The volatility shown by the market signals that the Bitcoin halving event is approaching. According to historical data, halving events are usually preceded by a decline in market capitalization and trading volume.

Nonetheless, smart investors will use this drop to look for altcoins with potential. This article lists 4 cryptocurrencies that we see as promising investment opportunities in anticipation of the next bullish cycle.

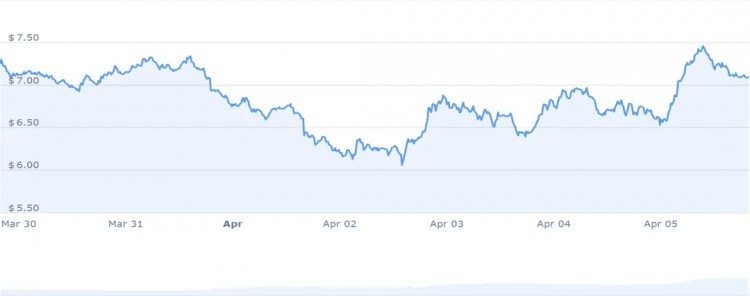

NEAR Protocol has seen a decline in price action, with a small 8% drop over the past week. However, if you zoom out, its performance over a wider timeframe shows significant growth. Month-to-date, NEAR is up over 50% and over 500% over the past six months.

Furthermore, NEAR has been hovering between $6.74 and $7.98, with the last intraday trading price at $7.09. Its price has surged an impressive 254% so far this year, signaling a sustained uptrend. Moreover, NEAR is trading above its 200-day simple moving average, indicating positive momentum.

Judging from the recent trend, if the momentum continues to gain momentum, NEAR may set its nearest resistance at $8.67. However, there is a huge obstacle at the second resistance level at $9.91. Conversely, downside protection lies at $6.18, with stronger support around $4.93. The trajectory of NEAR will largely depend on market sentiment and its adoption progress. With 16 green days out of the past 30 working days, there is confidence in sustainable growth.

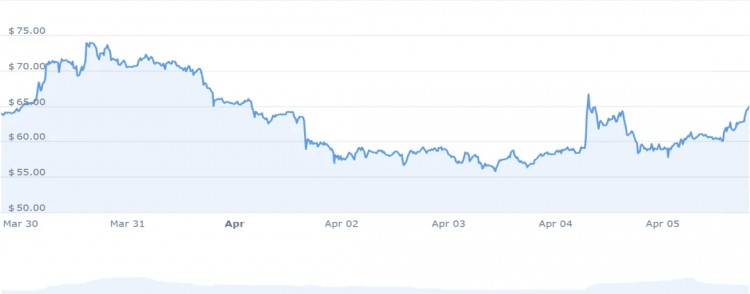

Coinbase’s subsidiary for institutional clients has revealed plans to list perpetual futures contracts for BRC-20 tokens Ordinals and Worldcoin on April 11. In an announcement on April 5, Coinbase International Exchange announced that it will list perpetual futures products for ORDI and WLD as early as April 11. As a result, institutional investors will be able to purchase these futures on Coinbase International and Coinbase Advanced.

The launch of ORDI and WLD perpetual futures contracts reflects the platform's commitment to providing diversified investment opportunities for institutional participants. In addition, this development expands the range of available financial instruments and reflects the growing maturity of the cryptocurrency derivatives market.

ORDI shares moved higher on the news, last trading 9.65% higher at $64.99. ORDI is trading near its cycle high of $66.70 and is 383.02% above its 200-day moving average of $13.55, indicating a strong bullish trend.

Furthermore, recent market trends show ORDI enjoying a string of positive trading sessions, with the 15/30 day showing green candlesticks. Overall market sentiment is positive, with a Greed Score of 75, indicating widespread greed among market participants.

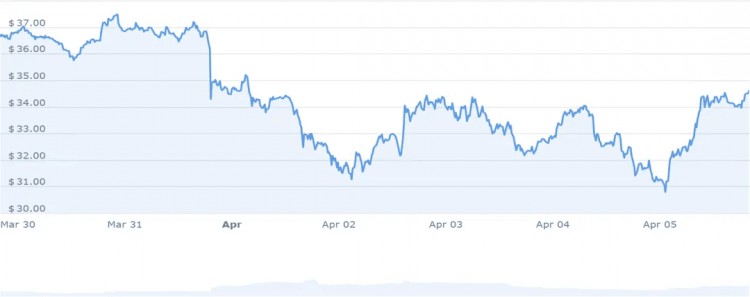

Injective has just launched its latest upgrade, Injective Bridge Ionic, which aims to bring significant improvements to the DeFi space. The upgrade brings enhanced functionality and a smoother user experience. In addition, it represents a significant step forward in improving interoperability within the crypto space.

In addition, INJ's market performance has reacted positively to the news, causing the injection trading price to rise to $34.72, up 10.10% in the past 24 hours. At the same time, investors are bullish on INJ, while market greed has also increased.

Injective is trading 214.33% above its 200-day simple moving average at its current price of $35.17. It has shown incredible growth over the past year, with its price surging by an impressive 503%. This performance outperforms 88% of the top 100 crypto assets, including major players like Bitcoin and Ethereum.

One of Injective’s key strengths is its high liquidity, which is driven by its strong market cap. This positive liquidity profile is further reflected in its performance relative to the token sale price.

In summary, the Injective Bridge Ionic upgrade further consolidates Injective's position as a leader in the DeFi space. With its continued growth trajectory and strong market fundamentals, Injective remains a promising investment opportunity.

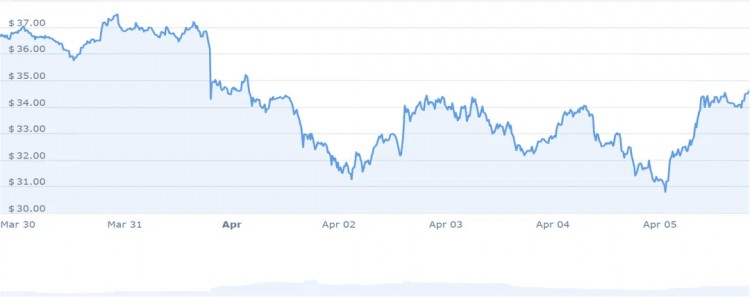

Theta Token is on an upward trend, prompting investors to consider it as one of the best altcoins to invest in right now. In the last intraday trading session, THETA is up 5.88% and is trading at $2.67. The coin is 100.79% above its 200-day simple moving average, and its positive performance further reflects its potential.

Theta Token has shown strong growth over the past year, outperforming Bitcoin and Ethereum. Despite the recent decline, there are compelling signs that Theta Token has made a major turnaround. Analysts point to a possible golden cross on the weekly chart, indicating a possible reversal of the long-term trend. As a result, Theta Token may approach the 200-week exponential moving average (EMA), and the prospect of a golden cross will boost investor confidence.

Additionally, with the upcoming Bitcoin halving this month, Theta Token’s price is expected to rise further, potentially reaching $5.28 at the 38.20% Fibonacci level. Likewise, the growing bullish sentiment presents an interesting opportunity for THETA traders and investors to keep a close eye on.

Theta Token is poised for a potential uptick, backed by strong technical indicators and positive market sentiment. However, investors should track its progress in the coming weeks before making a decision.

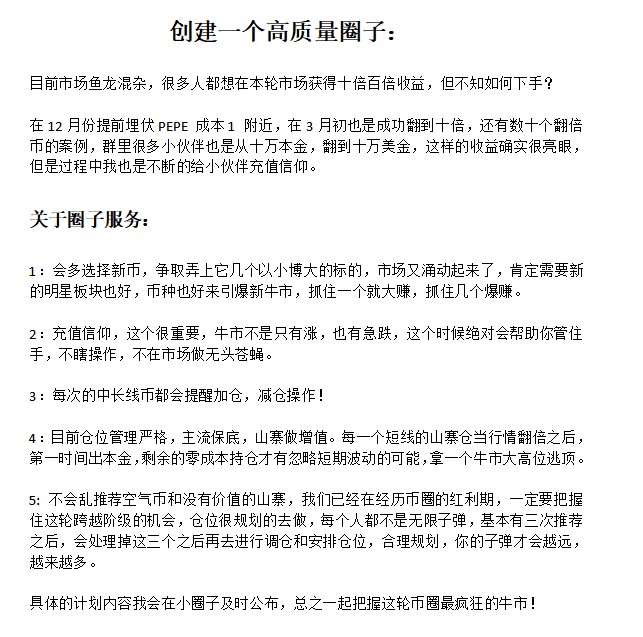

Create a high-quality circle

Spot mainly

I will share some content: as shown below:

Brothers who want to join, please contact afeng870. I will reply in time~!