2024 is a promising year for the encryption market. All eyes are focused on new tracks worthy of attention in the encryption field, including leading institutions. Various institutions have published their own research reports at the beginning of the year, looking forward to 2024 from a professional and detailed perspective, which is of great reference value.

Vernacular Blockchain reviewed the research reports of 23 leading institutions (including Messari, a16z, Coinbase, MT Capital, etc.), trying to summarize and find "institutional consensus" to improve certainty, which is now summarized as follows:

01

The top ten tracks that are generally optimistic

1) Bitcoin ecological renaissance

After the launch of Ordinals (a digital content encoding method based on Bitcoin) in December 2022, it led to the inscription and Bitcoin ecological craze. In 2023, the Bitcoin ecosystem will develop strongly, and Bitcoin's dominance (Bitcoin's proportion of the cryptocurrency market value) will increase from 38% in January to about 50% in December, making it the most noteworthy ecosystem in 2024. one.

Institutional forecasts are also generally optimistic about the development of the Bitcoin ecosystem this year:

Bitwise, a mainstream U.S. crypto index fund management company, predicts that the Bitcoin trading price will exceed $80,000 in 2024;

Coinbase believes that at least in the first half of 2024, the main focus of institutional investment will continue to be on Bitcoin, as the passage of ETFs will create strong demand from traditional investors to enter this market.

The forecasts of other institutions are also optimistic. The main reasons are:

The U.S. Securities and Exchange Commission (SEC) has approved a spot Bitcoin ETF, and the next big event, the Bitcoin halving event in April, is coming, and supply and demand are expected to change significantly;

The Bitcoin ecosystem will see infrastructure upgrades, the addition of programmable features, including basic protocols (such as Ordinals), as well as the development of protocols such as Layer 2 and other extensible layers (such as Stacks and Rootstock).

2) Development of Ethereum L2

In addition to the Bitcoin ecosystem, Ethereum, as the pioneer of smart contracts, the development of Ethereum Layer 2 is also a major event that various institutions predict in 2024, especially with Vitalik releasing the Ethereum 2024 roadmap and the Cancun upgrade approaching. , ARB, OP and other Ethereum Layer 2 project tokens have experienced skyrocketing prices recently.

Competition in the public chain ecosystem has always been fierce. In 2023, public chain ecosystems such as Solana and Avalanche have developed rapidly, and their momentum has even surpassed Ethereum. However, Ethereum, as the leader, has also begun to exert its influence. Most of the predictions of various institutions are based on the completion of the Cancun upgrade, gas costs will further drop significantly, which can drive the explosion of the Ethereum Layer 2 ecosystem in 2024. Bitwise believes that a major upgrade to the Ethereum blockchain will bring average transaction costs below $0.01, laying the foundation for more mainstream uses.

If the upgrade is successfully implemented, some leading Ethereum Layer 2 projects (such as Optimism, Arbitrum, Base, etc.) can completely compete with other Layer 1 public chains in terms of performance.

In addition, according to Vitalik's vision, in the long run, the direction of zero-knowledge proof is the future of Layer 2 of Ethereum, and the two Layer 2 projects of zkSync and StarkWare are also favored by everyone.

3) Development of Solana Ecosystem

In the past 2023, the Solana public chain ecosystem has performed well. Whether it is technology accumulation or community, it has laid a solid foundation for the long-term development of the Solana ecosystem, and the explosion of the Solana ecosystem has also attracted a large number of users and funds.

Various institutions predict that in 2024, more projects will choose or migrate to the Solana public chain, and the Solana ecosystem will continue to explode. Because, whether it is TPS, gas fees, or community users, Solana is more resistant to attack.

Market institutions’ expectations for Solana in 2024 focus on the following aspects:

Solana’s technical upgrades, such as the development of light clients through Tinydancer, allow validators to complete verification work at a lower cost and achieve a higher degree of decentralization;

Solana's performance improvements, including improving throughput and performance, improving user experience, deploying new Token standards, etc., have enhanced its robustness;

The launch of new products, increased on-chain liquidity, and expansion of developer tools have contributed to the prosperity of the Solana DePIN ecosystem.

4、DePIN(Decentralized Public Internet Network)

DePIN, or decentralized physical infrastructure network, is a new method of building and maintaining infrastructure in the real world. Its goal is to build decentralized networks in industries such as telecommunications, energy, mobile communications, and storage. In 2023, there are over 650 DePINs with a market cap of over $20 billion and annual revenue of over $150 million.

An overview of DePin development in 2023

In 2024, the cryptocurrency data platform CoinMarketCap has listed DePIN as an independent classification, reflecting the encryption market’s high focus on this area.

DePIN covers a wide range of fields, including server networks, wireless networks, sensor networks and energy networks. Currently, various companies predict that the DePin track has huge growth potential. For example, according to predictions by encryption research institute Messari, the overall industry size of DePIN is currently approximately US$2.2 trillion and is expected to grow to US$3.5 trillion by 2028. Messari also pays special attention to the following subdivided DePIN sub-tracks: cloud storage market, decentralized database, decentralized wireless network and combination with AI.

However, while making predictions, various institutions also believe that the maturity of DePIN will require long-term investment and operational development by the market, institutions and developers before it can gradually penetrate into people's lives and applications and complement the existing infrastructure. Parallel, to substitution.

5) The combination of AI and blockchain

The rapid development of artificial intelligence (AI) in 2023 has also promoted the development of AI+ web3 services. In early January 2024, the market value of AI-related Tokens reached US$7.04 billion. Given the increasing popularity of artificial intelligence, forecasts are mostly optimistic about using AI as a core function to enhance the appeal of blockchain-based encryption platforms.

At present, the tracks that various institutions are more optimistic about are:

Direct applications of AI in crypto: trading bots, automated payments and arbitrage bots combined with blockchain. Integrated scenarios include AI Agent utilizing encrypted infrastructure for payment, smart contracts to securely schedule AI models, and Token rewards for personal fine-tuning of models and collection of valuable data. Messari believes that advancements in AI will increase demand for cryptocurrency solutions.

Innovative applications of AI and encryption technology: Here AI is used to improve the user experience and efficiency of Web3, and more blockchain technology is used as guardrails and transparent layers for AI. For example, we have seen research and new use cases on zero-knowledge and machine learning (ZKML), games that allow users to train AI agents using ERC 6551, etc.

Bankless analyst Jack Inabinet believes crypto + artificial intelligence could be an explosive combination. While early activity was largely about promoting worthless projects to capitalize on the hype, the promise is still huge.

Encryption company DWF believes that by guiding social cognition and its limitations in centralized AI, decentralized AI has great potential for development in 2024 and can lead the future of AI through Web3.

6) The outbreak of GameFi and the development of chain games

The blockchain games in 2021 and 2022 are in full bloom, developing from "Play to Earn" to "X to Earn", with smash hit projects such as Axie and Stepn coming out. In comparison, the blockchain games in 2023 are relatively bleak. However, with the improvement of infrastructure, various institutions are still optimistic about the future development of chain games.

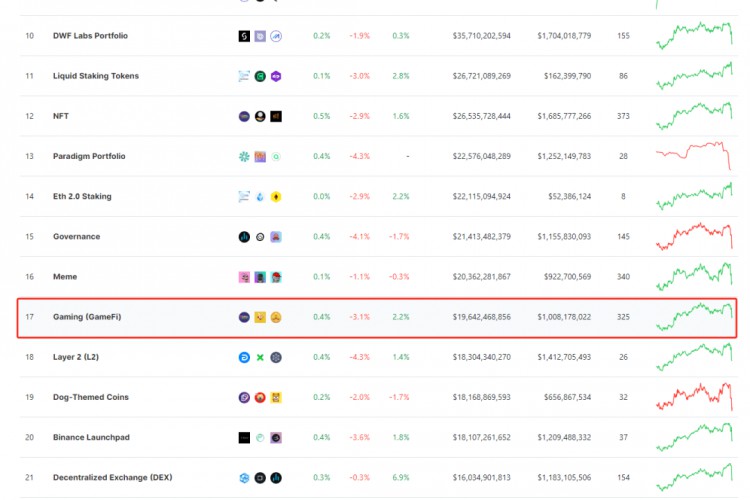

After all, from the perspective of the traditional Web2 market, games are a very potential market and have almost become a part of many people's lives. And most traditional game users don’t have much knowledge about the GameFi (Gaming) field. From a TVL perspective, as of the time of writing this article (2024.2.1), the TVL of the GameFi sector in the figure below is only $19.6 billion.

Overview of TVL of each track, source: coingecko.com

From the perspective of GameFi's development space, what is mentioned more often is that GameFi is expected to have a larger narrative in 2024-2025 and will receive more attention.

For example, Azuki researcher Wale Swoosh believes that gaming will become one of the big trends that define 2024. Gaming has been and will always be a great Trojan horse when it comes to cryptocurrency applications, and there is no doubt that the Web3 gaming trend seen at the end of 2023 will not only continue next year, but become even more pronounced.

Kelvin Koh, co-founder and chief information officer of Spartan Capital, believes that a number of AAA Web3 games will be launched in 2024, and believes that these games will bring millions of new Web3 users.

In general, various institutions are currently optimistic about GameFi mainly because of two points:

First, in 2024, blockchains focusing on games will continue to increase. In addition to some traditional and well-established public chains, new public chains such as Oasys and Sui have also joined them;

Second, the participation of large traditional game companies. For example, Oasys has attracted many well-known publishers to join its ecosystem, such as the well-known Ubisoft Entertainment (Ubisoft game software), Square Enix (a Japanese game software production, development company and publisher), Activision Blizzard (Activision Blizzard) , Epic Games and more.

7) Development of modularization and zero-knowledge proof (Snark) technology

In 2023, modular blockchain and zero-knowledge proof (ZKP) have been fully developed, such as Celestia, zkEVM, etc. And an obvious phenomenon is that these two narratives have begun to show a trend of integrated development. Projects in the ZK field have begun to combine specific vertical fields (such as co-processors, privacy layers, proof markets, and zkDevOps) for "modular" development.

Leeor Groen, managing director of Spartan, believes that privacy and security will be key drivers in Web3. As technology develops, users will begin to realize the value of zero-knowledge proofs and modular blockchains, and users will not even know that they are starting from The backends of applications ranging from digital identities to games rely on these zero-knowledge proofs and modular blockchains.

A16z believes that the rise of modular technology stacks has brought about the greatest advantages of open source and modular technology stacks. As tools inspired by formal methods are widely adopted by developers and security experts, the next wave of smart contract protocols is expected to be more robust and less secure. Vulnerable to expensive hacking attacks. The mainstreaming of SNARKs technology will become a trend.

Looking forward to 2024, various institutions and researchers also expect this trend to continue, and zero-knowledge proofs will become the interface between different components of the modular blockchain stack. This provides greater flexibility for developers to build dapps while lowering the barrier to entry for blockchain stacks; for consumers, ZKP may be seen as a way to protect identity and privacy, such as in ZK-based decentralized form of identity.

Another important point to mention is that SNARKs can provide corresponding proofs for calculations that generate specific outputs, making the verification of proofs much faster than the speed of performing corresponding calculations. It will become a key project in 2024.

8) Mobile terminal and decentralization trends may become mainstream channels, improving user experience.

Regardless of the type of crypto ecosystem, if it wants to develop in the long term, its ultimate goal is to attract new users and encourage existing users to become more active participants. With the recovery of the market, the improvement of infrastructure and the layout of various institutions, institutions generally believe that there will be a large influx of crypto users in 2024.

Like a16z Chief Technology Officer Eddy Lazzarin believes that although the user experience in the encryption field has been criticized, developers are actively testing and deploying new tools to reset the encryption front-end user experience, such