在經歷了 2022 年加密貨幣寒冬和 2023 年經濟低迷之後,2024 年比特幣減半時間表變得至關重要。透過限制比特幣的創造,它逐漸限制了比特幣的供應,類似於黃金的稀缺性。

比特幣的總供應量上限為 2,100 萬枚,已開採略多於 1,900 萬枚。這使得剩下的比特幣數量接近 200 萬個。以下是 2024 年 4 月比特幣減半的預期。

冬天過去了嗎?

比特幣在 2023 年經歷了大幅上漲,全年漲幅約為 152%。這次飆升是在 2022 年經歷了一段動盪時期之後發生的,在此期間,比特幣在 2021 年創下歷史新高後,面臨著著名項目崩潰、流動性問題和幾起引人注目的破產等挑戰。

最近加密貨幣價格的上漲使企業擺脫了停滯狀態,促使礦業公司在比特幣減半事件之前加速獲利。隨著下一次減半的臨近,生產比特幣的獎勵將減半,促使礦工爭先恐後地尋求利潤。

它是如何運作的?

比特幣挖礦涉及使用計算工作驗證新交易並將其添加到區塊中的獎勵過程。礦工確保區塊鏈帳本的一致性、貨幣性和不變性,並獲得新創建的代幣作為回報。

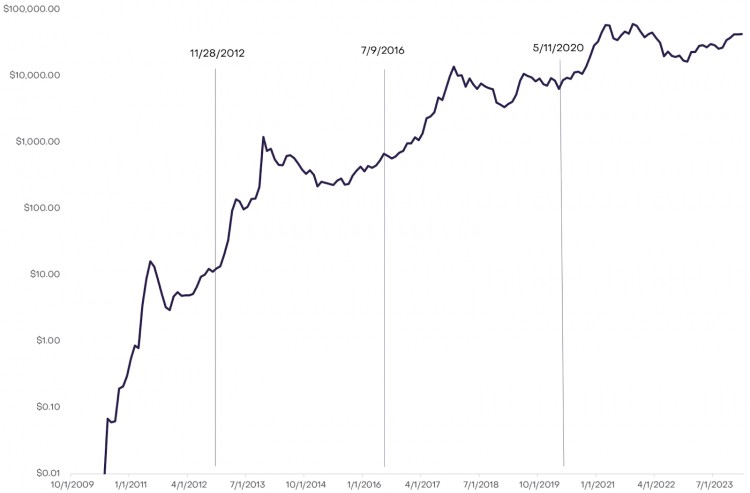

比特幣於 2009 年問世,為礦工提供了每個區塊 50 比特幣的獎勵。 2012 年 11 月,比特幣減半至每個區塊 25 個比特幣,稱為第二個獎勵時代。比特幣每 210,000 個區塊就會減半,從而將提供給礦工的獎勵減少一半。這些事件被編程為管理比特幣的供需動態,與其預先編程的功能一致。

獎勵減少帶來了財務挑戰,特別是對於那些嚴重依賴挖礦收入的人來說。比特幣的固定供應加劇了這個問題,如果獎勵減少而交易費用或比特幣價值沒有相應增加,則可能導致破產。此外,挖礦競爭的加劇造成了稀缺性,並推高了比特幣價格,但挖礦利潤卻降低了。

礦工兌現

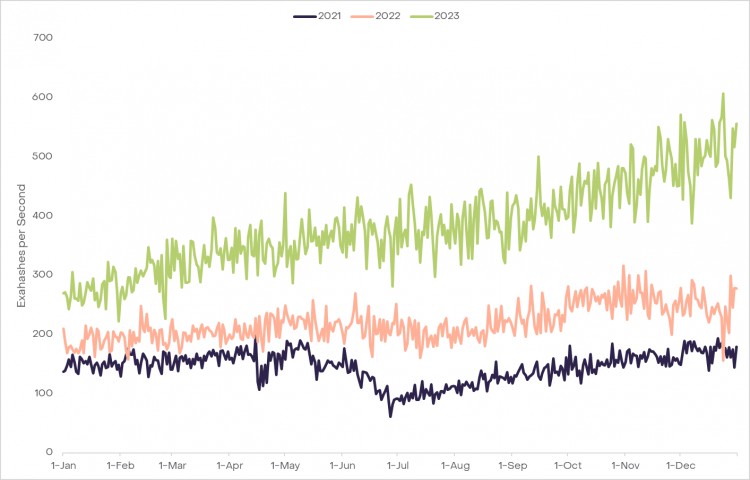

比特幣的哈希率(衡量挖礦所需的運算能力)已飆升至歷史最高水準。這表明礦工正在利用越來越重要的資源來解決複雜的數學難題並賺取比特幣。

算力的歷史數據表明,礦商往往會增加資本支出,以在減半之前保持競爭力。這種比特幣熱潮導致活動前幾個月的挖礦難度增加。因此,無法跟上更高生產成本的礦商被迫退出市場。

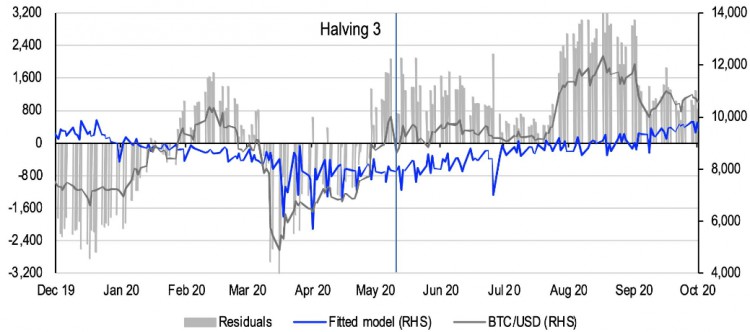

According to Grayscale, in Q4, 2023, there was a noticeable trend of miners selling their Bitcoin holdings on-chain, likely to build liquidity ahead of the reduction in block rewards. These measures suggest that Bitcoin miners are well-equipped to handle the upcoming challenges, at least in the short term.

Even if some miners exit the market, the resulting decrease in hashrate could lead to adjustments in mining difficulty, potentially reducing the cost per coin for remaining miners and maintaining the network's stability.

Historically, Bitcoin prices have surged following halving events. After the first halving in 2012, the price skyrocketed from $12 to $126 within six months. Similarly, following the second halving in 2016, Bitcoin's price surged from $654 to $1,000 within seven months. In 2020, after the third halving, the price surged from $8,570 to $18,040 in the same time period.

While initial apprehension may prompt some investors to sell off their Bitcoin holdings, renewed interest in the currency is expected to follow. The law of supply and demand will likely stabilize the market, potentially leading to a rebound in Bitcoin prices after an initial drop.

A recentstudyby Coinbase highlights the rising institutional interest in crypto assets, signaling a shift toward more mature market behavior. This trend is characterized by decreasing volatility and a rising inclination toward sophisticated investment strategies. This transition signifies a new era in crypto investment, with institutional players moving beyond mere speculation toward adopting strategic, long-term positions.

As Grayscale points out, the upcoming Bitcoin halving in April 2024 is anticipated to differ significantly from previous events due to increased on-chain activity and positive market updates. Factors shaping this event include:

Miners' proactive measures to raise funds, such as equity offerings and reserve sales, may help offset revenue challenges.

Potential adjustments in mining difficulty, driven by changes in hashrate, could benefit remaining miners by reducing production costs.

The rise of Inscriptions has boosted on-chain activity, with millions of token collectibles generating substantial transaction fees for miners.

Inscription activity offers a new avenue to maintain network security through increased transaction fees as block rewards decrease.

The ongoing adoption of Bitcoin ETFs may absorb selling pressure and positively impact Bitcoin's market structure by providing a stable demand source.

The latter might be a significant factor. U.S. spot Bitcoin ETFs have quickly absorbed significant investment, with initial net flows totaling about $1.5 billion in the first 15 trading days. These inflows, equivalent to three months' worth of potential post-halving sell pressure, hint at the potential for mainstream adoption.

Angel investor Anthony Pompliano suggested that the recent milestone of $50,000 for Bitcoin is not its ultimate peak because of Wall Street interest. He suggested that as Bitcoin continues to climb, individual holders will begin to sell their BTC, leading to increased demand from Wall Street funds eager to capitalize on the cryptocurrency's upward trajectory.

Cryptocurrency analyst Benjamin Cowen elaborated that the early halving-year pattern for Bitcoin typically sees it hitting the bull market support band (comprising the 20-week SMA and 21-week EMA) in January or February of the halving year.

#Bitcoin early halving year pattern -Bitcoin has always gone to the bull market support band (20W SMA and 21W EMA) in Jan/Feb of the halving year.Will this time be different? pic.twitter.com/SgE2PjtCZ9

— Benjamin Cowen (@intocryptoverse) January 17, 2024

Bitcoin has defied bearish market conditions, showcasing remarkable resilience and evolution over the past year. Despite challenges, it has surged in on-chain activity, strengthened its market structure and emphasized its scarcity, challenging outdated perceptions and emerging stronger than ever.

$BTC #BTC #Write2Earn #TrendingTopic #Halving