There are three reasons why I want to talk about this topic today: The first reason is that during the VIP communication with a member over the weekend, we chatted for almost 40 minutes. At the end, he said that he actually discovered that after so many years, The profit from operation is not as good as that from Tun Coin. He said that he entered the industry in 2016. At that time, he had 400 pieces of pie and 100,000 LTC. At that time, he didn't know enough. He might have thrown it away if the pie increased fivefold. If he hadn't thrown it away, he would have been financially free now. But now it has been 24 years, and 6 years have passed, and now there is no big pie in his hand. He feels very painful (maybe not painful, but unhappy). I said yes, it’s really better to keep the pie, otherwise 400 pieces of pie are now worth more than 25 million U.S. dollars. LTC is currently worth 100 U.S. dollars, so LTC is also worth 10 million U.S. dollars, which adds up to assets of 200-300 million. , I can retire early and travel around the world.

The second reason is that I have also been thinking recently about how much Bitcoin can reach in this wave. I even estimated how much it can reach in the next wave. How much time is left for ordinary people to have the opportunity to buy a BTC?

Assuming that this wave can reach 200,000 US dollars, that is almost RMB 1.4 million. Then this bear market will have a correction of 50%-60%, which means the bottom range is between 560,000-700,000. Then the next bull market can see a maximum of 500,000 US dollars, which is 3.5 million yuan. Then even if the price is adjusted back by 50%, it will be 1.75 million yuan. In other words, after this wave of bull-bear transition, it will be difficult for an ordinary person to buy a big pie, because if you are an ordinary person, such as a food delivery person or an ordinary working-class person, you can earn 10 yuan a year. With a salary of 1.75 million, he would have to work for 17 years without food or water to afford it. However, Bitcoin has been rising, and you will definitely not be able to catch up at this speed. So after this wave of bulls and bears, it is almost difficult for ordinary people to own a Bitcoin.

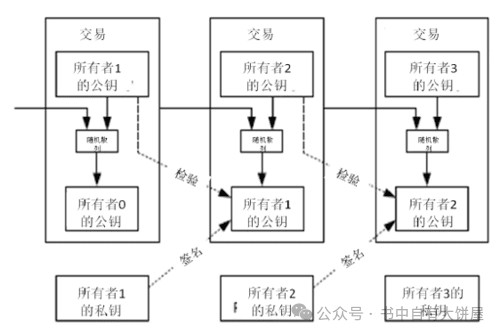

The third reason is the title of the article "Everyone of us should own a BTC". When I joined the circle in 2017, I saw it written by a big guy. I forgot whether it was Laomao or Li Xiaolai, but This is also my enlightenment article. Although these big guys have almost retired now, this concept is still deeply engraved in my heart. So for the currency circle that has passed 6 years ago, I can take over the mantle of this idea and write a new version of "Each of us should own a BTC" for the newcomers. Maybe this will change. Your life is as long as you keep the coins in your hand. And the most important point is that you must read the white paper "A Peer-to-Peer Electronic Cash System" written by Satoshi Nakamoto over and over again to understand it. What does it mean to understand it? To understand it means that you will immediately take out the money to buy it. BTC, even if it is to start your 1% position, this action.

Here I will divide it into three levels, namely: 1. The value of Bitcoin; 2. The flaws of human beings themselves; 3. The redistribution of social wealth.

1. Let’s talk about the value of Bitcoin first:

1. When Bitcoin was first designed, it was to solve payment problems. As you can tell from its name, it is a peer-to-peer cash payment system. But in fact, after so many years, it has not subverted the payment system, because now Payment is okay, but Bitcoin itself is not very convenient to pay (high GAS fee, plus 10 minutes for settlement), but it has become a value storage tool, known as digital gold, because of its total The quantity is only 21 million, and there is mining every year, and production will be reduced every 4 years. The production reduction every 4 years has caused its value to rise regularly (from now until the beginning of the previous three halving bull markets, it has not been broken. ), the currency circle is a carnival every four years, so many people say that Satoshi Nakamoto is a football fan (because the World Cup also happens every four years).

So to sum up, its first value is that it is a deflationary currency with a total amount limit that is halved every 4 years, and a lot of them have been lost so far (more than 3 million coins have been lost so far, and over time only will be more), so the total amount will only become less and less. We all know that rare things are more valuable, such as jadeite with high water content, purple-gold nanmu, etc. all have these characteristics.

2. If you want to say what the real value of Bitcoin is, it really has no value. Its only value is that its skyrocketing has attracted the attention of countless people. What people pay attention to is money. There is a book on economics called "Attention Economy" talks about the new economic system through attention, advertising and marketing, etc. This is why Douyin is so profitable now, because it can attract a large number of people to watch Douyin, and with traffic, it can be converted Realize. So this has led to many people joining in. For example, someone (V God) started Ethereum and said that he wanted to improve the blockchain and develop applications on Ethereum to make the blockchain truly useful. Then some people also invested in it. When money goes in, wherever there are people, there will be rivers and lakes, and wherever there are rivers and lakes, there will be business. Where there is business, there will be all kinds of intrigues, insidiousness and cunning, all kinds of funds and pigs, so the reputation of your circle has not been very good. . But this year may be much better, because with the passage of spot ETFs, the government should have more supervision and compliance, which is actually a big plus. As compliance becomes more and more, it will develop better and better in the future.

So we can summarize its second value, which is that its skyrocketing has attracted a lot of attention. Since its birth in 2008, there was no price at that time. In 2010, a trader bought it for 10,000 Bitcoins. 2 pizzas, this gave Bitcoin a price, and then it skyrocketed. And each time the increase is an exaggerated multiple, the last time it was 30 times, and the last time it was 90 times. So at least 15 times this time? From the lowest point, it is still 200,000 US dollars. So the current $60,000 is just the beginning. Calculated from the high point of each wave, in 2013 it was 1,100 US dollars, in 2017 it was 19,000, almost 20 times; then in 21 years it was 69,000, almost 3 times, so this peak is 2 times higher no matter how you calculate it, that is, 70,000*2= 140,000 US dollars, so there is also an expectation of 150,000 US dollars.

3. The value of Bitcoin, the currency-based value, is that it is the main body of belief in the current blockchain world. Without Bitcoin, there would be no other chains. The current total market value of cryptocurrency is 2.4 trillion US dollars, and BTC The total market value is currently 1.2 trillion US dollars, accounting for 50% of the share.

In the real world we live in, it is based on legal tender, which means that everything will be measured according to the current country's currency. For example, a bun is 3 yuan in RMB, while in the United States, a pizza may be 20 US dollars. In ancient times, we might use the gold standard, that is, gold and silver as currency to exchange. For example, a bowl of wine is one tael of silver. Going back further, we might use shells. For example, primitive people might use shells in transactions. Then They are shell-based. When we are in the currency circle, we must think in terms of currency standards, that is, we have to find a way to switch to BTC, because when the cryptocurrency first came out, there were no stable coins, and all other currencies were linked to BTC. As a trading pair, BTC is the cornerstone of all currencies.

2. The shortcomings of human beings themselves

The second question, let’s talk about the flaws of human beings, why most people can’t hold Bitcoin. We often hear that I made 10 times the profit by taking some Bitcoins. I’m very happy, but what you don’t know is that In fact, you missed it by 100 times, because after throwing it away 10 times, it is really difficult to buy it again at a higher price. People are averse to losses. This is a human flaw.

The second flaw of human beings is that humans themselves are short-sighted. I am talking about most people, but there are also a small number of people who are long-sighted. These people have become great people, such as Elon Musk, who actually wants to build rockets. To immigrate to Mars, it was impossible for him to even know whether he could complete this plan while alive. This was a bit great, and he also achieved great results. The same goes for Apple's Steve Jobs, Bill Gates, etc.

But human short-sightedness is not something we can easily change. It is engraved in our genes, because in ancient times, we might not have enough to eat or wear warm clothes every day. How could we think about 10 years from now? I’m sure I am thinking about what kind of tools I will use tomorrow, what kind of prey I will hunt, and where the prey will appear. When I catch the prey, I will think about how to store these physical objects, so at most I can arrive first 3 The activities within the sky, so this is also engraved in our bones after tens of thousands of years of evolution. We made 10 times the profit today, so it’s normal for me to feel safe. Although it is difficult for us to change, we must understand the principles and try to look further ahead. For example, do you want to make a 10-year plan? You can ask people around you, what is your 10-year plan? I think most people don’t have the answer, so if we want to become excellent, we should first give ourselves a 10-year plan? My current 10-year plan is to tell you about the blockchain program in 10 years. I won’t be able to see it in 20 years, and I am not as great as Musk.

3. Redistribution of social wealth?

Why are there fewer and fewer Bitcoins in the hands of retail investors?

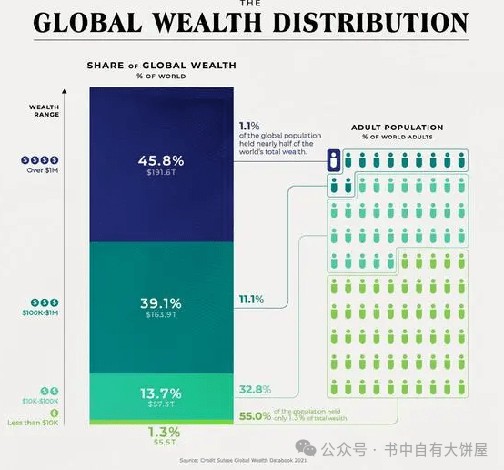

1. Because wealth itself has an aggregation effect, that is, money or wealth will gather in places with more money or wealth, and it will form a cycle, that is, rich people will become richer and richer, and people without money will become richer and richer. The less money you have, the same is true for Bitcoin. In fact, Marx has already written this in "Das Kapital", and it also proves that one day in the future, when the gap between the rich and the poor is very large, and the poor have no money to eat, then it is time to start the revolution, then communism Maybe it will come, of course we don't know whether we can realize this day.

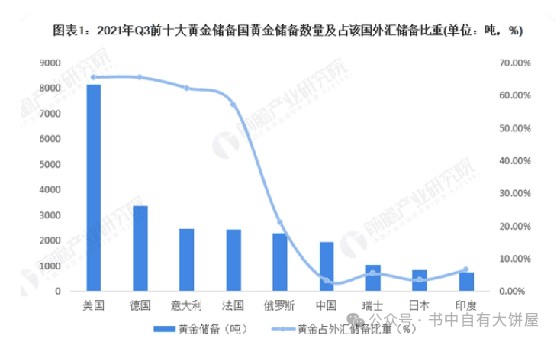

2. Let’s take a look at the current distribution of gold holdings. It can actually give us some inspiration. The current gold reserves are first in the United States with 68%, followed by Germany, Italy, and France. This actually depends on the country’s national strength and degree of development. Directly proportional. And we should often see rich Americans wearing gold jewelry, and even their teeth are inlaid with gold. It’s an exaggeration, right? So wealth will flow to where there is money.

3. Current distribution of Bitcoin

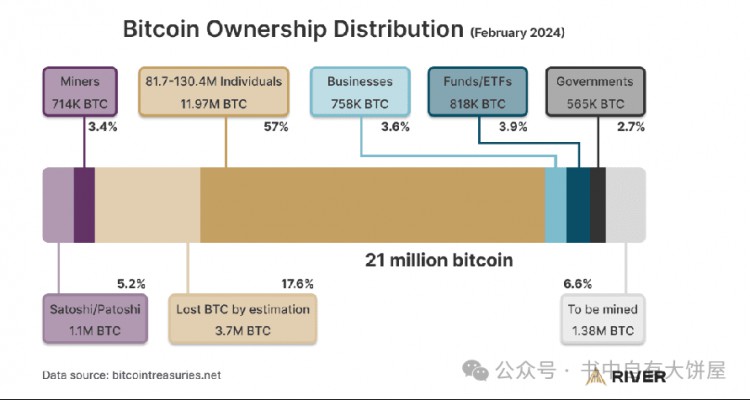

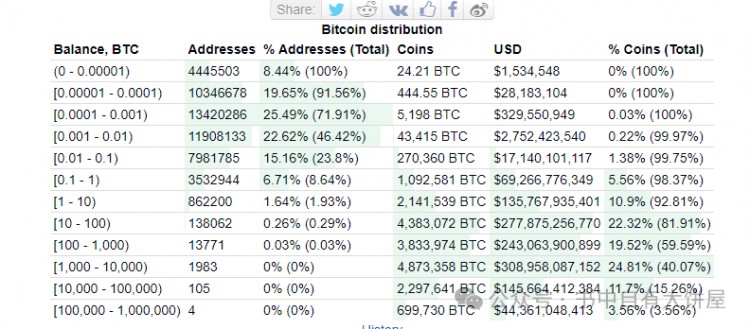

Let’s look at the current distribution of Bitcoin. There are 1.1 million Satoshi addresses (5%), 3.7 million lost (17.6%), 700,000 miners (3.4%), 12 million retail investors (57%), and 560,000 government (2.7 %), fund ETF 800,000 (3.9%), institutions 750,000 (3.6%), and 1.3 million has not yet been tapped. That is to say, the number of permanently lost coins should be around 4-5 million.

So the current situation is that there are actually more retail currency institutions and governments, so it is a good day for retail investors. As the process progresses, I think this ratio may be reversed. In other words, institutions and governments may hold 56% of the tokens (100-5.2-17.6-6.6)*0.8, while retail investors only hold 5%~6% of the tokens. It is also a saying we often hear that 20% of the world's people control 80% of the wealth.

There are currently 50 million non-zero Bitcoin addresses. Compared with the 6 billion people in the world, there is still a very big gap. Currently, it can be seen that no more than 2% of the addresses hold more than 1 Bitcoin (currently Almost 1 million). So currently, if you hold a Bitcoin, you have almost entered the top 2% position. This is still among the currency holders. If you put it in the world, it will also be ranked one in ten thousand.

Final summary:

1. I won’t summarize the value of Bitcoin. Please do more research and experience on your own.

2. Human flaws. We know our own flaws and strive to become better people. We should take a long-term view, exercise more, and stay healthy. In fact, we will eventually find that health is priceless. Once we know it, we must I am doing it slowly, and I am also working hard to exercise, although sometimes I am lazy.

3. For those who can hold a Bitcoin for a long time, we can deduce from several dimensions that he can at least rank in the t