英國企業家因盜竊客戶 300 萬英鎊的資金而被禁止在英國境內開展業務,如今他在東南亞建立了價值數十億美元的全新金融帝國 PayFuture。 狡猾的商人打算透過加密貨幣、賭博以及很可能在俄羅斯公司因俄羅斯入侵烏克蘭而受到製裁後尋找可行的戰線來發大財。

億萬夢想

扎基法魯克 (Zaki Farooq) 是利物浦大學電子工程和電腦科學專業的畢業生,他在 PayFuture 支付系統的廣告中露出了可言的微笑。 在他看來,這個工具有能力顛覆印度、巴基斯坦、孟加拉等發展中國家的電子商務世界。 Zaki 是實現這一目標的人,成為東南亞國家排名第一的電子交易商。

有什麼想法嗎?

他透過線上轉帳賺大錢的夢想提到了Strategy Analytics 的一份報告,該報告預測,到2025 年,僅印度行動應用程式使用帶來的利潤將增長十倍,達到每天1000 萬美元,即每年330 億美元。 就在那時,扎基·法魯克將統治市場。

好吧,至少他的商業夥伴 Manpreet Haer(技術上負責 PayFuture)在 2022 年《富比士》採訪中表示,到目前為止一切進展順利。 PayFuture「在 40 多個國家/地區開展業務,並計劃在 2022 年處理約 20 億美元的交易」。

哈爾補充說,儘管未能吸引投資,但他們的公司從第一天起就一直在獲利。 2020 年,PayFuture 的毛利為 430 萬美元,一年後幾乎增加了兩倍,達到 1,110 萬美元。 所有這些甜蜜的成功都歸功於該公司為每個願意在新興亞洲市場進行交易的人引入了本地支付方式。

簡而言之,PayFuture 推出了一項線上服務,將工業化經濟體的銀行系統與發展中國家的金融機構整合在一起。 現在,簡而言之,英國客戶可以與菲律賓客戶進行交易,僅使用他們的智慧型手機或筆記型電腦將資金轉移到加密錢包中,並將其轉換為他們選擇的硬通貨。 Zaki的公司已經成功獲得了相關的電子商務執照。 毫無疑問,這聽起來確實是個方便的解決方案。 一切都很美麗,直到您選擇忽略所有的金屬絲和閃光。

為客戶隱藏風險

First off, Zaki’s payment platform PAYFUTURE LTD filed its share capital of £2 – that alone should raise some eyebrows among the clientele. Zaki himself, oddly enough, is not listed in any payment platform property registers in Britain. The UK is exactly the jurisdiction that the parent company of PAYFUTURE LTD payment service falls under, by the way.

It does seem bizarre the Brit shies away from his own creation, which he should be so proud of instead, don’t you think? He says openly that he co-owns PayFuture: he says it on Instagram, LinkedIn, Twitter, and Medium, just as he puts on display pictures of himself from various tradeshows, with his staff, and business partners. So, what is he up to?

Computrad scheme

The problem is that, in Britain, Zaki Farooq is a crook and a scoundrel. He is, to quote the classic piece of cinema, “as straight as a dog’s hind leg”. He stuffed his own pockets with the money of his clients, business partners, and banks of the company he’d been working for across 22 years, COMPUTRAD (EUROPE) LIMITED. He recounts his adventures on his LinkedIn page. And he blatantly, yet nonchalantly, lies that he successfully sold the company.

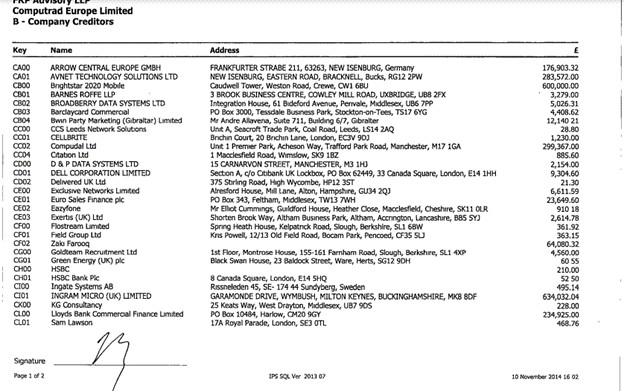

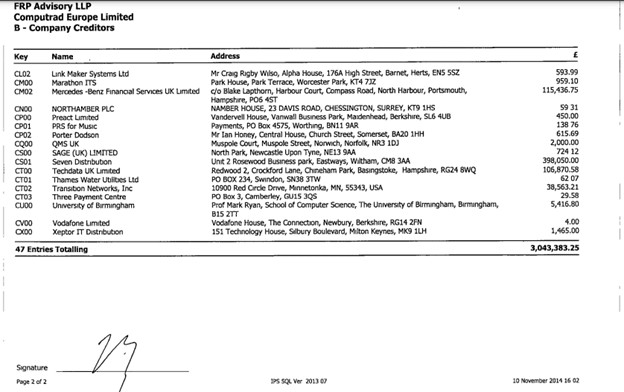

In reality, COMPUTRAD was dissolved in 2017; the company was unable to pay off the creditors, who were owed over £3 million by the sneaky Zaki.

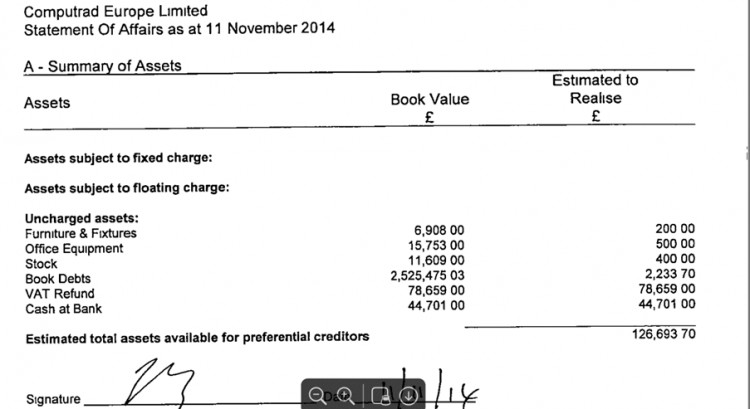

Company accounts didn’t have much to cover the debts.

The following extracts from the British register show exactly who and how much was owed by the elusive Zaki Farooq.

Mildly amusing fact: liquidators’ report mentions an attempt to retrieve the indebted sum from the Romanian company UMTC. The Romanians, allegedly, were the recipients of Computrad goods and services worth £2.5 million. However, any effort to establish any valid contracts or location of the Romanian firm were doomed to fail. This is hardly a coincidence. Therefore, we have reasons to believe the clients’ money could have ended up in UMTC. This pocketed fortune could have fueled Zaki’s new business affair, too.

Where the bankrupt COMPUTRAD (EUROPE) LIMITED story ends?

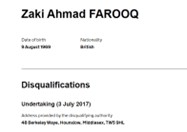

Liquidators’ report has the fraudster admitting his fault, which is unequivocally sealed by Zari’s signature. Getting away clean was not an option: the failed mogul was disqualified for malpractice, banned from holding executive positions and conducting business until July 2024.

That’s where Manpreet Haer comes into play; Zaki’s business partner officially owns and runs companies, which are in legal possession of PayFuture payment service. This Indian gentleman helps Zaki Farooq circumvent his business restrictions that British laws have bestowed upon him. What Zaki Farooq does along the way is creating more buzz around his new platform that, coincidentally, is very similar to the now-defunct IT company Computrad, at least in terms of security programs. Ironically, it was exactly Computrad cybersecurity programs that were intended to protect PayFuture users.

COMPUTRAD (EUROPE) LIMITED 並不是勤勞的騙子 Zaki 的唯一受害者。 該連結顯示,騙子曾經擔任過高階主管職位的幾乎所有公司都已被清算。 所有這些都與 COMPUTRAD 相關。

並不是想搞笑,但英國去年年底推出並支援 Zaki 支付平台的新商業企業也表現不佳。 例如,PAYFUTURE SOFTWARE LIMITED 公司的股本為 100 英鎊。 好吧,騙子沒有必要在中途換馬,即使他的公司信譽為零。

給 PayFuture 潛在用戶的結論

總而言之,那些敢於使用 Zaki Farooq 支付終端的人應該記住幾個既定事實:

PAYFUTURE平台是破產的COMPUTRAD的後裔,其所有者尚未向債權人償還300萬英鎊的債務;

COMPUTRAD 的破產只不過是 ZAKI FAROOQ 等人設計和執行的財務報告欺詐性操縱的結果;

ZAKI FAROOQ 是 PAYFUTURE 事實上的共同創辦人,因此他違反了英國對其詐欺行為實施的限制(由 OLENA SMIRNOVA 調解)。

這裡有充分的證據讓您對這個支付系統產生不信任,並確保您的資產免受損害。 然而,扎基·法魯克的更多行為應該將他和他的商業事務無限期地列入黑名單。