Unconsciously, $BNB returned to around $600 again, just one step away from ATH. Starting from 2024, BNB has experienced an expected reversal, with an increase of more than 90%, leading all tokens of the same type. After experiencing the bear market and interest rate hike cycles and the impact of policies, why did $BNB return to strength and point directly at ATH? (Attached is my review and thoughts on BNB)

I personally think we can boil this down to three reasons:

Bullish turn for the overall market ($BTC new highs)

Growth in Binance spot share trading data

Bull Market Golden Shovel $BNB

1/ bull market

The first point goes without saying. After experiencing the downturn of the interest rate hike cycle, BTC has now broken through new highs and successfully stood at the beginning of "7" with the expectation of ETF and the cash inflow after the adoption of ETF. The rise of BTC gave the market enough confidence to build positions in some blue-chip tokens.

2/ Data growth

With the return of liquidity and the arrival of the bull market, the spot trading volume of centralized exchanges is also rising. Binance still dominates spot trading volume in the crypto market. Moreover, we can see that it took only half a month for March to almost catch up with the spot trading volume of February. It is foreseeable that the transaction volume in March will have the opportunity to return to the level of December 2022, or even 2021.

It is worth mentioning that in the competition for "compliant" exchanges designated by The Block, Binance's spot trading share reached a terrifying 75.7% in February, while Coinbase dropped to 10.9%.

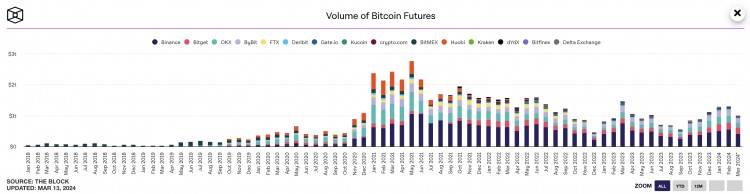

This is true for spot trading volume, and so is contract trading volume. Compared with the previous bull market, contract trading volume performed better. We can clearly see that while Binance’s trading volume dominates, it has been growing in these months. The high transaction volume will bring sufficient fee income to Binance. On January 17 this year, Binance completed the 26th BNB destruction, with an amount of approximately 2.14M and a value of approximately 636 million. We can look forward to Binance’s 27th burn in April.

3/ golden shovel

Similar to the last bull market, Binance’s main idea is to shape BNB into the role of a golden shovel. However, in the last cycle, users needed to use BNB to participate in the opportunity on BSC, but in this round, users only need to store BNB on Binance and participate in the continuous Launchpool/Launchpad. More simple and crude, powerful and powerful.

At the same time, I am not very worried that Binance will not have enough projects to issue Launchpool. After all, Binance Labs has invested in so many high-quality projects before - for the project side, issuing coins in the bull market is also a better choice. As an aside, I personally like the development of protocols such as Pre-Market and Points Market. The one I am most optimistic about right now is @WhalesMarket on Solana.

In addition, it is worth mentioning that BNB is a typical example of "expectation reversal" - just listen to these four words and you should understand what I mean. The core of the expected reversal is that after a good project experiences a negative event, the price of the project Token is affected and falls, leaving it in an undervalued state. As the impact of the event weakens, the project Token will return to a reasonable range or an overvalued state. This kind of expected reversal is more common in bear markets.

If we don’t want to fall into the situation of “veterans die of buying the bottom”, we might as well pay more attention to the valuation of the corresponding target and the new actions of the project side. I opened a position in BNB because of Binance’s continuous IEOs. From the actions of the project party, we can often see its tendency (it depends on what he did, not what he said). It is important to be on the same page with the project side.

Finally, let me talk about my current thinking on buying BNB: I will continue to hold it for the long term. I will not buy more BNB at this stage, but I will buy the bottom if it falls sharply. New profits from the BNB IEO will be directly used to increase BNB positions. At present, I will not look at the dollar value of BNB, but mainly focus on the growth of the BNB currency standard quantity. (I mainly focus on the coin-based volume growth of $SOL and $BNB)