美國銀行股週四連續第二天下跌,引發了人們對銀行業危機再度爆發的擔憂,因為交易員預計聯準會將加快降息步伐。

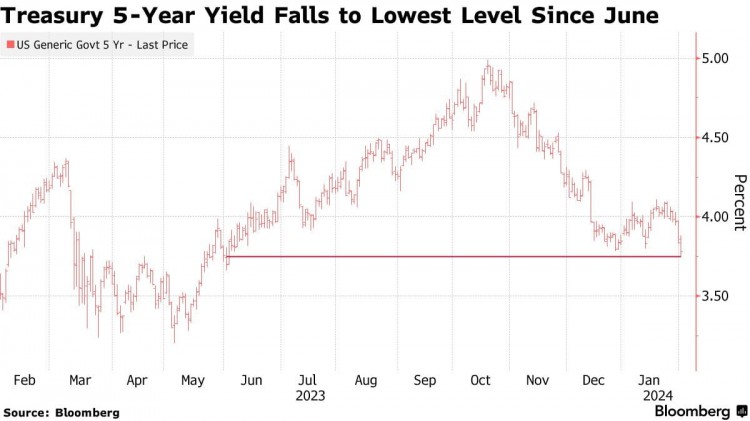

美國公債殖利率暴跌,五年期公債殖利率下跌多達9個基點至3.75%,為去年6月以來最低。 同時,交易員消化了更多降息的影響。 隔夜,聯準會主席鮑威爾表示 3 月不太可能降息,從而打壓了押注,掉期交易顯示 3 月降息的可能性略有增加。

五年期公債殖利率跌至去年6月以來最低水平

紐約一家小型銀行報告意外虧損,並削減股息並增加貸款損失撥備,因美國商業房地產的損失預計將加深,銀行股週三暴跌。 這讓投資人想起去年3月發生的美國地區銀行危機,當時的動盪也提振了對美國公債的避險需求。

Brandywine Global Investment Management的投資組合經理Jack McIntyre表示,雖然不確定商業房地產領域的問題有多大,但“這將對銀行貸款產生負面影響,而銀行貸款是我們經濟的命脈。” ”他指出,“投資者選擇先購買國債,然後再了解情況。”

週三的聯準會政策會議導致一些原本預計政策制定者將在三月開始降息的銀行放棄了這項呼籲。

然而,目前與未來聯準會會議掛鉤的掉期合約價格表明,聯準會今年將降息約 150 個基點,完全反映了 5 月首次降息的情況。

一些投資人擔心,聯準會降息的時間越長,經濟放緩、通膨可能跌破聯準會2%目標的風險就越大。

“如果最終結果是聯準會抵制經濟所需的降息,我們將看到市場面臨壓力,長期國債殖利率下降。”

紐約社區銀行 (New York Community Bank) 的股價週四暴跌 15%,延續了該公司週三宣布虧損時創紀錄的 38% 跌幅。 該公司的業績引發了更廣泛的擔憂,即規模較小的銀行往往在商業房地產市場上擁有更高的風險敞口。 KBW地區銀行業指數連續兩日下跌,累計跌幅擴大至11%,創3月以來最大兩日跌幅。

Unfortunately, the Federal Reserve plans to end its emergency financing program for banks just as signs of another crisis are emerging in the banking sector. The Bank Term Financing Program (BTFP), which was introduced during the banking crisis in March last year, will expire on March 11 and will not be renewed. The program allows qualified depository institutions, such as banks and credit unions, to borrow funds for up to one year, collateralized by U.S. Treasury securities, agency debt and mortgage-backed securities and other eligible assets, which will be valued at par.

Although the banking sector appears to be in trouble, the overall stock market remains strong, with the S&P 500 rising 0.4% on Thursday.

Earlier in the day, data showed U.S. labor productivity grew rapidly in the fourth quarter, while unit labor costs increased less than economists expected. Meanwhile, a measure of U.S. factory activity climbed to a 15-month high earlier this year.

Gennadiy Goldberg, head of U.S. rates strategy at TD Securities, said modest labor costs solidified market expectations that "rate cuts are coming even with strong economic growth."

Article forwarded from: Golden Ten Data