加密貨幣市場蓄勢待發

隨著2024年初比特幣ETF正式獲得SEC批准,加密貨幣市場迎來歷史性轉折,標誌著加密資產進一步被主流金融市場接受。未來,加密貨幣投資將變得更加廣泛和便捷。

此外,市場正處於下一個比特幣減半週期的前夕。隨著比特幣減半事件的臨近以及市場普遍預期聯準會降息,加密市場呈現前所未有的正面態勢。毫無疑問,這一系列利多因素將共同推動加密市場在2024年進入多頭市場。

如何在牛市跑贏別人

牛市往往能夠帶動整個市場的普遍上漲。在這個買啥都能賺錢的市場,如果你想跑贏其他投資者,選擇市值低但成長潛力大的優質項目是實現超額收益的關鍵。此類項目往往初始市場價值較低,增值空間較大。同時,如果專案本身俱備雄厚的基礎和未來的發展潛力,其成長動力也會更強。

因此,要獲得超越普遍上漲的超額收益,就應該努力在市場上挖掘此類低市價的潛力項目。

加密市場的遺產-NEOPIN

作為一個結合了 CeFi 和 DeFi 優勢的項目,NEOPIN 不僅具有強大的創新潛力,而且在合規性方面也處於行業領先地位。這些特點使得NEOPIN在即將到來的多頭市場中具有不可忽視的投資價值。

之前之所以被低估,一是市場上項目數量眾多,投資者的注意力往往集中在短期超高回報項目上,導致NEOPIN不具備長期成長潛力。成為市場熱點;其次,合規的 DeFi 對於一些關注「血緣論」的投資人來說,這個概念似乎不符合加密精神。市場用戶對這種許可式 DeFi 新模式的理解需要時間累積;最後,可能是因為NEOPIN是韓國項目,在美國和中國都有悠久的歷史。占主導地位的加密貨幣市場沒有足夠的聲音來引起投資者足夠的關注。

因此,在市場逐漸實現其真正價值之前進入意味著在未來獲得可觀的投資回報。接下來我們將詳細介紹NEOPIN計畫和產品功能,以及在多頭市場的爆發潛力。

項目介紹

NEOPIN is positioned as a decentralized "crypto bank", aiming to provide users with one-stop DeFi services by integrating the security and compliance of CeFi with the flexibility and openness of DeFi. Product features include decentralization Wallet, DEX trading, liquidity mining, liquidity staking, lending and more.

The NEOPIN project is developed by a team with deep technical background and rich industry experience in South Korea. The team members mainly come from giants in the traditional and Web3 fields such as Samsung, Neowiz (South Korea's largest gaming company), Binance, Gnosis, etc., and are committed to creating a safe and convenient DeFi ecosystem.

Program features

Compliance Services

NEOPIN emphasizes compliance and user security. They are currently one of the members of the innovation program of the Abu Dhabi Investment Office (ADIO) in the United Arab Emirates. They are the first Korean Web3 project to receive investment from the office and cooperate with the Abu Dhabi Global Market in the United Arab Emirates. , becoming the world’s first DeFi protocol to integrate a regulatory framework. NEOPIN ensures that platform operations comply with international financial regulatory standards by implementing KYC and AML policies and two-factor authentication.

CeFi and DeFi integration

As technology and markets mature, users’ demands for decentralization, security, and privacy protection in financial instruments increase. In addition, DeFi’s ability to provide global users with unrestricted access drives broader market participation, so it is foreseeable that , future trading activities will gradually shift from traditional centralized exchanges to DEX. During this transformation, NEOPIN has naturally become an ideal transition middleware with its unique advantages in combining CeFi and DeFi.

By combining the security of CeFi and the innovation of DeFi, NEOPIN provides a unique platform that enables users to securely access decentralized financial services such as cryptocurrency trading, staking, lending, mining, and more.

RWA based multiple benefit agreement

NEOPIN RWA products utilize the BDLP (Bond Derivatives Linked Protocol) mechanism and use sDAI and Internet bond derivatives sUSDe based on U.S. Treasury bonds to provide returns higher than U.S. Treasury bond returns. The protocol supports DAI, USDT and USDC deposits, providing users with up to 30.2% annualized rate of return.

NEOPIN has also developed a proprietary AI algorithm for the protocol, which is able to analyze and provide optimal asset management ratios for each user, allowing users to efficiently utilize complex DeFi derivatives based on personal preferences and on-chain data.

Project Dragon ecological faucet

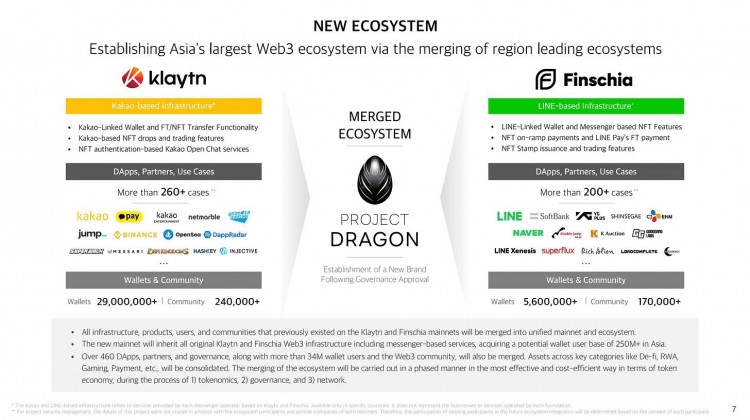

NEOPIN is currently the leading project in the Project Dragon public chain. Project Dragon was formed by the merger of two public chains, Klaytn and Finschia. It has integrated more than 250 million users and is compatible with traditional public chains such as Ethereum, Cosmos, Polygon, and Tron. The market values of Klaytn and Finschia are approximately US$820 million and US$240 million respectively, and the combined project valuation reaches approximately US$1 billion. This large user base and combined ecosystem provide NEOPIN with huge growth potential and market Influence.

Backed by Japanese and Korean giants

Some people may not be familiar with the Klaytn and Finschia mentioned earlier, but everyone knows Kakao and Line, the two Asian technology giants behind them. As the leading public chain in Japan and South Korea jointly built by the two giants, NEOPIN not only has strong technical and resource support, but also has access to more than 250 million potential users in Japan and South Korea.

NEOPIN Bull Market Outlook

The current TVL of NEOPIN is US$183 million, which is at a seriously underestimated level. From a track perspective, NEOPIN is a one-stop DeFi platform, benchmarking against Raydium in the same track, which integrates trading, liquidity mining, staking, etc. platform, Raydium's current market value is about US$600 million, while NEOPIN's market value is only about US$85 million, and the price still has room for a 7-fold increase. If the NEOPIN ecosystem further explodes in the future, it will benchmark against the first echelon of DeFi such as Uniswap, Curve, and Pancake. projects, the price space is even more unimaginable.

From the perspective of the public chain it is located in, NEOPIN is currently the leader of Project Dragon. Compared with public chains with similar valuations such as Avalanche or projects with the same ecological status in Polygon such as Benqi, Trader Joe, GMX, etc., the valuations of these projects are also Basically, it is between 3-5 times that of NEOPIN. This difference shows that NEOPIN is undervalued by the market and also hints at the room for price growth.

Looking further, the strong technical support, compliance and inter-governmental cooperation behind NEOPIN provide it with a solid foundation. These factors, coupled with its core position in the Project Dragon project and the cooperation between the two major technology giants in Asia, The background supported by Kakao and Line provides a strong guarantee for NEOPIN's rapid development and market value growth.

In addition, NEOPIN has not yet been listed on Binance, the world’s largest cryptocurrency exchange, and Upbit, South Korea’s largest exchange. Once listed on these two platforms, it is expected to attract a large number of new users and capital, further pushing up its market value. In view of the huge potential of the cryptocurrency market in Japan and South Korea, NEOPIN is backed by powerful technology giants in these two countries, and its future growth potential is worth looking forward to.