At the end of the first month of 2024, the Centralized Exchange (CEX), the most profitable track in the crypto asset market, has also submitted the most comprehensive data for the whole year.

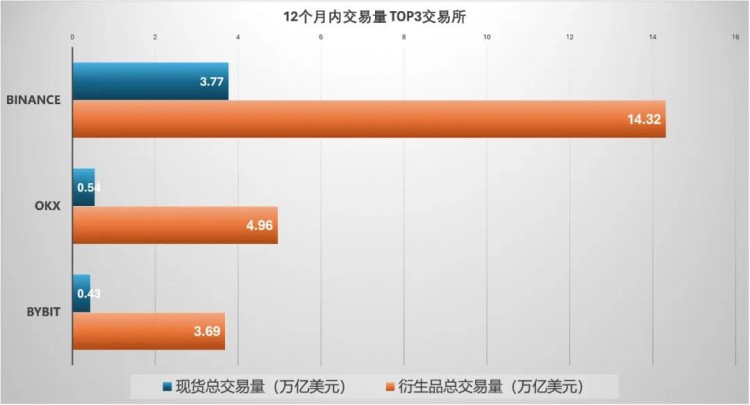

Based on data from TokenInsight's "Crypto Exchange 2023 Annual Report", DeFiLlama, and CoinGecko, in 2023, the world's top 10 crypto asset exchanges contributed 34.26 trillion U.S. dollars in trading volume throughout the year, a decrease of about 16% from 2022. Among them, in spot and In terms of annual derivatives trading volume, Binance ranks first, with OKX and Bybit ranking second and third respectively.

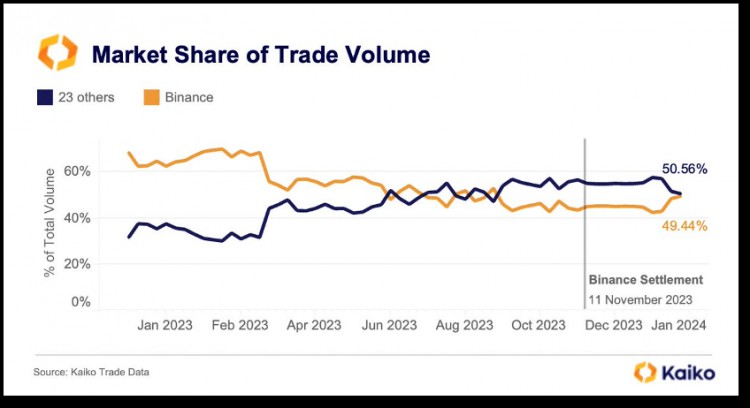

In terms of market share, Binance has reduced to 48.7% from 54.2% at the beginning of the year. Although it has dropped by more than 5%, it still maintains its dominant position. OKX occupies 16.1%, and Bybit occupies 12.3%. Both of them have increased from the beginning of the year, and together they are not as good as Binance. KaikoData data shows that Binance’s market share has recovered to 49% in the past two months.

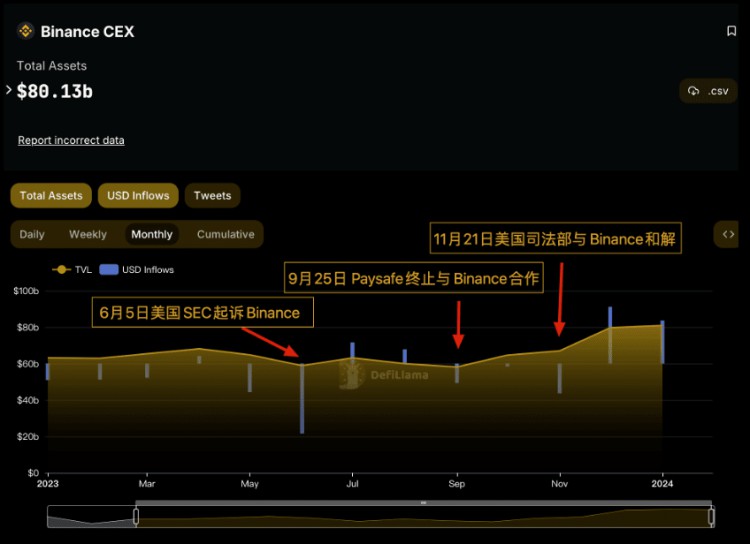

Judging from the changes in transaction volume and net capital inflow data, Binance’s decline in share is not unrelated to its enforcement actions with regulatory agencies such as the U.S. SEC and the Department of Justice, especially since it reached a settlement with the U.S. Department of Justice on November 21 last year and was After being fined US$4.3 billion, there was a net outflow for 13 consecutive days, with a total of US$2.865 billion “leaving” Binance.

There are always voices from the outside world worried about whether Binance’s “family wealth” is still strong.

On December 4, funds returned to Binance. In December last year and January this year, when Bitcoin ETF expectations were rising, Binance's net inflow of US dollars reached 5.4 billion. The "lost ground" was recovered, and Binance on various chains The total asset value of addresses reached 80.9 billion at the end of January, an increase of 28.25% compared with the same period last year, ranking first among all companies in terms of volume and growth.

The data performance has stabilized Binance's internal and external "military morale" to a certain extent. The market foundation it has accumulated over the past six years has not been easily leveraged. It also complements the overall rise of the crypto asset market in the past two months, and this "global "First" has not slackened off, and has maximized the "desire to win" in attracting and retaining users.

Binance still ranks TOP1 in multiple indicators in the CEX industry

It has been 2 months since Binance reached a settlement with the U.S. Department of Justice. In addition to the impressive $4.3 billion fine, the U.S. Department of Justice also described the platform as “the largest in the world,” not even “one of the” add. This does not rule out the element of supervision that “the higher it is positioned, the heavier its responsibilities will be.” However, the impression of “the world’s largest” is not an exaggeration.

In the past 2023, Binance is still the crypto asset trading platform with the largest market share. Although this figure has dropped from 54.2% at the beginning of the year to 48.7%, in TokenInsight's "Crypto Exchange 2023 Annual Report", this figure is still Nearly half, the remaining 51.2% is shared by 9 mainstream crypto asset trading platforms, of which only 3 have a market share of more than 10%.

Crypto CEX market share analysis (from TokenInsight)

Crypto CEX market share analysis (from TokenInsight)

Since Mt. Gox opened the business track of crypto asset exchange in 2010, rise and fall have become the eternal themes here, and they have always been the protagonists. The most noticeable change in the pattern among Chinese-speaking users is the "big three" that were often mentioned in the past. Today, "B" and "O" are still present, and "H" is being replaced by the new "B".

TOP3 refers to the order, and the data gap between the current top three, second, third and first is not small.

Taking transaction volume as the dimension, we sorted out the data entered by CoinGecko (the first 11 months of 2023 and January 2024). In the spot market, Binance’s transaction volume was US$3.77 trillion, OKX was US$0.54 trillion, and Bybit was 0.43 Trillion US dollars, the sum of the two is less than 1/3 of Binance; CEX’s derivatives trading has contributed more considerable trading volume to the market, Binance is 14.32 trillion US dollars, OKX and Bybit are 4.96 trillion US dollars and 3.69 trillion US dollars respectively. Dollar.

Trading volume data of TOP3 crypto asset exchanges within 12 months

Trading volume data of TOP3 crypto asset exchanges within 12 months

Taking the total asset value (TVL) of the exchange’s addresses on each chain as the dimension, DeFiLlama data shows that as of January 31, Binance’s total asset value was US$80.9 billion, followed by OKX at US$15.5 billion. , the third position belongs to Bitfinex with US$13.7 billion, and the gap is still several times higher.

The capital inflows of Binance and OKX during the month were both over 1 billion US dollars, which is quite considerable. The following exchanges had monthly inflows of over 100 million US dollars in capital, including Robinhood and Bybit, a total of 6 exchanges.

Turning negative into positive, Binance has inflows of over US$5 billion in two months

If you look at the data, the TVL in the Binance address has been relatively stable throughout 2023 and has remained at around US$60 billion, with high liquidity of capital inflows and outflows.

In June and September last year, Binance's TVL experienced two significant declines, falling to US$58.8 billion and US$58.1 billion respectively. The US dollar value also outflowed US$3.8 billion and US$1 billion respectively in these two months.

The two declines were somewhat related to regulatory/partner actions. In June, it was the time when the U.S. SEC sued the Binance entity for selling unregistered securities; and in September, Binance’s Euro banking partner Paysafe terminated the cooperation between the two parties.

Last 12 months Binance TVL and USD value inflow data (from DeFilLama)

Last 12 months Binance TVL and USD value inflow data (from DeFilLama)

It can be seen that the external situation is difficult not to affect Binance users' operations on the withdrawal and retention of funds, and inflows often occur again one month after the outflow. The incident that made Binance’s name widely hit the media headlines was the settlement with the U.S. Department of Justice on November 21 last year. After that, funds flowed out of Binance for 13 consecutive days. Throughout November, a total of US$1.635 billion was on the chain. It does appear to be in outflow status.

Interestingly, Binance’s TVL has continued to increase during this period, from US$64.6 billion in October to US$67 billion in November. It is difficult not to envy Binance’s resilience.

In the following December and January this year, Binance’s TVL broke the previous high, reaching US$79.6 billion and US$80.9 billion respectively, an increase of 18.80% and 20.74% respectively compared with November; TVL in January increased by 28.25% compared with the same period last year. %; The pattern of “outflow followed by inflow” continued again in December and January. The value of the U.S. dollar within two months turned from negative to positive in November, with the inflow value being US$3.113 billion and US$2.359 billion respectively; in these two months, Binance The market share also increased to 49%.

Binance’s market share has recovered to 49.44% in the past two months (from KaikoData)

Binance’s market share has recovered to 49.44% in the past two months (from KaikoData)

After entering 2024, the impact of the U.S. Department of Justice’s penalties on Binance is weakening, which is not only reflected in the retention of funds in Binance, but also in transaction volume.

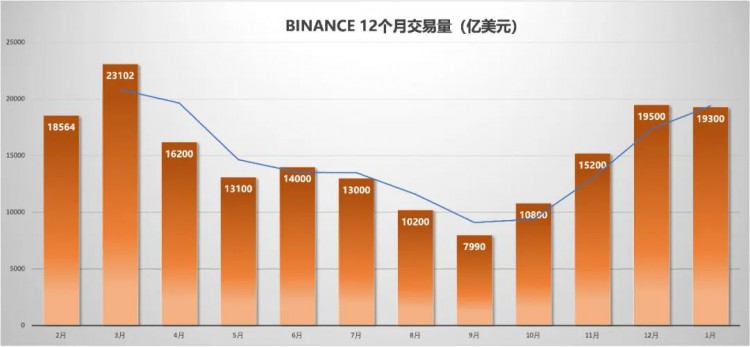

In the past two months, Binance has maintained its leading position in terms of trading volume in the spot market and derivatives market. CoinGecko data on February 1 shows that Binance’s spot trading volume within 24 hours was US$14.872 billion, exceeding the average daily trading volume in the past 12 months of US$10.332 billion; derivatives trading volume within 24 hours was US$39.719 billion, while the recent Its average daily derivatives trading volume within 12 months was US$39.246 billion.

The external market helps fill the internal “desire for survival”

Faced with the adverse impact of "the largest fine in the history of U.S. financial regulation," Binance has indeed demonstrated its foundational resilience in the crypto asset trading market six years after its establishment. This "hump" seems unlucky, but it is also very lucky.

In the two months after the U.S. Department of Justice settled with Binance, expectations for the launch of the Bitcoin ETF were getting higher and higher. These two months were also the period during which Binance’s total trading volume continued to break through, reaching US$1.95 trillion and US$19,300 respectively. One hundred million U.S. dollars.

Some analysts even believe that the resolution of the entanglement between the world's largest crypto-asset exchange and regulators with criminal powers will help accelerate the adoption of a Bitcoin ETF. Causal logic is a matter of opinion, at least in terms of chronological order, this is indeed how things unfolded.

The settlement between the U.S. Department of Justice and Binance was reached on November 21 last year; on January 10 this year, the Bitcoin ETF was approved. In December and January, Bitcoin reached two recent highs of US$44,000 and US$48,000. Binance’s capital retention and transaction volume also rebounded significantly in these two months.

The total trading volume of Binance spot + derivatives in the last 12 months

The total trading volume of Binance spot + derivatives in the last 12 months

Within 12 months, the highest monthly trading volume on Binance occurred in March last year. At that time, the spot trading volume was US$559.47 billion, the derivatives trading volume was US$1.75073 billion, and the total monthly trading volume reached US$2.3102 billion. If we compare the total transaction volume in February last year and January this year, it was already the second highest in 12 months.

Although Binance’s capital outflow in November gave other competitors the opportunity to take share, the market situation has given Binance the help to defend its basic market. At the same time, the platform is also struggling to "defend its territory."

Despite leading the competition, this real "world's number one" is still full of "desire to survive", or it maintains a high sensitivity to attracting and retaining users. The most visible thing to the outside world is Binance Launchpool new currency mining. The action of the plate.

Binance Launchpool launched 4 projects in January

Binance Launchpool launched 4 projects in January

This product has always been regarded as the "most wealth and flow effect". In January 2024 alone, Binance Launchpool's new currency mining section launched 4 projects, while there were 10 projects in 2023 and 10 projects in 2022. Only 5 years old. Binance keeps 5 billion to 6 billion US dollars in funds on the site in a short-term and fast way, and the number of participants in each period is about 200,000.

After Binance, similar sectors on other platforms also began to accelerate innovation. For holders of crypto assets, competition between trading platforms is always a joy to see. Binance can still maintain its lead in adversity, which makes people look forward to what "big tricks" it can use to attract users and funds in the future. ".

In 2024, the influence of regulatory authorities on crypto asset exchanges will not stop, and competition on the CEX track will continue. Over the years, the CEX landscape has been changing, with rises, declines, and disappearances happening every year. It is not difficult to find that in the face of users and the market, only those platforms that always maintain a desire for survival and a sense of awe can become long-distance runners on the track. As long as the crypto asset market is expanding, the destination will never end.