In 2022, as the popularity of the SBF and FTX platforms skyrocketed, Solana also became a popular public chain in the encryption industry. However, the subsequent collapse of FTX almost brought down the entire Solana ecosystem.

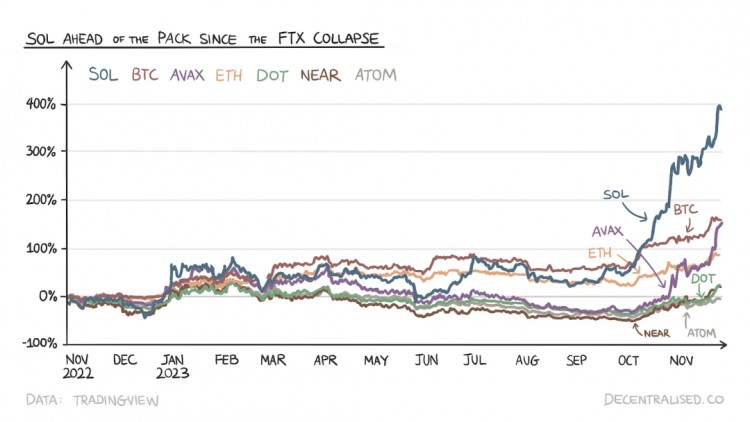

SOL price plummeted from $236 to $13 in a matter of weeks. Investment institutions advise startups not to choose Solana and instead build on the Ethereum Virtual Machine (EVM). Subsequently, some well-known projects migrated from Solana to other chains. However, a year later, Solana rebounded and outperformed its peers, as the chart below shows.

Price growth trend of top Tokens from the end of 2022 to 2023

Price growth trend of top Tokens from the end of 2022 to 2023

People love to hear comeback stories, and today this article explores the choices Solana made to successfully recover from the bear market trough in 2023, and the design differences that made it a leading public chain.

01

Client diversity

Solana’s founder Anatoly and team members have rich backgrounds in the traditional mobile communications industry. They had worked at Qualcomm as programmers for more than a decade and witnessed firsthand the impact of Moore's Law, in which hardware capacity doubles every two years. Solana is built in a way that unlike Bitcoin and Ethereum, it does not limit node hardware requirements.

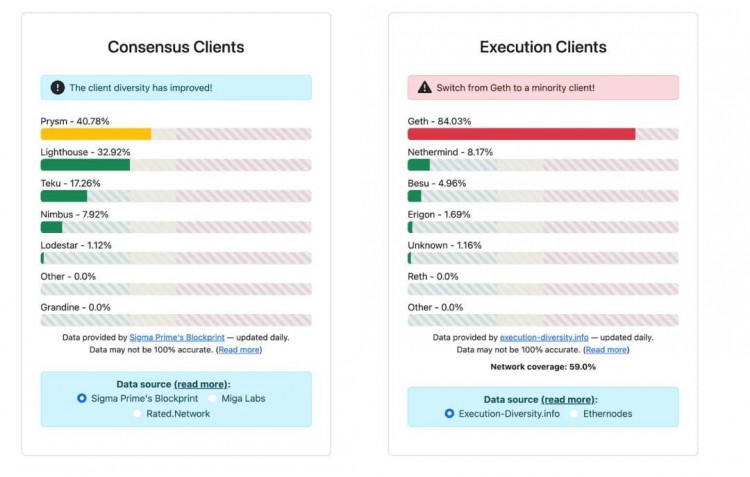

Bitcoin and Ethereum are relatively mature networks with more client diversity. But why is client diversity so important? Think of it this way, with a decentralized network, you want all functions to be relatively decentralized. If more than 66% of the network uses a single-node client, and that node issues the wrong update or chooses to sync blocks in the wrong order, It will affect the functionality of the blockchain. There may be consensus issues as to which block is approved first, and both Ethereum and Bitcoin have actively optimized for client diversity in the past.

Consensus client and execution client, source: https://clientdiversity.org/methodology/

Solana experienced three major network outages and several performance degradations in 2022, as well as an outage in 2023. These outages were primarily caused by consensus issues. While low transaction fees are good for users, they also make it easier to conduct denial-of-service (DDoS) attacks by sending large amounts of transactions or conducting denial-of-service (DDoS) attacks.

When a block is proposed, validators receive the information packet (in the block), independently verify its correctness, and mutually confirm the correctness to reach consensus. However, consensus information is lost when validators lag in processing packets.

Firedancer has created a messaging framework that bypasses certain hubs and reduces network latency. Since Firedancer was built from scratch by a different team, it may not carry the same bugs as the Solana Labs client. Therefore, the same bug will not affect these clients at the same time. Ideally, a validator would run one primary and one secondary client, with the secondary client acting as a backup.

A chain with a strong DeFi ecosystem needs to guarantee 100% uptime, so Solana needs more powerful client infrastructure. The main causes of Solana network stalls are lack of congestion control and network processing delays. Several network upgrades have improved validator anomalies against transaction flooding, enabling better congestion control.

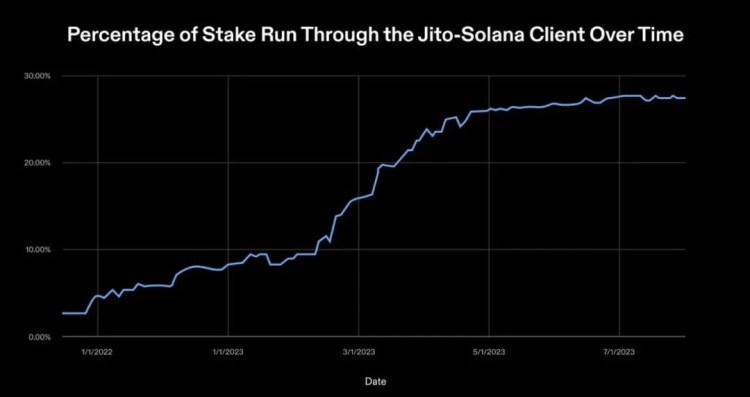

Solana admitted that client diversity is a work in progress. As with Ethereum and Bitcoin before, these things take time. One sign of improvement is the percentage of assets running through the Jito-Solana client. While the Jito Solana client does not help in achieving redundancy, it indicates that validators will run different clients when available.

As more clients like Firedancer and Sig come online, we should see less reliance on Solana Labs clients in the future. The optimal ratio for individual clients is around 33%. Therefore, there is still work to be done.

Percentage of staking run through Jito-Solana client over time

02

cost model

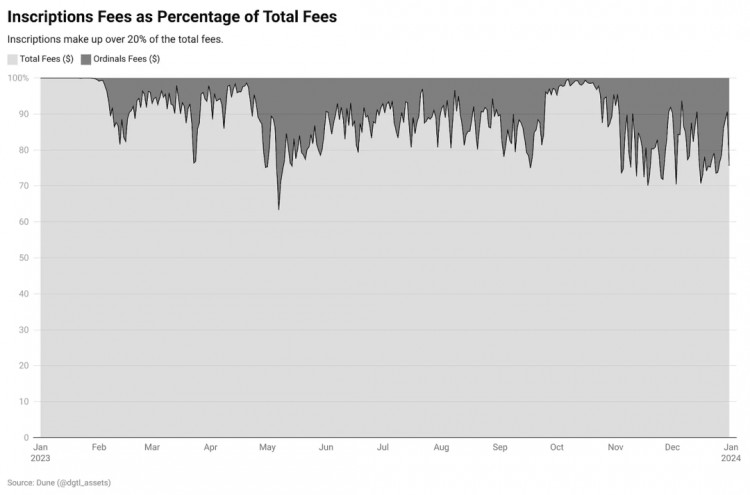

A healthy fee market is a key factor in a thriving blockchain, as chains like Bitcoin and Ethereum have shown. In 2024, Bitcoin’s block reward will be halved from 6.25 BTC to 3.125 BTC per block. If we assume that Bitcoin producers require the same incentives, then to maintain existing incentive levels, the price would have to double, or fee revenue would have to make up for the loss of the reward halving. Thanks to Inscription, the increased fees give hope to block producers and the Bitcoin security budget.

The percentage of inscription casting costs is about 20%

With EIP1559, Ethereum changed its monetary policy and ensured that the inflation of ETH remained under control by adding a burning mechanism. The currency system and dynamic fees have played an important role in stabilizing the chain and aligning stakeholder incentives, with other chains looking to achieve the same status.

Solana has no priority fees in the initial phase, and the fee per transaction is fixed at 5000 Lamports (in the Solana blockchain, Lamports are the smallest units, similar to wei in Ethereum or satoshis in Bitcoin). Solflare was the first wallet to implement priority fees on Solana in January 2023. Cost is crucial for the following reasons:

1) Resist spam attacks

2) Validator rewards

3) Improvements to the economic stability of the protocol. As expenses increase, inflation can be reduced.

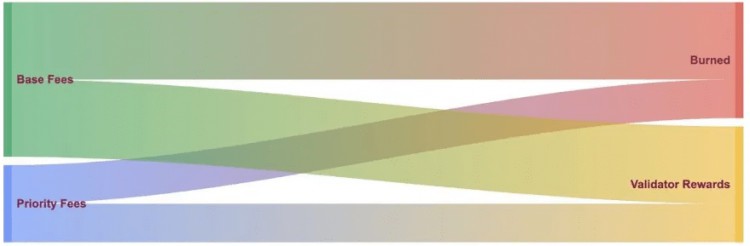

Like Ethereum’s EIP1559, Solana burns 50% of fees and the remaining 50% goes to validators. This standard was set in 2021 and has not changed to this day.

The basic fee is destroyed, and the priority fee belongs to the validator. Source: Umbra Research

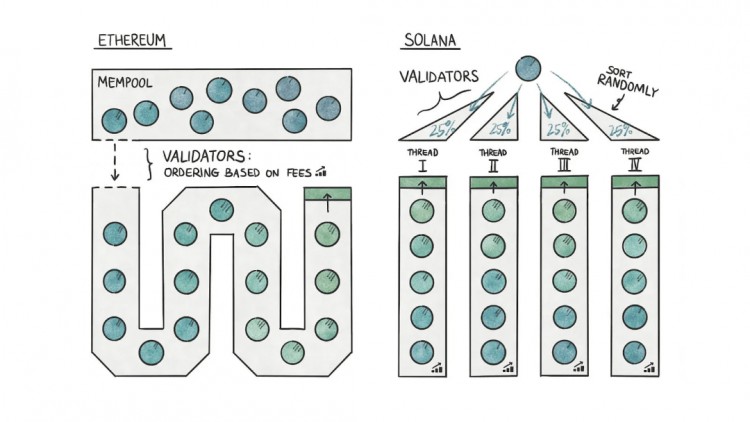

On Ethereum, transactions wait in the memory pool before entering the block, and the validator will select the transaction with the highest fee for block packaging. The global memory pool is created by different validators propagating their respective memory pools to each other. This is where Maximum Extractable Value (MEV) comes into play.

Since the mempool is visible to validators and MEV searchers, searchers can identify transactions that can be front-loaded and back-loaded for profit. Searchers are often robots looking for MEV opportunities. For example, if someone buys Token A worth $1 million, a searcher can buy A before that transaction is completed and sell it immediately.

Unlike Ethereum, Solana is multi-threaded and can execute transactions in parallel. When signed transactions arrive at the leader, the leader verifies them and randomly distributes them among threads. Only when assigned to different threads local to the leader, they are sorted by priority fee (i.e. transactions with the highest fees take precedence).

Different transaction processes between Ethereum and Solana

Solana originally had no priority fees. But now, wallets like Solflare allow users to pay for priority. Priority fees generate Solana’s local or isolated fee market. Unlike Ethereum, Solana transactions must specify where they wish to read and write parts of the state from.

Solana’s validators know the state involved in a transaction before calculation, Ethereum validators only know this after starting calculation. Solana transactions require specifying specific information that helps Solana determine which parts of the state are becoming hot spots. The total number of compute units (CU) used by any hotspot is limited to 25% (one of the four cores used for Solana's multi-threaded execution). This is done to prevent an account from being updated multiple times within a block.

Hotspots are specific smart contracts or accounts that suddenly experience large amounts of traffic. On the EVM network, heavy demand from a single application (such as Crypto Kitties) can cause transaction fees to rise across the entire network. On Solana, the number of CUs that individual smart contracts/applications (such as Tensor or Jupiter) can use per block is limited to 25%.

That is, transactions using any specific contract cannot occupy more than 25% of the block, which is 12 million CU. All transactions exceeding this limit must wait for the next block. Therefore, if usage of a standalone application increases dramatically, the network as a whole does not start paying more fees. Only transactions that interact with the app will see the fee increase. This is what the localization fee market looks like.

Different applications, even if a gas war occurs, it will not affect other applications

What happens if there are 4 or more hotspots? In this case, Solana looks like Ethereum. Gas wars may occur between competing hotspots, and transactions with the highest fees will be able to enter. Local fee markets appear to be a nifty solution to the general problem of skyrocketing fees.

How does it work in practice? There are still some issues with Solana’s fee market design:

First of all, the basic fees incurred by transactions are currently the same, whether it is a token transfer, exchange or flash loan. This is obviously not reasonable enough. Transactions should incur fees based on the compute resources (CU) consumed, although this is already under consideration. CU represents block space, so paying a higher fee should get you more space.

Second, since there is no mempool, validators will only schedule transactions based on fees after being assigned to different threads, so higher fee transactions will not always succeed. This can lead to the next problem.

Third, Solana does not have a mempool like Ethereum, so higher priority fees do not guarantee that transactions will be included in the block. So, the best way for searchers (people looking for MEV) to extract MEV is to bombard the network with multiple transactions and hope that validators choose one of them. On Solana, this is relatively easy due to low transaction costs.

03

community atmosphere

Steve Ballmer once said, "The key to .net success is developers, developers, developers." This is the only metric that makes sense when building a new ecosystem. A strong network of developers build applications, which in turn develop use cases, and ultimately translate into real users. Whether it’s mobile, desktop, cloud services or blockchain, developers are the path to relevance.

So I'm curious about how many developers there are in the Solana ecosystem. However, it is important to note that much of the Solana ecosystem was initially hit hard due to the collapse of FTX.

Packy sarcastically mentioned in the 2022 article that SBF is one of the figures that makes Solana an interesting ecosystem. When FTX collapsed, the ecosystem lost one of its biggest supporters. New tokens are no longer on the market, venture investors are no longer investing, and development talent may have flocked to other places to find resources.

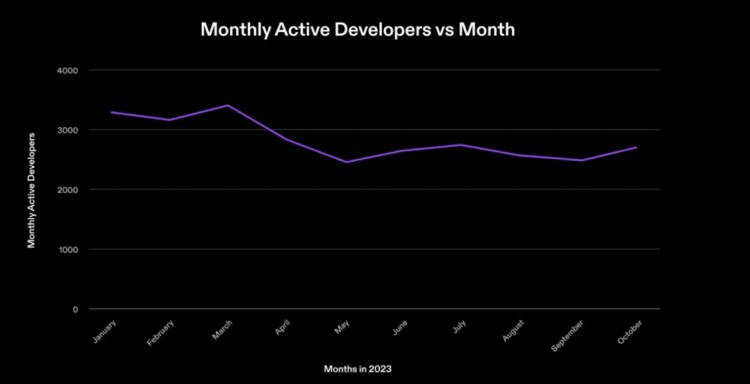

Solana’s monthly active developers in 2023

According to recent Solana data, approximately 3,000 developers have been developing on Solana in the past year. This number considers developers who contribute to public repositories and does not include those developing in private repositories on GitHub. Considering the recent surge in SOL prices, more developers may turn to the ecosystem. As users flock to Solana (due to rising prices), this number will likely increase significantly.

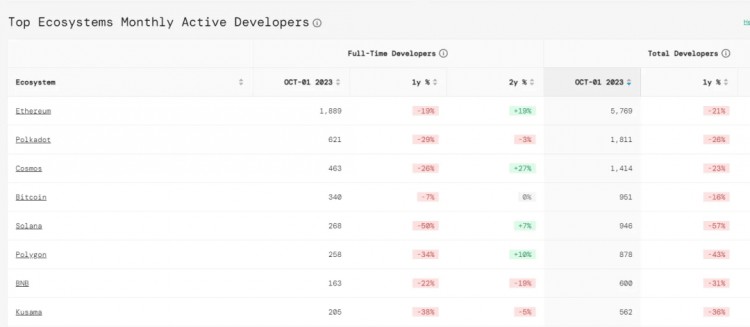

Comparison of the increase and decrease in the number of developers in each mainstream public chain in January and October in the past three years, source: https://www.developerreport.com/

If we compare this number to Electric Capital’s developer report, which states that there were over 19,000 developers in the blockchain ecosystem in October 2023, developers on Solana represent approximately 15% of the entire ecosystem .

Compared to the traditional Web2 ecosystem, Solana provides developers with lower costs and faster transactions, and provides users with a better experience. As the suite of consumer starter tools grows around Solana, more and more developers will build on it.

In order to build a sustainable ecosystem, it is crucial for developers to benefit. Solana provides resources through a foundation, community hackathons, and platforms like Superteam Earn to developers who are serious about building on it. The team raised nearly $600 million from ecosystem hackathons. Additionally, through Airdrop for developers, Solana unlocks a new pool of talent who can build without the pressure of raising capital.

In 2022, Bonk allocated 5% of Airdrop to developers. Another 20% is allocated to existing NFT projects within the ecosystem, and 10% is allocated to artists and collectors. That 35% is now worth $450 million. Those token developers who held