2024年,離「質押年」這個預測還差一波大行情。

從 Cosmos、Solana 生態到以太坊,質押擼毛已經是公認的財富密碼。隨著以太坊流動性質押與資本效率需求的提高,EigenLayer 發幣預期、AltLayer 空投大毛與 Renzo 融資消息直接引爆重奪大戰Restake由Eigenlayer創辦人Sreeram Kannan首次提出,允許已經質押在以太坊上的ETH,再次質押在其他共識協議上,讓其共享到以太坊的經濟安全性,保證自身的安全啟動和運作。

目前,Renzo、ether.fi、Kelp DAO、Eigenpie、Swell、Puffer Finance等以太坊LRT項目的空投積分計劃引發了市場的FOMO情緒。在這些主流項目之外,重倉是否還有其他機會?在此,作者對Restake 做了一個短暫的盤點,共整理了47 個項目,以太坊Restake 協議有20 個,全鏈LRT 協議則有7 個。除EigenLayer 與以太坊相關協議、LRTFi、基礎設施外,工程師也整理了部分Cosmos、NEAR、Solana、比特幣、BNB Chain、Polygon、Berachain等其他公鏈Restake項目,以饗讀者。

重新抵押協議

特徵層

是否發幣:未發幣

支持質押幣種:ankrETH、cbETH、wBETH、oETH、swETH、stETH、ETHx、osETH 等

是否積分積分累計:EigenLayer 積分

EigenLayer 是以太坊再質押協議,也是再質押變形的龍頭,支援 ankrETH、cbETH、wBETH、oETH、swETH、stETH、ETHx、osETH 等 LST 代幣,以太坊驗證節點使用橋樑 ETHlama 再質押。DefiLlama數據顯示,EigenLayer TVL已超20億美元,自12月18日漲超7倍。

近期,EigenLayer 推出 EigenLayer 和 EigenDA 的第二階段測試網,主網將於 2024 年啟動。第三階段將引入 EigenDA 外部的 AVS(主動驗證服務),第三階段將於 2024 年進入測試同時,EigenLayer 還該計劃為DApps 提供「共享安全」模式,該模式將允許協議透過利用公共以太坊再質押池加入網路。此外,EigenLayer 上的以太坊再質押金(目前超17 億美元) )能夠同時提供給網路上開發的所有服務,以實現共同的安全機制。

2023年2月,EigenLayer背後團隊EigenLabs完成5,000萬美元A輪融資,Blockchain Capital領投,Coinbase Ventures、Polychain Capital、Hack VC、Electric Capital、IOSG Ventures等參投,估價條款未揭露。

EigenLayer尚未發幣,但已推出「再質押積分」,根據用戶再質押時間與金額發放。目前,EigenLayer將再質押開放窗口延期至2月6日至2月10日,並為所有LST取消上限。

海帶DAO

是否發幣:未發幣

支持質押幣種:ETHx、sfrxETH、stETH

是否累計積分:是

Kelp DAO 是一個多鏈流動性質押平台,其創始人最初制定了流動性質押協議 Stader Labs,Stader 在 Polygon 與 BNB Chain 上均是第二大 LSD 協議。根據 DefiLlama 數據顯示,Kelp DAO TVL 現為 2.55億美元。

Kelp DAO 目前正在EigenLayer 上建構LRT 解決方案,其再質押代幣為rsETH,目前支援的LST 包括ETHx(Stader)、sfrxETH(Frax)和stETH(Lido)。用戶可將上述資產再質押代幣取用rsETH ,reETH目前價格是各種獎勵與已質押 LST 的基礎價格。rsETH 可用於其他 DeFi 協議。

目前,Kelp DAO 已激勵推出 Kelp Miles。Kelp Miles 用於追蹤用戶對 Kelp 的貢獻,並用於確定未來的獎勵分配比例。Kelp Miles 相關用戶的 LST 再質押數量與質押天數。中介 2023 年 12 月 12 日日至2024年1月1日質押LST的用戶,可在未來3個月內獲得1.25倍Kelp Miles。1月1日後質押LST的用戶將照常獲得Kelp Miles獎勵。

另外,所有在EigenLayer上限關閉前在海帶上重質押的用戶獲得EigenLayer積分的資格,該積分將根據用戶存入LST的數量進行分配。

以太坊

是否發幣:未發幣

支持質押幣種:ETH

是否累計積分:是

ether.fi 是一個流動性抵押平台,已於 2023 年 11 月 15 日推出其流動性再質押代幣 eETH,允許用戶抵押其 ETH 抵押貸款,並自動在 EigenLayer 中再質押其 ETH,消耗用戶手動完成再質押。eETH 可用於Pendle、Curve、Balancer、Maverick、Gravita、Term Finance、Smmelier 等DeFi 協議。用戶可將eETH 封裝成weETH,weETH 未來也可在Balancer、Gravita、Pendle、Aura、Maverick 等DApp,另外,另外ether.fi 取代Staders,可用於質押eETH。根據DefiLlama 數據顯示,ether.fi TVL 現為5.07 億美元。

ether.fi 已推出忠誠度積分,eETH 或 weETH 持有者可 100% 獲得忠誠度積分與 EigenLayer 積分,忠誠度積分或將用於去中心化治理,不可轉移。忠誠度積分 = 質押的 ETH * 1000 * 質押天數。

本徵派

是否發幣:未發幣

支持質押幣種:swETH、wBETH、mETH、sfrxETH、rETH、stETH 等

是否積分積分累計:即將推出EigenLayer積分

Eigenpie 是多鏈收益協議 Magpie 推出提供流動性再質押服務的 SubDAO 組織,用戶可將其 swETH、wBETH、mETH、sfrxETH、rETH、stETH 等 LST 資產再質押至 Eigenpie。自 1 月 28 日開放 LST 預窗口以來,TVL已超1億美元,現為1.16億美元,預開放至北京時間2月10日03:00。

Previously, on January 23, Eigenpie announced EGP token economics, with a total supply of 10 million, and allocations including IDO (40%), community incentives (35%), Magpie Treasury (15%) and early supporter airdrops (10% ). Eigenpie promises to introduce the EGP token through a fair launch, without the involvement of VC or pre-sale events, ensuring equal opportunities for all participants. The team waives the token allocation and allocates 15% of EGP tokens to the Magpie Treasury.

Eigenpie has now launched a point reward system. For every 1 ETH of LST deposited, users can obtain 1 Eigenpie point per hour. Depositors can earn 2x points 15 days before pre-depositing. The points can be used to obtain airdrops and participate in IDO.

Renzo

Whether to issue coins: No coins have been issued yet

Supported pledge currency: ETH

Whether to accumulate multiple points: Yes

Renzo is an Ethereum staking protocol built on EigenLayer. The mainnet was launched on December 18 last year and launched a native ETH re-staking function. Users can earn ETH re-staking income and 100% of EigenLayer points. For every LST or ETH a user deposits, an equal amount of ezETH will be minted. Renzo runs a distributed Ethereum validator infrastructure powered by Figment and P2P.org, with unlimited participation in EigenLayer. When users deposit native ETH, they must reach the minimum limit of 32 ETH before staking through the Ethereum beacon chain verification node. Renzo will also launch a Trade feature. According to DefiLlama data, Renzo TVL is approximately $155 million.

On January 16, 2024, Renzo completed a US$3.2 million seed round of financing, led by Maven11, with participation from OKX Ventures, IOSG Ventures, Figment Capital, SevenX Ventures, and others, with a valuation of US$25 million.

Renzo has now launched the points program ezPoints. Users holding ezETH can receive 1 ezPoints every hour, and early users will also receive rewards. Users who provide liquidity to the ezETH/WETH capital pool will receive 2x ezPoints rewards, and new users can also be invited to earn exPoints.

Puffer Finance

Whether to issue coins: No coins have been issued yet

Supported pledge currencies: stETH, wstETH

Whether to accumulate multiple points: Yes

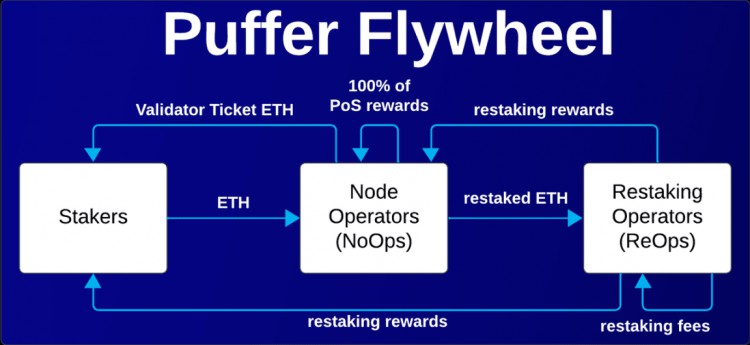

Puffer Finance is a native liquidity re-pledge protocol built on Eigenlayer. The protocol is composed of pledgers and node operators (NoOps). Users holding 1 ETH can run the validator and retain 100% PoS rewards (including execution rewards with consensus rewards). NoOps can delegate the ETH in their validators to re-staking operators (ReOps) in exchange for re-staking rewards, and node operators (NoOps) can also choose their MEV strategy independently. Stakeholders can deposit any amount of ETH to obtain the native liquidity staking token (nLRT) pufETH. pufETH also uses Compound’s cToken mechanism, which is not only fully compatible with DeFi protocols, but the value of pufETH will increase as the protocol mints validator tickets (tickets) and PoS re-staking rewards.

Puffer's nLRT is also different from other LRTs in that nLRT can receive traditional PoS rewards and re-staking rewards, while other re-staking protocols only provide point rewards related to their native tokens.

Image source: Puffer Docs

On September 1, 2023, several Ethereum liquidity staking providers, including Rocket Pool, StakeWise, Stader Labs, Diva Stake, Puffer Finance, and Swell Network, committed (or are committing) to limit their holdings to no more than the total pledged amount 22%, designed to deal with the increasing concentration of the Ethereum staking market.

In August 2023, Puffer Finance completed a $5.5 million seed round, led by Lemniscap and Lightspeed Faction, and led by Brevan Howard Digital, Bankless Ventures, Animoca Ventures, KuCoin Ventures, DACM, LBank Labs, SNZ, Canonical Crypto, 33DAO, WAGMI33, Concave And angel investor Lightspeed partner Anand Iyer, Eigen Layer founder Sreeram Kannan, Coinbase staking business director Frederick Allen, F2pool and Cobo joint venture Shenyu, Curve core contributor Mr. Block, North American Blockchain Association President Ramble, Eigen Layer Chief Strategy Officer Calvin Liu, Obol Chief Commercial Officer Richard Malone, and staking community leader Ladislaus von Daniels participated in the investment.

On January 30, 2024, Binance Labs announced its investment in LSD protocol Puffer Finance. The specific investment amount was not disclosed.

Puffer Finance will soon open staking for ETH, stETH, USDT and USDC, and users will be rewarded with Puffer and EigenLayer points at the same time. In addition, Puffer Finance has launched the Crunchy Carrot event on January 30. Users can link their Twitter accounts and wallets, select "Family" and retweet event tweets to earn points and view the points ranking list. At present, Puffer Finance has ended the first phase of staking ahead of schedule, the second phase of staking has started, and TVL has exceeded $150 million.

Swell Network

Whether to issue coins: No coins have been issued yet

Supported pledge currency: ETH

Whether to accumulate multiple points: Yes

Swell Network is an Ethereum staking protocol that launched the restaking token rswETH (Restaked Swell Ether) on January 30 this year, providing uncapped access to EigenLayer Restaking points that can be used in DeFi while continuing to accumulate Restaking rewards. Currently, rewETH version 1.0 allows users to deposit ETH to earn rswETH and accumulate restaking rewards in the form of Pearls and EigenLayer Restaked Points. According to DefiLlama data, Swell TVL is $457 million and Swell Liquid Restaking TVL is $4.43 million.

On March 14, 2022, Swell Network completed US$3.75 million in financing, led by Framework Ventures.

Swell Network’s native token SWELL has not yet been launched, and token economics have not been announced.

Stakestone

Whether to issue coins: No coins have been issued yet

Supported pledge currency: ETH

Whether to accumulate multiple points: None yet

Stakestone is a one-stop full-chain LST staking protocol, benchmarked against Lido, which can bring native staking income and liquidity to Layer2. It not only supports the head staking pool, but is also compatible with re-staking and will integrate EigenLayer. StakeStone supports ETH beacon chain re-pledge and LST re-pledge, aiming to become the leading protocol on the re-pledge track.

According to DefiLlama data, in just 3 weeks from December 15, 2023 to January 3, 2024, StakeStone TVL surged from US$4.17 million to US$542 million, and the current TVL is US$669 million. StakeStone is also deeply involved in Manta’s incentive activities, providing $720 million in liquidity out of Manta New Paradigm’s $900 million TVL.

StakeStone’s native LST is STONE, which has been officially upgraded to full-chain LRT. STONE is an OFT based on LayerZero that can be seamlessly used in multi-chain liquidity markets through STONE-Fi, such as DEX, AMM, lending, stablecoins, derivatives, GameFi, SocialFi, etc. STONE does not use a rebase mechanism, but is similar to Lido's wstETH in terms of generating revenue. In other words, the number of STONE will not change with the changes in the income generated by ETH staking, but its value will increase with the increase in ETH staking income. This is similar to the utility of Puffer’s cToken model.

StakeStone has not issued coins yet, and the team is expected to launch airdrop-related activities. Currently, users can stake ETH in StakeStone and earn income from the STONE-Fi ecological protocol.

ClayStack

Whether to issue coins: No coins have been issued yet

Supported pledge currencies: ETH, rETH, stETH

Whether to accumulate multiple points: Yes

ClayStack, a liquidity staking platform, entered the Ethereum re-staking space on January 24 via EigenLayer. ClayStack has changed its Ethereum liquidity staking token called csETH to a restaking token and will use the Ethereum restaking protocol EigenLayer to provide the new service. Currently ClayStack supports ETH, rETH, and stETH to be pledged into the protocol. ClayStack TVL is now $3.96 million, according to DefiLlama data.

CLAY, the native token of ClayStack, will announce its issuance plan in February and will provide users with bonus points at a 1:1 ratio before the token is released. The total supply of CLAY is 100 million, and 5% of the tokens will be distributed to the community through the IGD (Initial Governance Diversification) program.

Users can stake ETH or LST to earn CLAY points and EigenLayer points without upper limit. During IGD, users can receive more CLAY rewards. As weekly ETH deposits increase, so will csETH demand and CLAY Points allocations will increase.

Inception

Whether to issue coins: No coins have been issued yet

Supported pledge currencies: stETH, rETH, ankrETH, cbETH, wBETH, oETH, osETH, swETH, ETHx, sfrxETH, mETH, etc.

Whether to accumulate multiple points: No

Inception is an isolated liquidity re-pledge protocol that supports the re-pledge of various LSTs such as stETH, rETH, ankrETH, cbETH, wBETH, oETH, osETH, swETH, ETHx, sfrxETH, mETH, etc., and issues isolated liquidity re-pledges. Collateral Tokens (iLRTs). iLRT can be used in DeFi protocols and remains isolated from the underlying LST.

Inception has been launched on the Ethereum mainnet, and its current TVL is $65,000. Inception will also expand to other Layer2 networks and integrate multiple DeFi protocols.

According to the roadmap, Inception will launch a private placement round of financing in the first quarter of 2024, launch the mainnet, launch TGE in the second quarter, and develop full-chain LRT. InceptionLRT will launch the native token ING. The current token allocation rules are: 2.5% tokens are allocated in the Pre-Seed round, 9% is allocated to the seed round, 10% is allocated to the private placement round, 6% is allocated to the treasury, and 6% is allocated to consultants , 3% is used for marketing, 15% is allocated to team members, and 48.5% is used for liquidity incentives.

Sommelier Finance

Whether to issue coins: Yes

Supported pledge currencies: e