Over the past few months, Pendle has become a bright spot in the cryptocurrency market, attracting widespread attention for its significant rise in price. Soaring from $1.3 in January 2024 to $7.1 in April, Pendle proved the appeal of its unique revenue management solution in the volatile crypto market. But what exactly is Pendle, and why has it attracted so much investor attention?

Today, let’s take a look at Pendle and learn about the Pendle ecosystem in detail!

Pendle is a decentralized protocol based on Ethereum that focuses on innovative yield management strategies, allowing users to buy and sell future yields through its unique mechanism. This approach not only provides new investment opportunities, but also brings revolutionary changes to the liquidity and pricing of yields.

Yield Tokenization

At the heart of Pendle is its innovative yield tokenization mechanism. By packaging traditional yield promise tokens (such as stETH) into standardized yield tokens (SY), and then splitting these SY into principal tokens (PT) and yield tokens (YT), Pendle provides users with unprecedented flexibility to manage their principal and yield independently. This approach is similar to bond stripping in traditional finance, where PT is equivalent to a zero-coupon bond, and YT is the interest portion separated from the bond and can be traded separately.

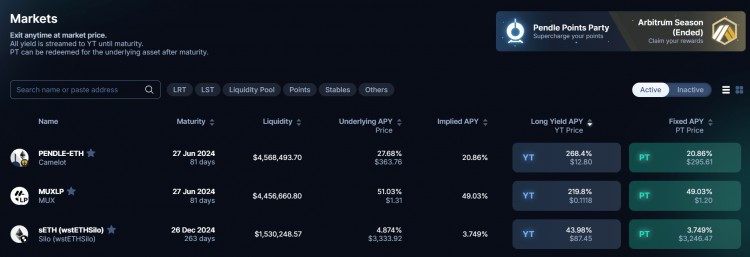

Pendle AMM (Automated Market Maker)

Pendle's automated market maker (AMM) is designed specifically for trading YT and PT, automatically adjusting its curve over time to reflect the accumulation of returns and the narrowing of PT's price range as it approaches expiration. This design increases capital efficiency, making trading returns more efficient as PT approaches expiration. Pendle V2's AMM enables the ability to trade PT and YT in a single liquidity pool by implementing a pseudo-AMM mechanism and flash swaps.

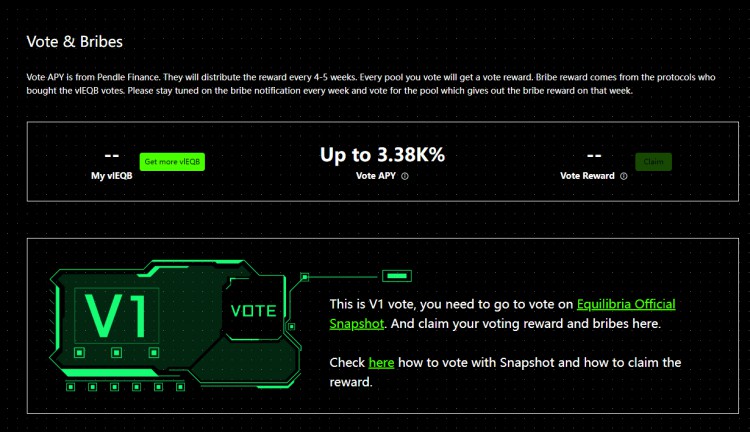

vePENDLE

vePENDLE introduces an interesting governance dimension, allowing $PENDLE holders to obtain vePENDLE by locking up, thereby participating in the distribution of protocol revenue, increasing the yield of liquidity providers, and influencing the emission direction of $PENDLE."Pendle Wars" refers to the competition among different DeFi platforms to accumulate more influence in the Pendle ecosystem, aiming to accumulate vePENDLE by locking more $PENDLE in order to increase their earnings on Pendle and pass these earnings on to users.Currently, Pendleton already has ecosystems such as penpie and equilibria that are derived from vePendle. For example, eqb that holds and stakes equilibria can obtain high returns through voting.

Pendle users can manage their returns through a variety of strategies, including buying YT to increase exposure to future returns (long returns), or trading YT to realize profits. For example, if a user expects the underlying APY of an asset to rise, they can buy YT to bet on the increase and profit when the returns exceed the purchase cost. The beauty of this strategy is that it provides users with the ability to maximize returns in uncertain market conditions.

Pendle introduces a new level of efficiency to the cryptocurrency market by providing liquidity for trading future returns. This not only facilitates transparent pricing of returns, but also provides investors with a platform to hedge risk or take advantage of changes in market expectations. In addition, by allowing users to trade future returns, Pendle brings new capital allocation strategies to the DeFi space.

Pendle has demonstrated great potential in the cryptocurrency ecosystem through its unique yield management strategy and technological innovation. As the DeFi field continues to develop, Pendle and its concept of tokenized yields may lead a new revolution in how we manage and trade the yields of crypto assets. Despite the potential risks, Pendle undoubtedly provides cryptocurrency investors with a new and advantageous way to manage and optimize their yields, laying the foundation for future financial innovation.

Although Pendle offers many advantages and innovations, investors should also be wary of the risks associated with it. These risks include market volatility, smart contract vulnerabilities, and uncertainty in the entire DeFi ecosystem. Investors should conduct thorough research and consider diversifying their investments to mitigate risks.