Congressional Budget Office (CBO) Director Phillip Swagel warned on Tuesday that the United States will face a Liz Truss-style market shock if the government ignores the United States' ballooning federal debt.

Swagel said the fiscal burden on the United States was increasing at an "unprecedented" rate, potentially triggering a crisis similar to the one that led to a run on sterling and the collapse of Britain's Truss government in 2022.

In September 2022, former British Prime Minister Truss launched a "mini-budget" that shocked the world. Against the background of soaring inflation and increasing government debt in the UK, once this budget with "unfunded tax cuts" as its core was exposed, it immediately caused chaos in the British financial market and kicked off the trend of rising UK mortgage interest rates. prelude.

Swagel said the U.S. is "not there yet," but the bond market could "bounce back quickly" as higher interest rates push the cost of repaying its debt to $1 trillion in 2026.

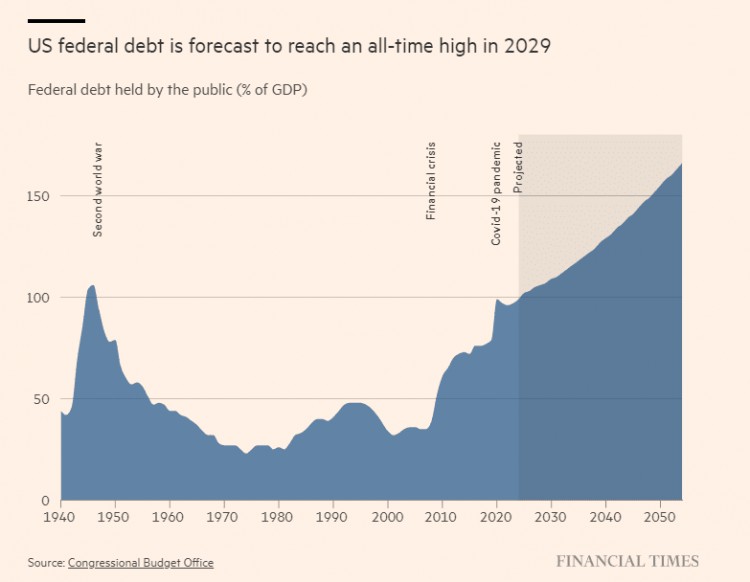

According to the CBO, as of the end of last year, the total U.S. federal debt reached $26.2 trillion, accounting for 97% of the gross domestic product (GDP).

After former U.S. President Trump implemented comprehensive tax cuts in 2017 and launched a huge stimulus package during the epidemic, the scale of U.S. debt surged. Trump has pledged to extend tax cuts that were set to expire next year if he defeats Biden in this year's presidential election.

“Some seemingly modest changes — or perhaps modest at first and then become more severe — could have large effects on interest rates and therefore on the fiscal trajectory,” Swagel said.

Swagel's comments to the Financial Times came a day after the independent regulator released new long-term economic forecasts. Forecasts show that U.S. debt levels will rise to 166% of GDP by 2054.

Fitch downgraded the U.S. credit rating from AAA to AA+ last year, citing concerns about "excessive and growing government debt." Moody's still rates the country AAA, but said in November it had downgraded its outlook to negative from stable.

Swagel's warning about the nation's debt burden comes as economists worry that years of fiscal profligacy by Democrats and Republicans will spell trouble for the U.S. economy.

Kimberly Clausing, a senior fellow at the Peterson Institute for Economic Research, said: "Policymakers need to significantly reduce the deficit, in part because of the enormous demographic pressures we face."

"Neither presidential candidate is talking about fiscal integrity, and one of them is even talking about extending tax cuts," said David Page, head of macroeconomic research at AXA Investment Management.

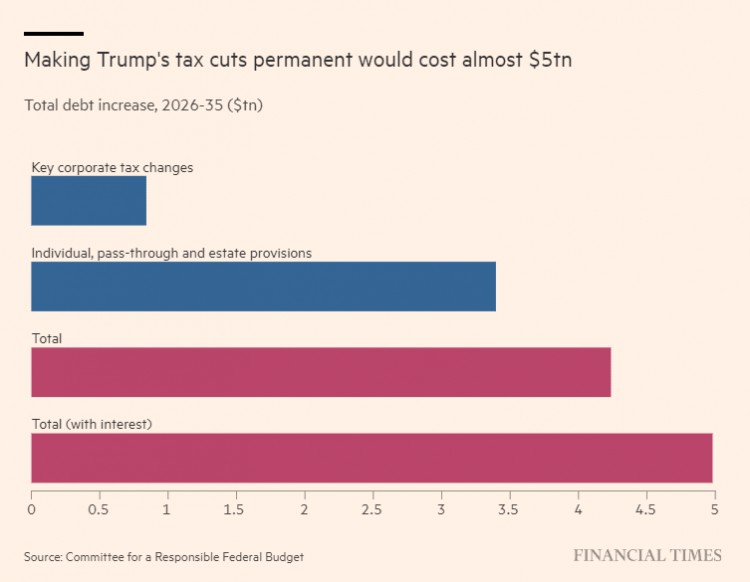

A think tank, the Committee for a Responsible Federal Budget (CRFB), said that if Trump extends the tax cuts, the federal debt will increase by US$5 trillion between 2026 and 2035.

Trump's extension of tax cuts will increase federal debt by $5 trillion between 2026 and 2035

Trump's extension of tax cuts will increase federal debt by $5 trillion between 2026 and 2035

CBO's forecast shows that the U.S. annual fiscal deficit will hover at about 6% of GDP over the next 10 years - this is based on the assumption that Trump's tax cuts are scheduled to expire in 2025.

Swagel served as U.S. Treasury Secretary during the Bush administration. He acknowledged that next year is "particularly important for fiscal policy" given concerns about extending tax cuts and additional Obamacare subsidies that are set to expire next year.

CBO forecasts released this week show that the debt-to-GDP ratio in 2029 will exceed the World War II high of 116%, a trend that Swagger described as "unprecedented."

U.S. debt-to-GDP ratio will exceed World War II levels by 2029

U.S. debt-to-GDP ratio will exceed World War II levels by 2029

"Much of the debt incurred during World War II was paid off within the generation that entered the war," Swagel said. "The financial burden created today is not something our generation can bear."

He warned that the dollar's status as the world's reserve currency would not always insulate the United States from market pressures as debt interest payments rise.

"We need to borrow from foreigners because foreign capital helps keep interest rates low in the United States," Swagel said. "But there are two sides to this. On the one hand, cash flowing overseas means a loss of national income. On the other hand, if It's even worse if there's no capital inflow for us to borrow from."

Article forwarded from: Golden Ten Data