隨著香港區塊鏈大會的召開,蘭桂坊終於恢復了幾年前的繁華景象。

01香港傳統金融失敗

近年來,加密圈的人都知道香港已經開始擁抱加密,但加密圈的人可能不知道的是,香港的傳統金融領域這些年其實表現並不好。

這是知名資料專家(老曼,下同)根據港交所發布的資料整理出的表格。

今年港交所IPO規模可能略超1000億港元。

或許今年,香港加密貨幣計畫的ICO規模將超過IPO規模。

很多人說,香港這幾年的環境已經改變了。有外部原因,例如歐美資本撤出香港,或將香港納入製裁範圍;當然,也有內部原因。

但加密產業的好處就是允許你做,不像有些地方有強行抓人、偷幣的野蠻行為。

加密產業對其他環境沒有太多要求:

團隊分散,對辦公環境無要求

大部分的收入和支出都是透過加密支付的,不需要傳統的金融設施來支持。

說到監管,大多數去中心化計畫都是在合規框架下運作的,真正引起轟動的騙局都是中心化計畫。

02香港政府的食物即將耗盡

受多種因素影響,香港政府近年來過得併不好,一直靠著過去的資本過日子。

香港政府與中國/美國政府不同。中美兩國政府的赤字可以用印鈔票來彌補。

但香港政府的赤字只能透過賺取美元來償還,同時維持港幣與美元的聯繫匯率制度。

香港政府目前總資產超過6,000億元人民幣,較巔峰時期減少一半。以這樣的消耗速度,資產還能維持2到3年。

03 其他產業不能依賴

香港零售業也大幅萎縮。每逢週末,香港人都來深圳買東西,山姆會員店裡擠滿了香港人。

中國內地人不再去香港消費太多了。香港物價高,服務差。對於需要在歐美消費的高端客戶來說不是更好嗎?去東南亞也很方便。

If it weren’t for the crypto industry, I wouldn’t go to Hong Kong very often.

Hong Kong's foreign trade is also in trouble. Hong Kong itself has no manufacturing industry, and its foreign trade mainly relies on mainland China's re-export trade:

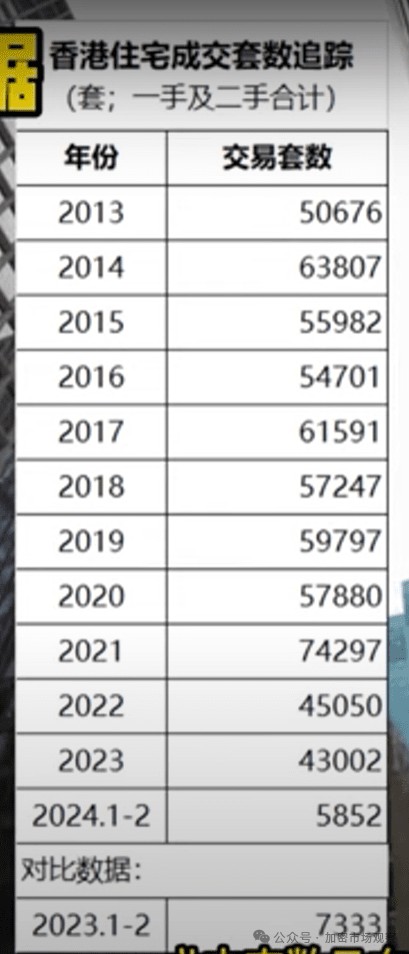

Other industries are not good, and Hong Kong's real estate is certainly difficult to do:

In this way, everyone can see the situation currently faced by the Hong Kong government.

Apart from encryption, there are actually not many other industries to choose from, and it seems difficult at present whether encryption can provide blood transfusions to the Hong Kong government in the short term to make up for the blood loss in other industries.

Currently, most projects just hang a sign in Hong Kong, raise funds in Hong Kong, and finally go to major exchanges.

The biggest move by the Hong Kong government at present is to issue licenses to several exchanges. To be honest, global crypto investors do not really recognize the value of the Hong Kong government's licenses, and the liquidity of these licensed exchanges is also pitifully low.

This year, as dex is gaining momentum, the trading volume of dex supported by mainstream public chains is stronger than that of many centralized exchanges. In this case, it is not very wise to still fantasize about supporting centralized exchanges with a local license.

I personally suggest that the Hong Kong government should focus on maintaining its linked exchange rate system and leave everything else to the market.

I will continue running in the afternoon. Bye~