近日,深陷債務糾紛的FTX又傳來新消息。

眾所周知,10月22日的FTX醜聞幾乎點燃了整個媒體和投資圈。然而今年,除了債權人仍在關注其法庭聽證會之外,隨著FTX的各種幕後操作浮出水面,業內其他人士也經常以頗為不屑和評判的態度提及這一機構。

這一消息與債權人密切相關。債權人最近終於得償所願了。在最新的法庭會議上,FTX表示預計將全額支付債權人,資金預計在2024年第二季末之前支付。而壞消息是,賠償金將不會在2024年第二季末支付。時價。另一方面,與先前的口徑不同,FTX表示重啟無望,這也讓FTT持有者難以接受。

從這個意義上來說,這次的新聞就像加密的常態一樣──有人歡喜,有人悲傷。

01

FTX,加密市場不可告人的秘密

在加密圈裡,FTX無疑是絕對的明星公司。 10月22日之前,堪稱加密圈的上層代表。然而10月份之後,它卻變成了加密圈人人喊打的毒瘤。

關於FTX的破產,我這裡不再贅述,只是簡單提一下它的總負債。 2022年11月11日,時任全球第二大加密貨幣平台FTX透過其官方社群媒體帳號宣布,FTX Trading Company、FTX America、Alameda Research以及其他約130家關聯公司已根據美國破產法申請破產。 》第11章在德拉瓦州地方法院啟動自願破產程序。當時《華爾街日報》稱,FTX 的資金缺口約 80 億美元。然而,隨著審判的繼續,索賠總數持續增長,最終索賠數量超過36,000件,索賠總金額約為160億美元。

高額欠款對加密貨幣社群產生深遠影響。事實上,整個2023年,加密市場仍在消化FTX的負面影響。最顯著的價格表現是,比特幣在2023年一度跌至16,000美元,而在FTX破產一年後,做市商的交易量幾乎減半,各交易所的交易量也減少了一半。此外,監管持續收緊、黨派博弈持續深化等外部影響也已顯現。可以相信,FTX在塑造當前加密格局方面發揮了關鍵作用。

Even after the ETF is passed, FTX's debt sell-off still has a greater impact on the price of Bitcoin and other currencies, but as the sell-off progresses, judging from the data, this impact is gradually decreasing. As of January 22, 2024, the FTX institution has liquidated all 22 million shares of GBTC it holds, including approximately 20,000 BTC.

FTX public position data at the end of August 23, source: coingecko

It is precisely because of its far-reaching impact that the restart of FTX has attracted so much attention. Although it has many problems of its own, the key to its difficulty in surviving cash flow is the liquidity environment under the previous macro tightening. As the former second largest transaction Therefore, it once had 9 million customer data, and restarting is not nonsense.

02

The restart of FTX is "crying wolf", and the FTT "meme" is beginning to appear

Discussions about restarting first began in January 2023. At that time, FTX’s newly appointed CEO John J. Ray III stated in a public interview that a special operations group had been established and was open to restarting exchange business, saying that customers were FTX’s technology agrees. Of course, it had been less than three months since FTX went bankrupt at that time, and the news did not cause any splash in the market.

Subsequently, news about the restart continued. Not only have the law firms of the FTX Official Committee of Unsecured Creditors held seminars on the topic of restarting many times, but some creditors have also jumped out and said they are positive about restarting. In FTX’s court hearing documents, you can also see financial statements related to "restarting". detail. However, creditors' optimism was mostly seen by the market as an unwinding operation. At that time, the leakage of more details about FTX once again deepened the impression that it was fraudulent and disrespectful to investors, and the market was still highly skeptical of its restart.

The reversal came from the April court hearing. In the early morning of April 12, Andy Dietderich, a lawyer from FTX’s attorney firm Sullivan Cromwell, stated at a court hearing in Delaware that FTX had recovered US$7.3 billion in assets, including US$2 billion in cash and US$4.3 billion in assets. Cryptocurrencies, $300 million in securities, $600 million in investments receivable, etc. It also mentioned in court for the first time that FTX is considering reopening exchange operations at some point in the future, and FTX's creditors are expected to convert their claims into shares in the reopened exchange.

As mentioned before, the market rumored that FTX had a funding gap of US$8 billion, and it had recovered US$7.3 billion in April, which undoubtedly injected a boost into the market. Affected by this news, FTT rose rapidly, reaching a maximum of 3 USDT that day, an increase of more than 90%.

Due to FTX’s previous high-profile moments, some investors firmly believe that it can start over. In this context, the restructuring of FTX is undoubtedly a huge benefit to the platform currency FTT, and its once glorious historical price has filled the imagination of investors. Since then, restart has become a key word for FTT holders. As long as the news of restart comes out, FTT will show a rising trend. FTT’s meme nature is beginning to appear, and FTX has lived up to expectations, with good news coming one after another.

In May, John J. Ray III confirmed the FTX 2.0 plan and put the restart on the timeline; in June, a list of court documents showed that many companies including Nasdaq, Ripple, BlackRock, etc. had objections to FTX 2.0. There is intention to restart. Then on October 25, Bloomberg reported that FTX was negotiating with three undisclosed bidders to restart its trading platform.

People familiar with the matter stated that FTX, which has 9 million customers, received attention from more than 75 institutions during the auction process, but after multiple rounds of negotiations and considerations, three potential buyers finally stood out. The three are Bullish, a cryptocurrency exchange owned by Block.one that hired former New York Stock Exchange President Tom Farley to run, Figure Technologies, a financial technology startup, and Proof, a crypto venture capital firm that participated in the bankruptcy acquisition of Celsius and invested in Aptos and Sui. Group. The acquisition offer will be submitted to the Bankruptcy Court of Delaware for review and will be finalized in mid-December 2023.

On November 9, Gary Gensler, chairman of the U.S. Securities and Exchange Commission (SEC), publicly stated that it is possible to restart FTX within the legal framework. Stimulated by a series of positive news, FTT quickly rose by 40% within one hour that day. After the acquirer was disclosed, off-site users were also ready to move. At that time, community sources said that FTX might pay a 50% discount (50%) from the price on the day it filed for bankruptcy on November 11, and would need to pay a handling fee of about 5%.

Supported by various news, the price of FTT continued to remain above US$2. Even the news of the liquidation of the Bahamas entities in December was regarded by investors as a precursor to restart. On December 11, FTT rose to a maximum of US$5.54.

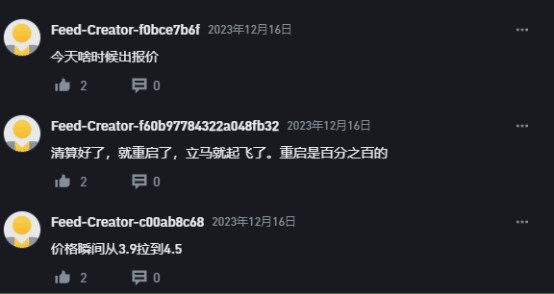

Some communities are confident about restarting, source: Binance Square

Some communities are confident about restarting, source: Binance Square

03

The dream of restarting is broken, but creditors have good news

But FTT’s beautiful dream ultimately had no choice but to stop.

In the latest court documents released on January 28, the documents showed that FTX’s compensation was in the second quarter of 2024, but it was not yet able to fully repay all losses to creditors. There are still some cryptocurrencies that have not yet been liquidated and are waiting or being processed. In liquidation.

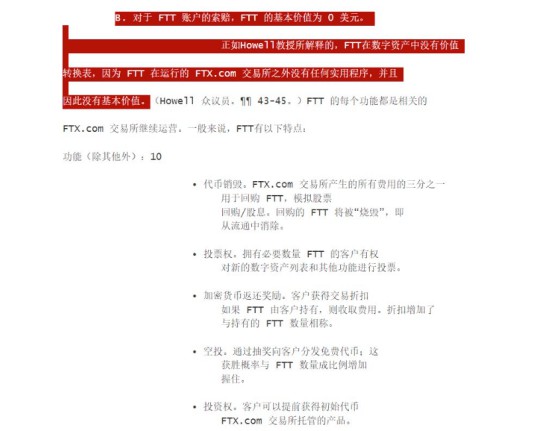

It is worth noting that the recovery of FTT is clearly described in the document, indicating that the basic value of FTT is zero. The court held that FTT is merely a utility token that has no value outside of an operating exchange that does not currently exist, and that any current market price for FTT is speculative. In other words, FTT is an air currency, and there will be no FTX exchange using FTT as the platform currency in the future. Even if FTX is restarted as a 2.0 platform, FTT will not have anything to do with it. In fact, from the perspective of U.S. regulatory requirements, compliant exchanges should not issue coins, which is why Coinbase chose the capital route of listing.

FTX court hearing document record, source @Phyrex_Ni

More cruel news followed. On January 31, at the latest court hearing, FTX lawyer Andrew Dietderich stated that FTX did not intend to relaunch the platform. The companies that the platform spent hundreds of millions of dollars to acquire proved to be of no practical use. Value, not many interested buyers. He also said that although FTX has a large number of customer resources, the team is still unable to find investors willing to invest huge amounts of money to restart the exchange.

Hit by the news that there was no hope of restarting, FTT suffered a heavy setback, once falling to $1.65 and now trading at $1.73, a drop of 37.44% in 7 days.

FTT price drops rapidly, source: Binance

But unlike the sad mood of FTT holders, there is good news for creditors’ claims.

As the crypto market continues to rise in recent months, FTX stated that it expects to have sufficient funds to fully pay all approved customer and creditor claims, based on the value of the Top 10 position assets previously announced by FTX, as of February 1 , this part of the recovered assets has exceeded 7.83 billion US dollars.

Of course, although the assets are sufficient to compensate, it is clear that creditor compensation will not be based on the highest market value, but will be based on the value on the filing date of the claim, which is concentrated around November 22. For example, when FTX declared bankruptcy, most currencies had already experienced huge depreciation. BTC was quoted at approximately US$16,000. However, today, BTC has reached US$43,000. Creditors obviously cannot compensate at the highest price, but can only compensate at the highest price. The price submitted for recovery will be the basis. In addition, the compensation will be based on US dollars. U.S. Bankruptcy Judge John Dorsey ruled that the size of each claim will be based on the amount owed to customers or creditors on the date FTX filed for bankruptcy.

The currency standard has changed to the US dollar standard. Naturally, some creditors are dissatisfied with this compensation method. But at least it is precisely because of the improvement of the current market that FTX is able to obtain sufficient capital appreciation to compensate for debts incurred in the bear market. Even if the compensation is not the highest amount, it is undoubtedly a blessing in misfortune for creditors. However, according to lawyers, full compensation is not a guarantee, but only a goal. Whether compensation can be paid still depends on the specific circumstances.

Looking back at SBF, which has already been imprisoned, it may only last for another 3 months, but the outcome will be different. However, it is difficult to pause time, and it is difficult to repeat the world. The market will eventually respond to investments that do not respect users and do not follow objective laws. The person dropped the hammer. Just recently, the flow of $400 million in cryptocurrency on the day FTX declared bankruptcy was also discovered. The thief was a large-scale SIM card criminal gang, not SBF as everyone had guessed. Adding the news of FTX's settlement, we don't know what we are facing. How would SBF feel about the 115-year sentence.

As for FTT? The hype should come to an end, because whether it is restarted or not, the currency has been declared worthless, let alone it is certain that it will not be restarted. But in the end, FTT may not return to zero, but remain as a meme symbol. After all, in the encryption market, everyone can meme, and animal coins can be rampant. And wouldn’t the legendary FTT be more in line with the standard?