Original author: Mary Liu

Original source: BitpushNews

On Wednesday, trading activity in the cryptocurrency market cooled slightly. As of the close of U.S. stocks that day, the total market value of crypto fell 1.2% to $2.6 trillion. Bitcoin and Ethereum face resistance at key levels.

Bitcoin hit a daily high of $71,754 before retracing to $69,793, down 1.2%. Ethereum is currently trading at $3,516, down 1.35% in the past 24 hours.

In the altcoin market, the native tokens of blockchain AI concept projects Fetch.ai, SingularityNET and Ocean Protocol are soaring amid the proposed merger plan. The proposed merger is called the "Artificial Super Intelligence Alliance" and the tokens of these projects will be named for Artificial Superintelligence (ASI).

Affected by this news, the existing tokens of these three projects rose sharply. In the past 24 hours, Fetch.ai (FET) rose by 15%, SingularityNET (AGIX) rose by 12%, and Ocean Protocol's token OCEAN rose the most. , up more than 36%. The three projects submitted their integration proposals to their respective governance communities today, kicking off a 14-day consultation period with a vote on the proposals expected to take place between April 2 and April 16.

The Base chain continues to lead the meme craze, with the most popular BRETT rising 11% in the past 24 hours. BRETT was inspired by the cartoon characters drawn by artist Matt Furie, and its market value was once close to $500 million. “It is now clear that memecoins have evolved from a cultural movement into a key tool in driving the adoption of new blockchains,” Coingecko wrote in a newsletter.

However, the hype has attracted the attention of regulatory agencies. The British Financial Conduct Authority (FCA) issued a document warning KOLs to pay attention to "misleading" encryption meme projects. Paid promotion needs to obtain regulatory approval to avoid potential criminal charges. FCA Listing “meme” projects as a focus area for online violations.

Cryptocurrency market ‘in the middle of a bull run’

According to a recent report from Grayscale, market cycle indicators suggest that the cryptocurrency market is “currently in the middle of a bull run,” supported by strong fundamentals and technical factors.

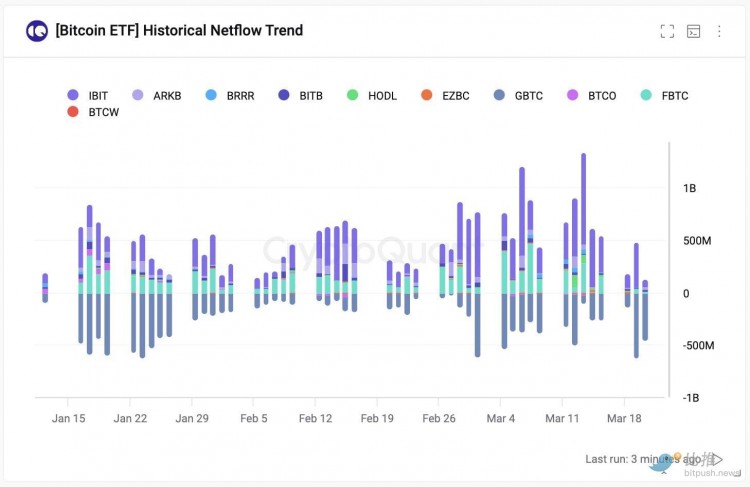

Despite Bitcoin rising from $63,800 to $70,000 in the five days leading up to March 27, only $151 million of leveraged short positions were liquidated in the BTC futures market. This suggests that bears remain cautious despite a whopping $888 million in net withdrawals from U.S. Bitcoin spot ETFs last week.

On the positive side, Bitcoin has shown resilience, falling from $73,757 on March 14 to $60,795 on March 20 without causing panic among spot ETF investors. Spot ETF flows reversed course this week, recording net inflows totaling $418 million on March 26.

Additionally, Grayscale reports that exchanges are holding significantly less Bitcoin, “down 7% since the local Bitcoin supply peak in May 2023,” suggesting that tight supply is partly due to spot Bitcoin ETFs moving BTC away to custodial cold wallets for long-term storage as investors anticipate future price increases.

Is BTC’s pre-halving correction over?

Analyst Rekt Capital said on the Bitcoin is now back near $70,000.”

Rekt Capital said in a video analysis yesterday that if the all-time high of $69,000 turns into a support level, Bitcoin prices may break through to new all-time highs. He said: “Bitcoin has broken through all-time highs and it is possible that it will reach a new high before the halving. Be prepared for the pullback to end.”

According to a research report from Bitfinex analysts, last week’s Bitcoin price correction indicated that the price has formed or is close to forming a local bottom. The analysts said: “We believe that Bitcoin’s correction last week from the current all-time high of $73,666 was quite A correction of around 17.5% indicates that we are close to establishing a local bottom and in fact the market is starting to follow this pattern."