Mandarin version for boys download mp3

Female Mandarin version download mp3

Cantonese version download mp3

Southwest dialect version download mp3

Northeastern dialect version download mp3

Shanghai dialect version download mp3

Today's picks

Terrorist attack in Moscow! The extremist organization "Islamic State" claimed responsibility

Ukraine's Kiev and Lviv regions hit by Russian air strikes

Fed's Bostic: Only one rate cut expected in 2024

Gaza Strip ceasefire agreement talks deadlocked

Princess Kate of the United Kingdom issued a video statement: She is receiving cancer treatment

The sponsor of the U.S. Biosafety Act suddenly resigned 7 months early

President Xi Jinping sent a message of condolence to Russian President Vladimir Putin over the serious terrorist attacks in Russia.

Offshore hedge fund stop-loss orders were triggered, and the yuan hit a four-month low last Friday

Premier Li Qiang of the State Council: Continue to promote the prevention and resolution of local debt risks and further promote the construction of a unified national market

China Evergrande withdrew its previous debt restructuring application to the U.S. court; Wanda’s 16.2 billion equity freeze has reached a settlement

Market inventory

Last Friday, as the market began to consider the possibility of a later interest rate cut by the Federal Reserve, the U.S. dollar index continued to strengthen, finally closing up 0.44%, closing up for the second consecutive week at 104.42. The benchmark 10-year U.S. Treasury yield fell back below the 4.2% mark, closing at 4.194%, and the 2-year U.S. Treasury yield, which is most sensitive to the Fed's policy rate, closed at 4.596%.

Suppressed by the strong U.S. dollar, spot gold continued its decline and once fell below the 2160 mark, eventually closing down 0.72%. However, it still closed up 0.44% on the week, at $2,168.48 per ounce; spot silver finally closed down by 0.29%, at $24.68 per ounce. ounce.

Affected by the possibility of a ceasefire in Gaza and the continuation of the reduction in the number of U.S. drilling rigs, oil prices were flat last week. WTI crude oil once reached $81 before the U.S. market, but then gave up all gains and finally closed down 0.01% at $80.74 per barrel. ; Brent crude oil closed down 0.02% at $85.52 per barrel.

The Dow Jones Industrial Average closed down 0.77%, the S&P 500 Index fell 0.14%; the Nasdaq Composite Index rose 0.16%, continuing to hit a new closing high. Tesla (TSLA.O) closed down 1.15%. The Nasdaq China Golden Dragon Index closed down 1.8%, Lufax (LU.N) fell 9%, Xpeng Motors (XPEV.N) fell nearly 8%, and Weibo (WB.O) fell 5%.

Major European stock indexes were mixed, with Germany's DAX30 index closing up 0.15%; Britain's FTSE 100 index closing up 0.61%; and the European Stoxx 50 index closing down 0.42%.

Hong Kong stocks opened lower and moved lower throughout the day. The Hang Seng Index opened 117 points lower at 16,745 points, and then plummeted, falling more than 500 points at most to 16,387 points. It fell from beginning to end in early trading. The market's decline narrowed slightly in the afternoon, but was still weak. As of the close, the Hang Seng Index closed down 2.16%, the Stock Exchange Index closed down 3.55%, and the Hang Seng Index's market turnover reached HK$135.65 billion. On the market, pharmaceutical distribution, pharmaceutical outsourcing, and logistics stocks were among the top losers, dairy stocks fell, and technology and Internet stocks and automobile stocks dragged down the market. In terms of individual stocks, Orient Overseas International (00316.HK) fell nearly 17%, JD Health (06618.HK) fell more than 12.5%, Li Auto (02015.HK) fell more than 10%, and Bilibili (09626.HK) fell Over 9%, Xpeng Motors (09868.HK) and WuXi Biologics (02269.HK) fell over 8%, Alibaba Health (00241.HK) fell over 7%; Tongcheng Travel (00780.HK) rose nearly 2.5% , Kingsoft Software (03888.HK) rose nearly 1%.

The stock indexes of the two A-share markets weakened, and AI application concept stocks rose sharply; as of the close, the Shanghai Stock Exchange Index fell 0.95%, the Shenzhen Stock Exchange Component Index fell 1.21%, and the ChiNext Index fell 1.47%. In terms of sectors, the media and entertainment sector surged, with Century Tianhong, Reader Culture, Huace Film and Television, etc. rising by 20%; the concept of computing power leasing surged, with Runze Technology and Aofei Data rising by 20%; the concept of memory chips strengthened, with Xtest testing , Kangqiang Electronics hit their daily limit; most sectors fell, with low-level economic concepts leading the decline, with Xianheng International, Yongyue Technology, etc. falling by the limit; seed industry concepts, gold concepts, lithium mines, semiconductors, non-ferrous metals, medicine, etc. leading decliners. More than 4,200 stocks in the two cities fell, with a transaction volume of more than 1 trillion yuan.

international news

1. The death toll in the Moscow concert hall attack in Russia reached 143. The extremist organization "Islamic State" (ISIS) claimed responsibility, and US intelligence officials confirmed this. Russia has detained four direct participants for interrogation. One suspect said that someone offered 1 million rubles to pay for the murder. Russian President Vladimir Putin said that all those behind the incident will be punished and March 24 will be designated as a national day of mourning.

2. Ukrainian President Zelensky denied that Ukraine was involved in the Moscow terrorist attack, saying that Putin was trying to blame others for the Moscow shooting. The Russian Ministry of Foreign Affairs retorted, saying that Zelensky's blaming of Russia for the terrorist attack was tantamount to self-exposure; US Secretary of State announced Lincoln said the United States stood with the Russian people. In addition, France raised the national security alert level to the highest level.

3. Ukraine’s Kiev and Lviv regions were hit by Russian air strikes, and Ukraine’s energy infrastructure was damaged in the missile attacks.

4. Atlanta Fed President Bostic said in a speech on Friday local time that he now expects one interest rate cut of 25 basis points in 2024, which is lower than the two previously expected. He expects a rate cut to happen later this year. He said he was "less confident" that inflation would continue to fall toward the central bank's 2% target than in December.

5. The U.S. House and Senate passed a $1.2 trillion appropriation bill, and the White House stated that Biden had signed it into law.

6. Negotiations on the ceasefire agreement in the Gaza Strip have reached a deadlock. The United Nations Security Council failed to adopt the draft resolution on the ceasefire in Gaza proposed by the United States. The vote on the resolution on the ceasefire in Gaza at the United Nations Security Council was postponed to Monday.

7. Affected by the attack in Ukraine, Russian crude oil refining fell to a 10-month low.

8. ECB Governing Council member Scicluna: An interest rate cut in April cannot be ruled out.

9. Princess Kate of the United Kingdom issued a statement saying that she is receiving cancer treatment.

10. India will extend its ban on onion exports until further notice.

11. Apple and Baidu held preliminary talks on using Baidu’s artificial intelligence generation technology in Apple devices in China.

12. The sponsor of the US Biosafety Act suddenly resigned 7 months early.

13. Orlins, Chairman of the National Committee on U.S.-China Relations: Sino-U.S. relations have rebounded from the bottom.

14. The agency responsible for export quarantine in Argentina will go on strike, and national exports may be affected.

domestic news

1. President Xi Jinping sent a message of condolence to Russian President Vladimir Putin over the serious terrorist attacks in Russia.

2. The Ministry of Foreign Affairs stated that China opposes all forms of terrorism, strongly condemns terrorist attacks, and firmly supports the Russian government’s efforts to maintain national security and stability.

3. Premier Li Qiang emphasized at the State Council’s video conference on preventing and resolving local debt risks that we should further strengthen the awareness of responsibility and system concepts and continue to promote the prevention and resolution of local debt risks.

4. Premier Li Qiang of the State Council stated that the legitimate rights and interests of various enterprises will be protected in accordance with the law, institutional opening will be steadily promoted, macro policy adjustments will be intensified, and the construction of a unified national market will be further promoted.

5. National Standing Committee: It is necessary to further optimize the real estate policy system and plan relevant support policies.

6. Offshore hedge funds' stop-loss orders were triggered, and the yuan plunged 500 points last Friday, falling below 7.27, hitting a four-month low.

7. The State Administration of Financial Supervision and Administration issued an announcement to solicit public opinions on the "Measures for the Management of Data Security of Banking and Insurance Institutions" and also publicly solicited opinions on the "Management Measures for Syndicated Loan Business (Draft for Solicitation of Comments)".

8. The Ministry of Commerce released the national version and the free trade pilot zone version of the negative list for cross-border service trade, which will be effective from April 21, 2024. Zheng Shanjie, Director of the National Development and Reform Commission: We are implementing and accelerating the introduction of the 2024 version of the negative list for foreign investment access.

9. According to Caixin reports, the Ministry of Commerce is evaluating the possible “301 investigation” by the United States into China’s shipbuilding industry.

10. Why are some public offerings in Beijing and Shanghai subject to supervision and cross-examination in different places? Get close to regulators: implementation measures for strict governance.

11. "Three new DMA strategies will not be added", and new products registered for quantitative private equity must be committed.

12. Minister of Commerce Wang Wentao met with executives from many foreign companies, including Apple CEO Cook and South Korea's SK Hynix CEO Guo Luzheng.

13. The Cyberspace Administration of China announced the "Regulations on Promoting and Regulating Cross-Border Data Flows"

14. Fang Xinghai, Vice Chairman of the China Securities Regulatory Commission: We expect that long-term funds represented by social security funds, insurance funds, bank funds, and public welfare and charity funds will further increase their allocation ratio to equity venture capital funds.

15. The China Meteorological Administration issued a geomagnetic storm warning.

16. Hong Kong Observatory: The temperature on Sunday hit the highest March record in 140 years.

17. China Evergrande withdrew its previous debt restructuring application to the U.S. court. In addition, some media said that Wanda’s 16.2 billion equity freeze has reached a settlement.

18. Soliciting opinions on the implementation details of the renovation of old villages in Guangzhou, encouraging room ticket placement, signing contracts early, and selecting housing first.

19. AMD CEO Lisa Su: The company will continue to increase investment in China.

20. Apple CEO Cook said that Apple’s head-mounted display products will be launched in China within this year, and the company is continuing to increase investment in research and development in China.

21. Didi’s revenue in the fourth quarter of 2023 was 49.4 billion yuan, a year-on-year increase of 55.4%, and full-year revenue was 192.4 billion yuan, an increase of 37%.

Risk Warning

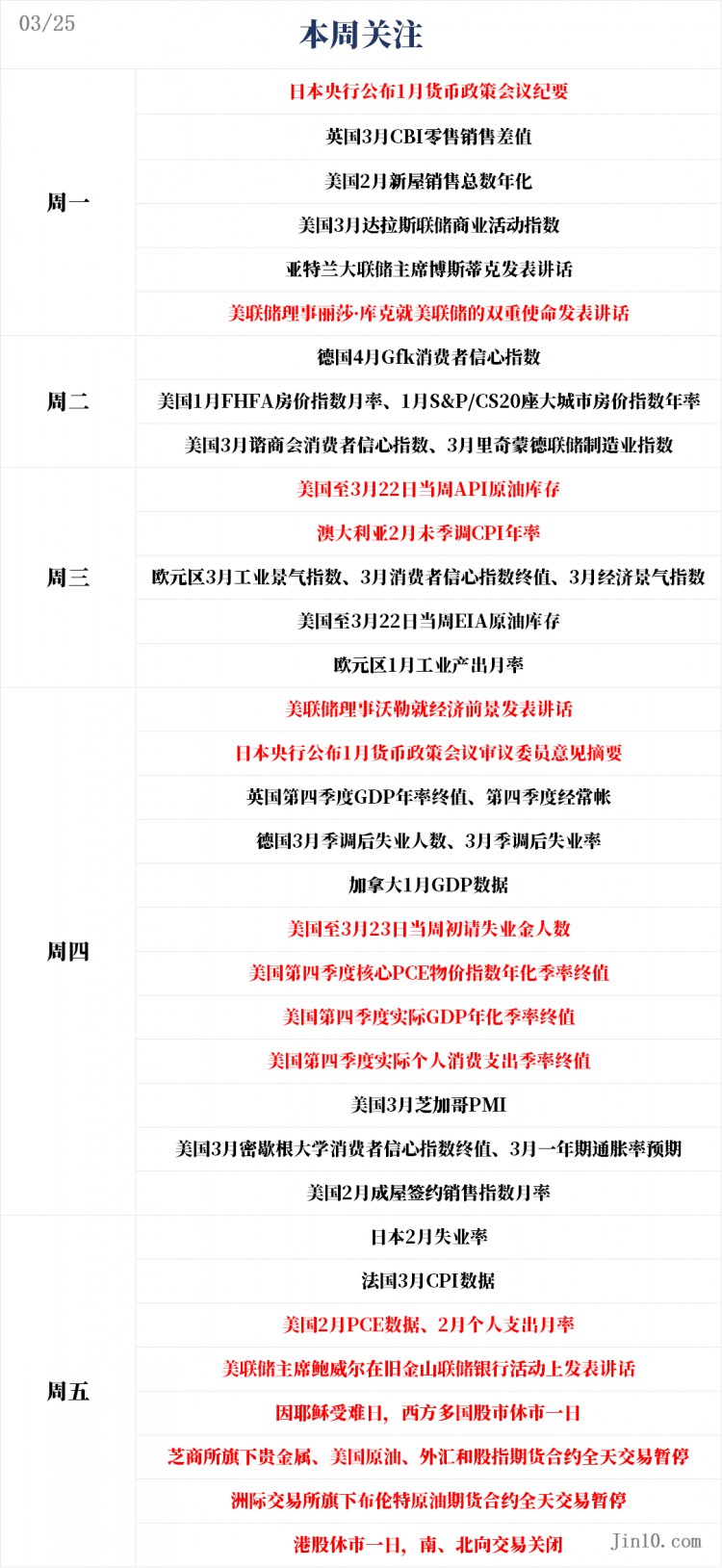

At 7:50, the Bank of Japan will release the minutes of its January monetary policy meeting;

At 20:25, 2024 FOMC voting committee member and Atlanta Fed President Bostic will give a speech. He previously stated that his interest rate cut expectations have been reduced from two rate cuts during the year to one rate cut during the year.

At 21:05, Chicago Fed President Goolsby will be interviewed by Yahoo Finance;

At 22:30, Federal Reserve Board Governor Lisa Cook gave a speech on the dual missions of the Federal Reserve.

Article forwarded from: Golden Ten Data