Mandarin version for boys download mp3

Female Mandarin version download mp3

Cantonese version download mp3

Southwest dialect version download mp3

Northeastern dialect version download mp3

Shanghai dialect version download mp3

Today's picks

U.S. seasonally adjusted non-farm employment hits new low since November 2023

ECB Governing Council member Simkus: A rate cut in June is very likely

Bitcoin once again reaches the $70,000 mark per coin

Sources say Bank of Japan is leaning toward ending negative interest rate policy in March

Sales of some gold shops in Dubai’s “Golden Street” have been halved

National Bureau of Statistics: CPI month-on-month increase expands

Ministry of Industry and Information Technology: Build 5G, computing power and other information facilities appropriately ahead of schedule

World Gold Council: Continued outflows from gold ETFs have little impact on gold prices

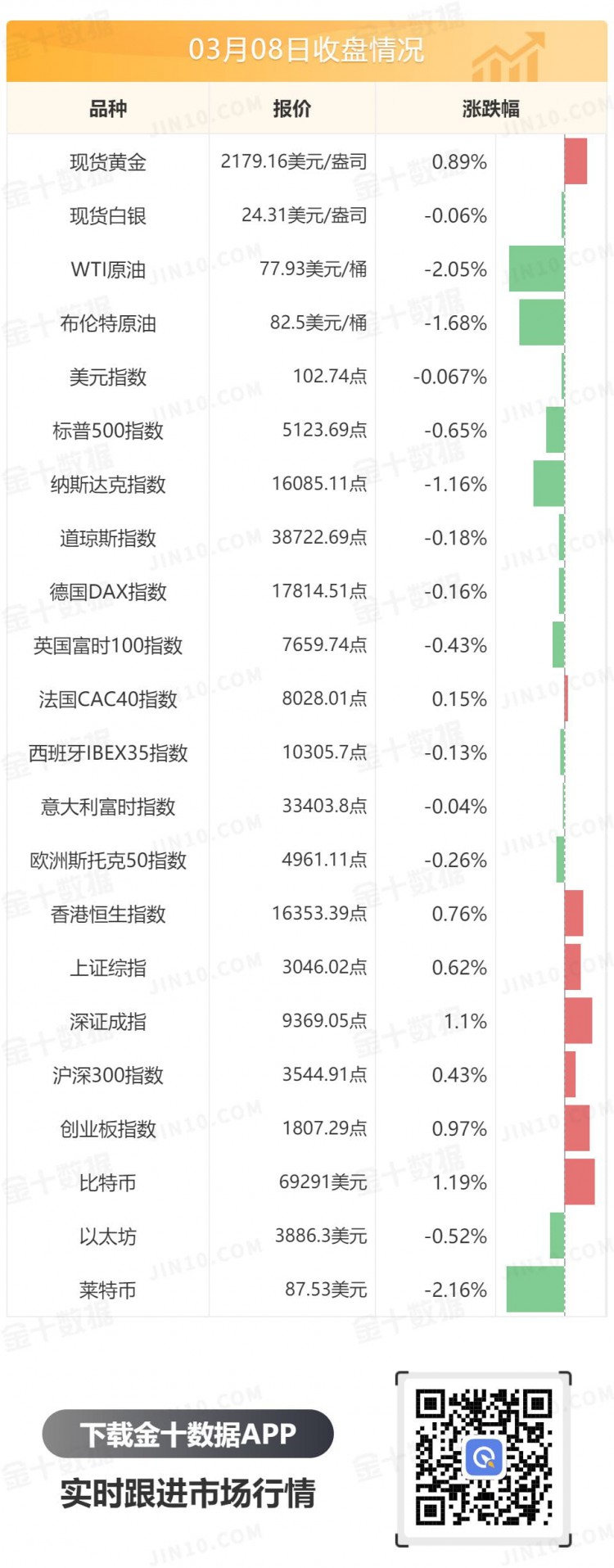

Market inventory

Last Friday, the U.S. dollar index remained range-bound in Asia and Europe. Later, due to the unexpected increase in the U.S. unemployment rate in February, the U.S. dollar index plunged sharply. However, it rebounded under the support of higher-than-expected non-farm payroll data. In the end, It closed down 0.067% at 102.74. U.S. bond yields fluctuated and consolidated, with the benchmark 10-year U.S. bond yield finally closing at 4.0769%; the interest rate-sensitive 2-year U.S. bond yield finally closing at 4.4777%.

Bitcoin once again stands above the $70,000 mark. Ethereum once approached US$4,000 per coin;

Affected by the trend of the U.S. dollar index, spot gold rose sharply in the U.S., once reaching the 2195 mark, but failed to stabilize. It finally closed up 0.89% at $2179.16 per ounce; spot silver closed almost flat, and finally closed down 0.06 %, reported at $24.31 per ounce.

International oil prices fell as continued concerns about demand offset the positive news. WTI crude oil closed down 2.05% to US$77.93 per barrel; Brent crude oil closed down 1.68% to US$82.50 per barrel.

All three major U.S. stock indexes fell. The Dow closed down 0.18%, the S&P 500 fell 0.65%, and the Nasdaq fell 1.16%. Nvidia (NVDA.O) fell 5.5%, halting its seventh consecutive rise. The blockchain sector continued its gains, with Marathon Digital (MARA.O) rising 7.71%, MicroStrategy (MSTR.O) rising 9.66%, and Coinbase (COIN.O) rising 5.77%.

Major European stock indexes generally closed lower, with Germany's DAX30 index closing down 0.16%; Britain's FTSE 100 index closing down 0.43%; and the European Stoxx 50 index closing down 0.26%.

The Hong Kong stock Hang Seng Index opened higher and fluctuated in a range. It continued to rise in the afternoon and then fell back slightly. The overall market showed a trend of rising more than falling. As of the close, the Hang Seng Index closed up 0.76%, with a cumulative decline of 1.42% last week; the Hang Seng Technology Index rose 0.78%. , fell 2.94% last week; the Hang Seng Index's trading volume was reported at HK$86.688 billion. On the market, oil and gas producers and shipping concepts were among the top gainers, while the biotechnology sector rebounded and rose; among technology stocks, Weibo (09898.HK) rose by more than 5%, BYD Electronics (00285.HK) rose by more than 3%; Youbi ( 09880.HK) rose by more than 10% at the opening in early trading, but fell by more than 12% by the close.

The three major A-share indexes collectively rose. As of the close, the Shanghai Stock Exchange Index rose 0.62%, the Shenzhen Stock Exchange Component Index rose 1.1%, and the ChiNext Index rose 0.97%. On the market, chip stocks rose sharply, with Tongfu Microelectronics, Guangxun Technology and other stocks hitting their daily limit; consumer electronics concepts strengthened, with Shengyi Electronics, Jingyan Technology and other stocks rising by 20%; in addition, BC batteries, liquid-cooled servers and other concepts as well as ships , media and entertainment, electricity and other sectors were among the top gainers; concepts such as pork, duty-free and tourism, coal, brewing and other sectors weakened. The total transaction volume of the two cities is approximately 860 billion yuan.

international news

1. The seasonally adjusted non-farm payrolls in the United States increased by 275,000 in February, the lowest level since November 2023. The U.S. unemployment rate rose to 3.9% in February, the highest level since January 2022. The swaps market is fully pricing in a 25 basis point interest rate cut by the Federal Reserve in June.

2. ECB Governing Council member Simkus: A rate cut in June is very likely; sources said that ECB policymakers unanimously support the first rate cut in June.

3. The U.S. Senate passed a government funding bill to avoid a partial government shutdown, and the bill was submitted to Biden for signature.

4. Bill Ackman, founder and CEO of Pershing Square Capital Management, is considering buying Bitcoin, boldly predicting that the price of Bitcoin could soar to much higher levels than anyone imagined.

5. Sources said the Bank of Japan is leaning towards ending its negative interest rate policy in March. Japanese media: The Bank of Japan is considering canceling the yield curve control plan and switching the new target to bond purchase volume, which will be decided at the March meeting.

6. The Bank of Japan’s ETF book floating profit hit a new high, reaching 34 trillion yen.

7. The U.S. Central Command said it shot down 15 Houthi armed drones; the Houthi armed forces in Yemen sent 37 drones to attack multiple U.S. warships.

8. German Defense Minister: The German Defense Forces budget gap in 2025 is 4.5 to 6 billion euros.

9. The United States evacuated some staff of its embassy in Haiti.

10. Asif Ali Zardari was elected as the new President of Pakistan.

11. Standard & Poor's downgraded Ukraine's long-term foreign currency credit rating to CC.

12. Saudi Aramco’s full-year net profit in 2023 fell 24.7% year-on-year to US$121 billion, but it is still the second-highest net profit in history.

13. US media: ChatGPT consumes more than 500,000 kilowatt hours of electricity per day, more than 17,000 times that of an average American household.

14. World Gold Council: The cumulative outflow of global gold ETFs since 2024 is approximately US$5.7 billion. The continued outflow has almost no negative impact on gold prices.

15. The sales of some gold shops in Dubai’s “Golden Street” have been cut in half, and the soaring gold prices have discouraged Dubai’s “rich”.

16. It is reported that Reddit plans to issue 22 million shares at a price of US$31 to US$34 per share; it is said that it is preparing to submit a revised IPO application to the US Securities and Exchange Commission. The IPO is reported to raise up to US$748 million. The company reportedly hopes to achieve a valuation of up to $6.5 billion through the listing.

17. The Pentagon released a UFO report: No evidence of alien technology was found.

18. The opening ceremony of the Paris Olympic Games is scheduled for 19:30 on July 26.

19. United Airlines passenger planes have frequent problems, with four accidents in one week.

20. Daylight saving time begins in North America.

domestic news

1. National Bureau of Statistics: In February, CPI recorded a month-on-month increase of 1%, an increase of 0.7% from the previous month, and a year-on-year increase of 0.7% from a decrease of 0.8%.

2. The work report of the Standing Committee of the National People's Congress proposed that in 2024, in order to accelerate the construction of a new development pattern and comprehensively deepen reforms, the Rural Collective Economic Organization Law, the Private Economy Promotion Law, etc. will be formulated, and the Mineral Resources Law, the Enterprise Bankruptcy Law, and the Anti-Unfair Competition Law will be revised. Law etc.

3. The central bank: It will continue to improve the financial market structure and product system, and enhance the stability of the financial market and the efficiency of monetary policy transmission.

4. Shanghai issued the "Implementation Plan for Promoting the Quality and Expansion of Service Consumption in the City": creating integrated demonstration application scenarios such as artificial intelligence large models, metaverse, and blockchain; encouraging enterprises to focus on "5G+", "VR+", "AI+" Increase investment in research and development in areas such as "Beidou+".

5. Caixin: The State Council issued Document No. 14 to further coordinate efforts to mitigate local debt risks in 19 provinces.

6. Ministry of Foreign Affairs: Opposing competition to define Sino-US relations.

7. Ministry of Industry and Information Technology: Build 5G, computing power and other information facilities appropriately ahead of schedule, and continue to promote the large-scale application of the Internet.

8. Ministry of Housing and Urban-Rural Development: Improve the “guarantee + market” housing supply system; real estate companies that are seriously insolvent and have lost their ability to operate should be bankrupt and reorganized.

9. Ministry of Human Resources and Social Security: The policy of reducing unemployment and work-related injury insurance premiums will be continued this year; social security cards will gradually become a “national card”.

10. Supreme Procuratorate: In 2023, the procuratorate prosecuted 27,000 people for financial fraud and crimes that disrupted financial management order.

11. Ministry of National Defense: China’s defense expenditure is open, transparent, reasonable and appropriate, with an increase of 7.2% over the previous year.

12. The first batch of savings bonds this year were sold out on the first day of issuance, and some bank quotas were sold out within an hour.

13. Lei Tianliang, Chairman of the Hong Kong Securities Regulatory Commission: It is recommended to optimize the overseas listing filing system for domestic companies.

14. There was a rumor on the Internet that "the brokerage company is checking whether the resigned personnel are Lingjun employees." The official refuted the rumor: it was not true and the case had been reported.

15. The first batch of 22 residential land planned for sale in Guangzhou this year covers a land area of 120.6 hectares.

16. According to Yicai, the production capacity of Huawei and BAIC's cooperation project is planned to be 300,000 units, and the monthly sales target of the first product is 10,000 units; the first Xiaomi Automobile store is expected to open in April, and test drives can be made by appointment.

17. WuXi AppTec: It plans to repurchase the company's shares for 1 billion yuan, cancel them and reduce the registered capital.

18. The box office (including pre-sales) in 2024 will exceed 15 billion.

19. Bytedance’s response to Blizzard’s former CEO’s negotiation to purchase TikTok: Untrue.

Risk Warning

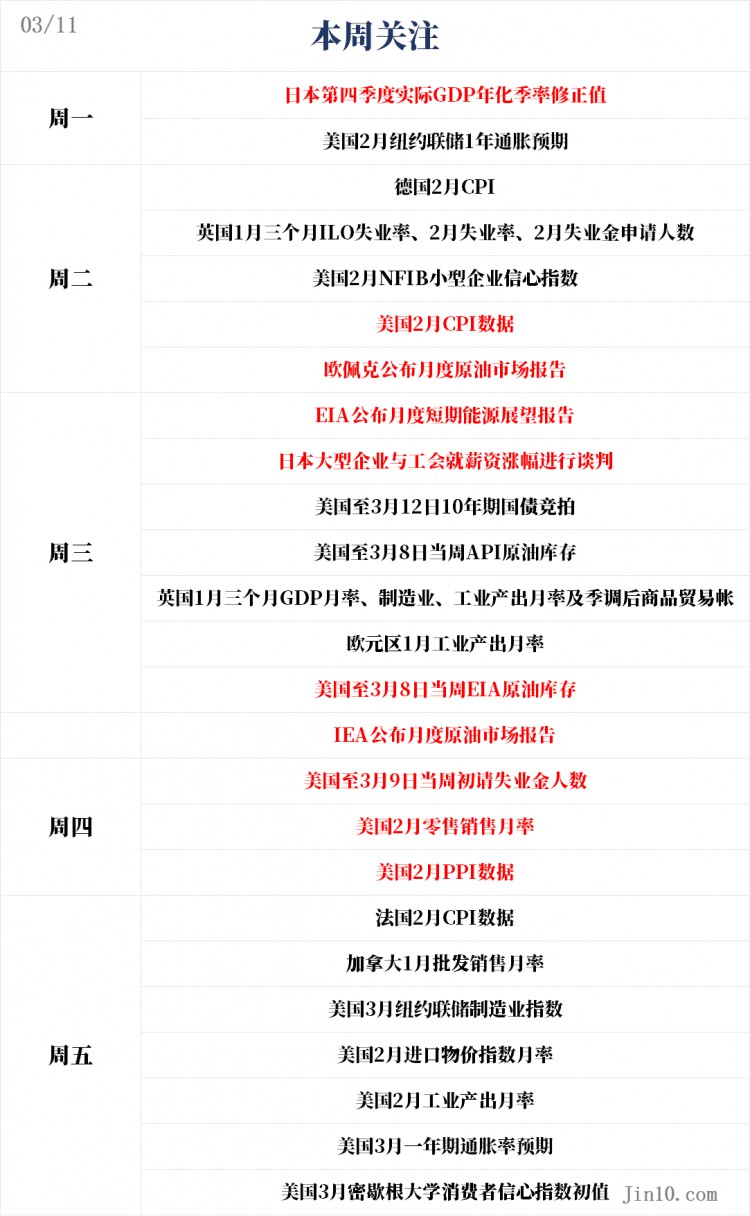

At 7:50, the revised annualized quarterly rate of Japan’s fourth quarter real GDP was announced. The market expected value was 1.10%, and the previous value was -0.40%;

23:00, the New York Fed’s 1-year inflation forecast for February was released, with the previous value being 3.00%.

Article forwarded from: Golden Ten Data