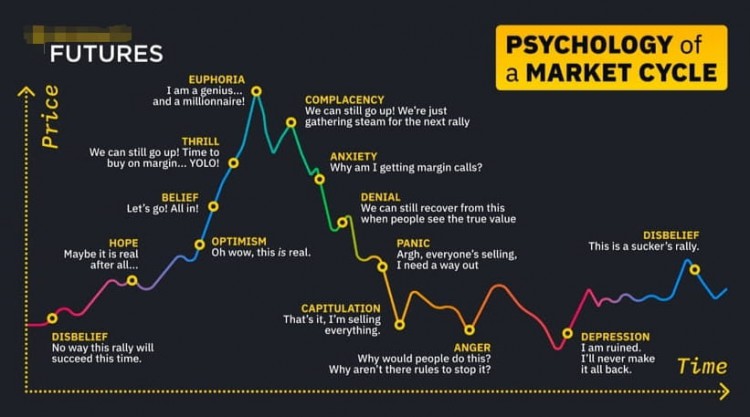

Analysis of the six stages of the bull market: Revealing the trajectory of market sentiment! The first stage: Don’t believe it will riseInvestors are generally disappointed with the market prospects, are not optimistic about future development, and remain skeptical of the upward trend. The second stage: I believe it will make up for the decline.There are certain fluctuations in the market, and investors believe that the rise is short-lived and will fall back at any time, and there is an expectation that the market will make up for the decline. The third stage: rising to the point of disbeliefThe market is rising rapidly, and investors are beginning to be surprised, but there is still a sense of disbelief that the market will continue. The fourth stage: rise to the point where you are willing to believe itAs the market continues to rise, investors gradually accept and believe in the market and begin to actively participate, forming an optimistic mood. The fifth stage: Don’t believe it if it doesn’t riseThe market enters sideways or short-term correction, and investors begin to doubt whether the market can rise again and take a wait-and-see attitude. Stage 6: Don’t believe it will fallThe market has entered a period of frenzy, and investors are overly optimistic about the market and generally believe that a large-scale decline will not occur. Market sentiment trajectory:Coming out of desperation: During a market downturn, sentiment reaches rock bottom and investors become pessimistic about the future.Expanding amid doubts: As the market fluctuates, investors gradually begin to question and start thinking about the market at this stage.Rising amid hesitation: The market gradually rises, and investors gradually participate in the market amid hesitation, forming an upward momentum.Ending in a mania: The market reaches a mania stage and investor sentiment is overly optimistic, marking the end of a bull market. Investment strategy:Grasp the rhythm: Understand changes in market sentiment, flexibly adjust investment strategies, and grasp the rhythm of the market.Risk management: Be aware of risks during market mania, adopt appropriate risk management strategies, and avoid over-optimism.Long-term planning: Make long-term plans based on changes in market sentiment, treat market fluctuations rationally, and avoid blindly following the trend. Pay attention to market sentiment and accurately judge market trends!