在 2023 年 12 月最後幾週短暫停頓之後,非 ( BTC ) (也稱為山寨幣)進入2024 年增速放緩,為今年第一個月帶來了潛在的「逢低買入”機會。

比特幣市值持續上漲至 45,800 美元,達到 2021 年 4 月以來的最高點,推動了各種山寨幣在 2024 年初的積極發展軌跡。

值得注意的是,有些突破性資產遵循明確的社交量模式。 根據1 月 2 日 加密貨幣 分析平台

Finbold 確定了 7 種最有潛力利用比特幣收益的山寨幣,並為投資者提供了潛在盈利的購買機會。

以太坊(ETH)

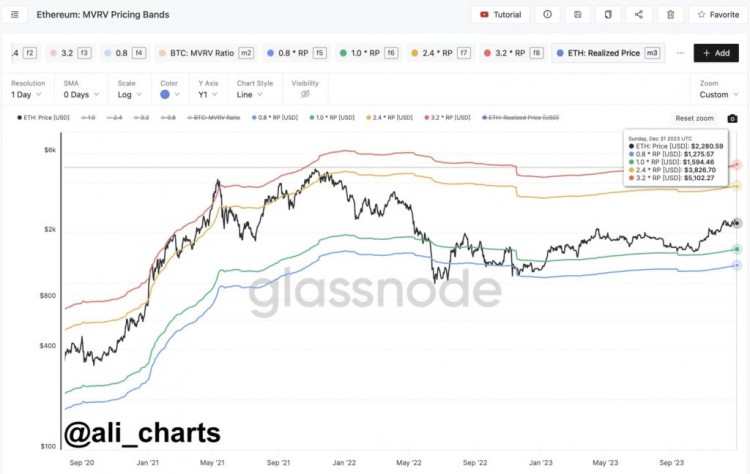

MVRV 比較可以評估當前價格是否高於或低於感知的“公允價值”,從而提供對市場盈利能力的見解。

根據加密貨幣分析師 Ali Martinez 於 1 月 2 日發布的帖子 ,根據

以太坊

(

ETH

) MVRV 定價區間,ETH 即將到來的重要價格目標確定為 3,830 美元和 5,100 美元

。

同時,根據最新消息,以太幣以 2,379 美元換手,當日下跌 -1.55%,過去一周價格正變化 5.84%,月度圖表上漲 5.38% 1月3日檢索。

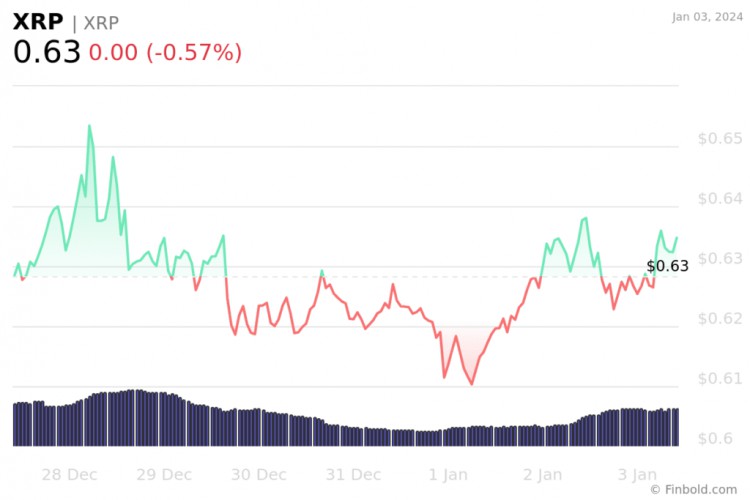

瑞波幣 (XRP)

如果歷史 模式,特別是透過超級孔雀魚指標(克里斯穆迪創建 的 GMMA 的高級版本)觀察到的歷史模式,採用七個短期和根據加密貨幣專家

的帖子

XRP 代幣的交易價格為 0.635630 美元,在過去 24 小時內小幅下跌 -0.57%。 但仍維持正面趨勢,較前一周上漲1.57%。 1 月 3 日的最新圖表顯示,上個月小幅下降了-0.63%。

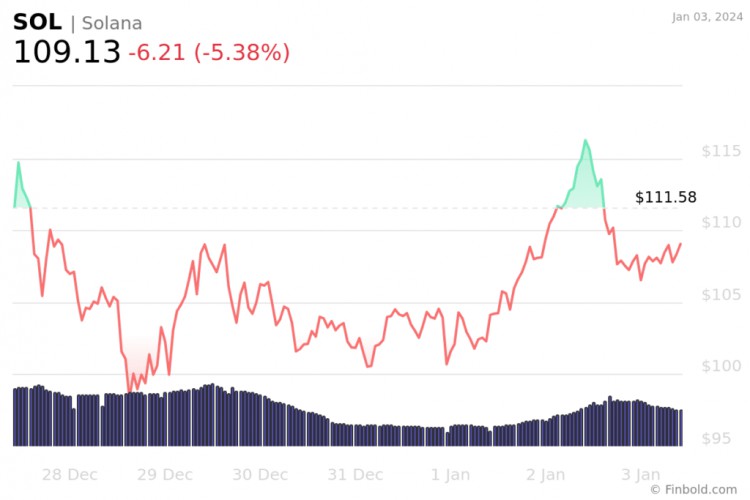

索拉納 (SOL)

正如加密貨幣專家 Michaël van de Poppe 在 12 月 28 日的 帖子 中所強調的那樣,人們非常關注在較長時間框架交易中在 70-80 美元範圍內建立

Solana

(

SOL

) 長期入場點。

At the time of press, Solana was trading at $109.12, decreasing by -5.40% in the past 24 hours and further by -2.20% in the past week, contrary to impressive gains of 71.36% in the past 30 days.

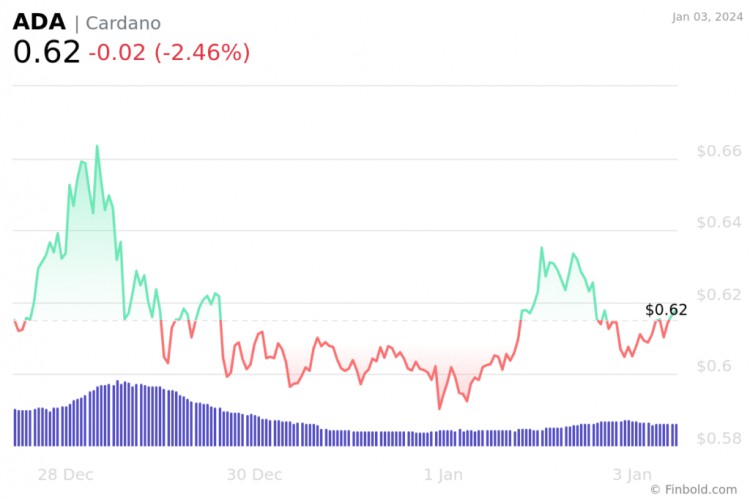

Cardano(ADA) has regained its leading position among all cryptocurrency projects due to significant monthly development activities on the GitHub platform. These activities indicate heightened efforts to expand the associated ecosystem, as per apostfrom

At the time of writing, ADA was trading at $0.617642, marking a decrease of -2.46% in the past 24 hours, contrary to the increase of 1.79% in the previous week and gains of 50.66% in the last 30 days.

The upcoming months forDogecoin(DOGE) are currently under consideration. Despite its categorization as a memecoin, the chart structure is notably promising. Before each anticipated upward movement, specifictechnical indicatorsare being monitored.

Firstly, aMACDbullishcross has been confirmed. Secondly, the ASO cross is still pending, while there has been a confirmed price breakout of a multi-year trendline, further contributing to the analysis from Jay Dee’sposton December 28.

Meanwhile, DOGE is trading at the price of $0.091952, which suggests a decrease of -1.56% on the day and a -0.24% drop loss across the previous week. Nonetheless, it also sustains a 2.62% gain over the past month.

Chainlink(LINK) exhibits indications of a bull pennant formation. A conclusive closing above $17.2 may serve as the triggering factor for a potential breakout, driving the price of LINK toward $34. Nevertheless, monitoring the $14.2 level closely is crucial, as a decline below this threshold could undermine the existing bullish outlook, as per Ali Martinez’sposton January 1.

At press time, Chainlink was trading at $15.44, recording a decrease of -3.44% in the last 24 hours. Furthermore, it was also still holding onto the 1.43% increase across the previous seven days and a decrease of -4.04% in the past month.

Polygon(MATIC) has recently explored the $1+ range, and this temporary position may not persist for an extended duration. Given the emerging momentum, a continuation towards $1.30 is likely, per Michaël van de Poppe.

At the time of publication, MATIC was trading at $0.977847, marking a decrease of -3.52% in the previous 24 hours, as well as losing -8.29% of its value in the past month, while retaining the gains of 18.30% on the monthly chart.

總之,

截至 2024 年 1 月,這七種山寨幣可能會提供有利的

投資機會,前提是維持其穩健的基礎。

儘管如此,投資者在投資這些資產之前必須進行獨立研究並仔細評估個人的風險承受能力。