Solana 成為業界最受歡迎的區塊鏈生態系統之一的原因有很多。

憑藉數以千計的 dApp、高效能架構以及歷史證明等創新機制,難怪數百萬用戶使用區塊鏈進行各種 DeFi 活動。

這不僅僅是 Solana 的本地用戶 - 隨著網路的發展,更多來自其他區塊鏈的用戶將他們的代幣遷移到 Solana。 對他們來說幸運的是,有許多跨鏈橋將他們的加密貨幣從不同的區塊鏈轉移到 Solana。

那麼問題是,您應該使用什麼橋呢? 最重要的是,正確的做法是什麼? 當我們回答這些和其他關鍵問題時,本指南將作為您的藍圖。

不過,我們首先要了解什麼是區塊鏈橋。

什麼是跨鏈橋?

這個術語可能是不言自明的,但跨鏈橋允許您將原生資產從區塊鏈 A 轉移到區塊鏈 B 以執行多項活動。 想像一下,您想要將 ETH 或任何 ERC-20 代幣轉移到 Solana 區塊鏈,反之亦然。

因此,跨鏈橋是一個中間人,它將您的 ETH 轉移到 Solana 區塊鏈或將您的 SOL 轉移到 Avalanche。 跨鏈橋通常有兩種工作方式。 一種是透過稱為包裝的過程。

橋接包裝加密貨幣

橋樑以 1:1 的價值創建硬幣的包裝版本。 例如,我們可以透過使用一個橋樑來在以太坊上使用 BTC,該橋鎖定您的 BTC 並創建一個名為 wBTC 的包裝版本,該版本可在以太坊網路上使用。 比特幣最受歡迎的橋接協議稱為 Wrapped Bitcoin。

這就像去太空一樣:你必須把自己裹在太空衣裡才能在那種環境中生存。 一旦到達地球,您就可以取下它並呼吸新鮮空氣。 即使是同一個你,你也被包裹在一些可以擴展你能力的東西中。 同樣,由於架構差異,來自一個區塊鏈的代幣無法在其他網路中運行。

包裝是透過儲存和傳輸資產資訊和數據的智能合約完成的。

它在 DeFi 投資者中也很受歡迎,允許他們在不同網路上建立的協議中使用他們的代幣。 一個例子可能是貸款協議或流動性提供者越來越受歡迎,因此投資者將他們的代幣連接起來並獲得可以在此類協議上運行的代幣。

打包資產的主要缺點是它們依賴託管人,這可能會引發有關安全性、中心化和交易對手風險的問題。 此外,它們可能緩慢、昂貴且複雜。

然而,值得注意的是,有一些基於智能合約的包裝器不依賴第三方託管人,而是將資產儲存在鏈上。 儘管如此,還是存在協議失敗的風險。

Bridging With Liquidity Pools

Other bridges have a different approach to swapping currencies. If a bridge leverages liquidity pools, it is because they incorporate staking and farming programs that prompt users to lock their assets into these pools to earn yield. The bridge then uses the assets to fulfill bridging requests.

Cross-Chain Bridge and Synapse Protocol are popular solutions. Here’s a summary of how they work:

Bob wants to convert their Solana USDT to an ERC-20 version.

Cross Chain Bridge receives Bob’s Solana-based USDT and taps into its liquidity pool of ERC-20 USDT.

The bridge then sends Bob the equivalent amount in ERC-20 USDT, charging a small fee.

Bob can always swap back his Ethereum-based USDT for his Solana-based version.

These bridges share similar drawbacks to wrapped assets — mainly security and centralization. But their main drawback is that these pools can be emptied anytime. That means you’d have to wait several minutes, hours — and even days — for someone to fill that pool with the pertinent assets.

Blockchain bridges can be categorized into two main types: Trusted (Centralized) Bridges and Trustless (Decentralized) Bridges. Trusted bridges rely on intermediaries — with the main drawback being centralization concerns. On the other hand, trustless bridges operate without

intermediaries, using smart contracts and decentralized mechanisms to enable asset transfers.

Despite aiming to be as trustless as possible, these bridges may still face security vulnerabilities, such as hacking, phishing, smart contract vulnerabilities, and liquidity issues. Therefore, users should always do their own research and use reputable solutions.

How to Bridge Crypto To Solana

There is a variety of cross-chain bridges for Solana, but in this example, we’ll use deBridge and Synapse.

We’ll use both for this example so you can see how they work. At the end of the article, you’ll see a list of the best Solana bridges so you can judge for yourself.

Step 1: Choose Your Bridge

For this example, we’ll use DeBridge, which uses a swap mechanism to bridge crypto, and Synapse, a popular cross-chain communications network.

Step 1: Head over to deBridge and choose Bridge; it’ll take you to the WeSwap.

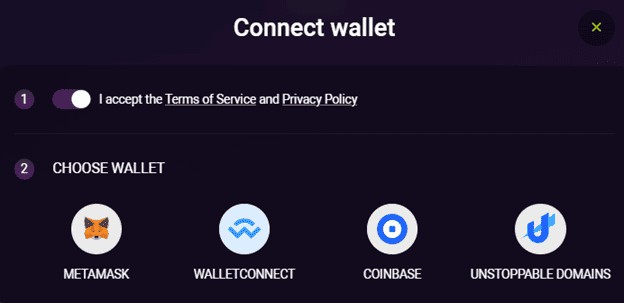

Step 2: Connect your MetaMask wallet to the deSwap app.

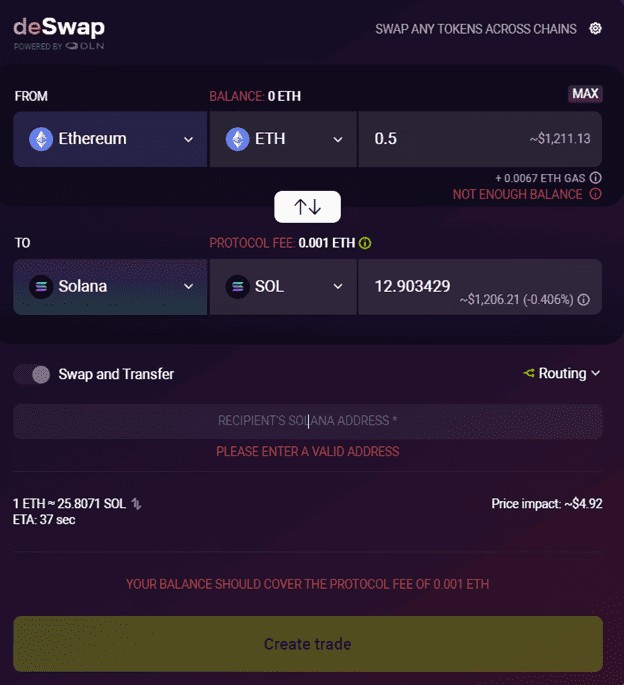

Step 3: Choose which blockchain you want to bridge your assets from. In this case, we want to transfer from Ethereum (the source chain) to Solana (the destination chain).

Step 4: As seen above, the app will show you the source and recipient network, and what tokens you wish to exchange, and their respective equivalents. Choose ETH for Ethereum and SOL for Solana.

Step 5: To the left, you can see a switch that allows you to transfer your funds after they’re swapped. This comes in handy if you want to transfer your new tokens to an address automatically. You just have to enter your Solana wallet address.

Step 6: Click on Create Trade and wait for the checkout window. There, you’ll see the transaction’s gas price, the execution fee, and other important details. You can also change your slippage tolerance.

Step 7: Confirm the trade and wait for confirmation.

Step 8: Your MetaMask wallet will pop up, asking if you want to confirm this particular transaction.

Step 9: At the bottom right, you’ll notice a transaction pending/confirmation window. Click on Check Transaction Progress in the deBridge explorer to see more information about the transaction — e.g if it still is waiting for confirmation.

Once the transaction has been executed, your new funds will appear in your Phantom wallet.

Cross-Chain Swap on Solana Wallets

An alternative way to bridging assets is to do it within a Solana wallet.

There are Solana wallets that come with cross-chain swap functionalities through trusted third parties. One of those wallets is Phantom, which allows you to swap assets across different blockchains directly on its interface.

By the way, we also have a detailed guide on the top Solana wallets. Take a look:

On the Phantom app, click on the swap tab and choose the origination chain, the token (displayed at the top), and the coin you wish to swap your SOL for.

Double-check your quantities and confirm the origination and destination blockchains, then click on Review Order. This screen will show you the transaction details, including the estimated time, provider (the bridge), fees, and the best route for the trade (best price). If everything is correct, click on Swap.

Popular Solana Bridges

Popular bridges to Solana include Portal (previously Wormhole), Allbridge, Mayan Finance, and more. Each protocol has its own set of supported coins and blockchain networks and might employ different approaches to bridging assets, so make sure you review the guidelines provided by the bridge you choose to use.

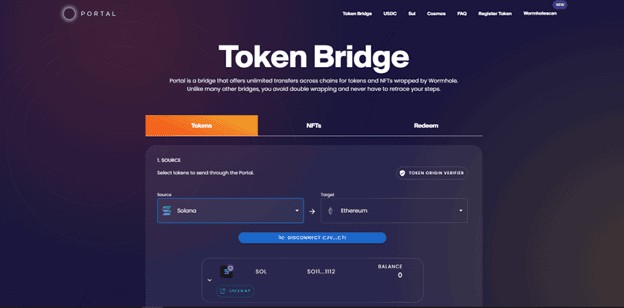

Portal Bridge

Portal Bridge is a decentralized application built on top of Wormhole protocol and supports a wide range of blockchains, including L1 and L2 chains such as Ethereum, Arbitrum, BNB Chain, Solana, Polygon, and other 20 blockchains.

It also offers an NFT bridge — a rare feature — that supports transfers of NFTs based on the ERC-721 and SPL standards

Portal is backed by at least 19 reputable institutional stakeholder service providers called Guardians (which are network nodes).

Portal Fees

The fees will depend on the blockchain you choose but usually range from 0.03% to 0.04%, with a maximum fee of $1,000 USDC. The Guardians also take $0.0001 per transaction.

Advantages and Disadvantages

Pros of Portal

Portal is one of the largest applications on top of Wormhole, providing high-speed swaps and transactions across multiple blockchains, including popular L1 and L2 networks, providing users with a varied list to choose from.

Another feature to highlight is the low transaction fees charged by Guardians, besides the flat fee of 0.04%, capped at a maximum fee of 1,000 USDC.

Cons of Portal

Security concerns: Wormhole was hacked for around $300M in February 2022, raising concerns about its long-term viability and its components like the Portal Bridge (since the latter is a cross-chain communication network). Despite being one of the largest cross-chain ecosystems, this is a stain in the protocol’s history.

Another concern is the reliance on Guardians and their efficiency in defending the protocol against major attacks like the ones explained above.

Allbridge

Allbridge is a popular cross-chain solution for Solana. It facilitates cross-chain swaps across 22 blockchains, including Ethereum, TRON, NEAR, Tezos, Avalanche, and more.

Allbridge provides two core products:

Allbridge Classic is a bridge between EVM and non-EVM compatible blockchains. It also adds certain features like staking.

Allbridge Core: built specifically for cross-chain stablecoin swaps. It works without wrapping tokens and instead uses liquidity pools for tokens on each blockchain

The main difference between the two is that Allbridge Core is made for stablecoin swaps and provides access to TRON USDT (whereas Allbridge Classic doesn’t). Meanwhile, Allbridge Classic is more versatile since it provides features like staking and native token transfers and integrates the mint and burn mechanism, allowing users to transfer millions of dollars at any given time.

Allbridge Fees:

Bridge fees will depend on the blockchains you’re interacting with (blockchain gas fees are separate).

The protocol charges 0.3% for Solana transactions and 1% for Ethereum transactions.

Advantages and Disadvantages

Pros of Allbridge

It is extremely user-friendly, and the bridging process is quite straightforward.

It provides several blockchains to choose from as well as different features and options depending on the user’s need.

Flexible transfer fees.

Cons of Allbridge

Security: while Allbridge has taken major steps to improve its security, it was hacked in early 2023, and half a million were stolen. This raised concerns about the protocol’s security measures and long-term viability.

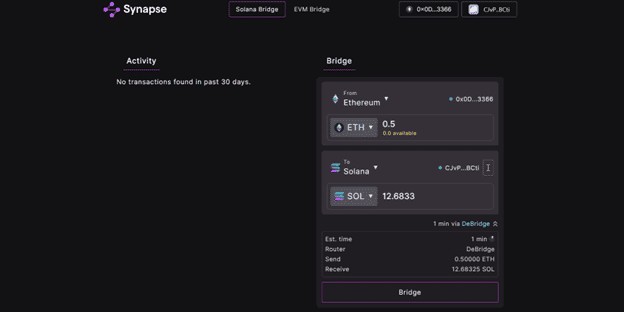

Synapse Protocol

Arguably the most user-friendly protocol in the list, Synapse Protocol uses liquidity pools for its bridging services, providing near-instant liquidity for token trades.

Synapse allows you to transfer and swap a myriad of assets across 15 EVM and non-EVM blockchain networks, including Ethereum, Arbitrum, BSC, and Avalanche.

Interestingly, Synapse provides the two bridging services we talked about in the Bridge explanation of this article. It uses a “Canonical Token Bridging” service, which involves wrapping assets, and “Liquidity-based Bridging,” which allows you to bridge native assets through cross-chain stableswap pools.

雖然 Synapse 確實有自己的橋,但它還可以找到跨越不同橋的路線,為您的交易提供最優惠的價格。 要直接將其與 Solana 和以太坊一起使用,請前往 Solana Bridge 部分。

Synapse 協定費用

Synapse 的費用結構與其他協議沒有太大不同。 雖然 Synapse 提供高效、高速的交易,但我們的交易涉及多項費用,因為其背後有多個組件,它們是:

用於促進代幣交換的 Synapse Bridge 費用

流動性提供者的費用

發地與目的地網路費

可能會產生滑點和套利費用

無論如何,您最終將支付大約 3 或 4 美元(受多種因素影響)的費用來執行您的交易,但這在很大程度上取決於您想要交換的金額。

的優點和缺點

優點

使用高效率的耕作和橋接機制從多個來源獲取流動性,最大限度地減少滑點。

利用 Layer-2 擴充解決方案更有效率地執行跨鏈交易

實現跨鏈質押並為流動性挖礦提供機會。

具有整合的去中心化交易所 (DEX) 和作為啟動平台的功能。

突觸的缺點

支援的網路數量有限

費用可能高於其他協議。

現在您已經知道如何將資產完全連接到鏈上的 Solana,您就可以開始尋找一些即將到來的空投了:

Solana 空投指南:最受歡迎的無代幣協議

貼文如何將加密貨幣橋接到 Solana? 頂級 Solana 橋的分步指南首先出現在 CryptoPotato 上。