原文來源:Odaily星球日報

原作者:jk

美國當地時間週二,美國司法部和商品期貨交易委員會(CFTC)對加密貨幣交易所KuCoin及其兩位創辦人提出刑事指控。 這起事件標誌著美國監管機構對加密貨幣市場的進一步監管,也是美國監管機構繼幣安案之後持續打擊洗錢計畫的一部分。

根據美國司法部週二公佈的起訴書,起訴書針對的是庫幣及其背後的實體,以及其兩位創始人Chun Gan和Ke Tang,指控他們經營未經許可的資金傳輸業務,違反了《銀行保密法》 。 同時,商品期貨交易委員會(CFTC)在同日提交的另一份起訴書中稱,KuCoin非法經營數位資產衍生性商品交易所。

發布起訴書的兩家機構表示,該交易所未能維持足夠的反洗錢程序,未能實施「合理程序」來確認客戶身份,未能提交可疑活動報告,未能向CFTC 和FinCEN 註冊,也未能向 CFTC 和 FinCEN 註冊。 這項行為使庫幣成為大規模洗錢犯罪資金的工具,涉案金額超過90億美元。

起訴詳情:KuCoin犯了什麼罪?

根據美國司法部發布的新聞稿,KuCoin 及其創始人被指控密謀經營未經許可的資金轉移業務,並密謀違反《銀行保密法》,其中涉及故意未能維持足夠的反洗錢義務(「反洗錢")程式. 這些程序旨在防止KuCoin用於洗錢和恐怖主義融資,但未能維持合理的程序來驗證客戶身份,也未能提交任何可疑活動報告。 KuCoin也被指控經營未經許可的匯款業務,並嚴重違反了《銀行保密法》。

需要注意的是,本次起訴並不包括美國SEC,因此指控中也不包括SEC的「最愛」—出售未註冊證券,因為證券相關事宜並不屬於本次起訴的管轄範圍。 裡面。

起訴書稱,KuCoin“謊稱沒有美國客戶”,故意規避美國反洗錢(AML)和客戶身份驗證(KYC)法規,而事實上,KuCoin擁有大量美國客戶,並且檢方聲稱KuCoin 允許其平台被用來洗錢超過90 億美元。

KuCoin solicited business from U.S. customers through its spot trading platform and later its futures trading platform, launched in July 2019. Since its founding in 2017, KuCoin has become one of the largest cryptocurrency trading platforms in the world, with more than 30 million customers and billions of dollars in daily cryptocurrency trading volume. KuCoin’s website promotes it as being among the top five in a public ranking of global cryptocurrency exchanges. One of the public rankings ranks KuCoin as the fourth largest cryptocurrency derivatives exchange and the fifth largest cryptocurrency spot exchange.

In a statement released by the Department of Justice, the founders and KuCoin entities were aware of their U.S. anti-money laundering (AML) obligations but deliberately chose to ignore those requirements: KuCoin failed to implement an adequate know-your-customer (KYC) process. In fact, KuCoin did not ask customers to provide any identifying information until at least July 2023. Only in July 2023, after KuCoin was notified of a federal criminal investigation into its activities, did KuCoin adopt KYC procedures for new customers. However, this KYC process only applies to new customers and does not apply to KuCoin’s millions of existing customers, including a large number of customers located in the United States. KuCoin has also never filed any required suspicious activity reports, has never registered with the CFTC as a futures commission merchant, and, at least until the end of 2023, has never registered with FinCEN as a funds transmission business.

For example, the Justice Department said that from August 2022 to November 2023, approximately 197 KuCoin deposit addresses received $3.2 million worth of cryptocurrency, indirectly or directly, from virtual currency mixer Tornado Cash, which was listed sanctions list.

The release reads, “In fact, KuCoin actively attempts to hide the presence of U.S. customers in order to make it appear that KuCoin is exempt from U.S. AML and KYC requirements. Although KuCoin collects and tracks the location information of its customers, KuCoin actively blocks their U.S. customers identified themselves when opening KuCoin accounts. Furthermore, KuCoin lied to at least one investor in 2022 about the location of its customers, falsely representing that it had no U.S. customers when, in fact, KuCoin had a significant number of U.S. customers. In fact, KuCoin had a large number of U.S. customers. , in many social media posts, KuCoin actively markets itself as an exchange for US customers where they can trade without KYC. For example, KuCoin stated in a message on Twitter in April 2022: “ KYC is not supported for US users, however, conducting KYC on KuCoin is not mandatory. Often transactions can be completed using unverified accounts."

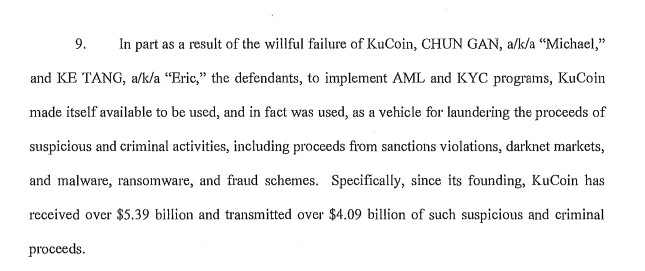

Due to KuCoin's deliberate failure to maintain required AML and KYC procedures, KuCoin was used as a vehicle to launder large amounts of criminal proceeds, including proceeds from darknet markets, malware, ransomware, and fraud schemes. Since its inception in 2017, KuCoin has received over $5 billion and sent over $4 billion in suspicious and criminal proceeds. Many KuCoin customers use its trading platform specifically because of the anonymity of the service it offers. In other words, KuCoin’s no-KYC policy is a key part of its growth and success.

Financial proceeds mentioned in the indictment, source: U.S. Department of Justice indictment

Each count against the founders carries a maximum penalty of five years in prison.

U.S. Attorney Damian Williams said: “As charged in today’s indictment, KuCoin and its founders deliberately concealed the fact that a large number of U.S. users were trading on the KuCoin platform. In fact, KuCoin allegedly used its large U.S. customer base to Becoming one of the largest cryptocurrency derivatives and spot exchanges in the world, with billions of dollars in daily trading volume and trillions of dollars in annual trading volume. However, financial institutions like KuCoin take advantage of the unique opportunities available in the United States , must also comply with U.S. laws to help identify and eradicate criminal and corrupt financing schemes. KuCoin allegedly deliberately chose not to do so. As alleged, by failing to implement basic anti-money laundering policies, the defendants allowed KuCoin to remain in the shadow of financial markets Operating within and used as a safe haven for illegal money laundering, KuCoin received over $5 billion and sent over $4 billion in questionable and criminal funds. Cryptocurrency exchanges like KuCoin cannot have it both ways. Today’s indictment should serve as a warning to others Cryptocurrency exchanges send a clear message: If you plan to serve U.S. customers, you must follow U.S. law, simple."

The Commodity Futures Trading Commission also filed a parallel civil lawsuit against KuCoin on Tuesday. The CFTC seeks restitution of unjust enrichment, civil monetary penalties, permanent trading and registration bans, and a permanent injunction for future violations.

At present, KuCoin has responded: "KuCoin operates well and our users' assets are absolutely safe. We have noticed the relevant reports and are investigating the details through our lawyers. KuCoin respects the laws and regulations of various countries and strictly abides by compliance standards." "

KuCoin CEO Johnny Lyu said in a post on The team will update progress in a timely manner."

This is the second time KuCoin has run into trouble with the law. New York State Attorney General Letitia James sued the exchange in March 2023 for violating the state's laws on securities and commodities trading.

What happens next?

A simple analysis can actually conclude that the U.S. Department of Justice has actually achieved a lot of results in the Binance case, and what follows is that exchanges that actually have U.S. customers will become the targets of subsequent lawsuits (at that time, Bitcoin An is also accused of instructing US customers to bypass US KYC and use the more liquid Binance exchange instead of Binance.US), because some exchanges are not registered with official US agencies, as in today’s KuCoin case Same as written.

One possible form is that the lawsuit will be targeted. After the case against a certain exchange is concluded, another one will follow; if most exchanges similar to KuCoin are sued at the same time in a short period of time, it is very likely that There will be a situation where "you can't claim to be a major exchange without receiving an indictment", that is, major exchanges may deal with it collectively or there are other possibilities. And handling them one by one and taking punitive measures can ensure the greatest success rate.

Taken together, this criminal charge sends a clear signal to global cryptocurrency exchanges that companies operating in the United States or serving American customers must strictly abide by U.S. laws. As the cryptocurrency industry develops rapidly, regulators are increasing their efforts to ensure the health and sustainability of the industry and protect investors from illegal activities. All these efforts point to a common goal: building a more secure and transparent digital currency market.