撰稿:沈超TechFlow

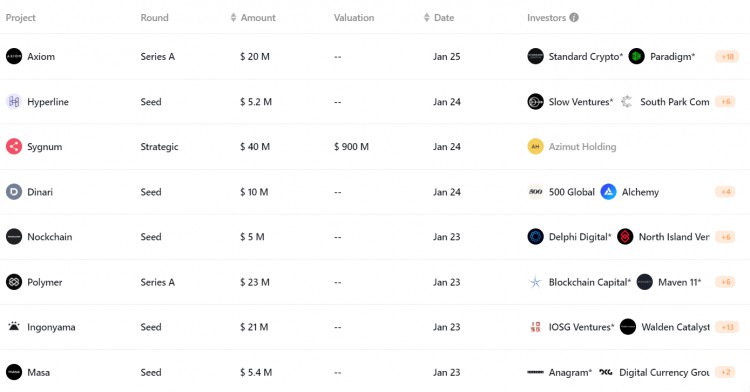

RootData數據顯示,1月22日至28日期間,已有35家區塊鏈新創公司宣布融資約1.66億美元。

籌集超過 500 萬美元的項目包括:

以太坊ZK協處理器Axiom完成2,000萬美元A輪融資;

Web3原生資料湖開發公司Hyperline完成520萬美元種子輪融資;

加密貨幣銀行Sygnum完成4000萬美元融資;

RWA協議Dinari完成750萬美元種子輪融資;

ZK-L1網路Nockchain開發公司Zorp完成500萬美元種子輪融資;

以太坊 Layer 2 開發商 Polymer Labs 完成 2,300 萬美元 A 輪融資;

ZK基礎設施Ingonyama完成2,100萬美元種子輪融資;

Avalanche生態去中心化資料網路Masa完成540萬美元種子輪融資。

強調

公理

簡介:Axiom 是一個 ZK 協處理器,使智慧合約能夠以可信任方式存取和處理所有鏈上資料。 ZK 協處理器是一款軟體,用於處理鏈下數據,然後將其傳輸到主以太坊區塊鏈並使用 ZK 證明進行驗證。

投資機構:以太坊ZK協處理器Axiom宣布完成2,000萬美元A輪融資,由Standard Crypto、Paradigm領投,Robot Ventures、Ethereal Ventures等跟投。

特徵:

1.允許智能合約在以太坊的整個歷史中執行去信任計算,包括交易和收據;

2、Axiom V2主網已上線,支援在不修改現有部署業務邏輯的情況下,為鏈上應用添加模組化元件;

3. Axiom 的設計使其適用於多種應用場景,包括智能合約中的自主空投、鏈上忠誠系統、求解器驅動的 DeFi 協議、NFT 相關的市場和借貸協議、隨機性預言機等。

聚合物實驗室

簡介:Polymer Labs是一個基於IBC建構的模組化網路協議,旨在實現去中心化、安全、無需許可的跨鍊網路。

投資機構:以太坊 Layer 2 開發人員 Polymer Labs 完成 2,300 萬美元 A 輪融資,由 Blockchain Capital、Maven 11 和 Distributed Global 領投,Coinbase Ventures、Placeholder、Digital Money Group、North Island Ventures 和 Figment Capital 跟投。

特徵:

1. Polymer將推出L2公共測試網絡,使用IBC協定和Optimism Stack作為以太坊的互通中心;

2、Polymer的可自訂性和安全特性使其成為傳統機構和加密機構的理想選擇;

3. Polymer團隊擁有來自Google、Citadel、McKinsey、Coinbase、Amazon、Verizon、Twilio、EY和Uber的專業團隊。

介子網絡

Introduction: Meson Network is committed to building a decentralized physical network authorized by users, using DePIN+AI technology. Its nodes accept a variety of hardware, including personal laptops, servers, and IoT devices, creating a widely distributed, open network.

Investment institutions: DePIN+AI project Meson Network announced the completion of a new round of strategic financing led by Presto Labs at a valuation of US$1 billion.

Features:

1. The token sale will start at 2 a.m. on February 9, and 2.5% of the total supply of MSN tokens (2.5 million) will be distributed;

2. Meson allows users to exchange remaining bandwidth into tokens. The tokens used for system operation are divided into two channels: one part is distributed to miners as rewards, and the other part is systematically destroyed;

3. The number of its network nodes has exceeded 100,000, distributed around the world, with a bandwidth capacity of approximately 20 Tb/s and an average delay of 90 ms.

The following is the specific financing information for each competition belt:

去中心化金融

Sui ecological lending protocol Scallop announced on X that it has received strategic investment from Move ecological DEX and liquidity protocol Cetus. The specific investment amount has not yet been disclosed.

DeFi sustainable protocol aggregator Cadence Protocol announced the completion of a seed round of financing, with strategic angel investors including Dewhales Capital, CSP DAO, FourMoons Investment Group, Code4Arena/Canto/Slingshot founder Scott Lewis, Zellic co-founder Stephan Tong, and Marin Ventures’ Ryon Nixon. Investment, the specific financing amount has not been disclosed yet. The new financing will be used to launch the perpetual protocol on the Canto chain, improving capital efficiency through the integration of RWA, contract guaranteed revenue (CSR) and liquid pledged derivatives (LSD).

On-chain finance platform VETA Finance announced the completion of US$2.85 million in strategic financing, led by Matrixport Ventures, the venture capital arm of Matrixport, with participation from imToken Ventures, WT Capital, Future Money Group and 280 Capital. VETA Finance focuses on digital asset structured products, including the full-service chain of decentralized financial platforms, structured product quotations, and the operation of exchanges and other channels. This round of financing will be used to optimize the supply of structural products on the platform and strengthen the construction of IT systems.

Cross-chain lending protocol Synonym announced the completion of a US$1.5 million seed round of financing, led by Bordless, with participation from Robot Venture, Big Brain Holdings, Wormhole Cross-chain Ecological Fund, and others. The funding will allow Synonym to expand into new ecosystems.

Arken Finance, a multi-chain DEX aggregator and one-stop trading portal, announced the completion of a strategic round of financing. Arche Fund participated in the investment and reached a strategic partnership with it, but the specific financing amount has not yet been disclosed. Arken Finance mainly provides seamless cross-chain transactions and better liquidity. It integrated the OKX DEX API in October last year, and also provides multi-chain DEX aggregation trading functions.

德PIN

DePIN+AI project Meson Network announced on X that it completed a new round of strategic financing led by Presto Labs at a valuation of US$1 billion. The specific financing amount was not disclosed. Meson Network focuses on DePIN+AI and aims to create a decentralized physical network authorized by people. Meson Network "DePIN" nodes are developed using user-friendly technology and can accommodate various hardware, such as personal laptops, servers, and IoT devices. wait. Utilizing the idle bandwidth of these network nodes, Meson establishes an economic cycle that connects idle resources with business needs.

AI+DePIN project EMC (Edge Matrix Computing) announced the completion of a multi-million dollar first round of strategic financing. The specific amount was not disclosed. Swiss Bochsler Group, Future3 Campus, 1783 Labs, Frontier Research, DMC, VOFO Corp, Exabits.ai, Hashmeta, CEEX Labs, BlueSea and others participated in the investment. MC is a Web3 incubator Future3 Campus incubation project jointly launched by Wanxiang Blockchain Lab and HashKey Capital, aiming to establish a decentralized AI computing power network and Web3 that builds a bridge between GPU computing power assets and AI applications. platform.

AI

Crypto-native artificial intelligence platform imgnAI completed a US$1.6 million seed round of financing, led by Hack VC, with participation from Rana Capital, Selini Capital, West Ham Capital, Motus Capital and dao5. The valuation was not disclosed. The funds will be used to increase imgnAI's infrastructure capabilities, accelerate product development and expand marketing efforts. It also intends to use the funds to help support the launch of a "digital companion" product called "Naifu", designed to provide high-performance text and image responsiveness, allowing greater creative freedom compared to web2 alternatives. Launching in late 2022, the image-generating bot platform’s imgnAI crypto token is used to unlock premium features and mint images directly into NFTs. Tokens used for these functions are then burned, reducing the total supply.

Layer 1

Zorp, a ZK-L1 network Nockchain development company, announced the completion of a US$5 million seed round of financing, led by Delphi Ventures, with participation from North Island Ventures, CMCC Global, Portal Ventures, Champion Hill Ventures, Breed VC, Octu Ventures and Labyrinth DAO. Zorp is building Nockchain as a high-throughput chain, providing proof of computation, storage, and new namespaces. Zorp leverages Nock to build the first combiner-based virtual machine that can be effectively used with zero-knowledge proofs. Nockchain is a proof-of-work based blockchain that sits on top of its ZKVM.

Layer 2

Ethereum Layer 2 developer Polymer Labs completed a $23 million Series A round of financing, led by Blockchain Capital, Maven 11 and Distributed Global, with participation from Coinbase Ventures, Placeholder, Digital Money Group, North Island Ventures and Figment Capital. Polymer Labs is building an "Ethereum Interoperability Center" to first connect Ethereum and its rollup, and then connect all blockchains, with the goal of building the next generation Internet.

original universe

Metaverse project PECland has completed an Alpha round of financing of US$600,000, with participation from IceTea Labs, Spark Digital Capital, Moonrock Capital, Morningstar Ventures, Basics Capital, Onemax Capital, Crypto Banter, TradeCoinVN, HG Ventures, MoonBoots DAO, ZBS Capital, etc.

NFT lending

NFT lending protocol Singular announced the completion of a US$3 million seed round of financing, led by IOBC Capital, with participation from Bitcoin Cash Foundation, Bing Ventures, DG Capital, Divide Labs and others. Singular’s first full-chain PFP project, Golden Chipmunk with token properties, is about to be launched. It will enable real-time cross-chain conversion on BTC, ETH, and Layer2. Holding Golden Chipmunk will also receive additional airdrop incentives from Singular in the future.

GameFi

P2E gaming platform Arcade completed US$4.8 million in financing, led by Crypto.com Capital, with participation from Solana Ventures, Shima Capital, KuCoin Labs and GSR. Arcade co-founder and CEO Josh Poole said that this financing was achieved through a simple agreement for future tokens. Arcade will also open a public sale for the ARC token on Ethereum, starting on February 27 and continuing. 72 hours. According to Poole, Arcade is not planning any more public sales in the future and “the way other tokens will be distributed is through some community incentive programs.”

Mon Studios, the developer of the MMORPG game Spellborne, completed a strategic financing of US$1.35 million from 32-Bit Ventures, Momentum 6, Yunt Capital, D64 Ventures, County Capital, and founders and senior executives from Animoca Brands, YGG, Faze Clan, Immutable, Tatsumeeko and other companies. Guan and others participated in the investment. Funds raised will be used to continue developing Spellborne.

Bitcoin Ecology

BiHelix, the infrastructure in the Bitcoin RGB field, received strategic investment from BTC NEXT, the Bitcoin network ecological investment management fund of LK Venture, a crypto investment and research institution under Linekong Interactive. It is reported that BiHelix is based on the Bitcoin native blockchain and combines the RGB protocol and the Lightning Network to build a Bitcoin ecological infrastructure with optimized nodes, aiming to solve the scalability and Turing incompleteness problems faced by the Bitcoin blockchain. bottleneck.

Bitcoin DA layer Bsquared Network (B² Network) announced the completion of a seed round of financing, with participation from HashKey Capital, OKX Ventures, IDG Capital, KuCoin Ventures, ABCDE, Waterdrip Capital, OGs FUND and Antalpha Group. B² Network is the first Bitcoin second-layer network implemented through ZK Rollup and on-chain logic gate commitment verification mechanisms. It is compatible with EVM and is very developer-friendly. B² Network solves Bitcoin's scalability challenges while retaining the core principles of decentralization, trustless operations, and transparent ledgers, aiming to expand the utility and influence of Bitcoin and its emerging derivative assets in Web3.

Bitcoin DEX Bitflow Labs announced the completion of a $1.3 million pre-seed round of financing, led by Portal Ventures, with participation from Bitcoin Frontier Fund, Bitcoin Startup Lab, Big Brain Holdings, Newman Capital, Genblock Capital, Tykhe Block Ventures and others. Bitflow focuses on sustainable BTC yields, using technologies such as PSBT, atomic swaps, AMM, and Layer-2 solutions such as Stacks to conduct BTC, stablecoin and other transactions.

Gamified Bitcoin accelerator 10n8 Little Dragon announced the completion of $1.5 million in financing from investors including Centauri Digital Asset Group, Mirai DAO, New Tribe Capital, 3M Capital, Ivan on Tech, SeedThrift Ventures, Boxmining, Spicy Capital and Satoshi Stacker. Venture capital firms participated in the investment. The goal of 10n8 Little Dragon is to accelerate projects in the Asia-Pacific region and promote more users to stake, play games and earn income in different mining pools and games. In the future, it will also develop Metaverse games based on Unity.

social applications

Social network Friends With Benefits (FWB) announced that its software development company Scene Infrastructure Company has completed a $3 million seed round led by a16z crypto. Scene Infrastructure Company is led by Jose Mejia, a long-time DAO contributor and former DAO product lead at Dapper Labs, and Zora Led by co-founder Ethan Daya. Friends With Benefits (FWB) will also become its test case to explore token and social network applications.

Web3 eSports fan engagement platform Stan completed US$2.7 million in financing, with participation from Aptos Labs, Pix Capital, Maelstrom Fund, GFR Fund, CoinDCX Ventures, Climber Capital, TDV Partners and Coinswitch Ventures. Stan helps users purchase collectibles and interact with popular esports figures, whether players or KOLs, through chat and audio rooms, as well as exclusive communities on its platform. Some of these collectibles are Web3 projects such as NFTs.

RWA

Web3 equity trading company Dinari completed a $7.5 million seed round of financing, with participation from Third Kind Venture Capital, 500 Global, former Coinbase CTO Balaji Srinivasan, Sancus Ventures, Version One VC and others.