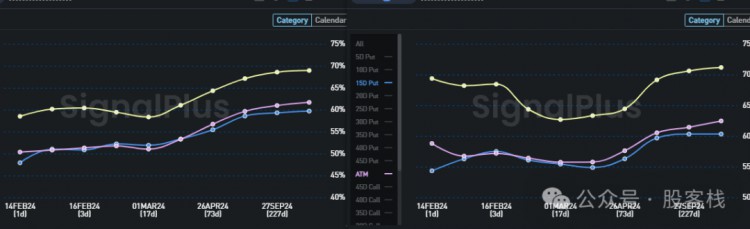

比特幣昨天很棒。 一波突破前高,特別是在美國股市開盤前的晚間。 一大波大額交易震驚了我,我的身家被抹掉了好幾個點。 幸運的是,今天早上織女星表面很正常。 只是遺憾昨天的存款不夠。 (右邊兩塊蛋糕上的選擇權還是有回報需求的,資金較多的可以投資)

從大宗來看,6月底的幾家OTM迅速成交了數百手,總數達到數千手。 直接將june的織女星提升到位。 這裡請注意,因為是假期,盤口的遠程流動性其實很差。 六月幾乎是最好的。 SEP在高峰期幾乎不開訂單。 OTC散貨估計比較難。

受此消息鼓舞,美股開盤後ETF也瘋狂湧入,直接衝擊了總計5萬隻,不少圈內朋友一起合照。

回想起去年這個時候和朋友們一起吃飯的時候,大家對經濟充滿信心,但對大局卻垂頭喪氣。 今年,情況將出現180度大轉變。

那些認為自己可以超越他人的人實際上被超越了。 這就是市場的鐵拳。 時代面前,個人的選擇永遠大於努力。

因為我們的策略主要是反曆的(這個策略我平時不怎麼講,線下課會重點講),它實際上有效地對沖了短期伽馬風險,將風險主要集中在了這個點上。最好的遠程流動性。 ,所以在這種大規模上漲的過程中,會出現一定的波動。 這也在我們的預估範圍內。 為了應對極端暴漲,減輕交易所給我們的保證金壓力,我們中期還安排了反比例做多一些尾部伽馬,希望能實現暴富。 。 。

標題是我們只想談談券商和交易所近年來的結構化產品。 最受歡迎的肯定是前段時間全國熱議的雪球結構產品。 很多人都談到了這個產品的缺陷,我就不贅述了。 我想說的是,如果CEX的結構化產品想要突破,那一定是

1比傳統金融更有彈性(畢竟這是銀行和澳門的綜合體)

2.流動性方面不要輸給 DeFi 太多(你去澳門買理財上不了檯面?)

3.講解必須考慮理財用戶的理解能力(Shark Fin和DNT是用戶容易理解的結構,所以複雜度頂多比這兩個產品高一點點)

The first point is that dual currencies in some places have enabled flexible redemption, dynamic quotations, etc., but these are far from enough. Because the first one is just the reason why this kind of product can be sold, and it is far from an explosion. What is an explosion is that your product is so good that users rush in from other markets in exchange for money just to buy your product. It's an explosion.

For example, even if my dual-currency asset is SELL PUT, since the guarantee is the currency corresponding to the delivery, why can’t the number of the delivered coins be used as a currency-based margin to purchase other corresponding structured products as collateral for structuring? Will the rate of return go up directly with such a set? If the delivery is not successful, I should be left with a bunch of Us. Can I package the interest from the excess U periods into a regular product and calculate the actual occupation ratio here? Although these two ratios are dynamic during product operation, this calculation method allows users to treat dual currency as their own asset package instead of a locked safe.

It is understandable that CEX actively reduces leverage, but any behavior that locks in user liquidity without giving users benefits (allowing users to take risks) is against the trend.

As for the explanation ability of the product, the reason why new products have not broken the circle at present is that the design is still based on the one-on-one professional sales method of investment banks back then, without considering that simplicity is the core, so what everyone sees is nothing more than Wall Street sales. If a product that has been purchased once is renamed and sold, it is inevitable that it will not be popular.

If I were designing something structured, I would consider the following directions:

A Two-way dual currency, but the unfavorable direction adds protection to lock in the maximum loss, and the dual currency supports automatic reinvestment

B All structured products can be PLUS secondary purchased. His exposure corresponds to new structured products that can be hedged. Can it be understood as the DLC of the game?

Part C structuring can access margins that count as part of the type of transaction

D: Guaranteed ETF + certain delta income, settled monthly, users can continue to invest. (for traditional funds)

E The user's deterministic income can be used to purchase assets in advance (equivalent to giving the user the option of shark fin income. If you want LONG's original target, you can also go to long alt to be more powerful)

F The bull-bear market spread U standard is a structured product that is very suitable for packaging to users, because the odds are determined when opening a position, and the profit stop point can be set in advance

I'm just talking nonsense, I'm a pure layman. If any broker uses the above idea, you'd better treat me to a meal, I can help you, hahaha

感謝您的觀看,請給我一個讚