The AI agent economy is here, and here are seven areas they are increasingly dominating.

In the field of decentralized finance (DeFi), the activity of AI agents (or bots as you might call them) is gradually increasing.

Current trends have evolved to the point where many are starting to believe that AI agents are expected to become the core of the cryptocurrency user base within the next few years. Remember that goal we always mentioned, attracting a billion new users? As AI protocols emerge, it is likely that these billion users are actually AI agents.

This article will explore the growing influence of AI agents in the DeFi space, provide insight into the diverse roles they play in the ecosystem, and identify key protocols that may accelerate their growth.

Let’s find out!

AI agents are becoming the future dominant force in DeFi

Vitalik’s recent blog post on cryptocurrencies and AI sparked widespread interest in the AI field. However, if you follow technology trends carefully, you may have noticed a specific application scenario mentioned by Vitalik: the role of AI in games.

AI plays an integral role in the “game” of DeFi. Here are seven of their most compelling use cases:

1.MEV Arbitrage Robot

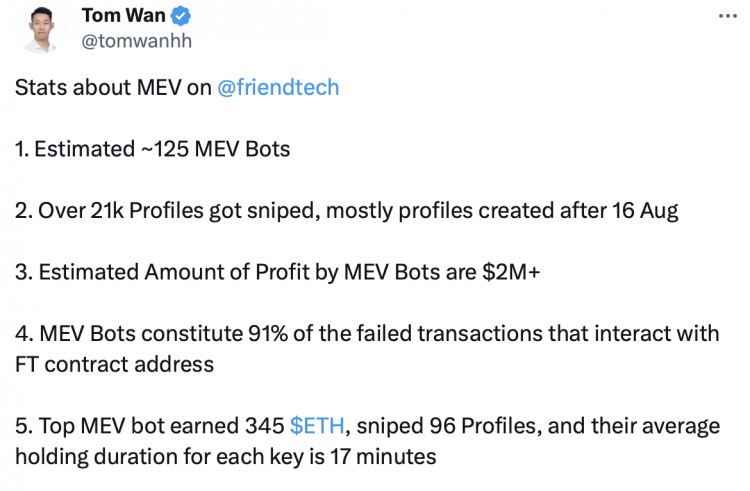

These bots focus on exploiting arbitrage opportunities created by the order of transactions within the blockchain. For example, Jaredfromsubway.eth is a MEV bot that has become one of the largest entities on Ethereum by trading volume, with activity comparable to large exchanges like Binance.

MEV bots are one of the most active participants on the chain. From flash sale NFT issuance to trading emerging tokens, there are users competing directly with these MEV bots in every corner of the ecosystem you can see.

A real life example is when a friend of mine deposited 5 ETH to his friend.tech wallet, the bot detected the deposit within seconds and started making potentially profitable trades against his account, This causes the account value to rise sharply first and then drop rapidly (as the bot quickly discovers there is no profit to be made). The speed of this series of actions is unmatched by ordinary users.

The MEV bot is estimated to have made $2 million from key snatching on Friend.tech alone.

2.Telegram robot

These trading bots can perform a range of operations related to crypto asset trading, providing users with the convenience of easily trading any token on Telegram, including your favorite meme coins. For example, TG bots like Unibot and Banana Gun are generating astonishing trading volumes.

3. Market Maker Robot

These bots provide liquidity to the on-chain market, doing so by placing buy and sell orders or becoming a provider in a liquidity pool. They use algorithms to determine the optimal price point for orders, with the goal of profiting from the bid-ask spread while maintaining the efficient functioning of the market. For example, things like market maker bots and “intention bridging” on Uniswap.

4. Robots in the game

Bots are quite common in traditional games as non-player characters (NPCs) and opponents (such as FIFA). However, in the blockchain game, bots are just starting to come into their own. One striking example is Parallel's Colony, a game in which an AI-powered Avatar has its own wallet and interacts with other Avatars.

5. Bots in social applications

Frenrug is an on-chain AI agent built using Ritualnet that is able to communicate with users in an application and buy or sell users’ keys based on interactions with them. It behaves like an NPC in the game, but doesn't just move around aimlessly. These bots make the in-app experience more interactive by adding the ability to execute on-chain transactions.

6. Predictive analytics robots

These AI bots use historical data and market signals to predict market trends and price movements. Sometimes they are also used in conjunction with trading bots to perform buying and selling operations based on their analysis. For example, Subnet 8 (prediction subnet) on Numerai and Bittensor.

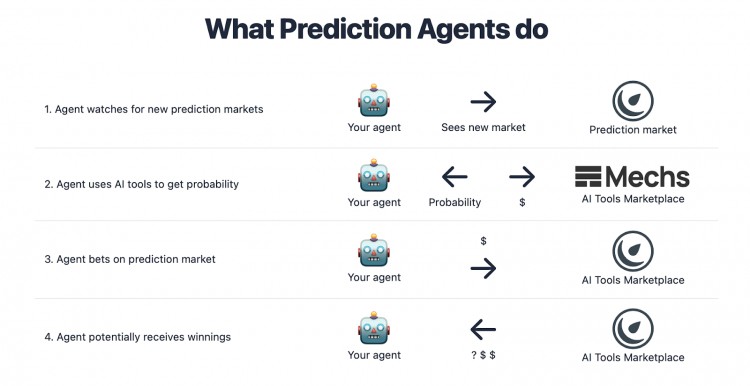

7. AI agents in prediction markets

Omen, mentioned by Vitalik in his blog, is a prediction market platform where different AI agents (market creation agents, AI machines, and trading agents) collaborate. They create, analyze and trade in markets for events such as politics, sports, asset prices and more, similar to Polymarket, but with AI participants.

After exploring the different types of AI agents in the ecosystem, let’s now look at some of the key protocols that are laying the foundation for the AI agent revolution:

️ Request

Website | Twitter

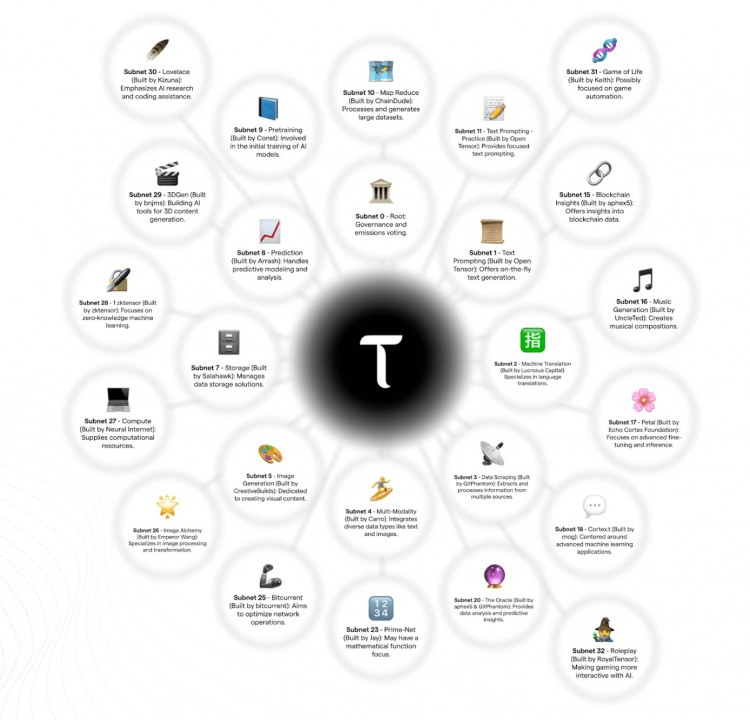

Bittensor creates a dynamic and open market that combines multiple machine learning models to form an interconnected machine intelligence neural network. This network of machine learning models can be leveraged by other participants in the network by building subnetworks. These subnets are specialized protocols that provide AI support for different use cases.

Currently, the Bittensor ecosystem has 32 subnets, each of which can be seen as an active market for AI agents. These agents are called subnet miners in the Bittensor ecosystem, and they participate in and solve ongoing incentive-based competitions. question. For example, in the “prediction subnet” Subnet 8, subnet miners compete to predict future price movements in financial markets such as Bitcoin.

️ Autonol

Website | Twitter

The Autonolas stack makes it possible to develop crypto-native autonomous services that can run continuously and perform operations autonomously. These agent services operate as multi-agent systems (MAS), where multiple AI agents cooperate to perform complex tasks.

For example, an AI agent that predicts markets can be built on Autonolas, called a “predictive agent.” This agent can be programmed with customized data analysis strategies, assist in the decision-making process, and actively participate in prediction markets.

AI agents built on Autonolas are already making headway in DeFi. A recent blog highlighted that over 9% of all Safe transactions on the Gnosis chain can be attributed to autonomous services running on the Olas network. By 2024, things were even more impressive – on many days, AI agents’ participation in Safe transactions on Gnosis Chain exceeded 75%. The high participation rate of AI agents on Gnosis Chain is a surprising detail that many people have not yet noticed. One popular use for them on the chain is as automatic signers for Safe multisig transactions.

DAIN (Decentralized Autonomous Infrastructure Network)

Website | Twitter

DAIN is a global network of AI agents designed to facilitate transactions, interactions, and collaboration. This is achieved through DAIN’s API, which provides a standardized framework for communication and collaboration between AI agents to perform complex operations.

While DAIN’s website is currently still under development, AI agents are already starting to be built on top of its stack. Take Asset Shield, for example, a DAIN-powered project that deploys AI agents as automated signers on multi-signature setups, thereby enhancing security.

Here’s how it works: An AI agent becomes one of the multisig members on Squads and programmatically approves or rejects transactions based on preset rules. For example, an AI agent might automatically block any transactions over a certain amount, or flag those that look suspicious. Users can set criteria for what is considered suspicious, which may be similar to the logic Rabby Wallet uses to alert users to suspicious transactions—for example, when a user transacts with a new website, the user will be prompted to think twice before confirming.

Conclusion

The AI agent economy has arrived. The impact of AI on the cryptocurrency space is no longer a distant possibility, it is becoming a reality.

As the underlying AI protocols continue to mature, it will become easier to develop complex AI agents and their application in various scenarios. All signs point to AI agents being a unique catalyst for this bull market.

Once AI agents become the future dominant force in the cryptocurrency space, we can expect the interactions, transactions, and collaborations between them to grow exponentially. This growth will require massive amounts of computing power and storage capacity. To meet these needs, the industry may turn to decentralized physical infrastructure network (dePIN) projects. Projects such as Akash, Filecoin, GenesysGo, io.net, Render, and Grass are at the intersection of AI and resources such as compute, storage, and bandwidth and may play a key role in meeting the growing needs of AI agents.