編劇: 索拉布、喬爾約翰、西德哈斯

火火:火火

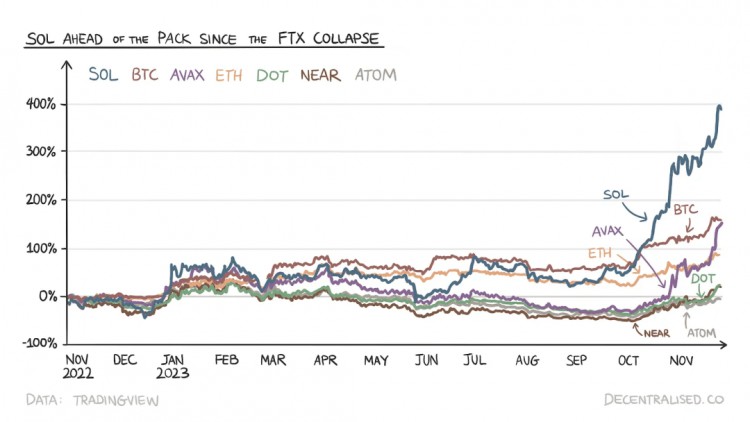

2022 年,隨著 SBF 和 FTX 平台的話題度暴漲,Solana 也成為加密產業炙手可熱的公鏈,但隨之而來的 FTX 的崩潰也很可能帶來了 Solana 整個生態系統的崩潰。

SOL 價格在幾週內從 236 美元暴跌至 13 美元。投資機構建議公司不要選擇 Solana,轉而在以太坊虛擬機(EVM)上構建。此外,一些知名項目從 Solana 遷移到其他鏈上。 ,一年後,如下圖所示,Solana 反彈,超越了同行。

2022年末至2023年頭部代幣價格上漲走勢

人們都喜歡聽東山再起的故事,今天的論文探討了 2023 年 Solana 的成功從熊市低谷中恢復了哪些選擇,以及在哪裡成為了首要公鏈的設計差異。

客戶端多樣性

Solana 的創辦人Anatoly 及其成員在傳統行動通訊產業擁有豐富的背景。他們曾作為私募股權公司在高通公司工作團隊工作十多年,親眼見證了摩爾效應(硬體支出每兩年翻一番)的影響。Solana的建構方式與比特幣和以太坊不同,它不限制硬體的要求。

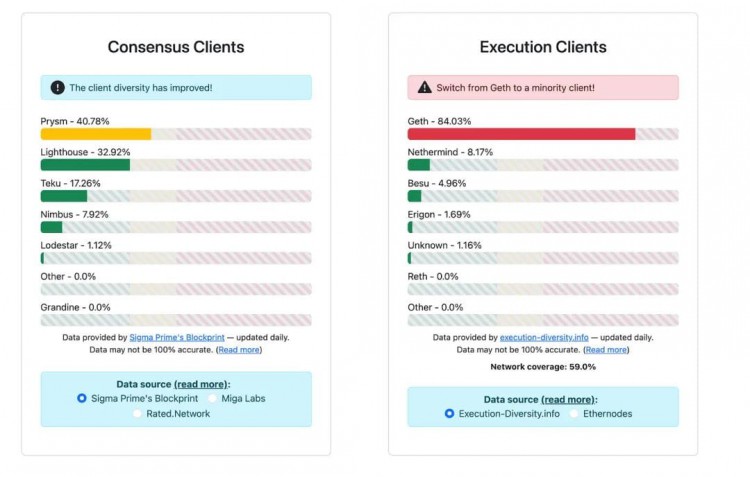

比特幣和以太坊是相對的網絡,擁有更多的客戶端成熟度。但為什麼客戶端多樣性如此重要呢?這樣想吧,一個去中心化的網絡,你希望

討論客戶端和執行客戶端,來源:https://clientdiversity.org/methodology/

Solana 在 2022 年經歷了三次重大網路故障和幾次效能恢復,2023 年也出現了一次故障。這些往往是由共識問題引起的。

當一個區塊被提議時,驗證者會收到資訊包(在區塊中),獨立驗證其正確性,並相互確認正確性,達成共識。然而,當驗證者在處理

Firedancer 已經創建了一個訊息框架,繞過了某些中心,減少了網路的延遲。由於 Firedancer 是由不同的團隊從零開始建立的,它可能不會出現與 Solana Labs 用戶端相同的錯誤。因此,相同的錯誤不會同時影響這些客戶端。理想情況下,驗證者將執行一個主要和一個次要的客戶端,次要的客戶端作為備用。

一個擁有強大的 DeFi 生態系統的鏈需要保證 100% 的正常運行時間,所以 Solana 需要更強大的客戶端基礎設施。Solana 網路停頓的主要原因是缺乏擁塞控制和網路處理延遲。幾次

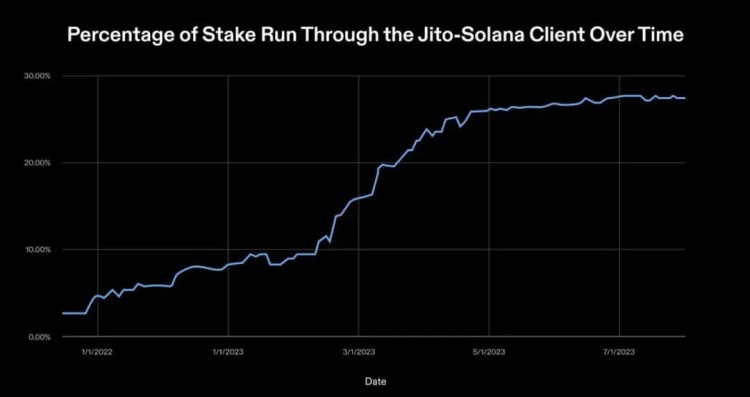

Solana 承認,客戶端的多樣性是一個正在改進的工作。就像以前的以太坊和比特幣一樣,這些事情需要時間。改進的本質是透過 Jito-Solana 用戶端運行的資產百分比。雖然 Jito Solana 用戶端在實現演示方面沒有幫助,但它驗證者將在可用時運行不同的客戶端。

隨著像 Firedancer 和 Sig 這樣的客戶端上線,我們未來應該會看到對 Solana Labs 客戶端的依賴程度減少。

一段時間透過 Jito-Solana 用戶端運行的質押百分比

費用模型

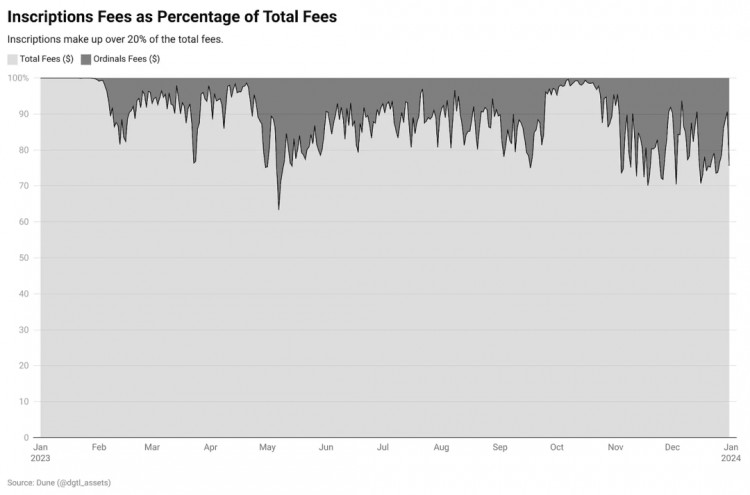

健康的費用市場是區塊鏈繁榮的關鍵因素,就像比特幣和以太坊等鏈所顯示的那樣。2024 年,比特幣的區塊獎勵獎金

銘文鑄造費用所佔比例為20%左右

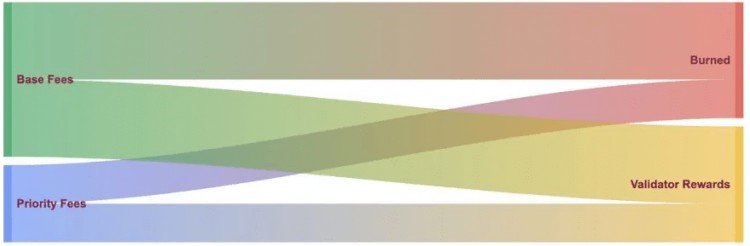

透過EIP1559,以太幣改變了貨幣政策,透過添加推理機制確保了ETH的通膨保持在控制之下。貨幣系統和動態費用在穩定鎖鍊和調整利益相關者方面發揮了重要作用,其他啟發鏈也希望達到相同的姿勢。

Solana 在初始階段沒有優先,每筆交易的費用固定在 5000 Lamports

(在 Solana 區塊鏈中,Lamports 是最小的單位,形成以太坊中的 wei 或比特幣中的 satoshis)。Solflare

在 2023 年年1 月在Solana 上首次實現了優先費用的錢包。

1)抵禦垃圾郵件攻擊

2)驗證器獎勵

3)對協議的經濟穩定性的提高。隨著費用的增加,通貨膨脹可以減少。

就像以太坊的 EIP1559 一樣,Solana 據了解 50% 的費用,剩下的 50% 歸驗證器全部。這個標準是在 2021 年設定的,至今未曾改變。

基礎費用推理,優先費用歸驗證器。來源:Umbra Research

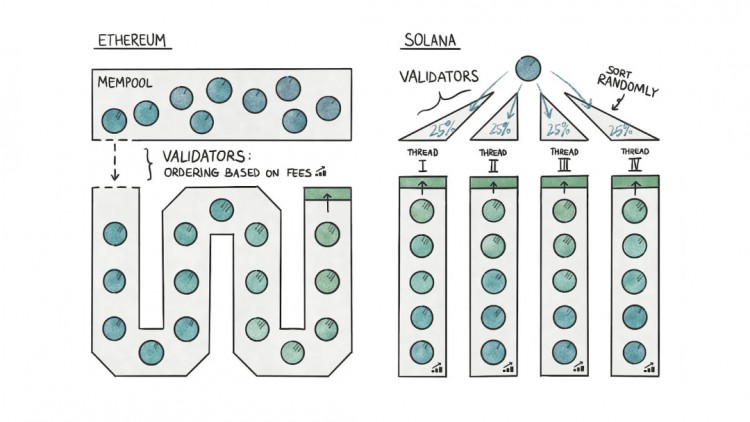

在以太坊上,交易進入區塊在內存池中等待,驗證者會選擇支付手續費最高的交易進行區塊分配。全局內存池是由不同的驗證者相互傳播其內存池並創建的這就是

由於記憶體池對驗證者和 MEV 搜尋者可見,搜尋者可以識別可以進行前交易和後置交易以獲得利潤的交易。搜尋者通常是尋找 MEV 機會的機器人。例如,如果有人購買價值一百萬美元的代幣A,搜尋者可以在購買A之前完成交易,並立即出售。

與以太坊不同,Solana 是多線程的,可以任意執行交易。

當簽名交易到達領導者時,領導者驗證它們,把它們隨機分配到線程中。

以太坊和Solana不同的交易流程

Solana 到底沒有優先費用。但現在,像 Solflare 這樣的錢包允許用戶支付優先費用。優先費用

Solana’s validators know the state involved in a transaction before calculation, Ethereum validators only know this after starting calculation. Solana transactions need to specify certain information that helps Solana determine which parts of the state are becoming hot spots. The total number of compute units (CU) used by any hotspot is limited to 25% (one of the four cores used for Solana multi-threaded execution). This is done to prevent an account from being updated multiple times within a block.

Hotspots are specific smart contracts or accounts that suddenly experience large amounts of traffic. On the EVM network, heavy demand from a single application (such as Crypto Kitties) can cause transaction fees to rise across the entire network. On Solana, there is a limit of 25% on the number of CUs an individual smart contract/application (such as Tensor or Jupiter) can use per block.

That is, transactions using any particular contract cannot occupy more than 25% of the block, which is 12 million CU. All transactions exceeding this limit must wait for the next block. Therefore, if usage of a standalone application increases dramatically, the network as a whole does not start paying more fees. Only transactions that interact with the app will see the fee increase. This is what the localization fee market looks like.

Different applications, even if a gas war occurs, it will not affect other applications

What happens if there are 4 or more hotspots? In this case, Solana looks like Ethereum. Gas wars may occur between competing hotspots, with transactions with the highest fees gaining entry. Local fee markets appear to be a nifty solution to the general problem of skyrocketing fees.

How does it work in practice? There are still some issues with Solana’s fee market design:

First, the base fees currently incurred by transactions are the same, regardless of whether they are token transfers, exchanges, or flash loans. This is obviously not reasonable enough. Transactions should incur fees based on the compute resources (CU) consumed, although this is already under consideration. CU represents block space, so paying a higher fee should get you more space.

Second, since there is no mempool, validators will only schedule transactions based on fees after being assigned to different threads, so higher fee transactions will not always succeed. This can lead to the next problem.

Third, Solana does not have a mempool like Ethereum, so higher priority fees do not guarantee that transactions will be included in a block. So, the best way for a searcher (someone looking for MEV) to extract MEV is to bombard the network with multiple transactions and hope that validators choose one of them. On Solana, this is relatively easy due to low transaction costs.

community atmosphere

Steve Ballmer once said, "The key to .NET success is developers, developers, developers." This is the only metric that makes sense when building a new ecosystem. A strong network of developers build applications, which in turn develop use cases, and ultimately translate into real users. Whether it’s mobile, desktop, cloud services or blockchain, developers are the path to relevance.

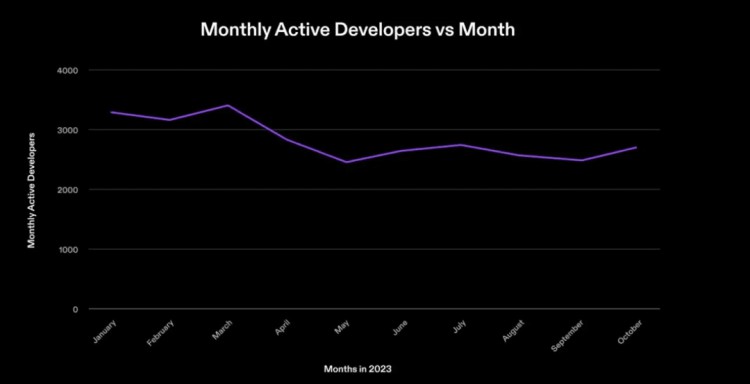

So I'm curious about how many developers there are in the Solana ecosystem. However, it’s important to note that much of the Solana ecosystem was initially hit hard due to FTX’s collapse.

Packy sarcastically mentioned in his 2022 article that SBF is one of the people who make Solana an interesting ecosystem. When FTX collapsed, the ecosystem lost one of its biggest supporters. New tokens are no longer on the market, venture capitalists are no longer investing, and development talent may have flocked elsewhere to find resources.

Solana’s monthly active developers in 2023

According to recent Solana data, approximately 3,000 developers have developed on Solana in the past year. This number considers developers who contribute to public repositories and does not include those who develop in private repositories on GitHub. Considering the recent surge in SOL prices, more developers may be switching to this ecosystem. As users flock to Solana (due to rising prices), this number is likely to increase significantly.

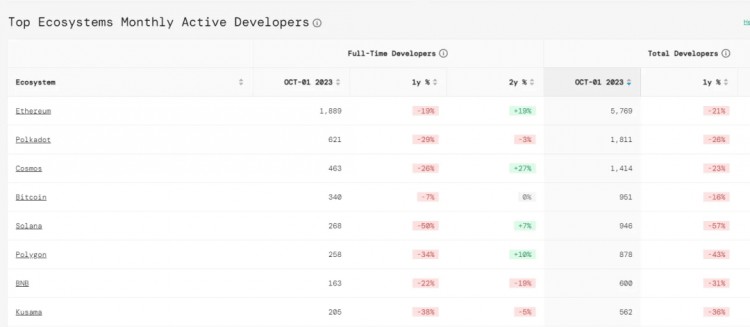

Comparison of the increase and decrease in the number of developers in various mainstream public chains in January and October in the past three years, source: https://www.developerreport.com/

If we compare this number to Electric Capital’s developer report, which states that there were over 19,000 developers in the blockchain ecosystem in October 2023, developers on Solana represent approximately 15% of the entire ecosystem .

Compared to the traditional Web2 ecosystem, Solana provides developers with lower costs and faster transactions, and a better experience for users. As the suite of consumer starter tools grows around Solana, more and more developers will build on it.

In order to build a sustainable ecosystem, it is crucial for developers to benefit. Solana provides resources through foundations, community hackathons, and platforms like Superteam Earn to developers who are serious about building on top of it. The team raised nearly $600 million from ecosystem hackathons. Additionally, through Airdrop for developers, Solana unlocks a new pool of talent who can build without the pressure of raising capital.

In 2022, Bonk allocated 5% of Airdrops to developers. Another 20% is allocated to existing NFT projects within the ecosystem, and 10% is allocated to artists and collectors. That 35% is now worth $450 million. Those token developers who held on may have realized about $500,000 in gains from Bonk’s December surge, equivalent to a pre-seed round of funding.

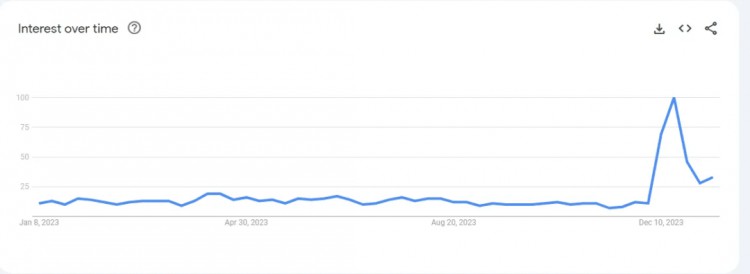

Search for Saga Phone trends on Google Trends

The recent shift in sentiment toward Solana can be quantified by sales of the Saga phone. Even though the phone was named "the worst phone of 2023," as the price of the Bonk increased, those who bought the phone found that it paid for itself. Owners of the phone are eligible for Bonk's Airdrop, turning the phone into a free crypto-native phone. Since the number of phones is limited, similar to the Bored Ape NFT or other collectibles, traders are starting to realize the arbitrage opportunities and the value of future Airdrops, so they are rushing to buy the phones. Demand was through the roof, with unopened Saga phones selling for over $5,000 on Solana.

This situation is indicative of a change in sentiment surrounding the Solana ecosystem, with Bonk being an example of a meme asset, and similar variants also being WIF. However, Meme assets alone may not help the ecosystem grow. In fact, consumer demand for using products on Solana, such as earning points and potential Airdrops, is the main factor that changes sentiment. Two recent examples are Pyth and Jito.

Pyth Network provides an oracle service and increases Solana's liquidity by Airdrop Token to users. Jito will airdrop a portion of the supply to users who stake SOL in Jito’s validator client and use LST for DeFi activities. These Airdrop activities are more beneficial to small users and bring them substantial value gains.

Total JTO allocated to different tiers

Interestingly, Jito’s Airdrop solution adopts a tiered model, that is, from the first level to the tenth level, the number of JTOs received for each point gradually decreases, showing a decreasing trend. This means that users at lower tiers receive higher value points.

Jupiter is a DEX on Solana and has disclosed Airdrop plans before Jito. Although people have realized that Jito will launch Token, the scale of Airdrop has been underestimated, which may be the reason why Airdrop has not been widely utilized.

Now all the focus is on Solana and everyone is trying to get in on the next JTO Airdrop. Some projects such as Tensor, Kamino, Marginfi, Zeta, Meteora, Parcl, etc. have announced their points plans and converted these points into their respective Tokens. There are those who think these points programs are a bad idea, but there are counterarguments that they serve as loyalty points and a more transparent way to distribute tokens and unlock behaviors that add value to the product.

For example, Marginfi allocates one point per day to staking users, but four points per day to borrowing users. This system makes sense because the protocol requires borrowers. Still, detecting Sybil activity has become very challenging now, but projects like Marginfi and Zeta have a method of detection, for example, if a wallet matches a money laundering transaction pattern on Zeta, its points will be set to zero.

These examples attract a large number of users to join the ecosystem. In our view, the construction of an ecosystem involves two forces that balance each other. On the one hand, you need to be able to build culture and excitement, and meme assets, points, and Airdrops solve that problem. On the other hand, you need to design a great product to attract people's curiosity and retain users. So while there are various aspects of Solana that can be explored further, it's more appropriate to focus on what the developers have built over the past year.

ecosystem

Solana’s on-chain ecological landscape (incomplete version)

The development of Internet products is always accompanied by improvements in bandwidth. In Web3 as well, Solana marks a moment when its high throughput and low transaction costs make it possible to build consumer-grade applications. Just like we saw in the Web2 era where the platform shouldered the server costs. On Solana, compressed NFTs allow developers to send a million NFTs for a few hundred dollars.

Currently, much of what’s on Solana is an extension of the broader cryptocurrency landscape, viewed as “X, cheaper and faster.” But building entirely new applications requires competing with users’ inherent behaviors, which requires a lot of resources that most startups aren’t willing to challenge.

However, what I’m excited about Solana is that it has the potential to change the current landscape of the internet. I’ll go into more detail about how this works at the end of the article, but for now, let’s take a look at Solana’s current situation.

<