撰文:律動 BlockBeats

隨著BTC ETF的獲批,比特幣生態正迎來令人振奮的黃金時代,許多人本輪牛市將主要在比特幣領域爆發。我們很榮幸邀請到深耕比特幣生態的行業信仰者、Merlin Chain的創辦人 Jeff。Merlin Chain 是一條專注於服務比特幣用戶、資產與協議的 BTC Layer2,透過 ZK 技術實現比特幣層安全性的共享,是目前比特幣生態系統中不可忽視的力量。

Bitmap 和 BRC-420 的設計初衷

BlockBeats:Bitmap.Game 和 BRC-420 的市場反應都非常好。可以分享一下您創建這兩個項目的初期嗎?

資產本身就是中心化的,任何人都可以刻寫,因此社區非常龐大。但是在剛剛銘刻的時候,市值卻只有200萬美元。希望基於這個龐大的社區,我們順便開發一些應用程序,提供一些實用性,於是推出了Bitmap.Game,一個比特幣上的元宇宙。

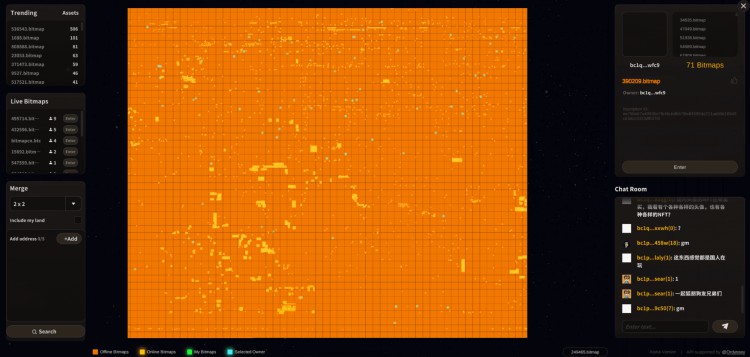

圖上的這些黃色光點都是目前線上的使用者看到的,放大地圖則可以每個人的地塊:

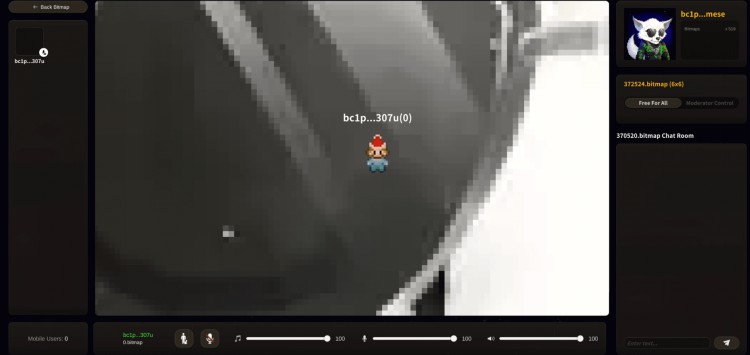

上面的所有圖片和內容,或者說在我們的產品中所有可見的內容,都是鏈上數據。每個人都擁有不同的錢包資產,可以選擇將這些資產作為地塊的封面。而進入具體的地區塊之後,則可以看到所有的頭像以及該房間的遊戲玩法、遊戲場景等,這些也都是鏈上資產。

最初我們推出Bitmap.Game 的初衷是建立一個與客戶端無關的、不依賴特定伺服器、去中心化、取得權限的產品。因為所有的資料都來自於鏈上,而不是在我們手中,因此即使我們停止運營,其他人也可以選擇建立自己的客戶端繼續發展,任何人都可以競爭開發類似的產品。我們認為這樣的產品是未來的發展方向,可能有些獨特,但確實是我們的初衷。

而BRC-420,我們稱之為資料標準化、模組代幣化的資產協議。事實上,我們可以將任何資料變成模組,並代幣化該模組,設定成為一種資產。例如,有一個名為Bitmap.town 的DLC,包含600 多個元宇宙的遊戲資產,如動畫、腳本、頭像、音樂等,它們被打包成一個DLC,然後進行代幣化。項目發布後,所有內容將全部上鍊,用戶可以自己存取、基於其建立自己的內容,同時持有這些代幣,而不再依賴開發這個DLC 的團隊。

目前走勢,BRC-420資產的交易量很大,漲幅、持有者人數、市值也都不錯。雖然最初稱其為元宇宙協議,但實際上BRC-420和元宇宙沒有必然的聯繫。我們希望未來能有更多基於去中心化的產品結構以及鏈上模組完全可組合的資產協議的創新玩法。

BlockBeats:這有點像是把銘文變成了一張遊戲卡,把比特幣變成了一台遊戲機,玩家可以往裡面拷貝遊戲。你覺得這些功能特性對整個比特幣生態的發展會有什麼樣的影響影響?

一是因為,我認為任何新的生態都需要有自己的敘述,在比特幣生態中再做一次以太坊的東西,或者反過來,都沒有創新。就像藍盒子火爆之後,每個人鏈上都出現了一個420協議,有各種顏色的盒子。我們一定要做在沒有出現過的東西之前,打造新的敘述,才能讓比特幣生態發展。例如,以太坊的許多內容不上鍊,現在我們要把鏈上的內容進行組合。

第二個新記述下的新產品模式,這一點在BRC-420 上的一些產品中可以看到倪的一些端。Mineral,打造了一個將DeFi 和算力結合的玩法;例如基於Bitmap的玩法鏈上遊戲,點陣圖谷、點陣圖大戰,都在使用BRC-420協議發行資產,基於鏈上內容的產品運營模式:先發行BRC-420資產,借用其進行圖幣轉換,然後或代幣空投,然後再在二層網路上建立基於這些資產的產品。我覺得整個產品模式的創新會隨著大趨勢不斷出現,

最後一個是可組合性,我認為這是區塊鏈最大的生產力創新,但在以太坊等生態中很少有人提及。相信你也知道 DeFi 樂高這個詞,DeFi 的本質就是不同的樂高之間從Uniswap到流動性挖礦,到Compound,再到曲線等等,智能合約讓整個行業的爆發均源於可組合性。而比特幣能則解決內容上的可組合性比方說你做了一個遊戲,裡面有20個,我可以基於其中的15個模組快速做一個新遊戲,而不需要重新造輪子。我覺得我們抓住了比特幣生態中模組最獨特的創新,而不是重新玩一遍以太坊的玩法。

Jeff 的比特幣生態創業之路

BlockBeats:從您的演講中可以普及您對於比特幣,以及整個加密行業都非常了解。在本輪比特幣生態爆發之前您有沒有考慮過在其他生態中創業?

作為互聯網一代的用戶,我們都深刻地傳播了互聯網以促進生產力的提升,我們可以通過視訊會議參加,可以在網絡上獲取更多信息,許多人能夠看到之前只有少數人可以看到的世界,等等等等。因此,我認為生產力創新是核心關鍵點。

在2017年的ICO,還是2020年的DeFi之前,我都沒有找到自己喜歡的切入點,因此一直專注於Web2的創業。其實我的上一家公司也涉及到了元宇宙領域,在全球大概有4000萬到4500萬的用戶。

這次選擇到比特幣創業,其實很巧合。當我們決定再來看看Web3的時候,剛好碰上了Ordinals生態的崛起,我覺得很幸運。

其次,市場風向逐漸回歸到了初步比特幣的加密文化,讓我對Web3創業重燃初心。在我看來,以太坊生態過於建制,有太多的既定規則,太多明確的玩法,中心化程度很高興,例如需要追隨V神創業、追隨以太坊基金會創業,然後再涉足VC、交易所等等。這樣的玩法讓我覺得失去了加密的初心。

Ordinals的完全鏈上的理念,和我一直堅信的消費權限的可組合性以及我自己的理念不謀而合,因此在這一次浪潮中選擇了在比特幣生態中創業。

BlockBeats:能看看下面您是個堅定的比特幣信仰者,可以分享一下您是如何接觸比特幣的嗎?為什麼現在會如此堅定地相信比特幣的未來?

Jeff: I actually came into contact with Bitcoin very early. In 2012, I took investment from a VC and founded my first company in China. This investment institution also happened to invest in Coinbase and Ripple. At that time, I myself was an early scholar in computer science. Later, I turned to political science and sociology when I went to the United States for high school and undergraduate studies. The combination of these backgrounds made me full of faith when I came into contact with Bitcoin.

At that time, many programmers did not trust Bitcoin and thought that the technology was very backward; while many liberal arts students felt that it was too unfamiliar and did not have much experience. But after I saw the Bitcoin white paper for the first time, I jumped into it without hesitation. Therefore, I am very good friends with the first batch of people who came into contact with Bitcoin in China. At that time, we discussed the purchase method together, and later we also did transactions together. There is no specific reason why I believe in Bitcoin, it is just a belief.

I think Bitcoin and Ordinals are very similar, both are antifragile and have no weaknesses. Even if the price drops to a very low level, even if no one likes it, it will always exist and will not be eliminated or killed by a file. This was my favorite at the time. Because the world is very fragile, and various countries and regions have various problems that require such anti-fragile things. So since more than ten years ago, I have had great faith in Bitcoin, and last year I also started to believe in the Ordinals ecosystem.

BlockBeats: I feel like you are a very punk person. Has this belief in the Bitcoin ecosystem affected your project positioning and development direction?

Jeff: First, we hope to find the most unique innovations in the Bitcoin ecosystem and never follow the old path of Ethereum. As entrepreneurs, we are eager to challenge uncertainty, which can stimulate the motivation for innovation. If you follow the same old path that others have already walked, you will lack freshness.

Second, our belief in ecology is also our belief in people. When we started building the Ordinals product, around May or June of last year, almost all of Ordinals’ assets were reduced to zero. The entire Bitcoin ecosystem and Ordinals have been ridiculed and looked down upon by the outside world. When I am out there, almost no one around me knows that I am doing Ordinals, because once I say it, many people will think it is a scam or a game played by children.

However, in that case, we found that Ordinals has 5 to 10 Twitter Spaces every night, including English and Chinese, where a group of developers gather together to keep warm and think of new things. In fact, the pressure to learn at that time was much greater than it is now. New protocols, new standards, and new innovations appeared every day. I could feel the vitality of the entire ecosystem. Everyone's belief and investment in this matter was very high. This made me feel the purity of an industry in its early days, as well as the dedication and belief of the users and developers surrounding this ecosystem.

Therefore, whether it is Layer 2 we are working on or new products in the future, they will all revolve around these users and assets. We sincerely hope to build in this ecosystem for a long time, and at the same time participate as users for a long time, and truly become part of these local communities, including local assets. Compared with many other projects that choose to quickly introduce Ethereum’s assets and mechanisms, we prefer to build and innovate natively around past users and assets.

The development status of BTC L2 and the innovation of Merlin Chain

BlockBeats: Can you share why you decided to create Merlin Chain?

Jeff: Three or four months ago, I often discussed with others that Bitcoin Layer 1 was difficult and impossible to play. You will find that all users are buying new assets. The previous asset has just finished trading and has stopped rising. Everyone has gone to the next asset to buy new ones. I have been busy all the time, but I don’t know what I am busy with.

Most of the assets that have risen rapidly and have high market values are from three months ago, and it is now difficult to generate new assets. One is because the narrative is not new, the other is because the application scenarios are too limited, and the third is because financial liquidity and leverage are too weak. Therefore, in order to make this ecosystem more prosperous, it is currently necessary to use a virtual machine environment to implement these functions.

Therefore, Bitcoin’s Layer 2 is an actual user demand, not a fantasy demand. In addition, there is also a demand for capital. Since there is no way to invest in Layer 1, it is all Fair Launch, so investors will choose to invest in Layer 2.

The reason why we want to do Layer2 is actually for our community, users, and what we want to do. For example, in the past six months, people have always asked us why we don’t make games based on Bitmap or P2E. This is actually because doing these things requires a virtual machine, which cannot be achieved on Layer 1. All users and the ecosystem are calling for this demand, so we decided three months ago to build a true Bitcoin Native expansion plan.

BlockBeats: What are the differences/advantages between Merlin Chain and other L2s?

Jeff: The biggest feature is that we want to serve the native users of Bitcoin first, and explore native innovations with native users and native assets. We feel that if even the basic market cannot be well served and only serves Ethereum users from the beginning, most of whom are Ethereum users and their assets are ETH and USDT, then this chain can hardly be called the Layer 2 of Bitcoin. Although such chains are still called Bitcoin Layer 2.

Based on this, we collaborated with Particle three months ago to develop a Bitcoin wallet solution. Whether you use Unisat or OKX, any Bitcoin wallet can seamlessly switch between layer one and layer two. This matter has added a lot of construction time and cost, but we feel that this must be done to serve Bitcoin users well.

The second feature is to serve Bitcoin assets, that is, ORDI, SATS, RATS, etc. At present, most of the so-called Bitcoin Layer 2 have Ethereum assets and even BNB Chain assets. We feel that we must let Bitcoin assets and communities use it first, so that we can have the opportunity to further explore what kind of innovations ARC-20 and BRC-420 can have. Instead of using Ethereum and USDT to innovate, that is not innovation.

The third thing is actually a matter of course, which is to embrace the innovation native to Bitcoin. Only by putting Bitcoin's real users, protocols, builders, project parties, and Bitcoin's native assets into a virtual machine can we expect innovation. If it were all about Ethereum, there would be no innovation in Bitcoin.

At present, the total market value of Bitcoin-related assets is only about US$4 billion. Compared with the market value of Bitcoin, there is still a long way to go. We need to embrace these assets and users, and then explore model innovation with them.

The first Launchpad we are going to launch is the People's Launchpad made by Particle, which will follow the BRC-20 protocol and bring some innovations in the issuance of Bitcoin's native assets.

Technically, we feel that EVM compatible is not an innovation, everyone is EVM compatible. Our innovation is to build our own cross-chain bridge, so we can cross-chain any assets we want to cross-chain, such as Bitmap and BRC-420 , ARC-420, currently has no other chain support except ours. The other is that we built ZK Rollup, further compressed the size of ZK proof, and built a DA Layer that inherits the security of Bitcoin. These will be displayed in our GitBook. But in fact, many teams are exploring this direction with us. Things that have not yet been launched can hardly be said to be our own technological innovation.

On the ecological side, we have People's Launchpad, Mineral, Bitmap War, and MOBOX games. We hope to serve more of this existing Bitcoin ecological product, because these communities are active and easy to start, gain traffic and revenue.

Jeff talks about the future prospects of Merlin Chain and Bitcoin ecosystem

BlockBeats: How will the launch method of Merlin Chain be different from other projects?

但是人們的Launchpad會沿著比特幣一層類似的發行方式,可以降低成本,讓持有者變多,還能讓整個發行的過程變得更加更加。其上發行的所有代幣都會採用10萬美元的估值發行。大家可能對於Merlin Chain 的期望很高,覺得應該是億甚至幾十億的市值水平,但我們仍然會拿出一定的捐款,在People's Launchpad 上按照10 萬美元的估值進行公平發射。

我覺得這會是一個重社群、公平、好玩,同時能夠讓使用者以高於成本獲得資產的發行方式。

BlockBeats:Merlin Chain近期會有新消息嗎?未來的路線圖是怎麼樣的?

點燃我們會做一些開發者生態的活動,讓更多的建設者進來,因為我們不希望把以太坊的DApp直接搬進來,用同樣的模式去玩,因此我們投資孵化了很多的原創項目,用比特幣的創建Dapp的方法。其中一個產品可以在二層上接收任何代幣,用於銘刻層的資產,構成跨鏈代打,非常比特幣。

我們今年會激勵做兩期開發者計劃,讓更多的人以比特幣全新的方式去構建,實現更多的用戶、更好的流動性,以及更多創新的產品。

BlockBeats:很多人在說本輪牛市會主要發生在比特幣上,您的想法是怎麼樣的?可以分享一下對於比特幣生態發展的預期嗎?

比特幣的市值佔整個加密貨幣領域的50%以上,如果出現了生息的功能,這個資金體量可以帶來的金融衍生品回報,以及流動性,是其他生態無論創新怎麼都無法實現的。我覺得比特幣資產的生息需求,已經夠撬動牛市了。

比特幣上的新資產的想像空間也很大。多頭市場的時候,ERC-20幣的總市值和ETH本身的市值其實是相近的,而當前比特幣資產的市值還是比特幣的兩百分之一從兩百分之一朝著百分之一百奮鬥的過程,相對於比特幣資產全部漲200倍的過程,我認為可以稱為牛市。這樣的200倍缺口對整個加密市場造成很大的影響,目前其他市場上沒有類似的機會。

BlockBeats:您覺得在比特幣生態的發展中,Merlin Chain 會扮演什麼樣的角色?會如何賦能比特幣的專案和資產?

當生態有了一定的流動性之後,交易量、用戶、DeFi基礎設施逐漸成熟之後,比特幣的持有者甚至巨鯨就有機會使用比特幣單一資產進行生息,從而放大流動性。透過服務原有資產、最初用戶,把交易量做大,由此來反向吸引比特幣,OG們把錢交換來生息理財,實現正向循環,這就是 Merlin Chain 嘗試的事情。