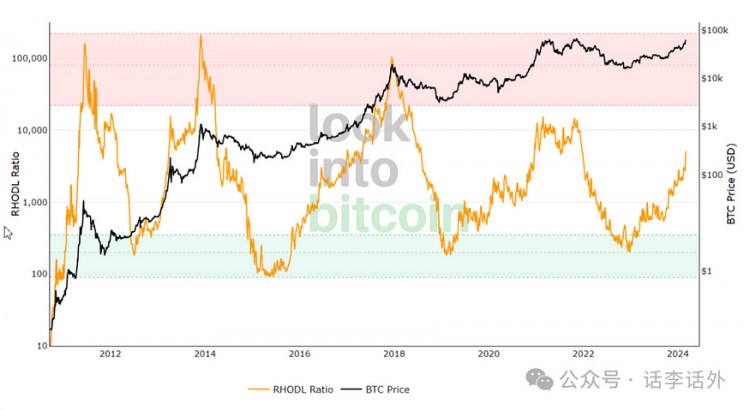

7. RHODL ratio

This indicator uses the ratio of realized value HODL waves, and when the orange line approaches the red band area, it indicates that the market is overheated and suitable for profit taking. As shown below.

8.NUPL indicator

The NUPL indicator calculates unrealized profit/loss by subtracting realized value fr