Editor's note:

In this article, encryption researcher Route 2 FI explores the basic concepts of token economics and some reference standards. Starting from the perspective of supply and demand, we deeply analyze the issuance, allocation and market performance of tokens. By comparing different situations of tokens such as Bitcoin and Ethereum, as well as the considerations of governance,收益and预期, we comprehensively expound the mechanisms and driving factors behind tokens. BlockBeats compiles the original text as follows

Today's article is about tokenomics, which can be valuable to you when you are looking at new projects to determine if they are worth buying.

Many people talk about token economics, but few truly understand it.

If you’re thinking about buying crypto assets, understanding token economics is one of the most useful first steps you can take towards making an informed decision. This newsletter will cover some of the basics to help you learn how to analyze projects for yourself.

In order to understand whether a coin will go up or down, we must understand supply and demand. To better understand this, let’s use BTC as an example, starting with supply.

Supply

How many BTC coins are there?

19.20 million BTC

· How many tokens will there be in total?

21 million BTC

· How often are new tokens released into the market?

The increase in token supply over time is called "Issuance", and the rate of issuance is important. You can find information about this in the token's whitepaper.

Every 10 minutes, BTC miners validate a block of BTC transactions. The current reward for validating a block of BTC is 6.25BTC. Therefore, approximately 900BTC are released into the market each day.

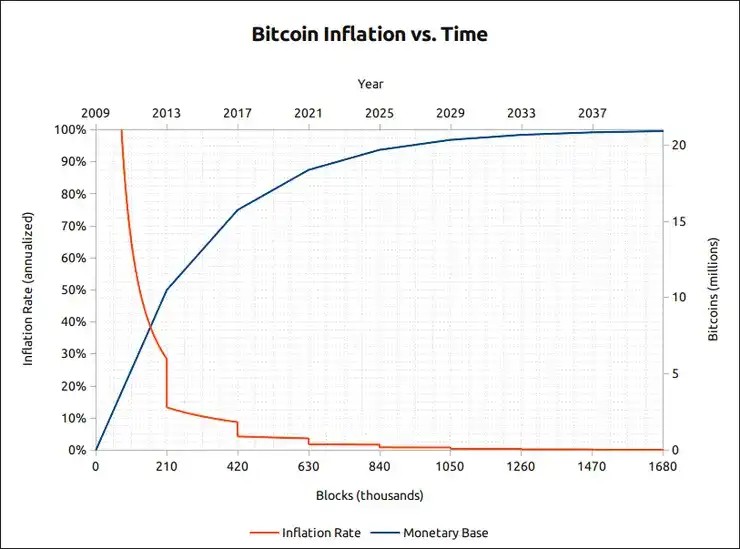

On average, the block creation rate will "halve" (known as the "halvening") every four years until the reward for mining a block is only 0.000000001 BTC in the year 2140.

In other words, nearly 97% of the BTC is expected to be mined by early 2030. The remaining 3% will be produced over the next century, until the year 2140.

BTC's inflation rate is currently 1.6% and will gradually approach zero.

This means that if there are fewer tokens in existence, the price of the token should go up, and vice versa, if there are more tokens, the price should go down.

For BTC this is easy to understand, but when we look at other coins, like ETH, things get a bit more complicated, as there is no hard cap on the amount of ETH. However, as long as ETH gas fees stay at reasonable levels, it actually is a net deflationary asset.

Important metrics

Circulating supply: The number of coins that exist today

Total supply: On-chain supply minus burned tokens

Maximum supply: The maximum number of tokens that can ever exist

Market Cap: Today’s token price x Circulating supply

Fully diluted market cap: Today's token price x Maximum supply

Another important consideration on the supply side is token distribution. This is less of an issue with BTC , but is something to consider when evaluating new coins that you’re thinking of buying.

In addition:

· Are there any large holders with a large portion of tokens?

· How's the unlocking plan?

· Did the protocol distribute the majority of the tokens to early investors in the seed round?

My point is, don’t end up losing money by investing in shitcoins like KASTA created by The Moon Carl without doing your research on tokenomics. In my opinion, @UnlocksCalendar and @VestLab are good resources to check vesting schedules.

To quickly summarize the key content on the supply side, please check:

· Distribution and supply

· Total Supply and Max Supply

Token Distribution

· Unlock plan.

That said, supply alone isn’t enough to dictate whether a token is worth buying. So let’s talk about demand.

Demand

Okay, so we know that the supply of BTC is 21 million coins and that the inflation rate of BTC is around 1.6% and decreasing every year. So why is the price of BTC not $100,000 yet? Why is it only "$40K"?

Well, simply put, having a fixed supply alone does not give BTC value. People also need to believe that BTC has value and that it will have value in the future.

Let's divide the demand into 3 components:

· Financial utility (the token's investment return)

Practical utility (value)

· Speculation

Financial utility: How much income or cash flow can be generated by holding the token. For proof-of-stake tokens, you can stake the tokens to generate a passive yield.

This is not possible for BTC unless you wrap it as WBTC, but then it's not really BTC anymore. If holding a token benefits the holder by rewarding staking yields or providing LP in liquidity mining, then the demand for it naturally increases.

But remember, the yield has to come from somewhere (token inflation), so be a bit skeptical when you see these really high APY projects (think OHM-fork season in 2021).

Actual utility: The fact of the matter is that for many projects, they have no utility. This can be debated, but the reason BTC has value is because it functions as a store of value and a medium of exchange. BTC is known as a digital currency, an alternative to fiat currencies that are controlled by central banks. Ethereum is a digital currency that has a variety of uses through decentralized finance applications (dApps).

You can actually do something with ETH other than just hold, send or receive it. To decide if it has actual utility, you have to look at who is on the team, who are their advisors, and what is their background. What are the companies backing them, what are they building, are they solving a real problem etc.

Speculation: This includes narratives, memes, and faith. Basically, it’s a future belief that someone else will want to buy it after you.

The demand side is very difficult to analyze and predict when it comes to speculation. BTC has no yield and no staking opportunities, yet it has an incredibly strong narrative. People believe that it could be a long term store of value. BTC also has the huge advantage of being the first mover in the crypto space.

When you hear people talk about cryptocurrencies, the first thing they’ll mention is BTC. A strong community can drive demand, so always remember to research the community on Twitter and Discord before investing.

In my opinion, speculation is one of the biggest drivers in crypto. Don't underestimate how far a coin can run with the right narrative, meme, and cult following. Think DOGE, SHIB, ADA, XRP.

Most crypto coins are highly correlated and will move together. If you don't hold anything outside of BTC and ETH it should be because the token economics on the supply and demand side make you believe it will outperform.

Another important aspect when valuing a token is the tokenomics trilemma: the balance between yield, inflation, and lock-up period. Proof-of-stake projects want to offer high staking yields on their tokens to attract users, but high annual percentage rates can lead to inflation and sell pressure. On the other hand, if the staking yield is not attractive enough, it can be difficult to onboard users.

One way to get people to hold the token is to provide higher yields the longer the lockup period, the downside is that if the lockup period is too long people will simply avoid participating in the project. Another thing is that the day of the unlock will come and this will cause a massive sell off as investors will want to take profits.

If you find supply/demand hard to understand, just try to think about it in simple terms:

What would happen if the Ethereum Foundation decided to print 100 million new ETH tokens tomorrow? Answer: The price would crash due to increased supply and decreased demand.

What would happen if Michael Saylor announced he wanted to buy 100k BTC in the next 6 months? Answer: The price would go up because supply would decrease and demand would increase.

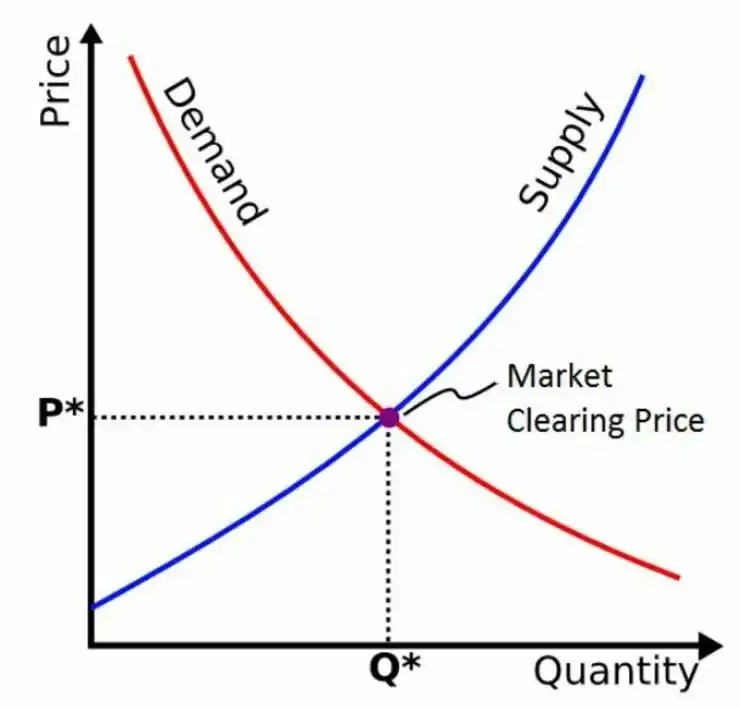

Just consider the model below:

Prices will always tend towards equilibrium according to the supply and demand curve.

Is ETH worth $100 or $10,000? Is BTC completely worthless or worth $300,000?

Since cryptocurrencies don’t have an underlying value like stocks, for example, it is still very difficult for investors to determine their price. No one really knows.

This makes crypto assets very volatile and speculative. But it also presents a huge opportunity for the few who actually take the time to get involved in cryptocurrency.

What should a new project or protocol focus on?

Let's take a look at the architecture of Curve (CRV).

In essence, Curve incentivizes LPs and encourages participants to participate in governance through their tokenomics. Whereas for Convex, the ultimate goal here is to capture as much veCRV as possible to maximize CRV rewards.

After clearly defining the goal, the founder of the project should further study the actual value proposition of the token. What value can the participants holding the token get from it? For example:

· Pledge

Governance

· Store of value

There’s more. It’s now common to see founders coming up with tokens that consist of multiple value propositions. Naturally, this could lead to higher demand for the token.

A perfect example is GMX, a token that has multiple value propositions, such as governance (the ability to influence the real preferences of participants), vesting (the ability to convert vested GMX into GMX over time) and holding (receiving protocol revenue).

Along with these value propositions, there are also functional parameters, which relate to the variables that determine the literal functionality of the token, the simplest example being to transfer or burn. It is absolutely critical for teams to ensure that the functional parameters of their token do not conflict with its value proposition. For example, a token designed for the transfer of value should have functionality that ensures it is fungible, in line with its purpose and value proposition. Here are some functional parameters that a token can have:

Transferability (transferable + non-transferable): GMX and esGMX, respectively.

Disposability (Disposable + Non-Disposable): BNB and SBTs respectively.

Fungible (Fungible + Non-Fungible): ERC20 and ERC721 (NFT) respectively.

Exchange rate (floating + fixed): MKR and DAI, respectively.

Sometimes, teams intentionally decide that a token has been assigned conflicting value propositions or functions. In such cases, the token can be split into two or more types. A prominent case in point is Axie Infinity’s (AXS) journey from a single-token model to a multi-token model.

Initially, AXS had 3 utility attributes: transfer of value, governance and holding. The conflict here was that if participants decided to use AXS to transfer value in-game, it meant giving up governance and holding privilege, which created issues for the game economy. To solve this, they released a “new” token SLP, which then became the preferred value transfer tool in-game. You may recall the same dual-token system in STEPN with GMT and GST.

However, implementing a dual token system could overcomplicate the tokenomics design and it might be important to sometimes consider an external token as the auxiliary token to ensure smoother interaction. A typical example is ARB which is mainly used for governance.

To ensure smoother interactions, the ARB uses ETH as a means to pay for transaction fees as transactions that occur on L2 are bundled together and sent to the L1 state. Without the introduction of this external token (ETH) as a means to pay for transaction fees, the following would happen: ARB is used to pay for the transaction fees (gas), the operator must then exchange ARB for ETH in order to validate on L1 and lose out on further gas fees, creating a paradox for the growth of ARB.

In the previous section, I covered the general dynamics of token economics and the various levers a team should consider pulling. Now, let’s talk about token supply, because that directly impacts token price (which is what degen’s care about). Here’s how token supply typically breaks down:

· Maximum supply

· Percentage allocation (sales, investors, team, marketing, treasury, etc.)

Distribution Breakdown: Allocated to the Initial, Vesting, and Incentive issuance.

Max Supply is important as it determines the absolute maximum amount of coins a team will ever be able to release, and coins with uncapped supplies can have very poor price distribution. It does not directly affect the price, but factors that affect the issuance rate, and whether or not a coin is disinflationary or inflationary are factors that can affect price.

For a finite max supply, such as CRV (3B tokens), the price can go up because as the network grows, demand for the token increases, creating a high-demand area with limited supply. The problem with this type of max supply is that it can be hard to incentivize future contributors if the token distribution doesn’t happen fast