編按:近期,根據Farside Investors數據顯示,比特幣現貨ETF自推出以來累計淨流入超121億美元。 貝萊德現貨比特幣ETF(IBIT)持有量超過理論最大供應量2,100萬枚比特幣的1%,市值超過160億美元。 比特幣ETF數據是散戶投資者的重要參考指標。 請閱讀:《ETF日線數據為何值得關注,與市場有什麼關係?》 》。 不平衡創辦人GoldenGoat在X上分享了他對比特幣ETF的分析。BlockBeats轉載全文如下:

你有沒有想過實際流通的派數量有多少?

現貨ETF真的能買斷所有流通供應嗎?

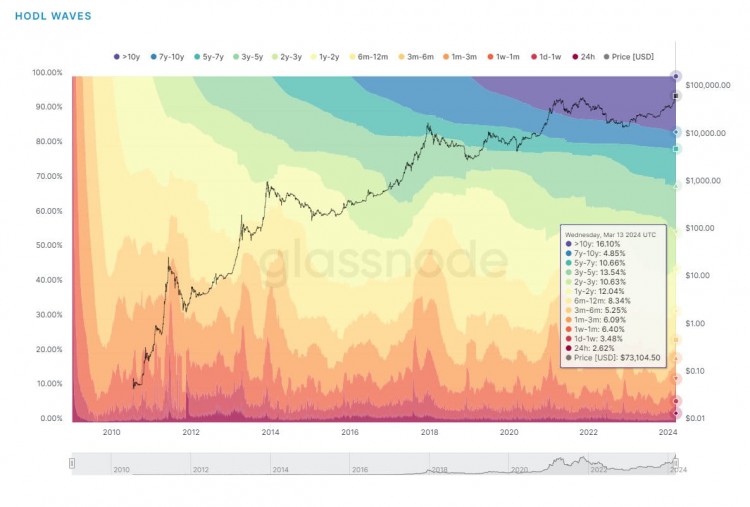

到目前為止,總共開採了 19,654,193 個比特幣,但有多少已經遺失或被遺忘?

這裡簡單統計一下,參考圖。

來源:金山羊

32.18%的比特幣在過去一年被轉移。 這個數字是 6,324,719 比特幣。 這個數字是今年內參與交易的比特幣的完整計數。

然後是交易所持有的比特幣總量,目前已超過 180 萬枚。

來源:金山羊

近兩個月ETF淨增持量超過20萬隻,目前總持倉量超過80萬隻。

來源:金山羊

還有超過20萬個是微觀策略持有的,由各國政府持有或收藏。 當然,這些持有的比特幣和交易所持有的比特幣,並不是一年之內全部轉移,但一定有交集。

所以對於一年內超過600萬活躍比特幣來說,20%的折扣並不算太多,也就是500萬(並不是高估了今年信徒持有數量)

以7萬美元的價格計算,如果價格不變,只需要3,500億美元就能買斷目前流通的全部比特幣。 近兩個月ETF淨流入超過100億美元。 不包括額外發行的$USDT。

來源:金山羊

所以理論上,如果餅不繼續漲,被全部買斷只是時間問題。 而如果餅掉下來,美國又不出現經濟衰退之類的黑天鵝,那隻會加快傳統資本收購比特幣的速度(之前花了7萬一美元,卻莫名其妙地回撤,崩盤) ,現在每隻只需5 萬美元)

這也是我的陰謀感。 近期日內的上漲都是在貝萊德IBIT數據出來之後,因為幣圈人士再次看到了貝萊德如此大買盤引發的FOMO情緒。

So to sum up, I said that for the currency circle, you only need to pay attention to one indicator now, which is the fund inflow of ETFs (other indicators are paper tigers. Similarly, in 2021, pay attention to grayscale buying volume and $USDT additional issuance volume). If If it slows down significantly for several consecutive days, you should pay attention to the risk of a correction. If you encounter a larger correction but the inflow of funds does not increase significantly, you should pay more attention.

The conclusion is simple. As long as ETFs continue to flow in, the market will continue to rise. Unless emotions go crazy and rise too much in a short period of time, the value of the part that rises too much will return.

Recession is still a nuclear bomb-level negative for the big pie, and it is also a nuclear bomb-level negative for the global market, and it will directly affect market sentiment, and at the same time affect the inflow of ETF funds, and even turn the inflow into a continuous outflow (this is not the case now) 3 years ago, the Bitcoin bought by Grayscale could only be turned into GBTC and competed with each other in its own pool, and was eventually beaten to a negative premium of close to -50% at the end of 2022). Then by then, it will be a trend When reversing.

And for us ordinary market participants, if we have another opportunity like this, please cherish the cheap pie!

This article is reprinted with permission from: "Rhythm Blockbeats"

Original author: GoldenGoat, imbalance